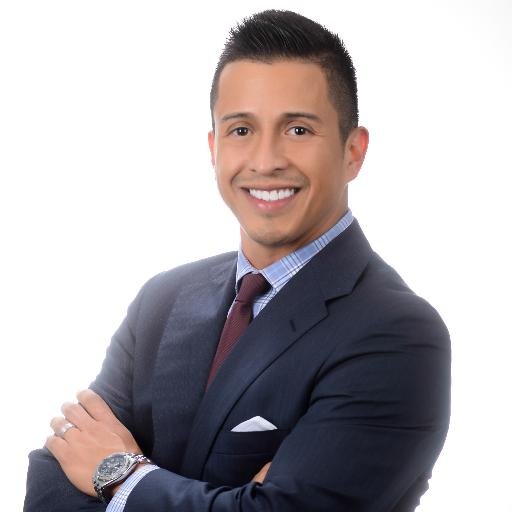

Ricardo Mendiola

@Ricardomendiola

Followers

569

Following

1K

Media

1K

Statuses

3K

Credit Expert - Real Estate Expert - Entrepreneur - Investor - Husband - Father

Dallas, TX

Joined September 2009

Take a moment to envision your ideal home and set clear, achievable goals. Break down the home buying process into smaller steps to make it less overwhelming. #DreamHome

0

0

0

Struggling with Credit? The Secret Secured Credit Card Solution! More Information on our Q+A Episode here: MSI Wealth Chronicles Ep. 13 https://t.co/js5BLOghCb

#podcast #msicreditsolutions #msiwealthchronicles

https://t.co/STxmddMGWK

0

0

0

If you've faced a foreclosure, focus on rebuilding your credit by making all payments on time, keeping credit card balances low, and potentially considering a secured credit card. #CreditRebuilding

0

0

0

🎉 Closing Day Success! So excited for my clients who just relocated from Houston to Forney! Their brand-new, fully loaded Chesmar home is absolutely beautiful, and they’re thrilled to start this next chapter in the DFW area 🏡✨ 🙌💰Welcome home and congrats! 🥂💙 #ClosingDay

0

0

0

🎉 Closing Day Success! So excited for my clients who just relocated from Houston to Forney! Their brand-new, fully loaded Chesmar home is absolutely beautiful, and they’re thrilled to start this next chapter in the DFW area 🏡✨ Welcome home and congratulations! 🥂💙 #ClosingDay

0

0

0

Enhancing your financial literacy involves understanding key concepts like APR, amortization, and the impact of compounding interest. Knowledge is power! #FinancialLiteracy

0

0

0

If you’re 100% debt-free, you might not qualify for a mortgage. Read that again. 🤯 It sounds backward, but buying a house requires leverage, and leverage is built on credit. Power of Leverage: No debt = no credit history = a tough approval process.

0

0

0

If you’re 100% debt-free, you might not qualify for a mortgage. Read that again. 🤯 It sounds backward, but buying a house requires leverage, and leverage is built on credit. 🔑 Debt is the evidence you can handle future debt.

0

0

0

One common credit myth is that carrying a small balance on your credit card helps your score. In reality, it's better to pay off your balance in full each month. #CreditMyths

0

0

0

Credit Repair + Real Estate 🟰 Keys to a new home🏡🔑📈 #CreditRepair #Homeownership #Transformation #realestateagent #MSICreditSolutions

0

0

0

💔When my client decided to pay off all her collections and did not ask for a pay to delete! $11K gone, and now she has to wait 7 years for the paid collections to fall off 💔 #creditscoretips #creditscore #creditrepair #fyp #creditrepairservices

0

0

0

When considering refinancing, calculate the potential long-term savings versus the upfront costs of refinancing to determine if it's a beneficial move for you. #Refinancing

0

0

0

Maintaining good credit as a homeowner allows you to take advantage of opportunities like refinancing at a lower rate if market conditions change. #HomeownerFinance

0

0

0

Factors influencing property valuation include recent comparable sales, the home's square footage, the condition of the property, and any unique features or upgrades. #PropertyValuation

0

0

0

How does the appraisal process work? Here’s what you need to know: An appraisal confirms that the home’s value aligns with the loan amount you’re seeking. Appraisers assess recent sales, the condition, any upgrades, and the location. The appraisal can make or break your deal.

0

0

0

Don't Pay Medical Debt! A HUGE Credit Score Mistake! More Information on our Q+A Episode here: MSI Wealth Chronicles Ep. 13 https://t.co/js5BLOgPrJ

#podcast #msicreditsolutions #msiwealthchronicles #Audio #video #credit #viral #fyp #newcar #creditrepair #finicialfreedom #finance

0

0

0

Avoid closing credit card accounts with a long history of positive payments, as this can shorten your credit history and potentially lower your score. #CreditMistakes

0

0

0

Don’t ignore your collections; hire us to help you! 📈😀 #creditrepair #collection #creditscore #creditrepairservices #repo

0

0

1

A good real estate agent can provide valuable insights into the local market, help you navigate complex paperwork, and advocate for your best interests throughout the transaction. #RealEstateExpert

0

0

0

Keeping your credit card utilization below 30% of your credit limit is generally recommended. High utilization can negatively impact your credit score, especially when applying for a mortgage. #CreditUtilization

0

0

0