Optuma

@Optuma

Followers

10K

Following

4K

Media

3K

Statuses

4K

Empowering Traders, Analysts, and Portfolio Managers to discover unique market opportunities with powerful software and valuable education.

Brisbane, Australia

Joined May 2009

To request a free demo of our advanced charting and analysis software see here:

optuma.com

Unlock the full potential of technical analysis with Optuma's intuitive software. Start your free trial and access advanced charts, tools, and alerts.

2

2

9

RT @RRGresearch: *** LOOKING FOR BETA TESTERS ***. Here's a screenshot of the new hashtag#RRGchart app that we are developing for the @TheT….

0

1

0

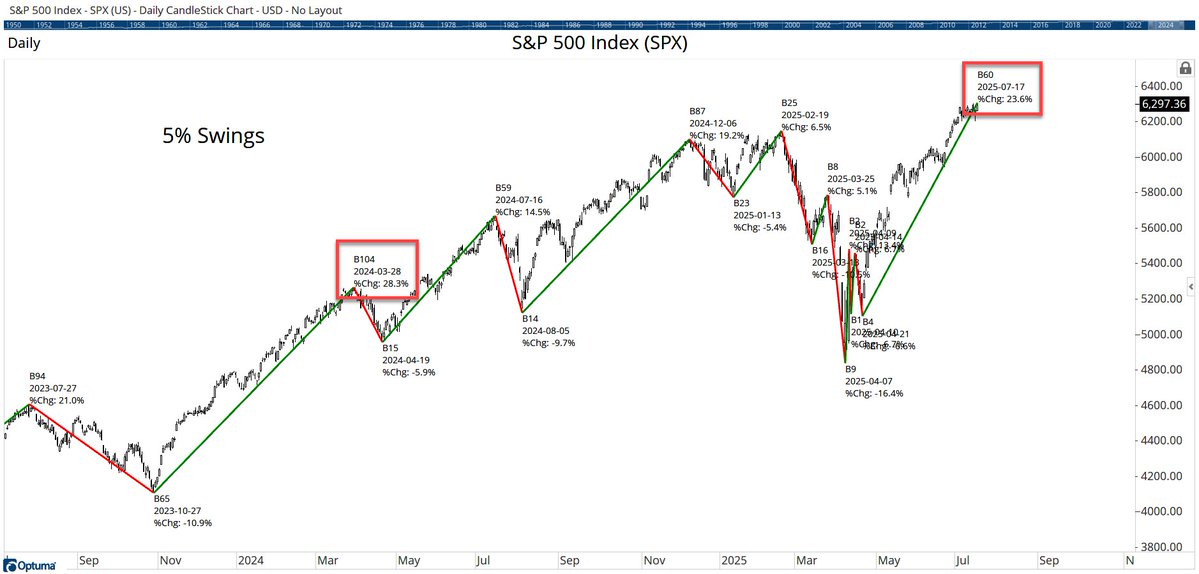

RT @CMTRandazzo: 📈 Not All Highs Are Created Equal. In February, the $SPX hit a new high, but under the hood, many stocks were struggling.….

0

2

0

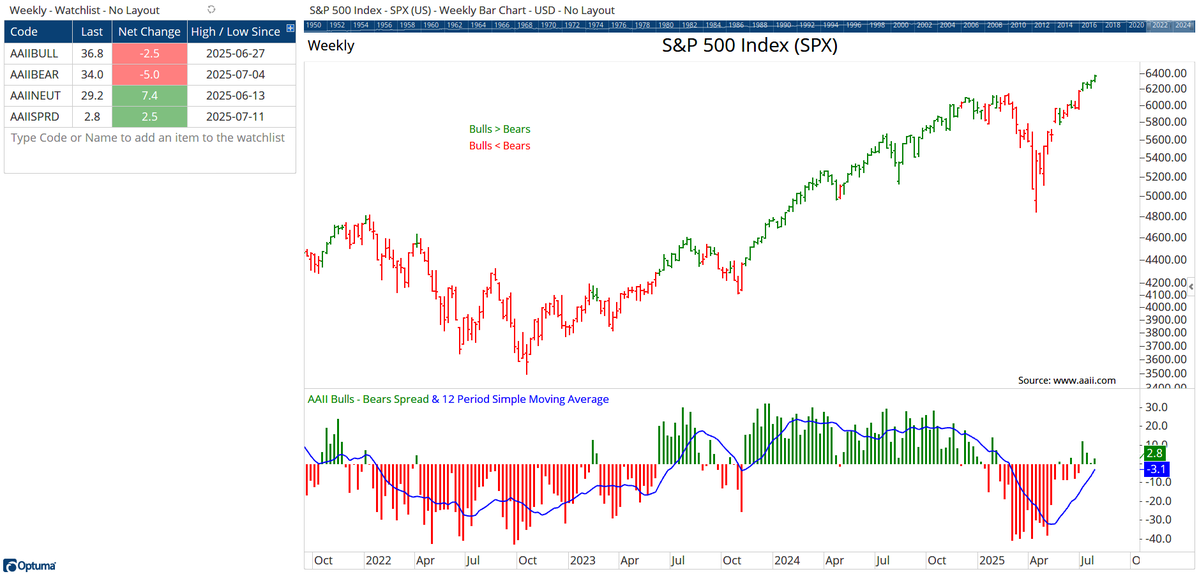

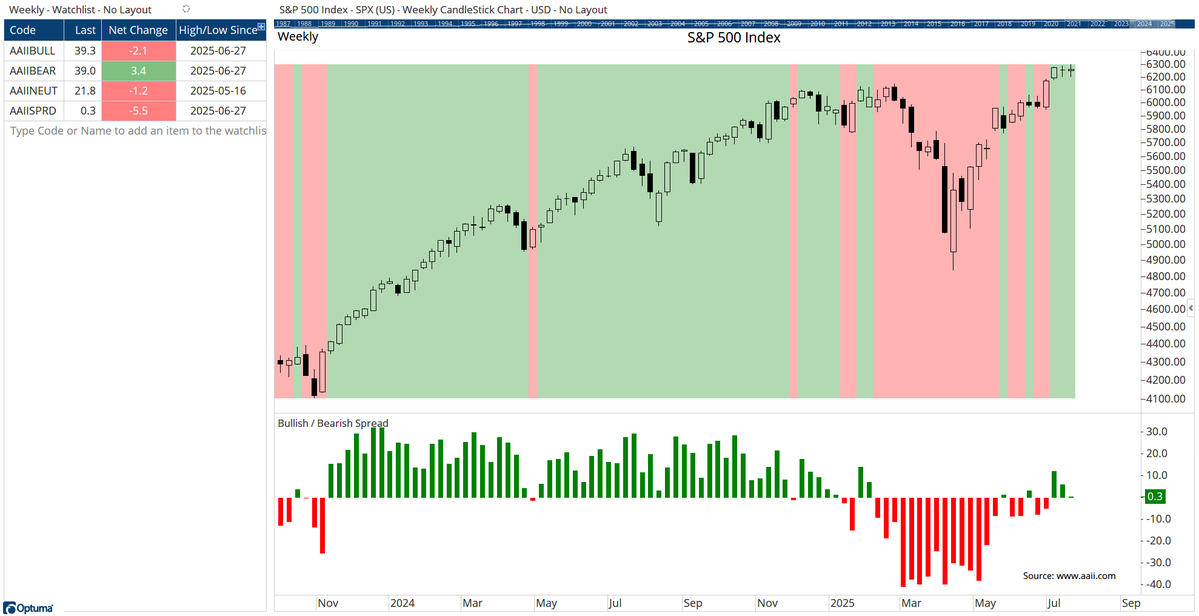

The week's @AAIISentiment survey shows the Bull and Bears are almost equal, with a spread of only +0.3. This is the 1st time this year that the spread has been positive for 3 consecutive weeks:

0

1

6

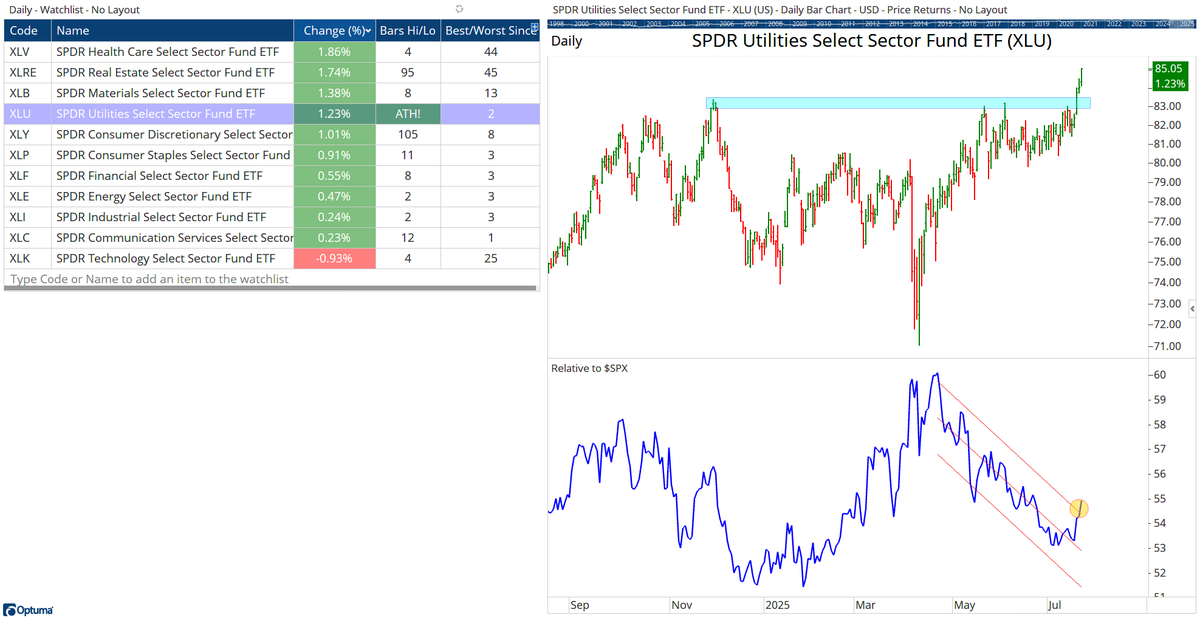

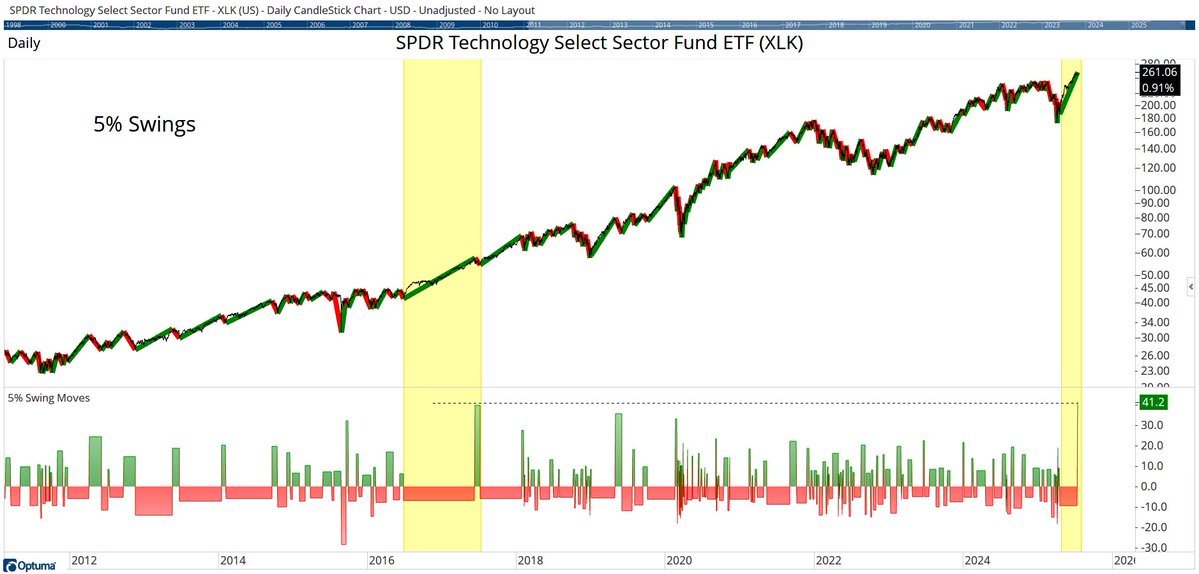

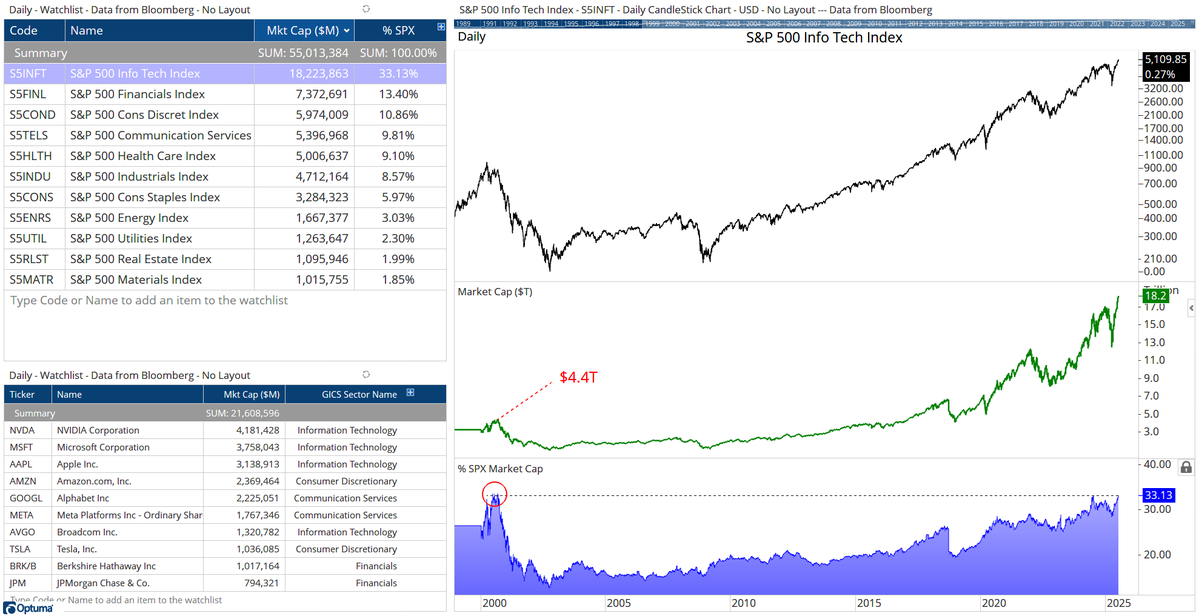

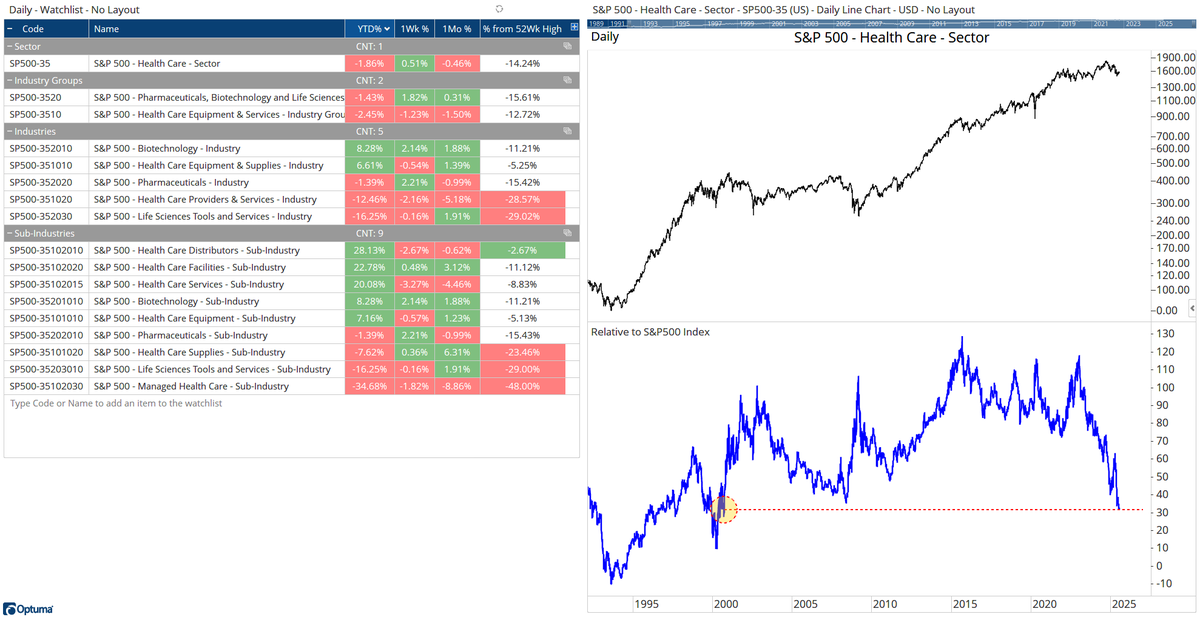

RT @CMTRandazzo: 📈 Tech still leads, Healthcare still lags—and Discretionary may be waking up. In today's Chart Advisor:. • $XLK hits new….

0

1

0