Restructuring__

@Restructuring__

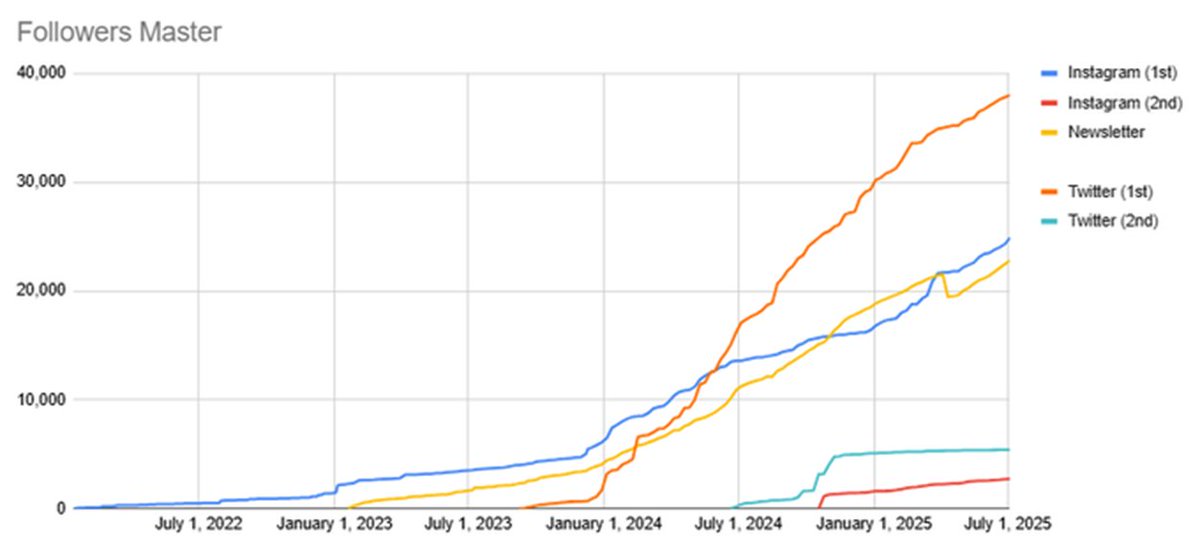

Followers

38K

Following

2K

Media

907

Statuses

2K

MF PE Investor sharing lessons on Public, Private Investing, and Rx - Check out my newsletter! DMs are open if your company is looking to reach our audience

Join 20k+ investors/bankers 👉

Joined April 2022

M&A —> back up.Trading —> back up.On-cycle —> pushed out .Markets —> all time highes.IPO —> backk . Banks ruling the world

JUST IN: Investment banking is bouncing back. Goldman crushed estimates with 26% fee growth, driven by a 71% surge in M&A. JPMorgan beat too—deal fees up 7%, trading +15%. Citi and Wells Fargo followed. M&A is snapping back, IPOs are returning, and equity desks are thriving on.

3

2

32

If you want to get out of banking, need to read Pari Passu Newsletter - See Post preview for Friday.

The Landlord’s Nightmare Tool: Inside the UK’s CVA | POST PREVIEW . Before cross-class cramdowns took center stage in English law, the Company Voluntary Arrangement (CVA) quietly became the weapon of choice for distressed UK retailers. Why? . Because it offered a fast,

1

0

4