Rainmaker

@RainmakerTrade

Followers

1K

Following

29

Media

94

Statuses

197

Trading Strategies, Factor Investing and sharing code for Machine Learning strategies. Not financial advice

Joined January 2024

MoM Core CPI came in at 0.44%, also slightly higher than expected. Just like in January, the main culprit is Shelter: this month's reading isn't quite as high as January's, but still higher than expected #CPI #investing #StockMarket

1

0

2

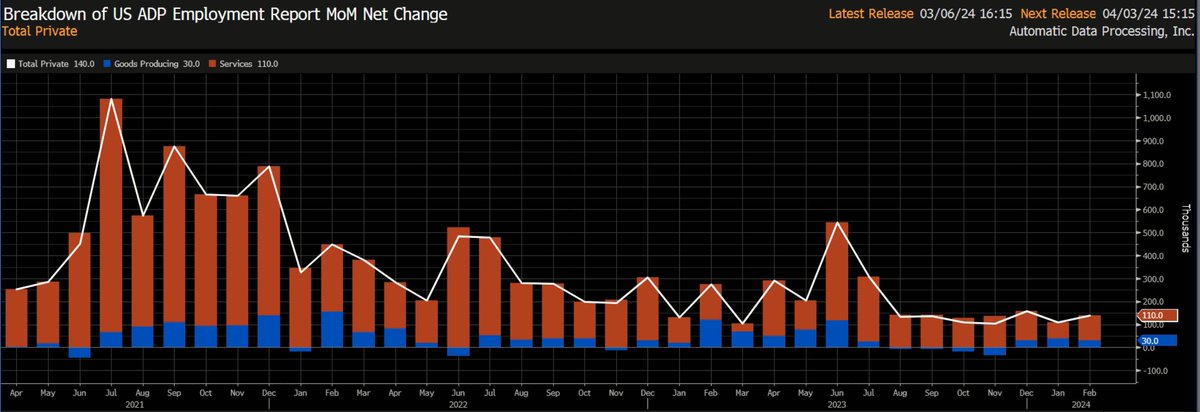

Rates are down today due to weaker ADP Employment report, continued $NYCB troubles and Powell reiterating for the thousandth time that the economy remains strong with a rate cut coming later in the year #stocks

0

0

0

Today's ADP Employment report came under expectations with only 140k jobs added vs. expectations of 150k. As usual, most jobs were added in services sector, no surprises there #investing #stockmarkets

1

1

1

You can expect a huge pop after trading resumes, since it got the capital injection it needed. I doubt this is the last time it causes jitters in the market, though #investing.

0

0

0