Robert Prechter

@RobertPrechter

Followers

11,399

Following

40

Media

23

Statuses

237

Personal tweets denoted with an -RP signature. Account managed by @socionomics staff. RTs are not endorsements.

Joined February 2011

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

London

• 367650 Tweets

Rio Grande do Sul

• 323749 Tweets

#WWEBacklash

• 300525 Tweets

May the 4th

• 286153 Tweets

Star Wars

• 273361 Tweets

Madonna

• 247692 Tweets

La Liga

• 179455 Tweets

Barcelona

• 149300 Tweets

Girona

• 123728 Tweets

SOUTH KOREA APOLOGIZE TO BTS

• 106310 Tweets

Xavi

• 102364 Tweets

Haaland

• 99059 Tweets

Sarah

• 89068 Tweets

Hamilton

• 82477 Tweets

#النصر_الوحده

• 79520 Tweets

こどもの日

• 71312 Tweets

Alonso

• 44915 Tweets

Vargas

• 33374 Tweets

برشلونة

• 31905 Tweets

West Midlands

• 31536 Tweets

#Amici23

• 31243 Tweets

Andy Street

• 25779 Tweets

Janja

• 25374 Tweets

ケンタッキーダービー

• 24280 Tweets

Cano

• 18484 Tweets

Sergi Roberto

• 16620 Tweets

Laporta

• 16249 Tweets

Hulk

• 14118 Tweets

تشافي

• 11434 Tweets

Sabalenka

• 11365 Tweets

Holden

• 10956 Tweets

Last Seen Profiles

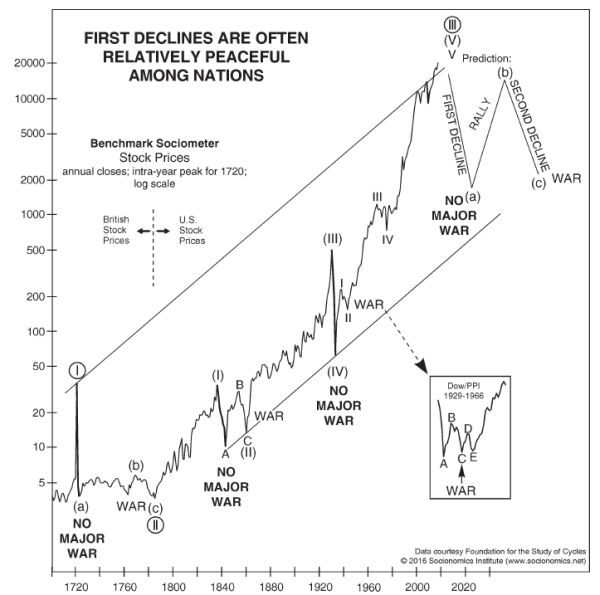

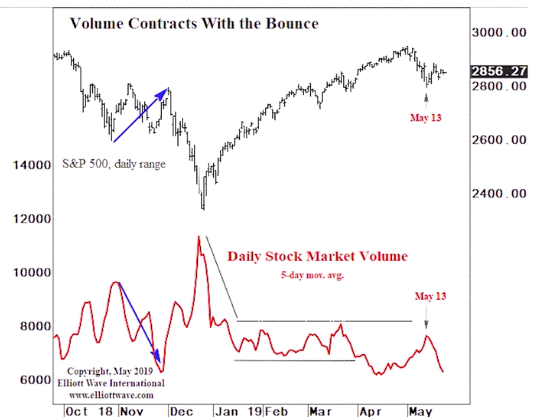

An interviewer once asked

@RobertPrechter

: "Under the Wave Principle, what is the most important thing to watch other than price?" Prechter replied: "Volume." Learn why:

3

22

87

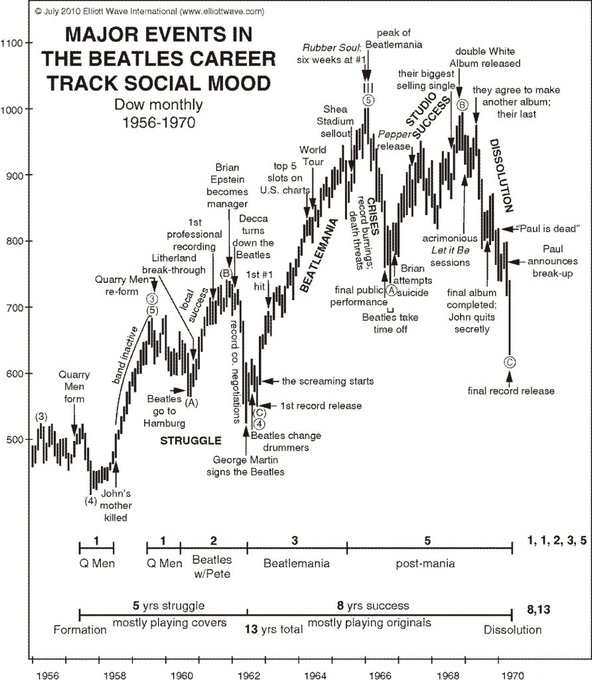

“...the radical shifts in the Beatles’ fortunes followed quite precisely the radical shifts in the stock market’s fortunes.” - Robert Prechter - Learn more about how social mood regulates the popularity of stars:

#elliottwave

#socialmood

2

20

56

“The Wave Principle describes financial markets because they move primarily on mass psychology.”

@RobertPrechter

#classicprechter

#ElliottWave

0

20

51

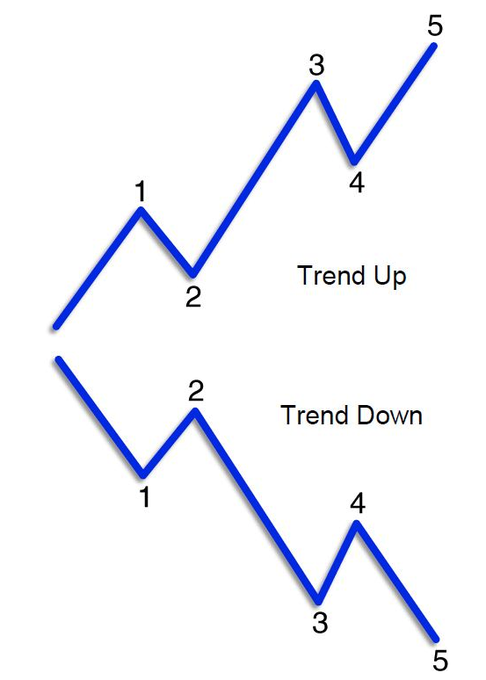

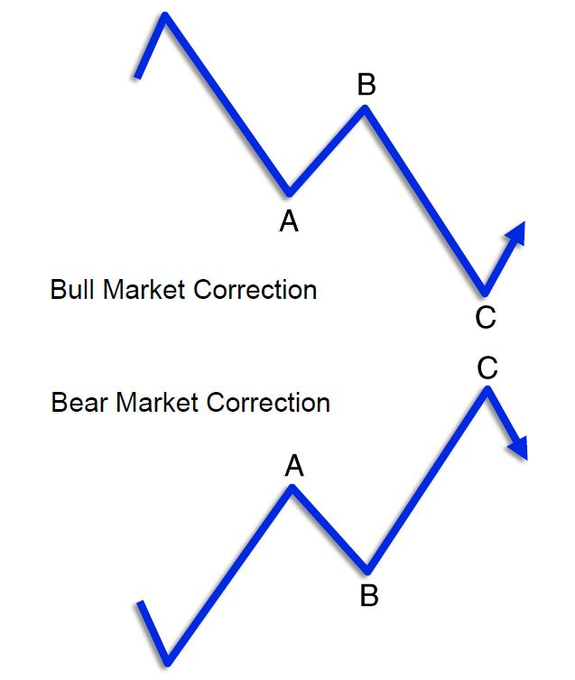

Kick off your 2023 trading with these key insights.

Full, free report available here:

#trading

#tradingtips

#tradersuccess

#invest

#investing

#investingtips

#stocks

#stockmarket

#Elliottwave

#daytrading

#swingtrading

#tradingmethod

#technicalanalysis

3

15

38

“Stock prices are a direct and sensitive record of changes in society’s feeling of self-worth.” – Robert Prechter

#socionomics

#classicprechter

1

11

26

“Events that make history are the result of shared mental states that take time to reach the point of mass expression.” -

@RobertPrechter

#classicprechter

#elliottwave

0

3

21

"Emotional Markets Produce the Clearest Wave Counts" - Learn more here >>

http://t.co/VCyty9Tc2R

http://t.co/kDGVxLMNkb

1

9

23

"The Wave Principle is a description of the dynamics of collective emotional change."

#ElliottWave

1

16

20

“Crowd psychology is impulsive, self-generating, self-sustaining and self-reversing."

#Socionomics

0

22

17

"The market always gives warnings before it changes direction" -

@RobertPrechter

- Listen to Bob Prechter's presentation to

@IFTAWorldwide

where he dismantles the commonly held beliefs that many use to forecast the markets:

1

8

16

“The unconscious mind is not rational, but *it is not random, either.* It is patterned, and therefore, to a degree, predictable.”

#EWT

0

14

19

"A trading method comes down to one thing: creating parameters for making decisions for entering and exiting markets." - Robert Prechter

#elliottwave

#trading

#classicprechter

0

6

15

"Bear markets move fast...investors & traders who are prepared have greater opportunities on downside than on upside"

http://t.co/S3tyyGAEQN

4

13

16

The

#market

is precise, not just a random walk, from day to day. Things are orderly, even in the panics.

2

11

10

“If it’s obvious, it’s obviously wrong!”-Joe Granville, one of the all-time great technicians. In memoriam

http://t.co/e0CGDaIUsH

0

10

10

You could read every book on monetarist and Keynesian

#economics

, and you would never understand the primary importance of mass psychology.

1

18

8

The

#market

appears crazy only if you expect it to be led by something other than social mood.

2

8

8

"The

#market

reflects quasi geometric forms and mathematical relationships over and over again."

0

8

7

Excerpt from Elliott Wave Principle: Key to Market Behavior

#ElliottWave

http://t.co/osC0fD9Cye

5

6

6

"Put 100% of your effort into dealing with the markets, but don't expect to get 100% of your fulfillment from it..."

http://t.co/zJa5jDol6Y

2

6

6

Social mood is a shared mental disposition that arises in humans when they interact socially.

@socionomics

1

4

5

Most observers believe

#markets

follow the law of cause and effect and that the causes are outside the markets.

0

3

6

When authorities fear

#deflation

, they don’t want you to hold cash. They want you to prop up debt via a bank account or money fund. -RP

3

7

4

#Bond

decline "baffles" analysts says

@nytbusiness

http://t.co/BNfN5MKJjd.

See our year-ago June 2012 forecast:

http://t.co/6YNnczay1P

-RP

0

0

5

"Evidence is rapidly mounting that the trend in interest rates on high-grade debt is poised to reverse." -RP 6/6/2012

#bonds

#treasuries

0

2

3

#SocialMood13

The Financial/Economic Dichotomy in Social Behavioral Dynamics: The Socionomic Perspective

http://t.co/6XKYfRgGoR

via

@SSRN

0

2

3