Rystad Energy

@RystadEnergy

Followers

14,172

Following

75

Media

2,057

Statuses

2,599

Rystad Energy is an independent advisory, research and energy intelligence company, equipping clients with data and insights that power better decision-making.

Headquartered in Oslo, Norway

Joined August 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Rio Grande do Sul

• 183143 Tweets

Madonna

• 133989 Tweets

Tottenham

• 81023 Tweets

Spurs

• 73960 Tweets

Leverkusen

• 64676 Tweets

Palmer

• 56817 Tweets

Dame

• 52458 Tweets

#虎に翼

• 46040 Tweets

Ole Miss

• 35079 Tweets

#ラヴィット

• 32525 Tweets

Ange

• 28780 Tweets

bruno mars

• 27226 Tweets

憲法記念日

• 27062 Tweets

Pacers

• 20275 Tweets

FDNY

• 18840 Tweets

OUÇA FOI INTENSO

• 18302 Tweets

EP INTENSO ZNEC

• 18252 Tweets

Anne Hathaway

• 12710 Tweets

DANNY OCEAN

• 11556 Tweets

Lillard

• 11399 Tweets

#SnowMan結成12周年

• 10840 Tweets

Last Seen Profiles

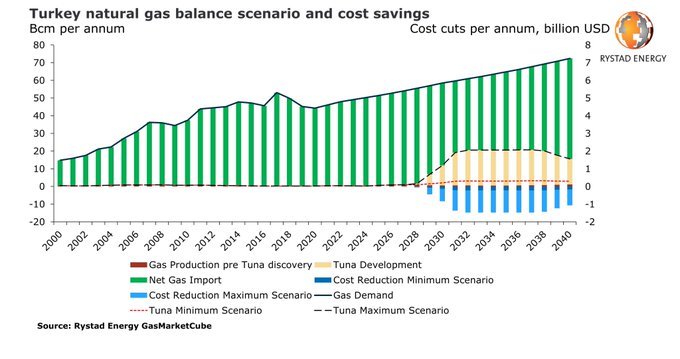

There’s a catch! Turkey’s hooked Tuna gas discovery could save it up to $21 billion in import costs

Read more here:

#RystadEnergy

#energy

#energymarkets

#oilandgas

#gas

#naturalgas

#turkey

13

142

386

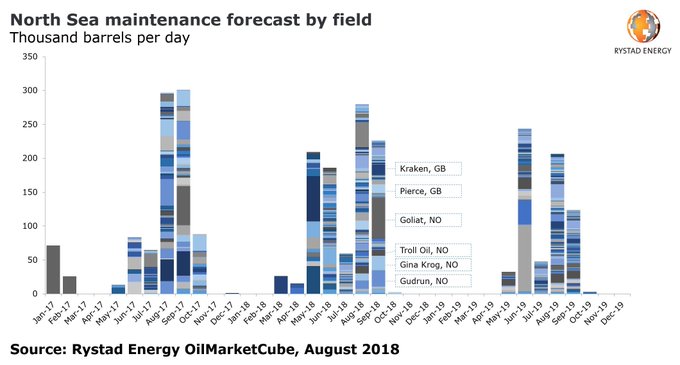

How is the North Sea monthly oil production affected by field maintenance? Our new database OilMarketCube has the answer. Join our webinar on September 5 to learn more:

#OOTT

0

34

214

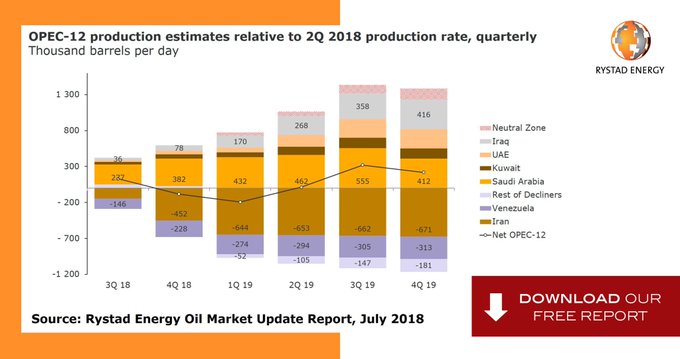

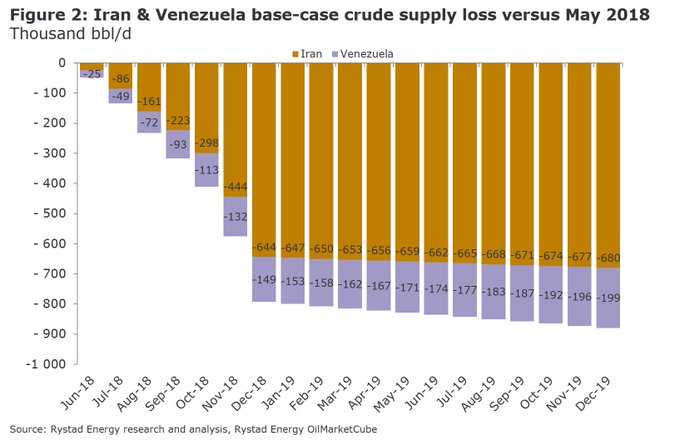

Even with a conservative crude production loss estimate from Iran, Rystad Energy projects that OPEC-12 will need to raise supply further to avoid a decline in overall OPEC-12 production through 1Q-19. Download our free report to learn more >

#OOTT

3

60

155

Which country had the greatest growth in overall

#oil

production in 2016? Rystad Energy Ranks knows, do you?

Iraq

1567

Saudi Arabia

1274

Russia

419

Iran

357

21

37

138

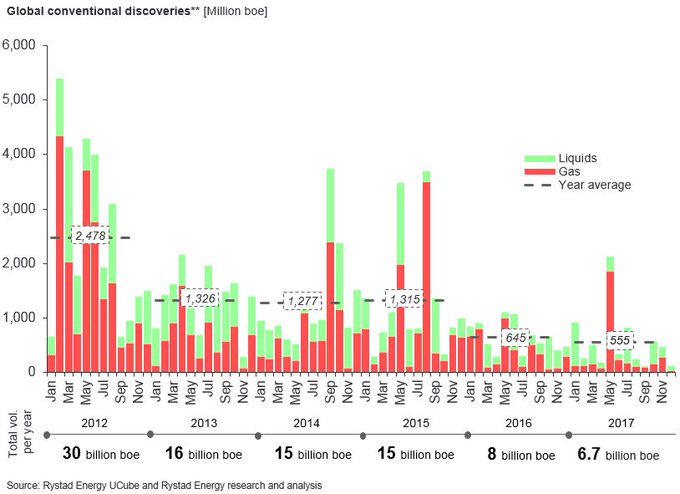

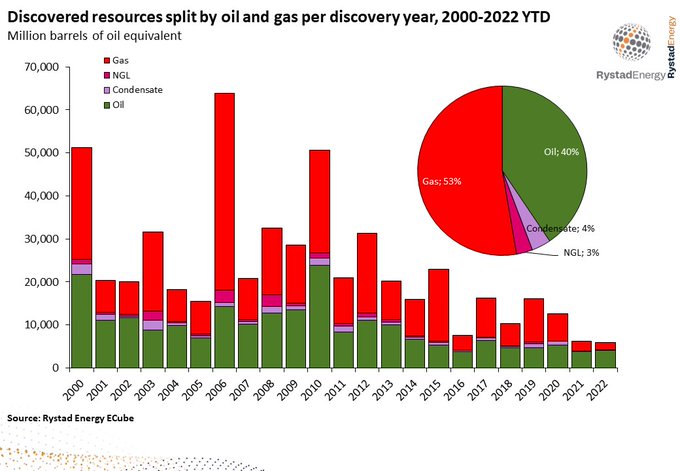

The world will not have enough oil to meet demand through 2050 unless exploration accelerates.

Read more here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#oildemand

#exploration

4

16

45

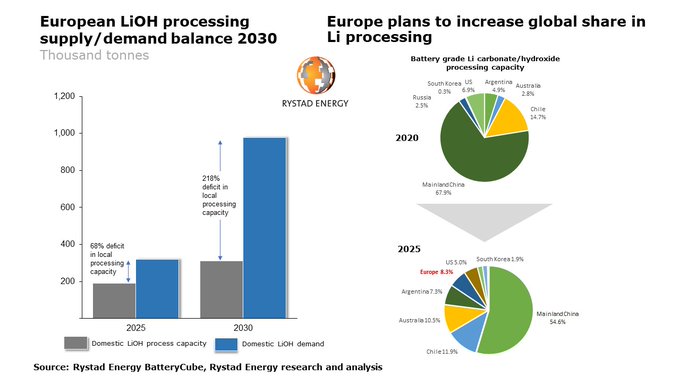

European Commission considers classifying lithium as toxic, potentially eroding its energy security and climate goals.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#lithium

4

27

44

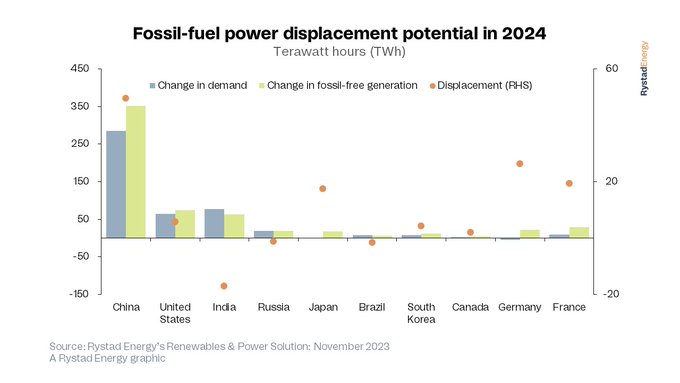

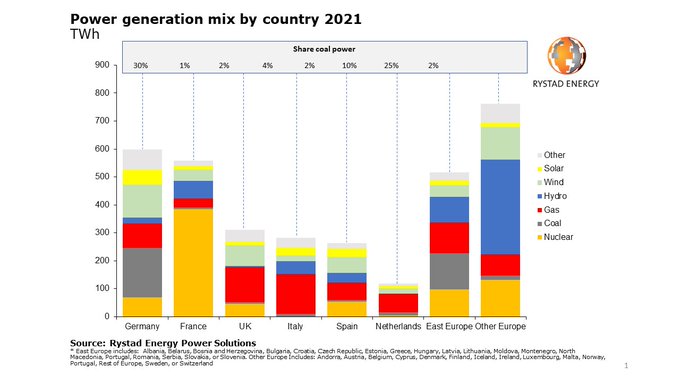

Coal-fired power generation is on track to peak in 2023 as new sources of renewable and low-carbon energy expand rapidly. Coal has dominated the global power sector for the past 30 years, but 2024 will begin a new era.

#rystadenergy

#renewables

#power

7

23

41

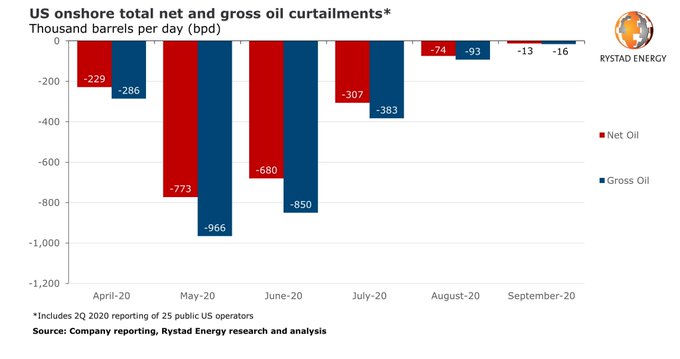

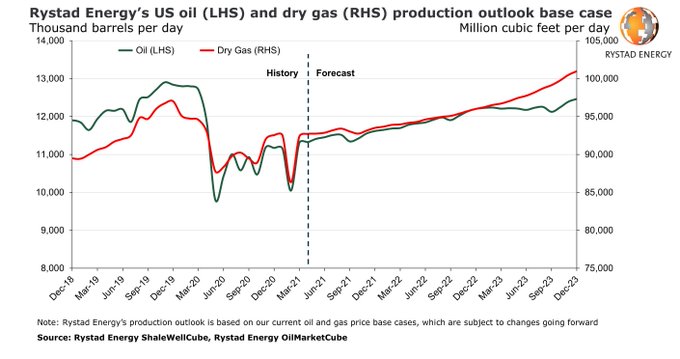

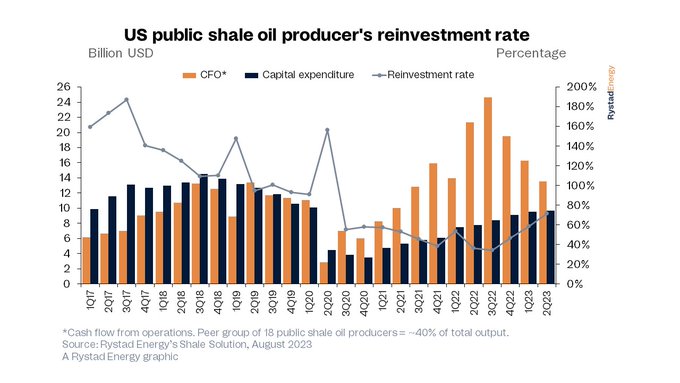

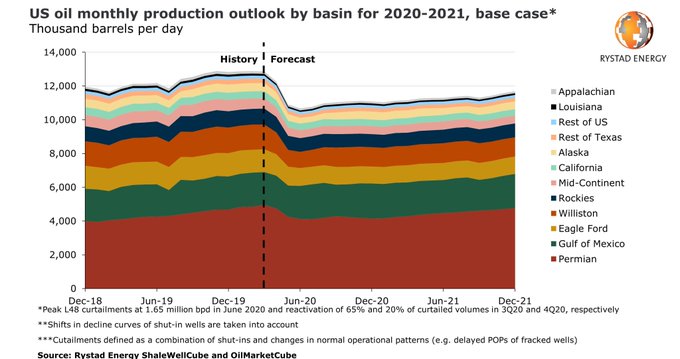

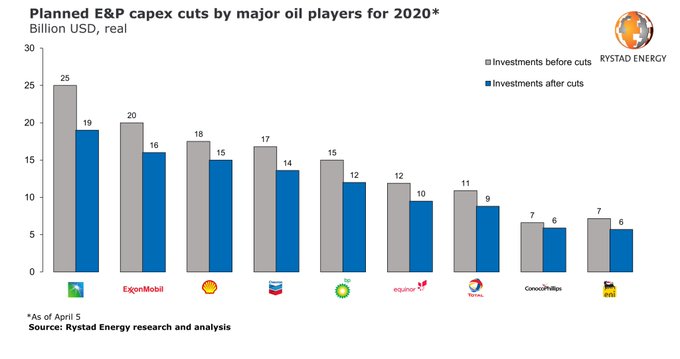

US fracking set for the biggest monthly decline in history as oil prices collapse and COVID-19 persists.

Full article here >

#RystadEnergy

#energy

#oilandgas

#fracking

0

27

41

Old King Coal: price reaches highest level in more than 200 years, on track for $500.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#coal

0

13

38

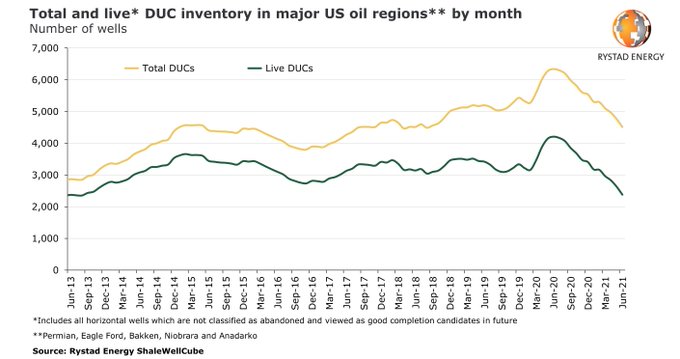

‘Live’ DUC well inventory fell to lowest since 2013 as the US continues to frack more than it drills.

Read the full PR here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#shale

#fracking

#drilling

1

10

36

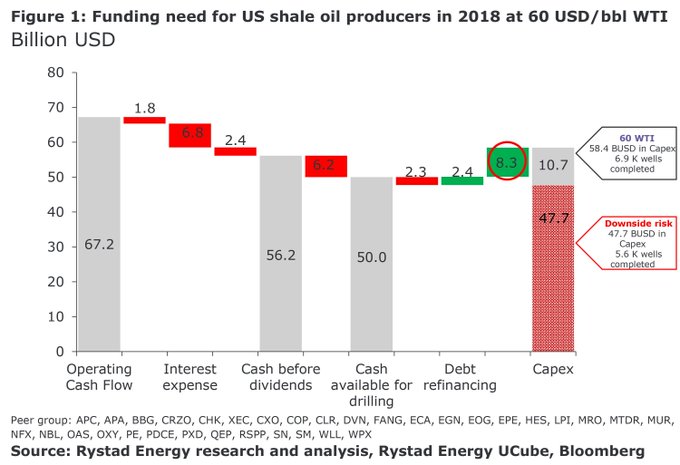

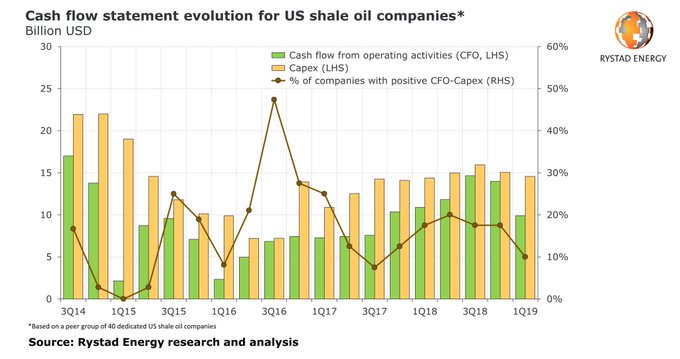

Rystad Energy's Shale Newsletter - "Top 33 shale oil producers’ need USD 8.3 billion of additional funding on top of USD 2.4 billion debt refinancing in a 60 WTI price environment to meet a capex expectation of USD 58.4 billion". Read here >

#OOTT

0

17

25

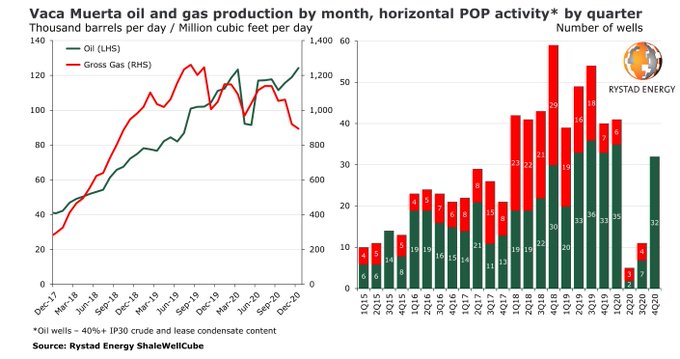

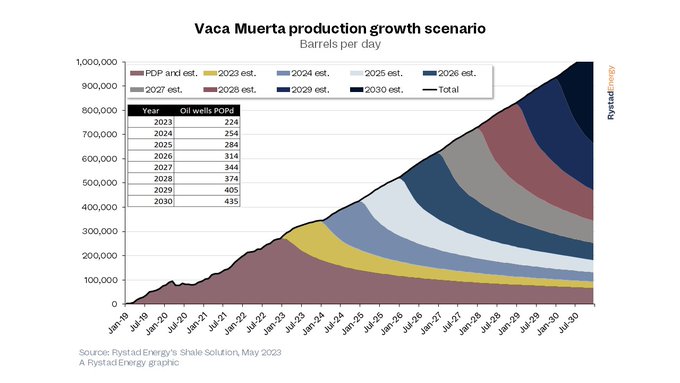

Argentina’s Vaca Muerta tight oil deposit is now producing at record levels, matching US well scores.

Read the full press release here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#shale

#oilproduction

#vaccamuerta

#argentina

3

13

25

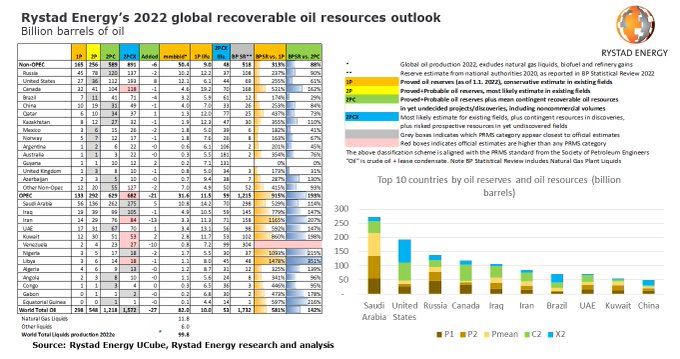

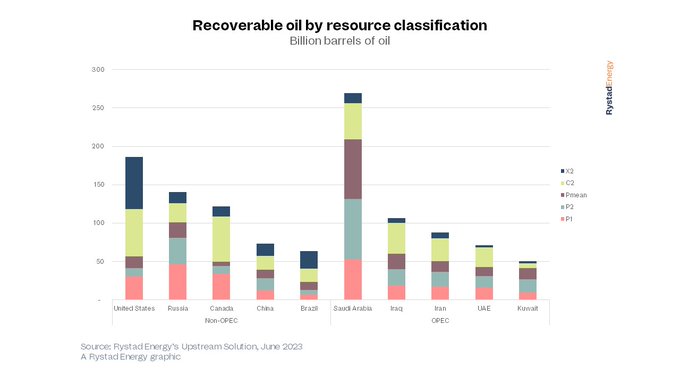

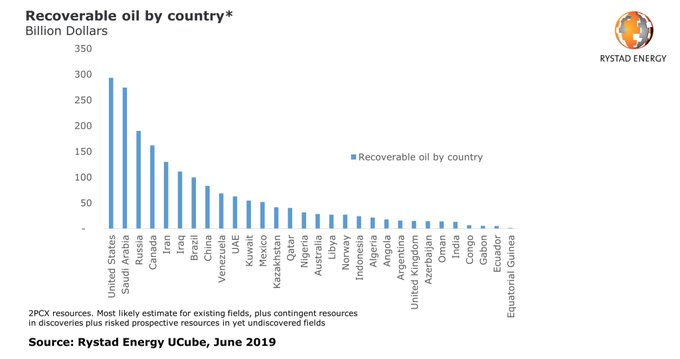

Total recoverable oil worldwide is now 9% lower than last year, threatening global energy security.

Read more here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#energysecurity

0

14

24

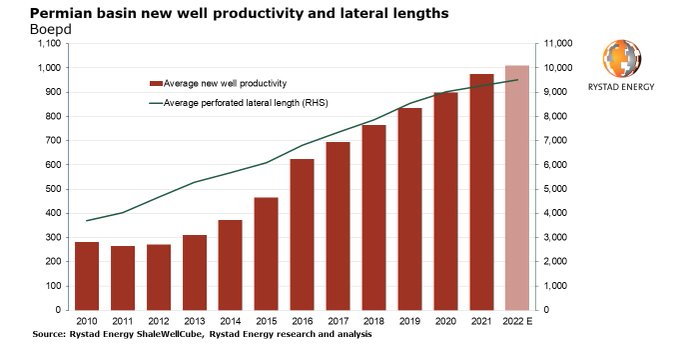

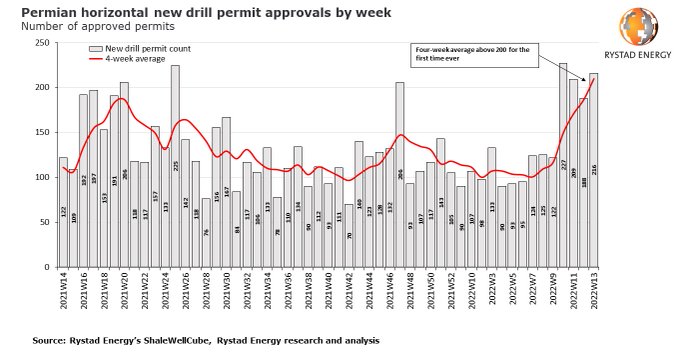

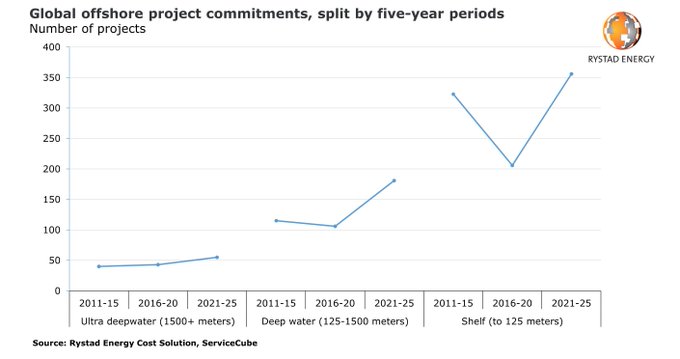

Permian new well productivity set to breach 1,000 boepd in 2022 on record lateral footage.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#shale

#permian

0

8

24

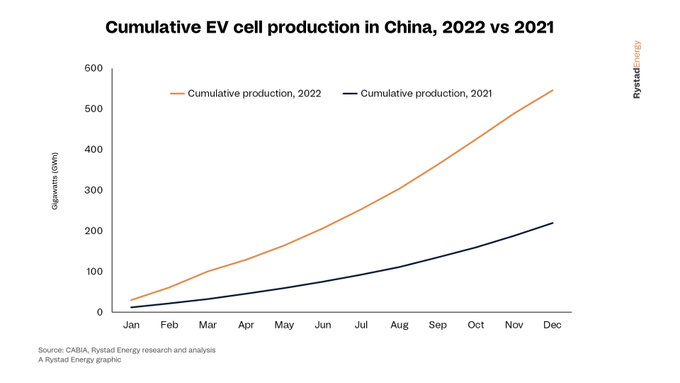

CHART OF THE WEEK: EV cell production in China doubled last year despite disruptions. In 2023 Rystad Energy expects manufacturing to increase again.

#rystadenergy

#energy

#batteries

#electricvehicles

#China

1

8

24

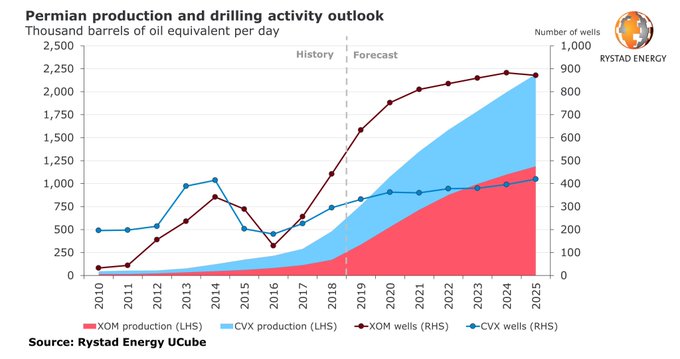

Chevron and ExxonMobil plan to significantly ramp up production in the US shale heartland as the oil behemoths are seeking to go from shale to scale in the Permian. Read more here >

#RystadEnergy

#shale

#permian

#permianbasin

1

18

25

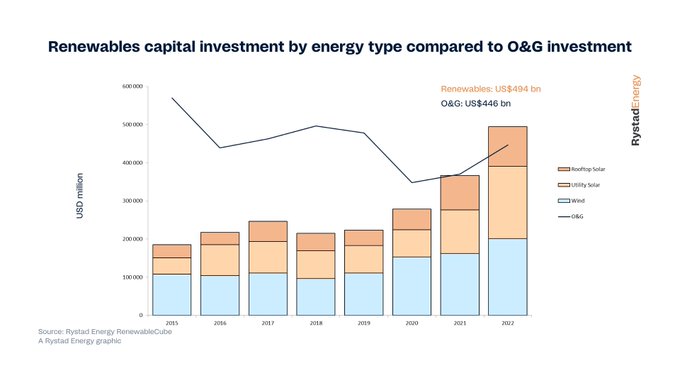

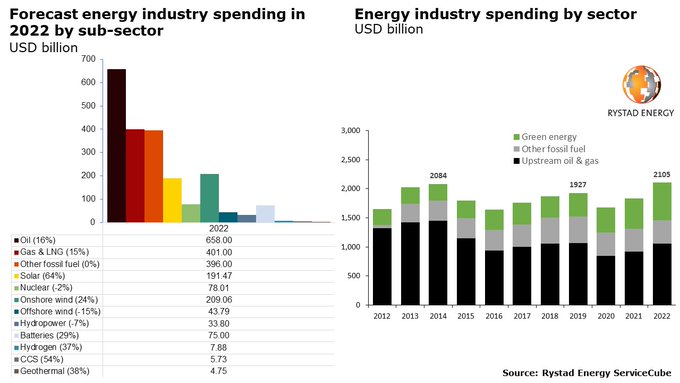

Chart of the week: In the run up to

#COP27

in Egypt, Rystad Energy is highlighting that capex on renewables is set to reach $494 billion in 2022, outstripping oil and gas at $446 billion. The first time that investment in renewables has overtaken oil and gas.

#rystadenergy

1

16

23

Global recoverable oil reserves now stand at more than 1,600 billion barrels, an increase of 52 billion barrels from last year’s estimate.

#rystadenergy

#energy

#oil

#upstream

0

8

22

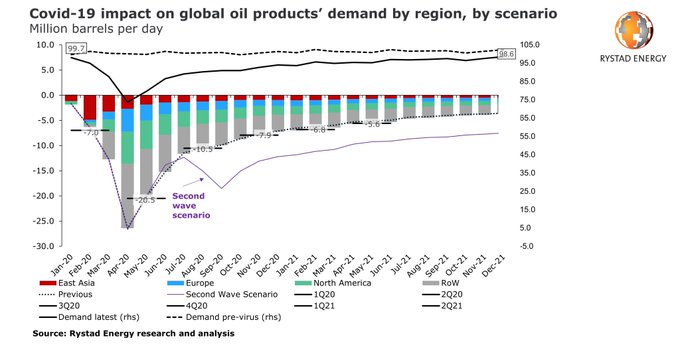

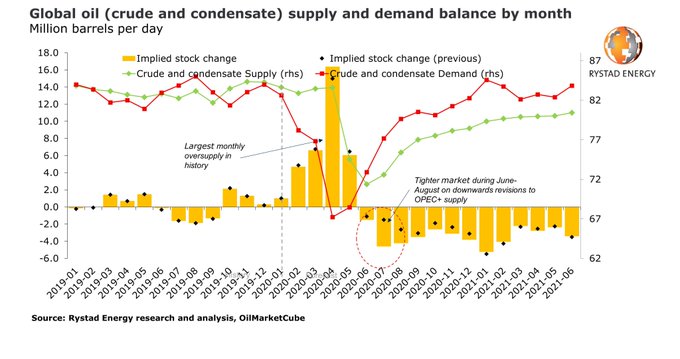

Modelling a second Covid-19 wave: Oil demand in 2020 could lose another 2.5 million bpd.

Read the full article here >

#RystadEnergy

#covid19

#corona

#coronavirus

#secondwave

#oilandgas

#oil

#upstream

#energy

#2020

#2021

#demand

1

12

20

Europe’s ban on Russian coal is a double-edged sword that will keep power prices high.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#coal

#power

0

9

21

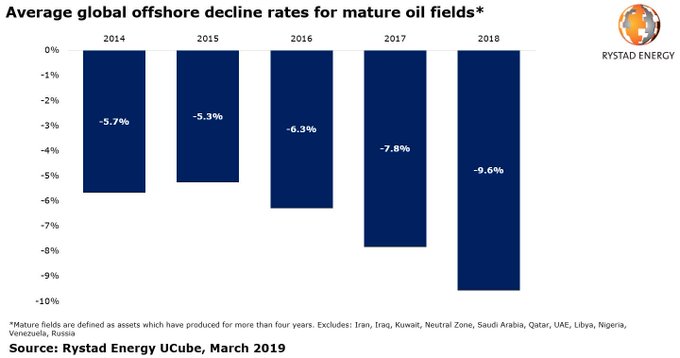

Rystad Energy's Friday Snapshot: Offshore decline rates reached almost 10% last year, driven by low infill drilling. Read more here >

#RystadEnergy

#offshore

#drilling

0

6

21

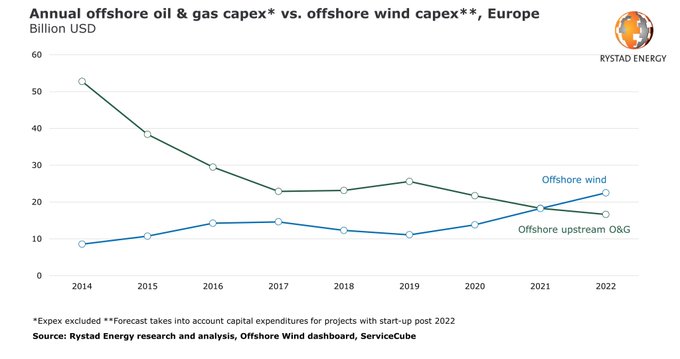

Offshore wind expenditure set to match upstream oil and gas in Europe in 2021, surpass it in 2022.

Read the full article here >

#RystadEnergy

#energy

#energymarkets

#offshorewind

#offshorewindenergy

#upstream

0

12

20

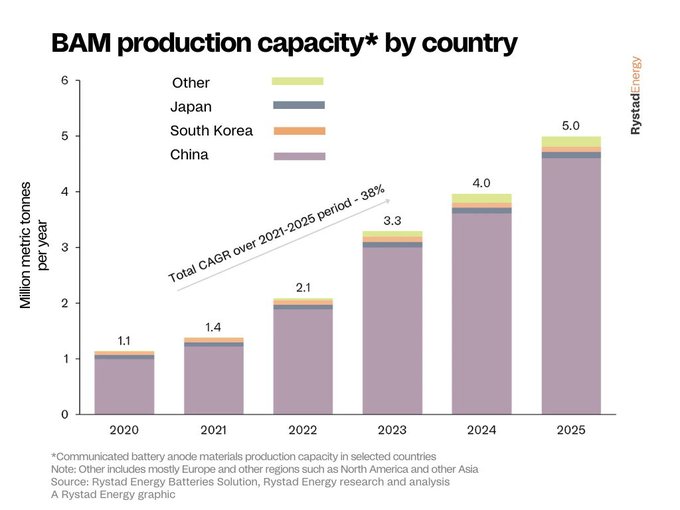

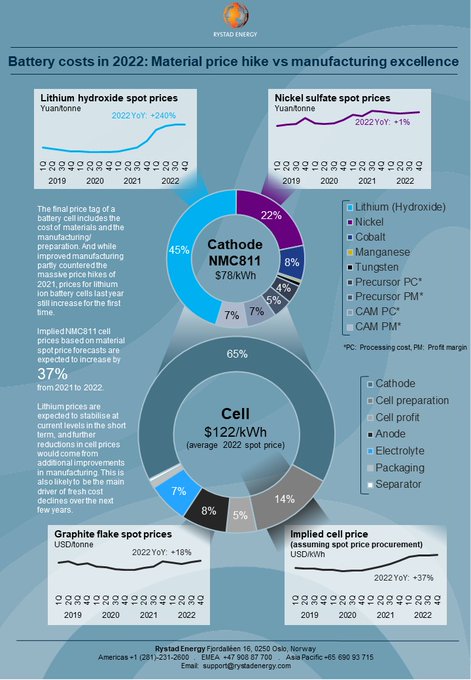

"Battery manufacturers are frantically building production capacity to meet demand. Manufacturers need to go from zero to 100 at breakneck speed,” Edison Luo, senior analyst at Rystad Energy.

#rystadenergy

#energy

#energytransition

#batteries

1

1

19

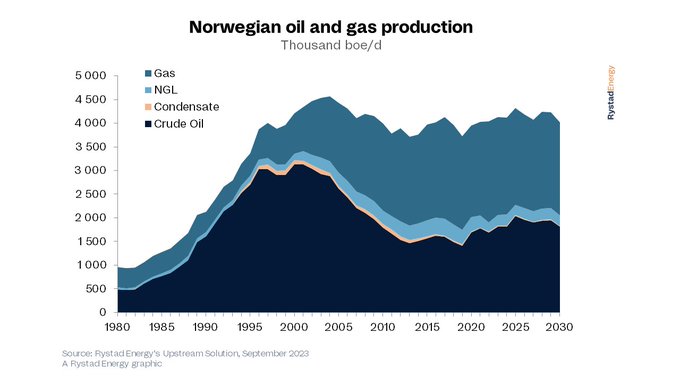

North Sea oil and gas industry blooms with increasing production and investments. The region's solid production provides resources to Europe and the rest of the world navigating through the energy transition.

#NorthSea

#Oilandgasindustry

#RystadEnergy

1

11

20

Bjørnar Tonhaugen, discusses what could potentially happen to oil prices when the U.S. and the world is projected to run out of viable physical storage capacity, with CNBC.

#RystadEnergy

#oilprices

#OOT

via

@YouTube

1

2

19

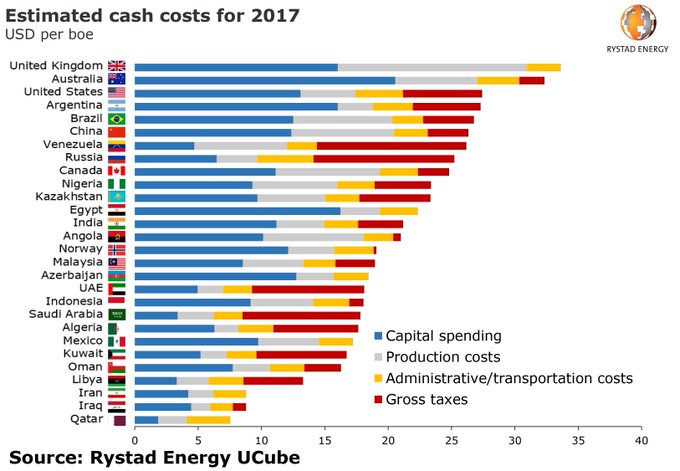

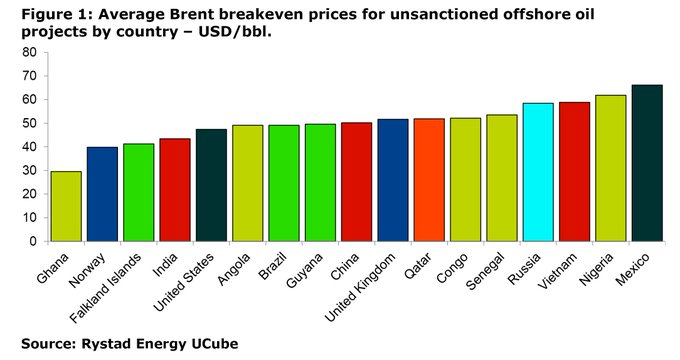

Oil production costs reach new lows, making deepwater one of the cheapest sources of novel supply.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#oilproduction

#costs

#deepwater

#supply

1

7

19

What are the main drivers behind the increasing prices of lithium-ion batteries?

With our BatteryCube you can analyze the cost structure of battery production as well as investments and economics across the entire value chain.

More here:

#rystadenergy

1

4

19

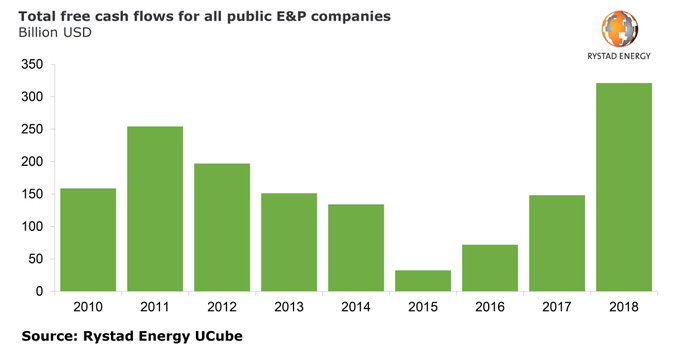

Just 10% of Shale Oil companies are cash flow positive, according to Rystad Energy. Read the full Press Release here >

#RystadEnergy

#shale

#cashflow

#oilandgas

2

7

19

Glut no more: Fresh OPEC+ cuts point to crude and condensate supply deficits through 2021.

Read the full article here >

#RystadEnergy

#energy

#energymarkets

#oil

#crudeoil

#opec

0

14

19

Susan Zou, our VP battery materials supply chain research told

@TheEconomist

that Congolese production will jump by 38% this year, to 180,000 tonnes.

#rystadenergy

#energy

4

6

17

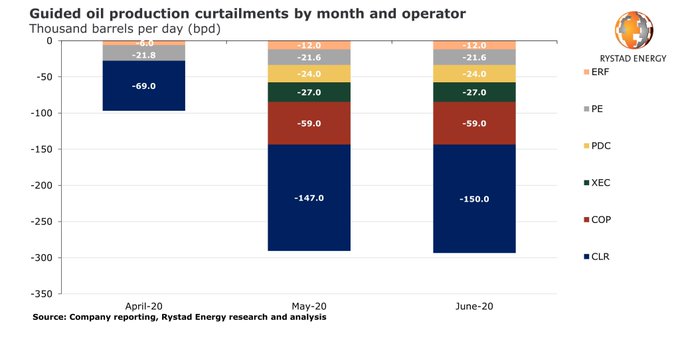

US oil shut-ins in numbers: Expect at least 300,000 barrels per day shut during May and June.

Read more here >

#RystadEnergy

#energy

#oilandgas

#oil

#shutins

#usnews

#oilproduction

1

11

17

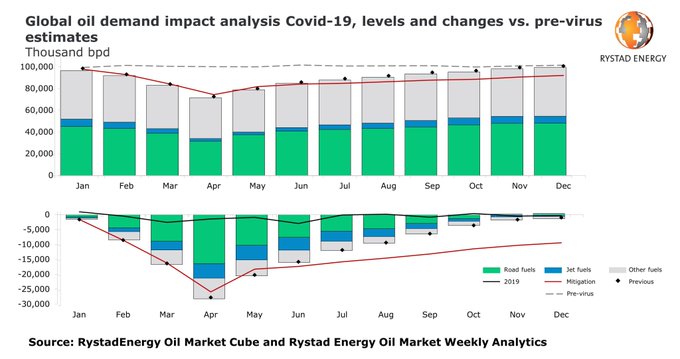

Rystad Energy's COVID-19 Report: Demand for road fuel is down by 16.3 million bpd in April, while jet fuel is down 65%.

Download our regularly updated COVID-19 Report here >

#RystadEnergy

#energy

#oilandgas

#oil

#demand

#coronavirus

#covid19

#OOTT

0

18

18

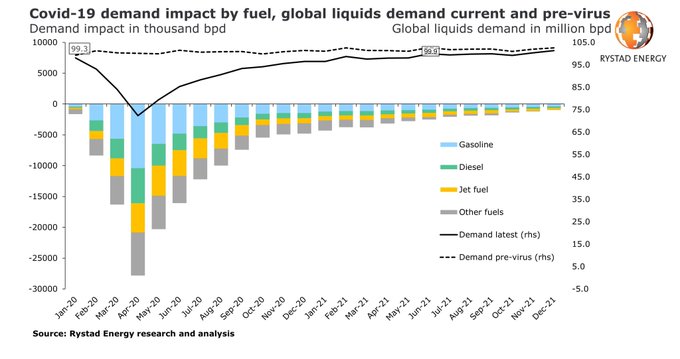

Gasoline, the refiner’s favorite child, is the key fuel behind the global oil demand doom.

Full PR here >

#RystadEnergy

#energy

#oilandgas

#oildemand

#gasoline

0

12

17

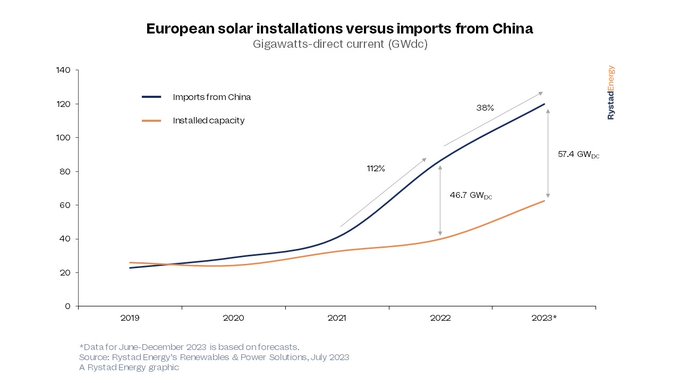

About €7 billion of Chinese solar imports are sitting in European warehouses, and the stockpile is set to continue this year despite existing inventory.

Read more here -

#rystadenergy

#energy

#solar

#europe

#china

0

8

13

We are thrilled to have NJ Ayuk, Executive Chairman, African Energy Chamber, joining us at the January Rystad Talks Energy.

He will discuss energy poverty, through the lens of Africa, with Jarand Rystad, CEO at Rystad Energy.

#rystadenergy

#energy

1

9

16

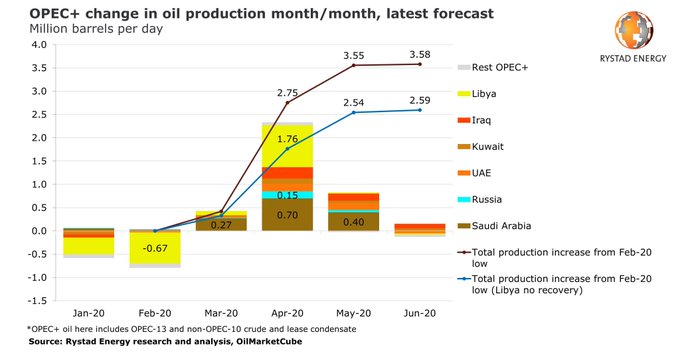

A crude tsunami: Up to 3 million bpd of extra oil can hit the market from April, more coming in May.

Read the full story here >

#RystadEnergy

#energy

#oilandgas

#oil

#oilprice

#forecast

#oott

0

14

16

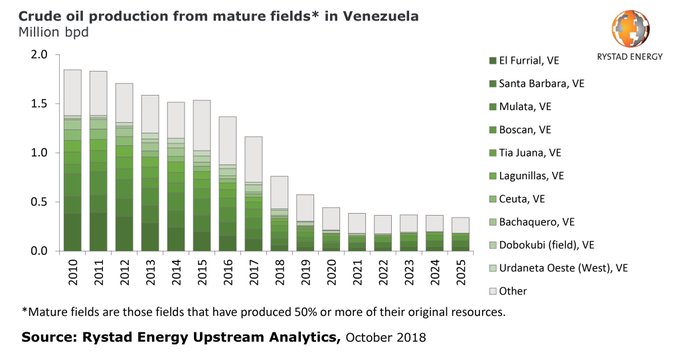

Rystad Energy's Friday Snapshot: Due to the absence of substantial project sanctioning since 2014 in

#Venezuela

, we forecast

#crude

production from mature fields in the country to decline 35% YoY in 2018 and 25% YoY in 2019. Find out more here >

#oil

1

17

16

Chart of the week: Gas exploration boost needed to meet demand.

Gas is crucial for a transition to a net zero future and moving away from coal. Recent price hikes also risk making gas unaffordable for the poorest, further exacerbating the energy crisis.

#rystadenergy

#energy

0

10

16

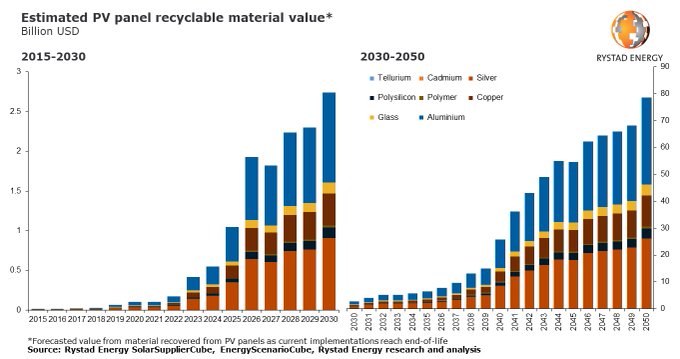

Reduce, reuse: Solar PV recycling market to be worth $2.7 billion by 2030.

Read the full press release here:

#rystadenergy

#energy

#energymarkets

#renewables

#solar

#solarpv

0

6

15

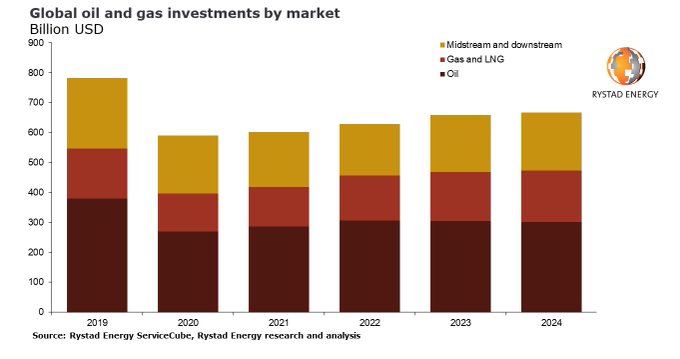

Global oil and gas investments to hit $628 billion in 2022, led by upstream gas and LNG.

Read more here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#investments

#upstream

#gas

#lng

0

12

16

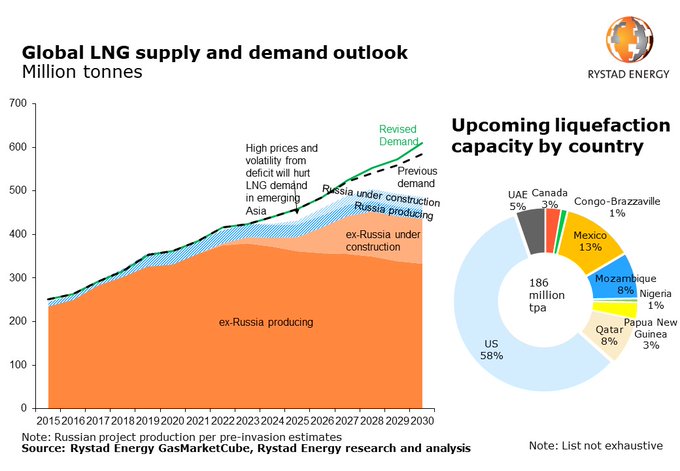

A perfect and unavoidable storm: LNG supply crisis will make landfall in winter 2022.

Read more here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#gas

#lng

0

8

16

US shut-in oil comes back: Most curtailed output is set to return by the end of August

Read the full article here >

#RystadEnergy

#energy

#energymarkets

#oilandgas

#shutins

0

4

16

Rystad Energy's Friday Snapshot: History’s largest oil glut months away from topping world storage while tanker freight rates explode.

Read more here >

#RystadEnergy

#energy

#storage

0

8

13

Our experts have developed a whitepaper to capture our views on a pragmatic approach to the transition for those involved in the US oil and gas industry. Download your copy now >

#energytransition

#USoilandgas

0

3

11

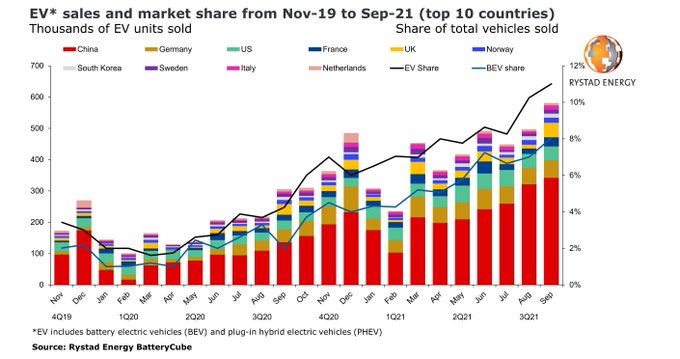

EV sales set to smash records with 7 million cars in 2021 while crossing the 10% annual threshold.

Read the full press release here:

#rystadenergy

#energy

#energymarkets

#energytransition

#EVs

#electricvehicles

0

10

15

US shale gets tempted by high prices but boosting output to tap OPEC+ inaction would take months.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#shale

0

6

15

Spain is on track to generate more than half of its power from renewable sources this year, the first of the top five European countries by power demand to accomplish this feat.

#rystadenergy

#energy

#renewables

#power

3

4

15

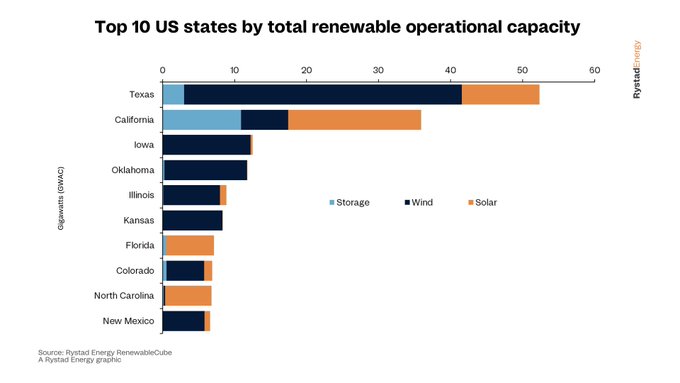

CHART OF THE WEEK: Everything is bigger in Texas…even renewables! The state’s oil and gas industry has a long and storied history, but it has quickly and efficiently become the US leader in green power installations.

#rystadenergy

#energy

#renewables

#texas

1

6

14

United States cements its position as world leader in oil resources. Full PR here >

#RystadEnergy

#oilandgas

#oilresources

1

9

12

Permian drilling permits hit all-time monthly high in March, signaling production surge on the horizon.

Read more here:

#rystadenergy

#energy

#energymarkets

#drilling

#permian

4

10

14

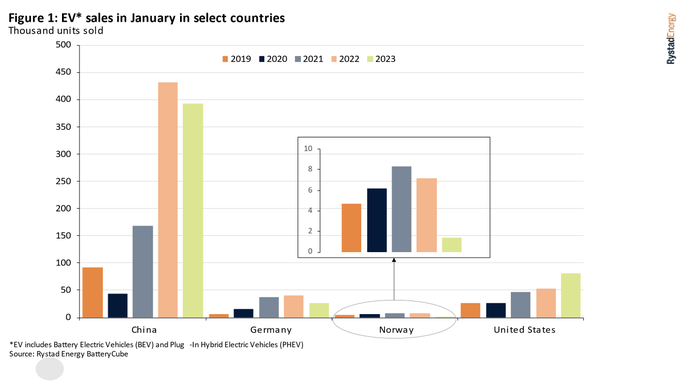

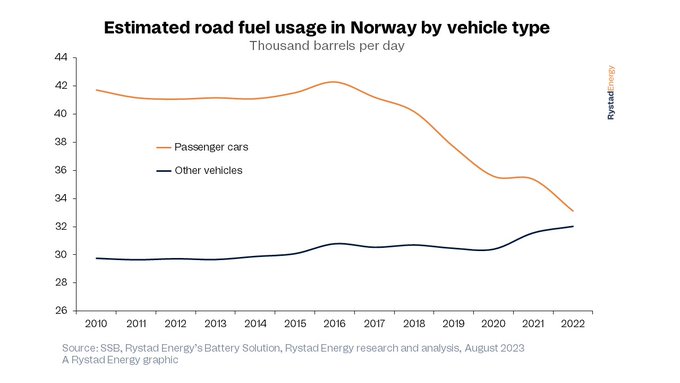

Sales of gasoline and diesel in Norway have remained relatively stable, falling only 10% in the last five years despite rapid EV adoption. But official figures don't tell the full story.

#rystadenergy

#energy

#evs

#norway

1

3

13

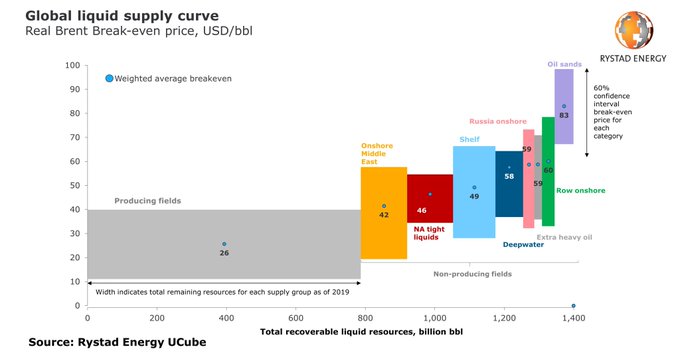

Rystad Energy ranks the cheapest sources of supply in the oil industry. See full PR here >

#RystadEnergy

#upstream

#supply

#oilandgas

1

8

14

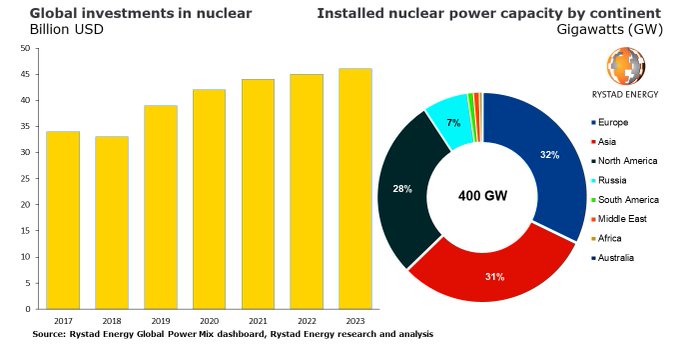

Nuclear investments on the rise: More than $90 billion to be spent in next two years, with more coming as 52 reactors in the works.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#nuclearenergy

#investments

1

8

14

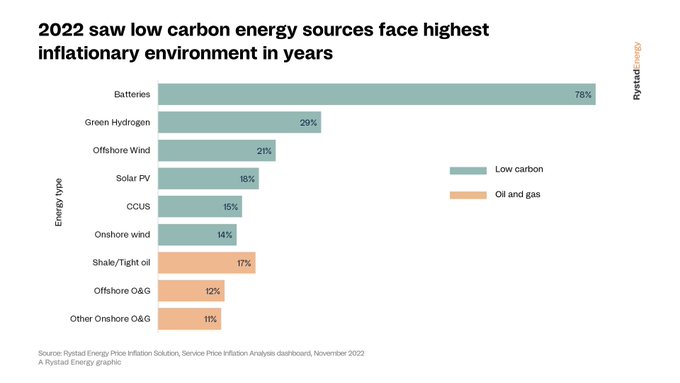

CHART OF THE WEEK: Inflation has stalked global energy markets throughout 2022, contributing to rising costs across the economy. As the energy transition gains momentum, renewable developments are facing the most intense inflationary pressures.

#rystadenergy

#energy

#inflation

1

3

13

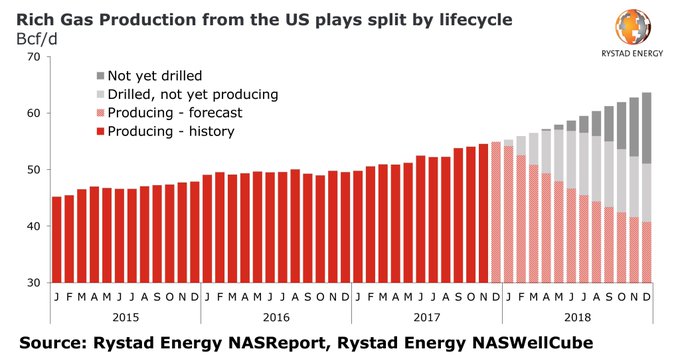

Rystad Energy's Friday Snapshot: We expect a significant increase in rich gas production in 2018 in the US plays coming from completion activity in the Appalachian Basin and the associated volumes in the Permian Basin and SCOOP & STACK. NASReport:

#OOTT

1

8

13

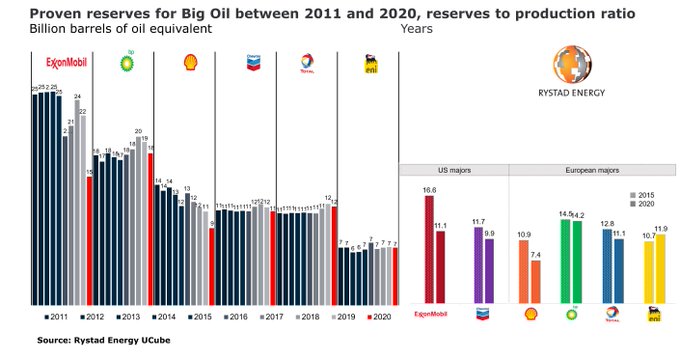

Big Oil could see proven reserves run out in less than 15 years as output is not replaced by discoveries.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#oilandgas

1

6

12

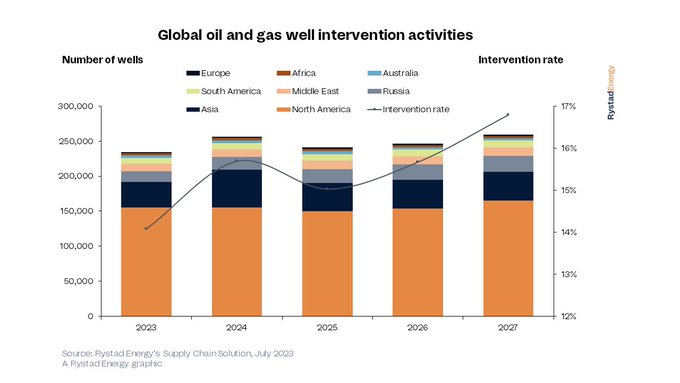

As oil and gas production companies look for efficient and cost-effective methods of increasing their output, the well intervention market is set to get a healthy boost and top $58 billion in 2023.

#Rystadenergy

#energy

#wellintervention

0

5

13

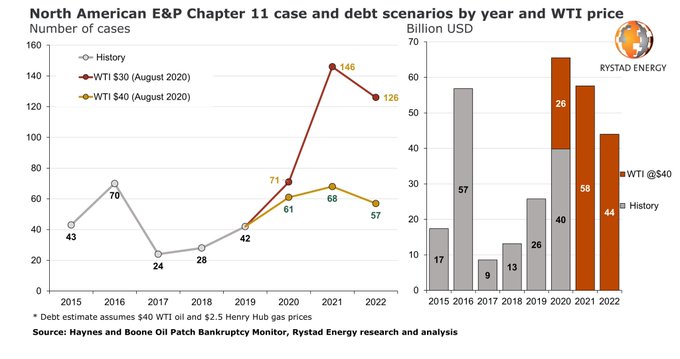

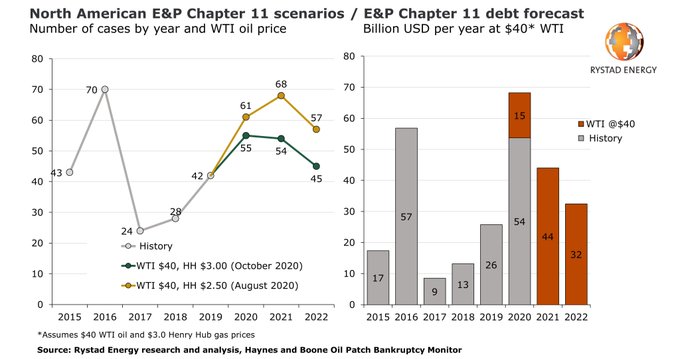

Even at $40 WTI, about 150 more North American E&Ps will need Chapter 11 protection by end-2022.

Read the full article here >

#RystadEnergy

#energy

#energymarkets

#exploration

#production

#covid19

#shale

1

4

13

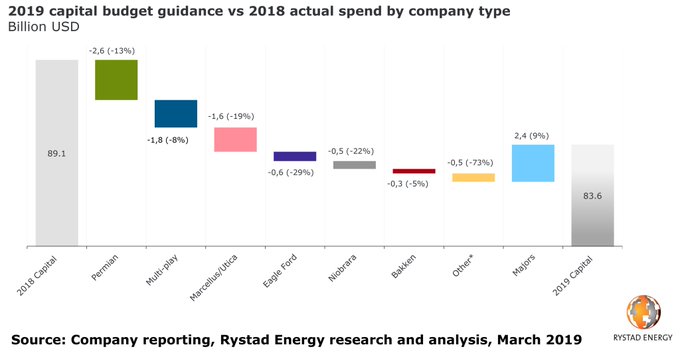

Rystad Energy's Shale Newsletter: US shale players cut budgets and boost production. Read the full newsletter here >

#shale

#capitalbudgetguidance

#oilproduction

1

5

13

Rystad Energy used

#data

to illustrate the novel coronavirus' implications on our lives and the

#energy

industry. We produced a

#report

, free for all, which will be updated weekly and can be found here:

#RystadEnergy

#corona

#coronavirus

#covid19

#report

1

12

12

CHART OF THE WEEK: Supply chain bottlenecks severely impacted US shale last year, most notably in equipment pricing and labor constraints. Sweeping congestion across major oilfields also resulted in lengthy delays of new wells coming on production.

#rystadenergy

#chartoftheweek

0

4

10

Rystad Energy's Exploration & Production Newsletter: Lack of field sanctioning drives long-term oil production decline in Russia. Find out more here >

#RystadEnergy

#exploration

#production

#oilandgas

#sanctions

#sanctioning

#newsletters

0

5

13

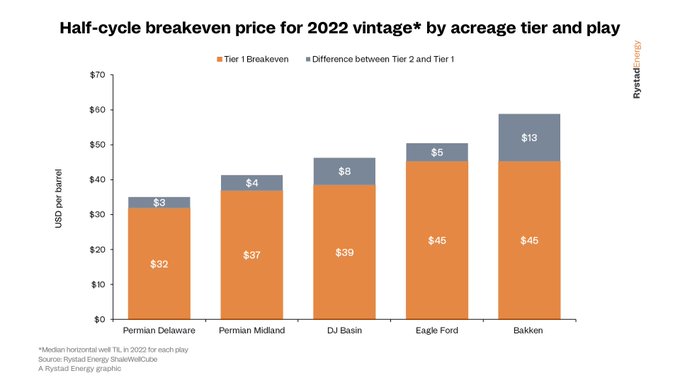

The reinvestment rate of US shale oil producers hit a three-year high in the second quarter. But this is not a sign of operators returning to the "old days of aggressive capital expenditure and rapid production growth."

#rystadenergy

#energy

#shale

2

5

12

Our SERA Newsletter on insights into Australian

#Renewables

is ready for you! Sign up now to receive the first issue >

0

1

11

Global shut-ins surge: Canada, Iraq and Venezuela lead the 2 million bpd wave.

More here >

#RystadEnergy

#energy

#oilandgas

#oil

#oilprice

#data

#analytics

#coronavirus

#covid19

0

11

11

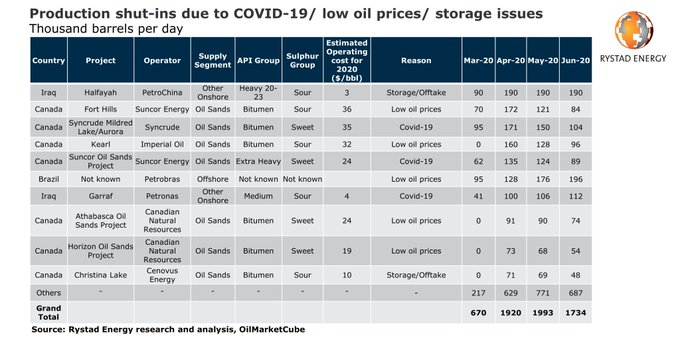

Offshore project commitments count set for a record in coming years, deepwater to have top growth.

Read more here:

#rystadenergy

#energy

#energymarkets

#oilandgas

#offshore

#costs

0

6

12

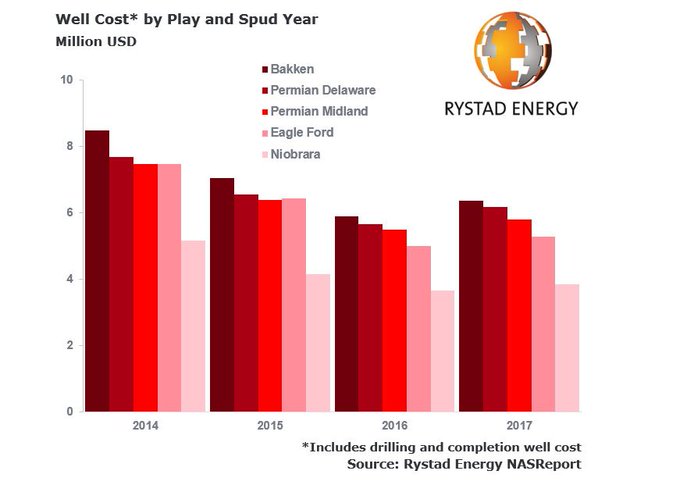

Rystad Energy's Friday Snapshot: NA

#Shale

well costs expected to grow on avg. ~10% YoY due to higher service costs

1

8

12

US oil output set to bottom out in June, will not recover to pre-Covid-19 levels in 2021.

Full article here >

#RystadEnergy

#energy

#energymarkets

#oilandgas

#coronavirus

#covid19

0

6

12

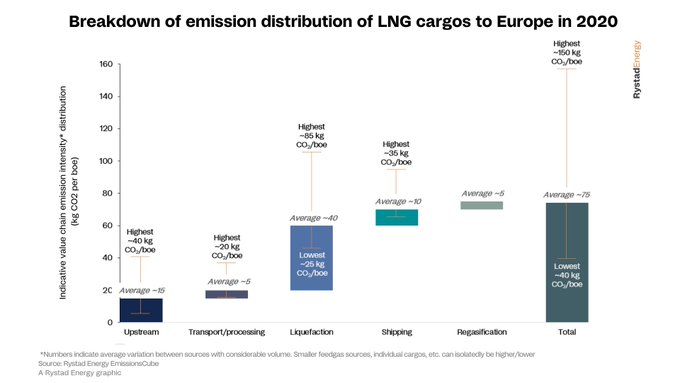

CHART OF THE WEEK: The majority of CO2 emissions in LNG take place during liquefaction.

As the world seeks to decarbonize, there are nascent plans to use renewable energy to power the compressing process thereby reducing emissions.

#rystadenergy

#oilandgas

#gas

#lng

3

6

11

Green Initiator of the Year:

@Equinor

(Hywind Tampen), congratulations on winning our Green Initiator Award!

#gullkronen20

#RystadEnergy

1

5

10

"Vaca Muerta could hold the key to Argentina’s future energy economy following more than a decade of oil production declines," says Alexandre Ramos Peon, our head of shale research.

#energy

#rystadenergy

#vacamuerta

#shale

3

6

12

On Argentina’s oil boom: “This is absolutely a once-in-a-generation opportunity,” says Alexandre Ramos-Peon, head of shale research at Rystad Energy.

Read more in Juan Pablo Spinetto's Bloomberg opinion piece here:

#rystadenergy

#energy

#vacamuerta

#oil

0

5

12

Global energy spending set to reach record high of over $2 trillion in 2022, led by oil and gas.

Read the full article here:

#rystadenergy

#energy

#energymarkets

#spending

#oilandgas

1

11

11

On May 6 Jon Andre Løkke, CEO of Nel Hydrogen will be joining us live on LinkedIn & Facebook for session 5 of the Energy Transition Marathon.

More:

#rystadenergy

#energytransitionmarathon

0

2

11

Offshore drillers to see contract cancellations of up to $3 billion till 2021, many to need restructuring.

Full PR here >

#RystadEnergy

#energy

#oilandgas

#offshore

#drilling

#corona

#coronavirus

#covid

#covid19

0

8

11

Olga Kerimova, Senior Analyst, discusses how "Ghana and Norway boast sub-40

#breakeven

prices for new

#offshore

#oil

projects" in Offshore Magazine. Read the full article here >

0

7

10

COTW: Colombia's offshore natural gas production could be an economically viable solution to recent domestic production declines. LNG will play a key role in the short term, but domestic gas could reach Colombians at lower prices in the long term.

#rystadenergy

#gas

#colombia

1

5

10

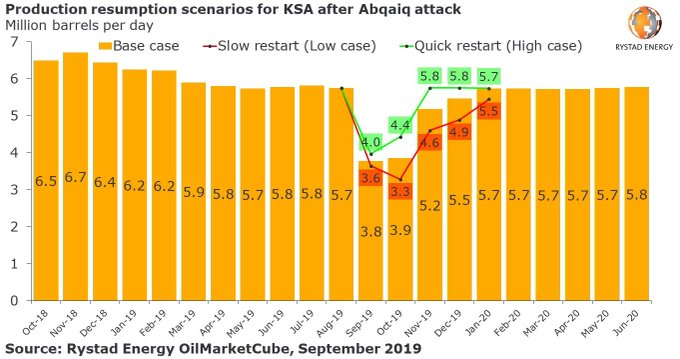

There is clear risk of a slower restart of Saudi Arabian oil production despite the optimistic guidance by Saudi Aramco following Saturday's attack ->

#SaudiArabia

#Oil

#OOTT

1

9

10