RebelFundVC

@RebelFund_VC

Followers

176

Following

34

Media

3

Statuses

22

Rebel is a seed-stage #venturecapital fund founded by two serial #entrepreneurs / #VCs & powered by a network of top #YCombinator alumni.

San Francisco, CA

Joined November 2019

As one of my first fund’s portfolio companies it’s truly very exciting to watch these guys make leaps and bounds in the world of robotics. Congrats on all the success.

lnkd.in

This link will take you to a page that’s not on LinkedIn

0

1

2

L.A. companies raised a total of $71 million in seed funding, a 26% decline from the first quarter of the year.

lnkd.in

This link will take you to a page that’s not on LinkedIn

0

1

2

Timing is Everything! One of our (RebelFund’s) earlier investments, Together ( https://t.co/q7BIkeJttt) is making a real difference. With an increase in employees working remotely due to COVID, greater employee support is required. In people-centered or… https://t.co/oBDfYQwerK

0

1

2

Still time to register for today's panel at 10:30am Pacific time for an exclusive webinar on how disruption creates opportunity in early-stage venture investing. https://t.co/Ifme8ZMLoj

1

0

0

Please join us on Tuesday, June 23rd at 10:30am pst for an exclusive webinar. Learn from some of the brightest minds in Venture Capital how global VC’s are turning COVID-19 disruption into investment opportunities. https://t.co/8BEHX8LhpV

0

0

0

Striving to stabilize the situation with COVID-19 around the world I have been asked to be a judge at Coronavirus Battle US. https://t.co/GOnc6RLJA6

0

1

1

P.9 If we are indeed entering a recession, VCs and founders can expect smaller round sizes, fewer and smaller IPOs, and lower valuations. Although, these predictions should not prevent startups from raising money during a recession at all.

0

1

1

P.8 More of these winners will undoubtedly present themselves in this current environment.

0

1

1

P.7 If investors remain active in venture during a recession, they have the ability to help new investments hire top talent during a floundering job market, allowing their invested capital to play a role in the trajectory of their portfolio companies as well.

0

1

1

P.5 Another reason it’s a great time to invest in venture is that downturns attract the best founders — those with a lot of grit and determination who aren’t just chasing easy money.

0

1

1

P.4 As such, venture capitalists are financially incentivized to look even more closely for top performing companies to diversify their portfolio, especially if they are able to get on the capitalization table at a good valuation.

0

1

1

P.3 Venture is simply betting on the future of the market. Smart investors will look @ downturns as an op to find great inv. Google, Uber, Square, Airbnb, WhatsApp...some of all the co’s that raised $ during a downturn- all able to return 10x for early inv, exceeding the avg IRR

0

1

2

P.2 Best to remember that in the past those VCs that have achieved a 10x return in their portfolio are the funds that have bet against the odds during a recession.

0

1

1

P.1 Irrespective of what’s happening in the public markets, venture is an illiquid asset class with a 10yr horizon. It’s the long-term nature of venture investing into visionary projects that creates the potential for enormous value appreciation, regardless of the market’s cycles

0

1

1

@rbelur @PedroPAndreu @ncldwell @ManojNair100 @ihabQ8 @carloscaceres75: #HBS classmate @richard_sussman launches Rebel! Read more at https://t.co/9zPpRJy1AG.

1

3

3

The Role of a #VentureCapitalist (To be an active or passive #VC).

lnkd.in

This link will take you to a page that’s not on LinkedIn

0

1

2

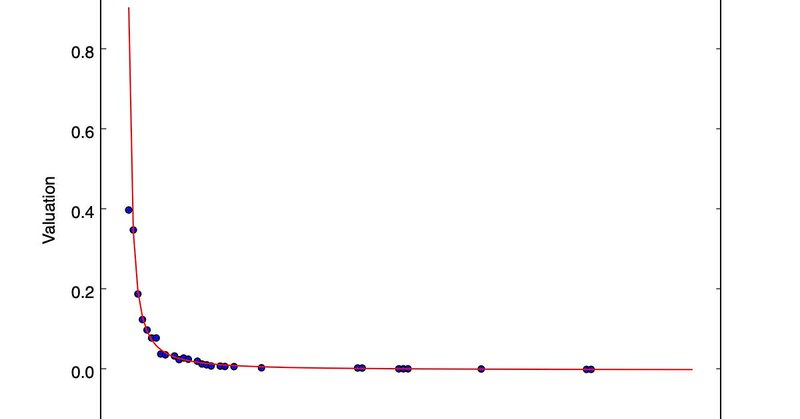

A great piece by my partner @jaredheyman on #seed #investing and the predictability of #YC #startup valuations @RebelFund_VC

jaredheyman.medium.com

While startup valuations are often closely held secrets, Y Combinator recently published a tantalizing glimpse into the value of its top…

0

1

2