NEXBRIDGE 🟧

@NexBridgeSV

Followers

3K

Following

169

Media

34

Statuses

106

Bringing real-world exposures on-chain with regulatory clarity and institutional trust.🟧

San Salvador, El Salvador

Joined January 2024

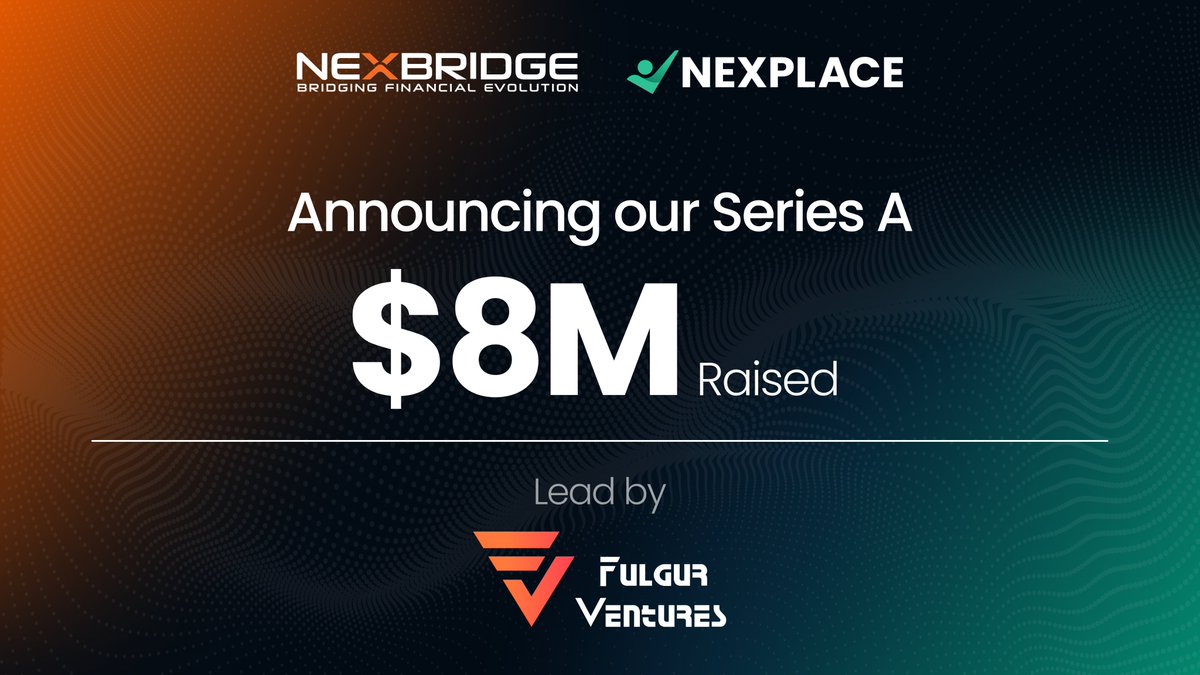

Regulated digital asset issuance on Bitcoin is entering the institutional mainstream. Together with @Nexplace_Global, we've completed an $8M Series A round led by @FulgurVentures to scale the issuance and adoption of regulated digital assets on the @Liquid_BTC. 🟧 Since

16

10

67

RT @stacyherbert: 🇸🇻EL SALVADOR IS BITCOIN COUNTRY. What a day!! Today, we graduated 350 young women from the Bitcoin Diploma program at In….

0

126

0

RT @Nexplace_Global: 🚀 We’re hiring!. Graphic & Visual Designer — Digital Assets | 📍 San Salvador (Hybrid). NEXPLACE & @NexBridgeSV are see….

0

1

0

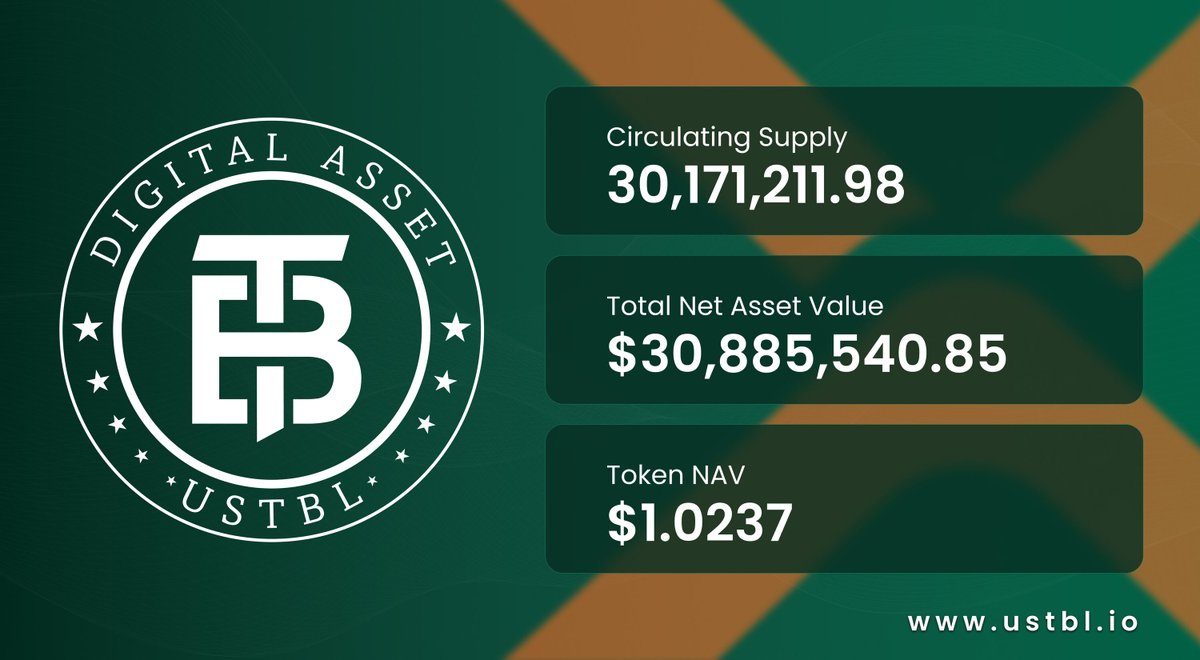

There’s a massive gap between market demand and legacy infrastructure. Why build your 2025 portfolio on 1975 rails?. ⦿ Slow settlements.⦿ Custody friction.⦿ Limited auditability. #USTBL bridges that gap. Exposure to short-term U.S. Treasuries —.fully backed by the iShares

3

3

10

RT @elsalvador: #Bitcoin | Producto tokenizado en bitcoin recibe calificación «A» en El Salvador. El primer instrumento financiero digital….

diarioelsalvador.com

El Salvador sigue avanzando en su objetivo de convertirse en un hub financiero global anclado en bitcóin (BTC). Esta semana, el producto Tokenized U.S. Treasury Bills (USTBL) -bonos del Tesoro de E…

0

10

0

RT @stacyherbert: 🇸🇻EL SALVADOR BITCOIN CAPITAL MARKETS: FIRST 'A' RATING FOR A DIGITAL ISSUANCE . El Salvador is becoming the Switzerland….

0

50

0

USTBL receives ‘A’ rating from @particula_io. USTBL, issued by NEXBRIDGE, has received an ‘A’ rating from Particula, a leading independent digital asset rating agency, setting a new benchmark for regulated digital assets on Bitcoin. Particula’s rating highlighted key

5

7

44

RT @bitcoinofficesv: 🇸🇻BITCOIN CAPITAL MARKETS NEWS OUT OF EL SALVADOR. The Bitcoin Office is excited to see bitcoin capital markets contin….

0

8

0

RT @CryptoRank_VCs: Top 7 Funding Rounds of This Week. @withAUSD – $50M.@DigitalXLtd – $13.5M.@KuruExchange – $11.6M.@NexBridgeSV – $8M.@Re….

0

70

0

RT @michelecrivelli: Not everything that starts early becomes meaningful. But everything meaningful starts early. Building capital markets….

0

5

0

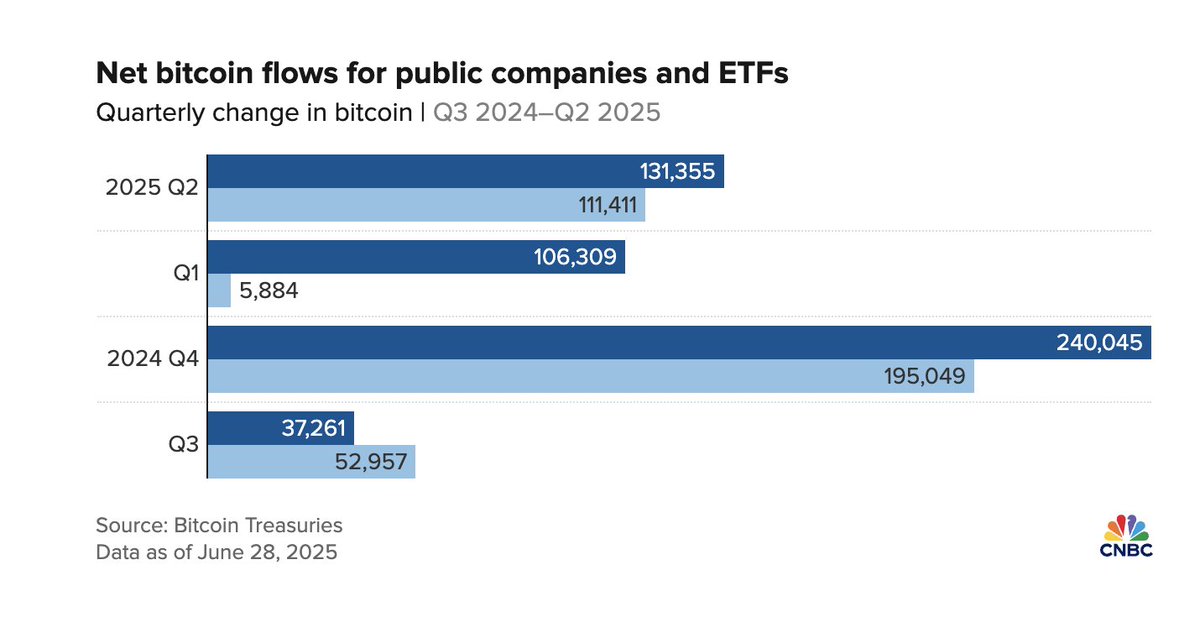

Corporate treasuries are hoarding Bitcoin. We're doing something different. While 140+ companies follow the @MicroStrategy playbook—converting cash to Bitcoin for balance sheet leverage—NexBridge takes the opposite approach. Not just holding Bitcoin. Building real

4

8

43

2025, the year that Wall Street discovers that Bitcoin ≠ Crypto. It already started in El Salvador. We're just building the bridge. #Bitcoin #LatAm #Tokenization #ElSalvador

2

1

14

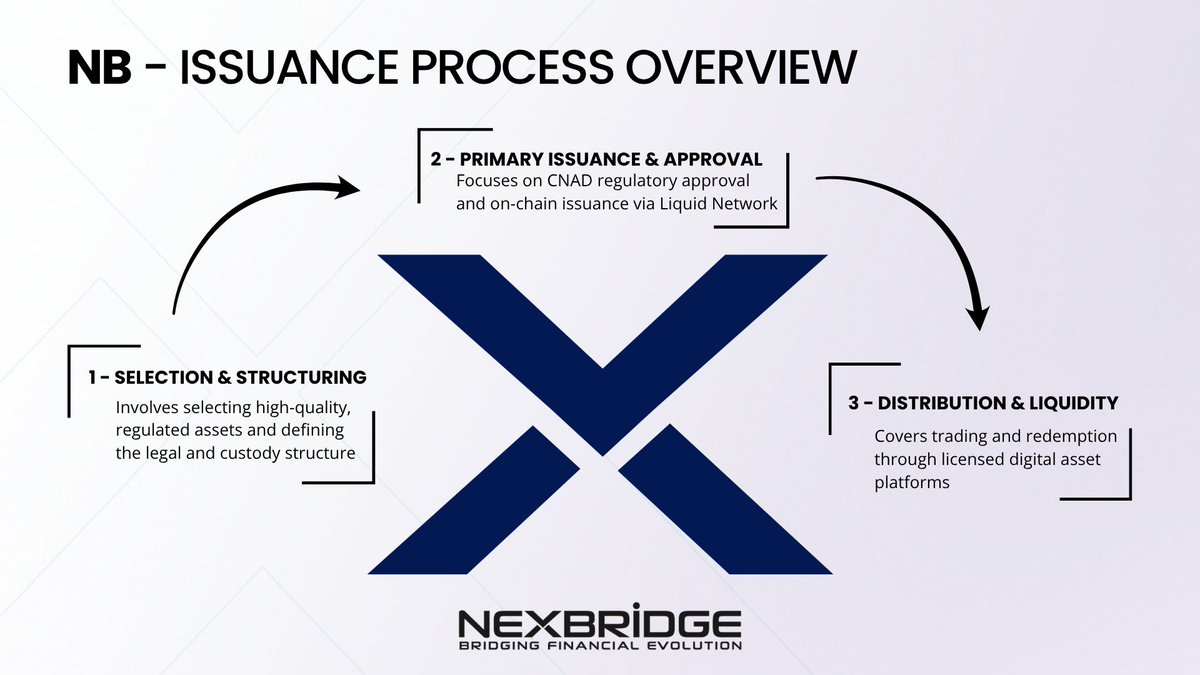

🏗️ How NEXBRIDGE Regulated Issuance Actually Works. Most people think tokenization is just "putting assets on blockchain.". It's not. Here's our 3-step regulated process:. STEP 1 → Selection & Structuring.⦿ Submit the Relevant Information Document (RID) to @cnadsv (CNAD)

2

1

12