Rihard Jarc

@RihardJarc

Followers

39,473

Following

2,682

Media

435

Statuses

6,895

Investor & writer @uncoveralpha . Tweets are only opinions. Researching and sharing the findings of the technology sector in detail (+12k subscribers).

Joined January 2016

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

ariana

• 243330 Tweets

$GME

• 203499 Tweets

Dr. Phil

• 150570 Tweets

Corinthians

• 139511 Tweets

the boy is mine

• 135333 Tweets

South Africa

• 90153 Tweets

Roaring Kitty

• 78453 Tweets

Alcaraz

• 73393 Tweets

Sinner

• 71451 Tweets

Saka

• 44380 Tweets

READ THE ROOM SOON

• 42265 Tweets

Dolly

• 39826 Tweets

Kaytranada

• 32810 Tweets

$PEIPEI

• 29504 Tweets

Gordon

• 25830 Tweets

#BBCDebate

• 23150 Tweets

Iceland

• 16900 Tweets

Justine

• 13750 Tweets

Zverev

• 13040 Tweets

القايمه السوداء

• 12717 Tweets

Penny Mordaunt

• 12684 Tweets

Rayner

• 11313 Tweets

Carlitos

• 11162 Tweets

Ruud

• 10140 Tweets

ジムシャニ

• 10011 Tweets

Last Seen Profiles

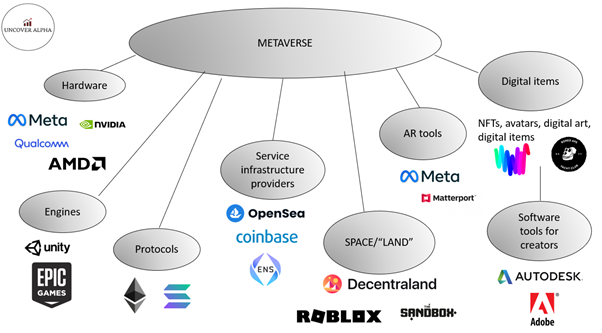

Every decade something special emerges that is about to change the world. And this is it for me - The Metaverse.

The assets that interest me in the space as an investor.

👇👇👇

$FB, $NVDA, $AMD, $U, $SAND, $MANA, $ENS, $ETH, $COIN,

#BAYC

& more.

34

185

763

Tomorrow my article on the Metaverse is dropping!

The picture is a small teaser.

Talking about interesting assets from an investor standpoint: $FB, $U, $NVDA, $AMD, $COIN, $ETH, $ENS, $SAND,

@BoredApeYC

& many more.

If you haven't subscribed yet 👉

26

137

642

I have been researching NFT's the last few days. There is a lot of hype but some projects are here to stay.

The most important thing is that you like what you own.

And with that, I got myself a

@KoalaAgencyNFT

. I really like the community, the social cause and I love Wallas🐨

208

237

613

@saxena_puru

Puru with all respect I do miss more of your stock tweets. Not taking any sides on this crypto theme just hoping for some more of your stock tweets because a lot of them have been great!

8

1

342

$PYPL expanding and adding a lead/ad platform to their products and leveraging all of their e-commerce purchase data.

No idea why the market doesn't like what $PYPL just introduced I for one like it.

Also, bear in mind

@acce

, the new CEO, just shipped more in the last 6 months

46

32

342