NINGI RESEARCH

@NingiResearch

Followers

7K

Following

630

Media

480

Statuses

1K

We publish research reports in the public interest. Not investment advice. Our social media manager is dyslexic. Disclaimer: https://t.co/O3NxrXlqpQ

Joined February 2022

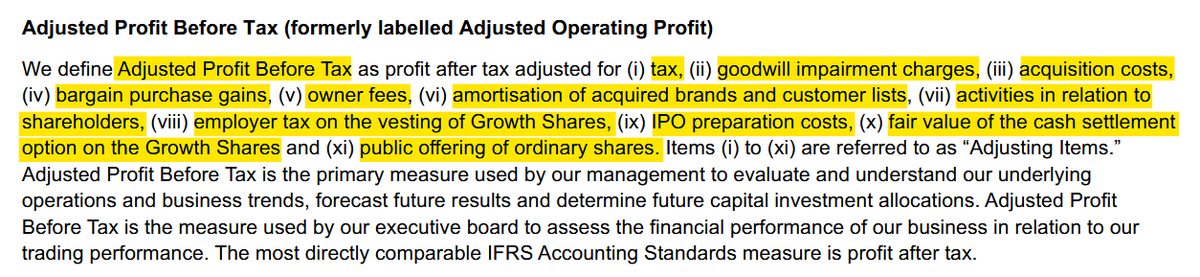

We are short Marex Group $MRX. Our research concludes it's a financial house of cards built on a multi-year scheme of accounting manipulation, intercompany transactions, and fake profits. This thread breaks down our findings.

19

22

285

Last year’s uplisting rumors surfaced just before #NorthernData raised $230M—and investors got burned. Not the first time: we flagged issues back in 2022. Read our report:

0

0

2

#NorthernData’s bitcoin mining unit is set to be sold to “Elektron Energy LP” for $235M. We couldn’t find any record of the buyer using multiple corporate registry databases. This raises questions about whether it even exists.

1

0

3

Last year, Bloomberg said #NorthernData aimed to list its AI arm at a $16B valuation in 2025. Today, it got a $1.2B takeover offer — 32% below Friday’s close. With Tether backing Rumble’s move, the deal will likely proceed.

2

0

9