PFRDA

@PFRDAOfficial

Followers

15K

Following

2K

Media

4K

Statuses

9K

PFRDA is the regulatory body under the jurisdiction of Ministry of Finance, Govt of India for overall supervision and regulation of pension in India

India

Joined June 2015

Young Professionals, Take Charge of Your Future with NPS! . Starting your financial planning early is one of the smartest moves you can make, and the National Pension System (NPS) is a powerful tool to help you do that! .#PFRDA #nps #NPSZaruriHai #FinancialPlanning

47

101

1K

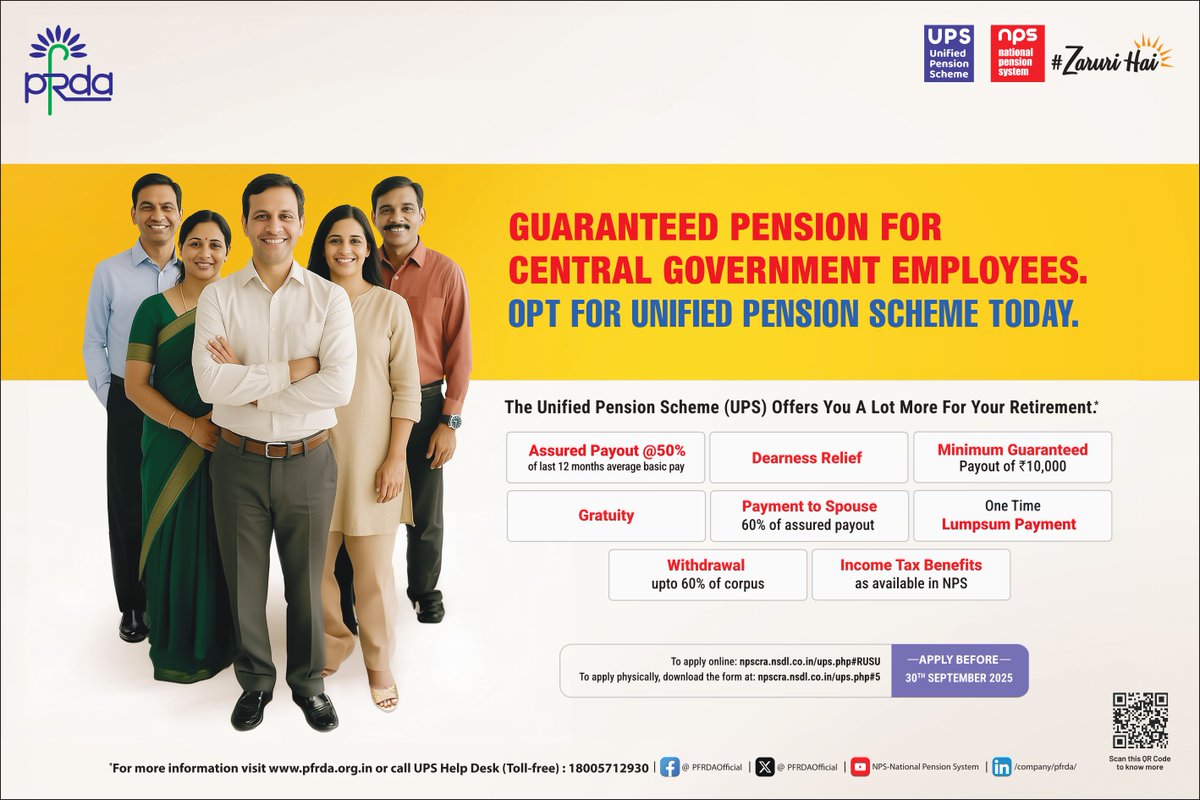

📢 Attention Central Govt Employees. #UPS offers an assured monthly retirement plan, blending financial security with long-term peace of mind. From a guaranteed monthly payout and dearness relief to gratuity and tax benefits similar to NPS, UPS ensures a dignified retirement for

2

3

9

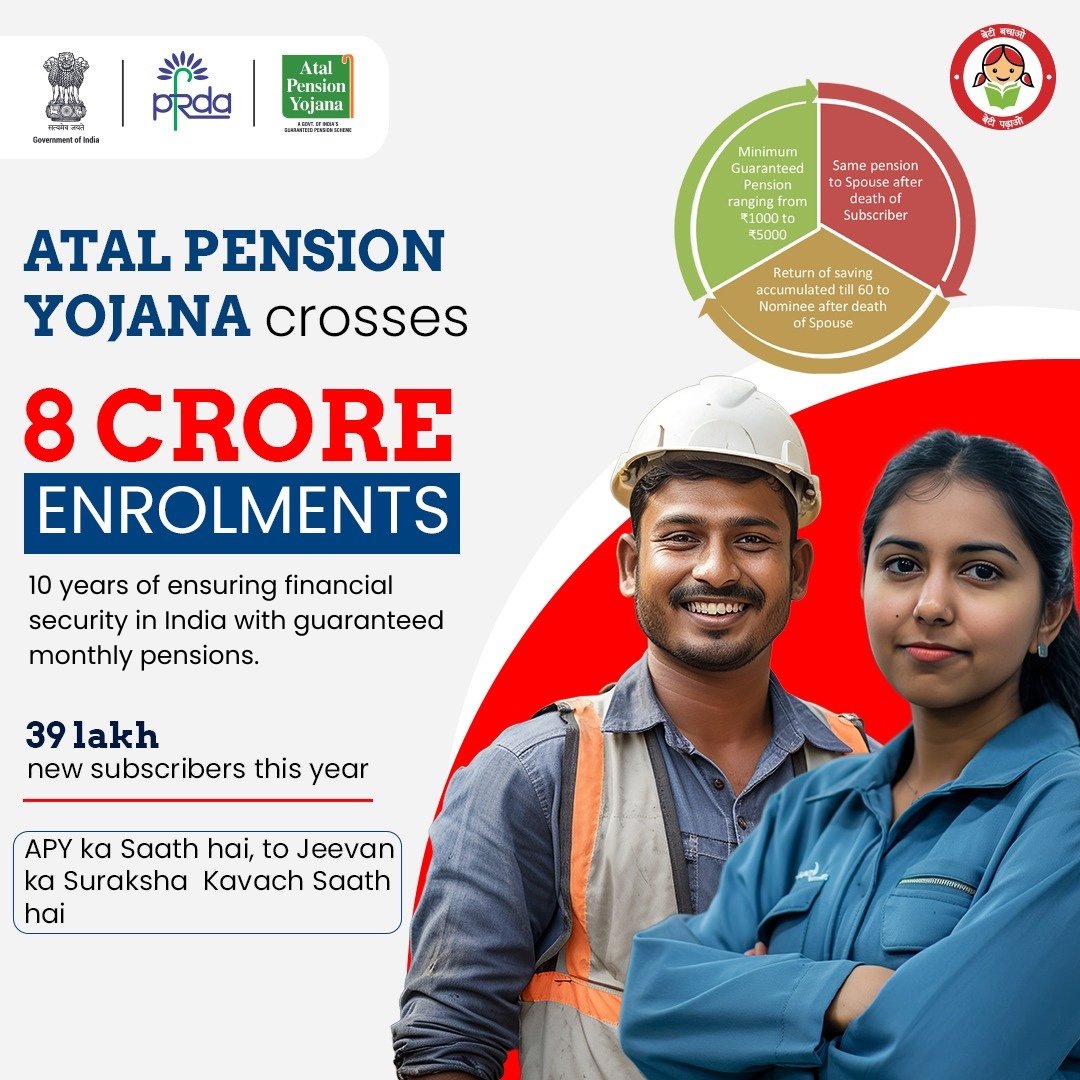

🎉 Atal Pension Yojana crosses 8 crore enrolments!. Press Release: #PDRDA #AtalPensionYojana #FinancialSecurity #RetirementPlanning #Pension #APY

2

1

2

Your investment strategy isn't set in stone under #NPS. 📊 You can change your investment choice up to 4 times in a financial year!. Adjust your plan as your life changes. More flexibility, smarter retirement. #PFRDA #DoYouKnow #SmartInvesting #NPSZaruriHai #FinancialPlanning

0

1

1

Did you know you can switch your Pension Fund under #NPS?. 🔁 One switch allowed every financial year. ✅ Choose the fund manager that best fits your goals. Stay informed. Stay in control. #PFRDA #NPSZaruriHai #RetirementPlanning #KnowYourNPS

2

1

1

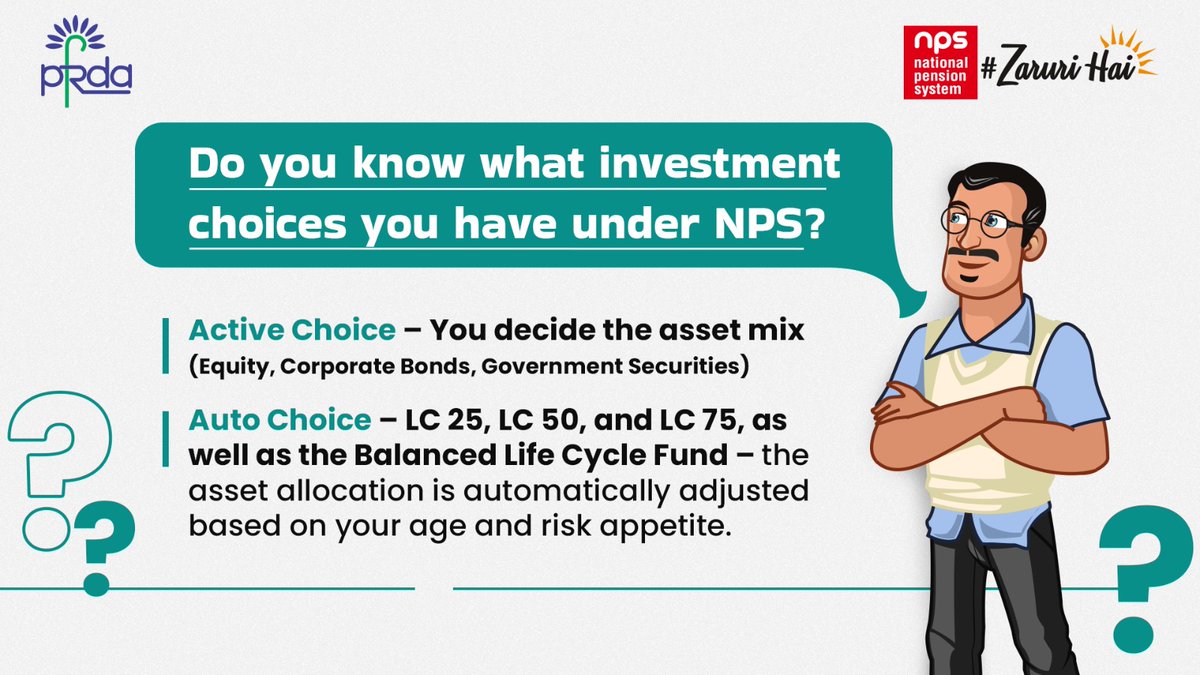

Do you know your money in #NPS can grow the way you choose?. 👉 Active Choice: You control the asset mix.👉 Auto Choice: Allocations adjust with age and your risk-taking ability. Your retirement, your strategy. #PFRDA #RetirementPlanning #SmartInvesting #DoYouKnow #NPSZaruriHai

3

1

4

PFRDA invites applications for the role of Chief Technology Officer (CTO) on contract basis. Here’s an opportunity to lead digital transformation at one of India’s key financial regulators - PFRDA. 🔗 View the detailed notification here: #PFRDA.

0

1

1

Why should Central Government employees opt for #UPS? . From guaranteed monthly pensions and tax benefits to dearness relief and inflation protection, this short video has it all. It also simplifies the process of how to migrate and opt for UPS. Hit play and plan your retirement

0

11

5

Why should #NPS be in your investment portfolio?. Because it’s low-cost, flexible, portable, and offers tax savings along with attractive returns. It’s not just an investment, it’s your long-term partner in financial security. #PFRDA #RetirementPlanning #TaxSaving #NPSZaruriHai

0

1

0

Do you know the yearly minimum contribution required to keep your NPS account active?. It’s just ₹1,000 per annum!. Yes, that’s all it takes to secure your retirement future with the National Pension System (NPS). Stay active. Stay secure. #NPS #PFRDA #RetirementPlanning

0

1

2

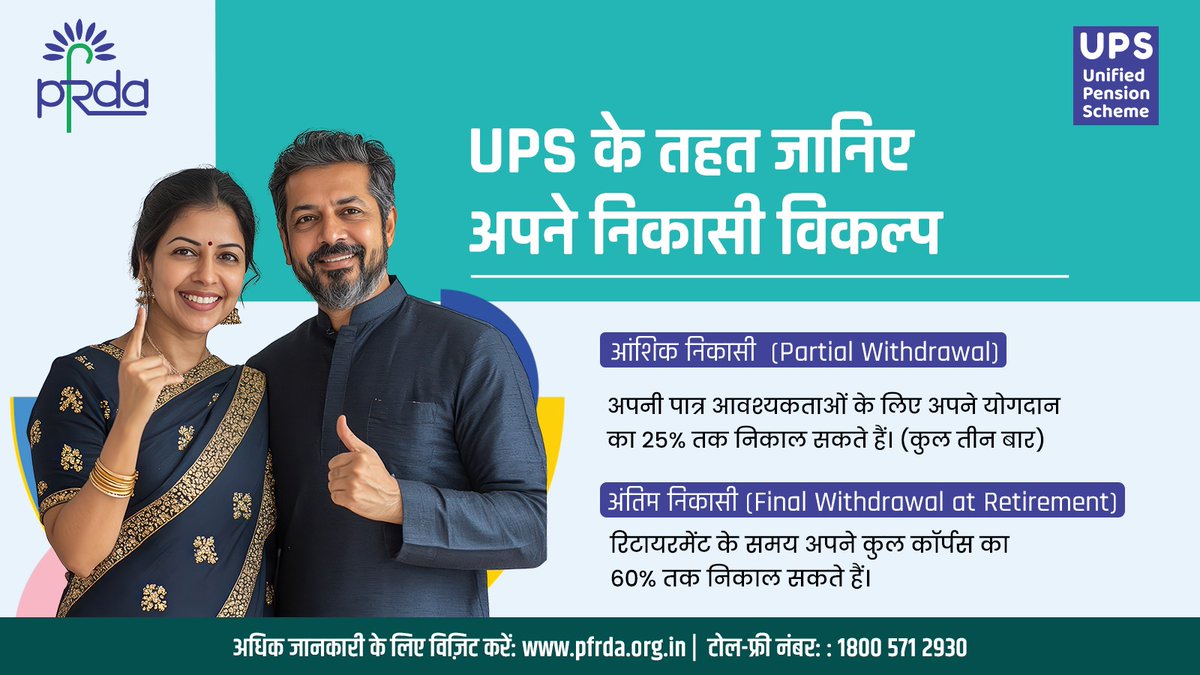

क्या आप UPS से जुड़ने के लिए तैयार हैं? यदि आप केंद्र सरकार के NPS सब्सक्राइबर हैं, तो UPS में माइग्रेशन की प्रक्रिया शुरू करें।. फॉर्म डाउनलोड करें: माइग्रेशन की अंतिम तिथि: 30 सितम्बर 2025. #UnifiedPensionScheme #UPS #PFRDA #NPS #PensionYojana

1

1

0

The latest edition of the #PensionBulletin (June2025 | Volume XIV, Issue V) is now live!. Stay informed with insights, updates, and developments from the pension sector. Read now : #PFRDA #RetirementPlanning #FinancialSecurity #PensionNews

0

2

3