S&P Global Ratings

@SPGlobalRatings

Followers

116K

Following

739

Media

9K

Statuses

18K

S&P Global Ratings is the world’s leading provider of independent credit ratings. We’re a division of S&P Global (@SPGlobal)

Global

Joined August 2010

From S&P Global Ratings: An increase in the proportion of auto loans backed by #BatteryElectricVehicles in auto loan ABS transactions in #Japan could affect the creditworthiness of the underlying pools of assets. Get more insights:

3

5

9

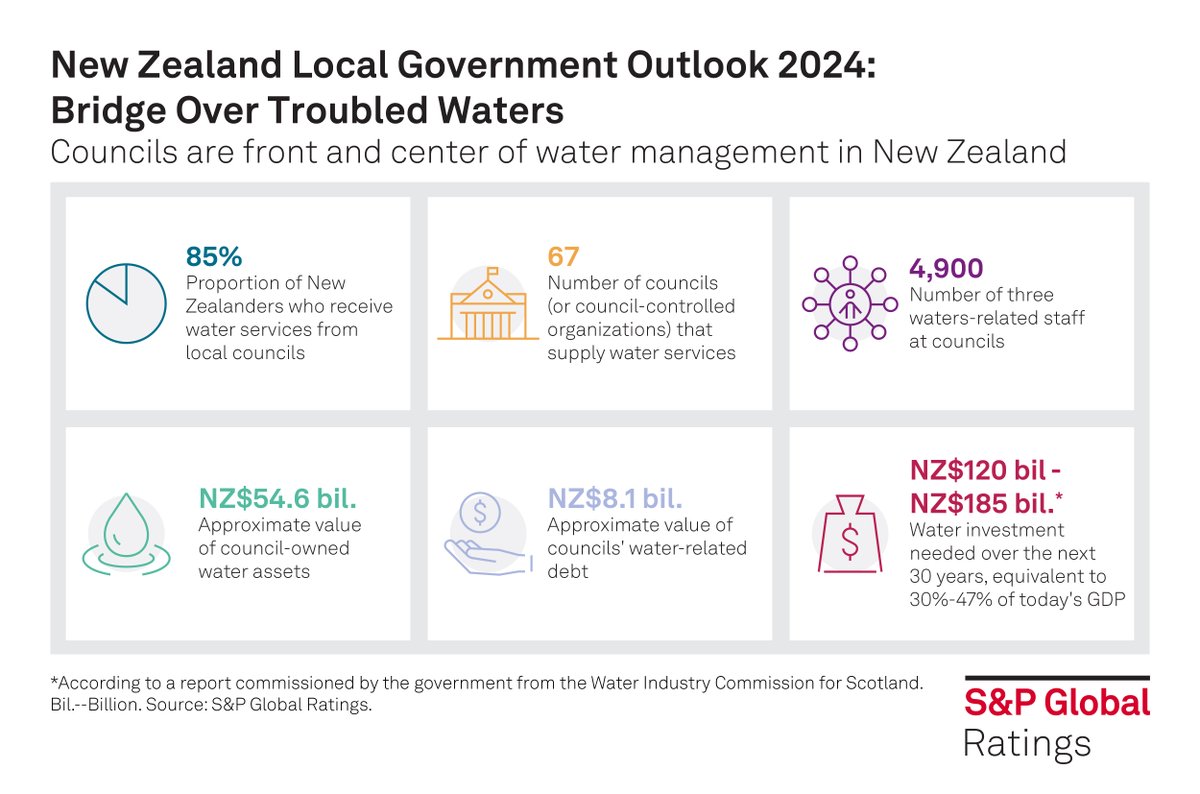

Either ratepayers, taxpayers, levy-payers, or tariff-payers look set to face steeper bills in the future to address #NewZealand's water woes. Read more: New Zealand Local Government Outlook 2024: Bridge Over Troubled Waters #AffordableWaterReform

4

24

24

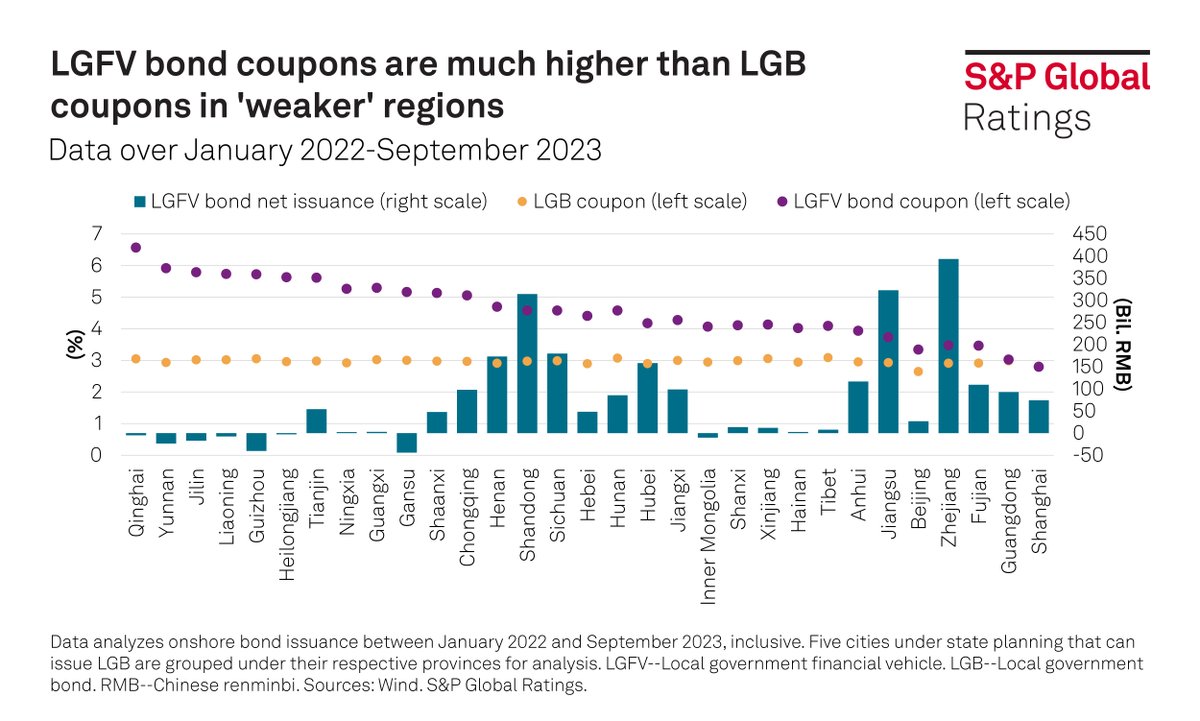

Beijing's "basket of measures" will channel RMB1.36 trillion toward #LGFVs' immediate liquidity risks. The sum will just put a small dent into the entities' debt problems. Read more:

1

7

11

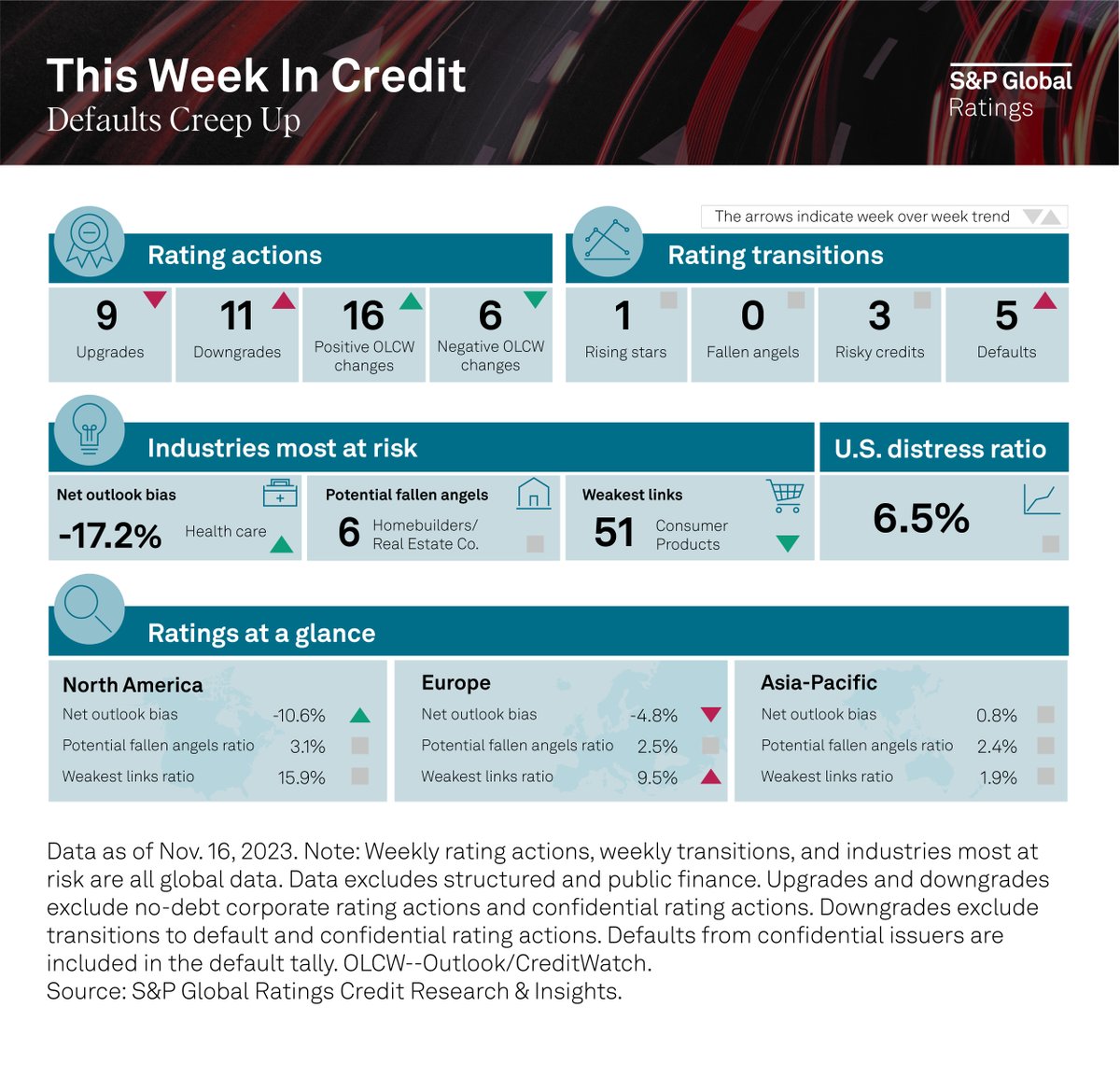

#ThisWeekInCredit:Five defaults last week brought this year's total to 138—1.8x higher than over the same period last year. This week will be calm on the data front with Thanksgiving holidays in the U.S. and minimal data from China and Japan. Go deeper:

1

8

9

Financial markets are innovating to meet the global needs for industrial transformation, but what does this look like? Join our 3 December event at #COP28 to hear how sustainable finance contributes to this transformation:

0

2

3

Europe is yet to see middle market #CLOs. Our Credit FAQ addresses key questions about our analytical approach for this product, and discusses how the market may evolve, considering ongoing market discussions:

0

2

2