Mits

@MitsTradingEdge

Followers

1,106

Following

201

Media

434

Statuses

1,546

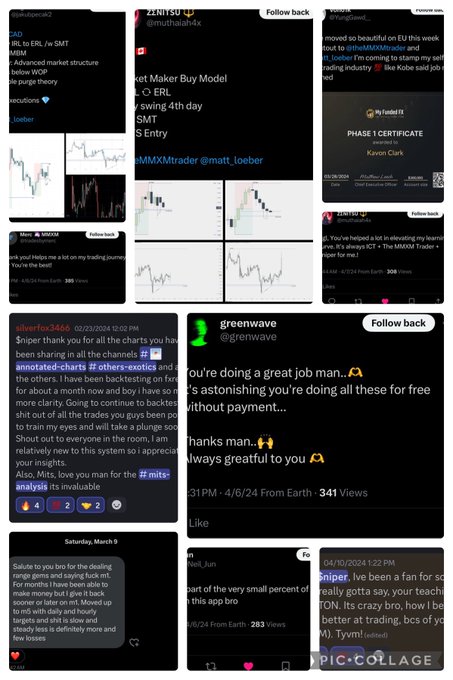

Trader | ICT Concepts | Sharing insights and focused on consistency, discipline & success | #themmxmtrader

Melbourne, Victoria

Joined January 2019

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Mother's Day

• 1186259 Tweets

Mauro

• 128325 Tweets

Racing

• 61392 Tweets

Emmanuel

• 54518 Tweets

Natalie

• 50511 Tweets

Denver

• 29424 Tweets

雨の月曜日

• 28375 Tweets

#DebateChilango

• 26567 Tweets

Minnesota

• 23620 Tweets

Bruins

• 21356 Tweets

Jamal Murray

• 21240 Tweets

Timberwolves

• 19112 Tweets

Fabra

• 18682 Tweets

Bennett

• 18220 Tweets

Panthers

• 17902 Tweets

BIRTH Campaign

• 16338 Tweets

Towns

• 15740 Tweets

Medina

• 15713 Tweets

Clara Brugada

• 15557 Tweets

Cristal

• 14805 Tweets

Geraldine

• 13159 Tweets

Gobert

• 12287 Tweets

Cruz Azul

• 12275 Tweets

Payet

• 11857 Tweets

Pumas

• 11727 Tweets

Last Seen Profiles

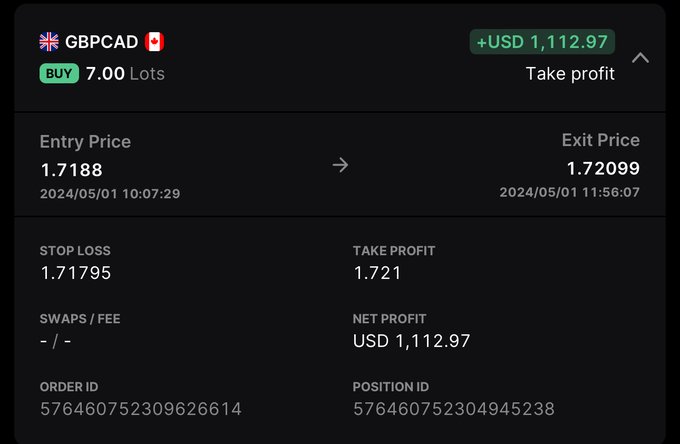

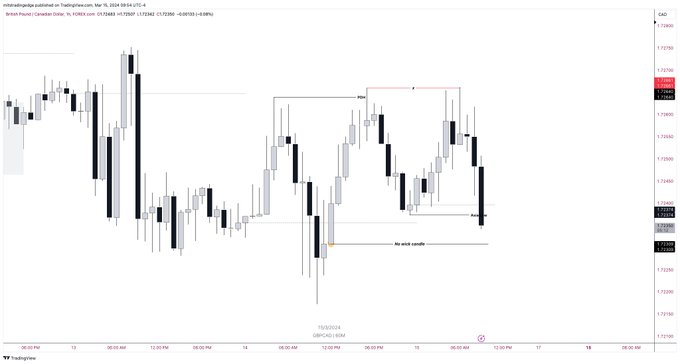

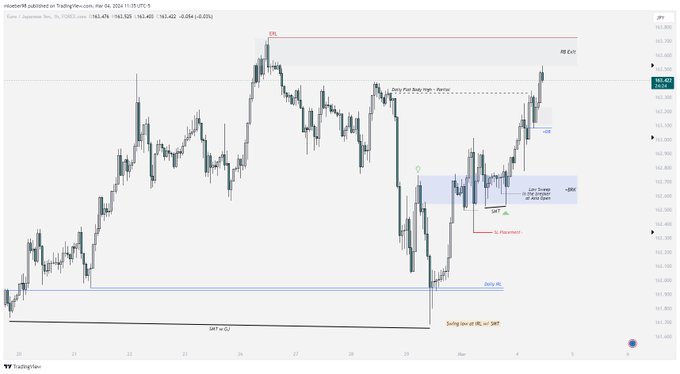

🇬🇧🇨🇦 2R 🔒

Good (old) Universal model

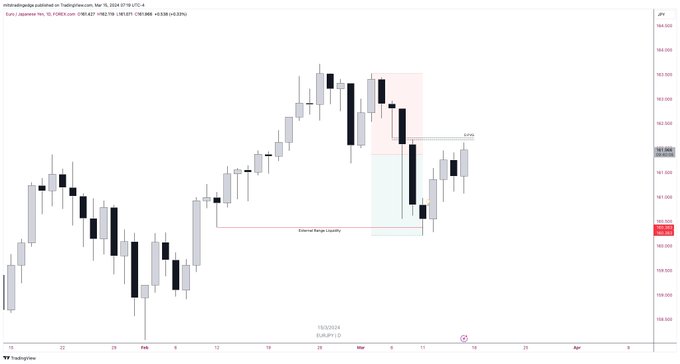

@theMMXMtrader

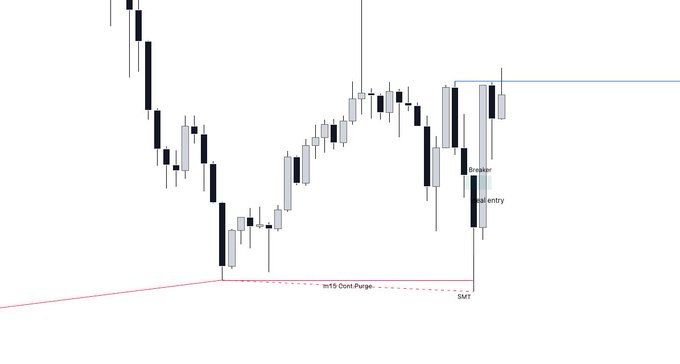

IRL to ERL along with SMT with EC

still in the trade - stops moved to b/e.

@matt_loeber

7

3

50

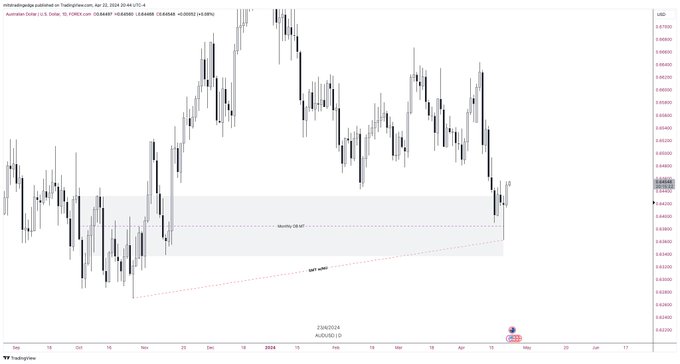

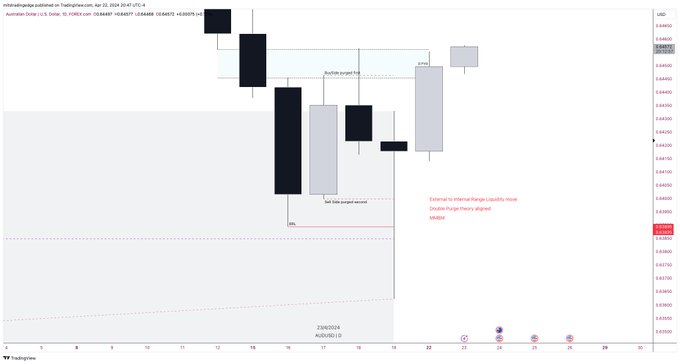

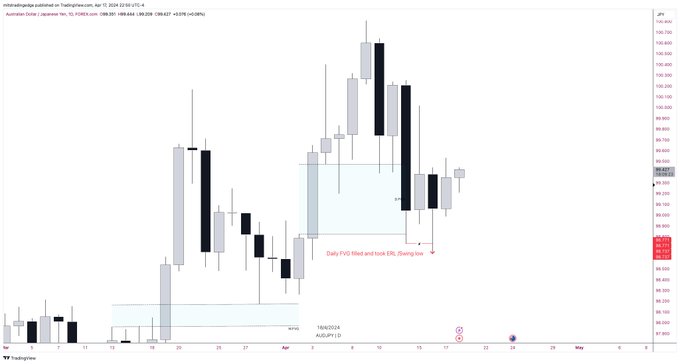

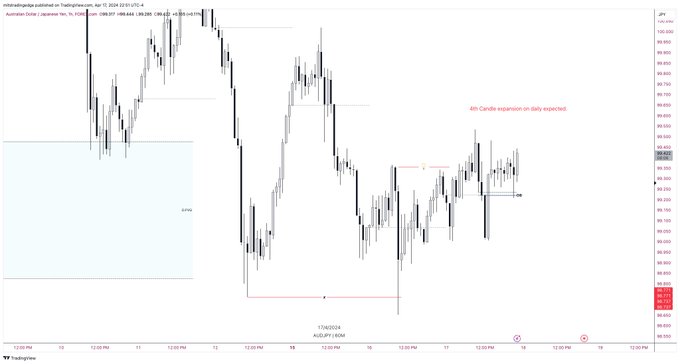

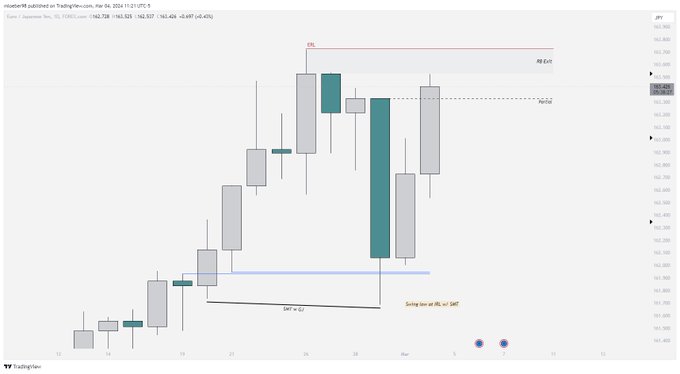

🇦🇺🇺🇸 Long 2.8R🔏

ERL to IRL move with SMT with NU

H1 MMBM

NY B&B Continuation model

aligned with

#doublepurge

5

6

49

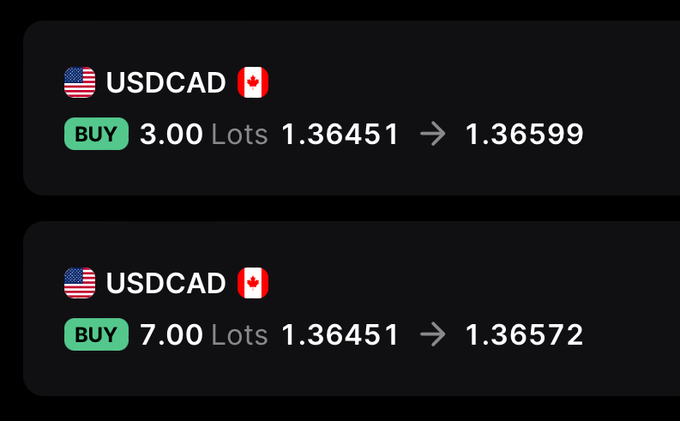

🇨🇦🇨🇭3.2R🔒

Selling --> Buying and then look for a possible manipulation.

@matt_loeber

had to say the spreads are crazy with

@DeiFunded

isn't?

IRL to ERL play on daily.

5

4

45

How many feel they have significantly moved away from chasing price, being indisciplined (say from start of this year)?

@theMMXMtrader

@matt_loeber

@daytradingrauf

all have taught and described how systematically and process oriented trading can be !!

So there is no reason for…

4

2

42

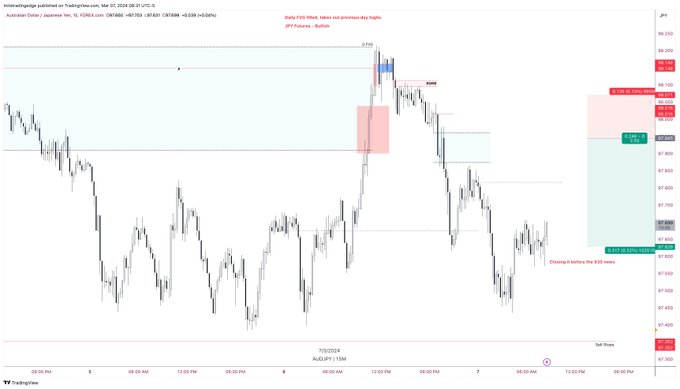

🇦🇺🇯🇵 2.5R 🔒

Asia model (AUD news is the driver)

m15 purge along with our new cute

#doublepurge

theory.

8

7

40

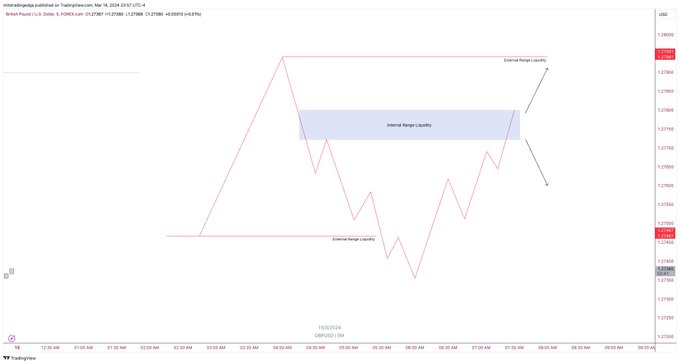

Silver bullet is the second stage of accumulation/distribution.

All MMBM or MMSM has atleast two stages of accumulation or distribution involved.

If you align the anticipated second stage along with a mitigation block from the other side of the buying/selling there are higher…

3

4

39

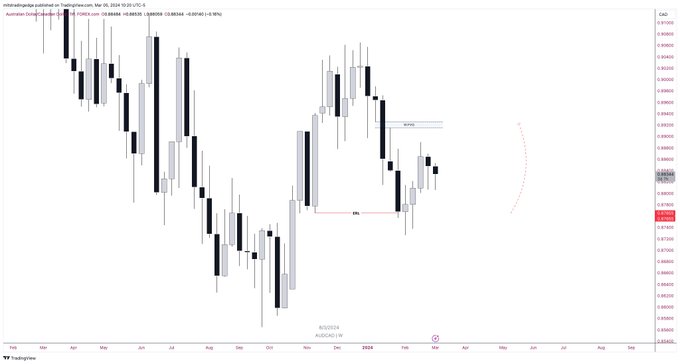

Why is

@matt_loeber

keen on CAD pairs?

Look at CAD futures and you can see a clear DOL which can push the xxxCAD pairs

1

2

29

Trying to trade without aligning timeframes was like trying to dance to three different songs at once—confusing and chaotic. PD arrays on various timeframes were like a tangled mess of spaghetti.

This is the sauce. This made the difference.

1

1

25

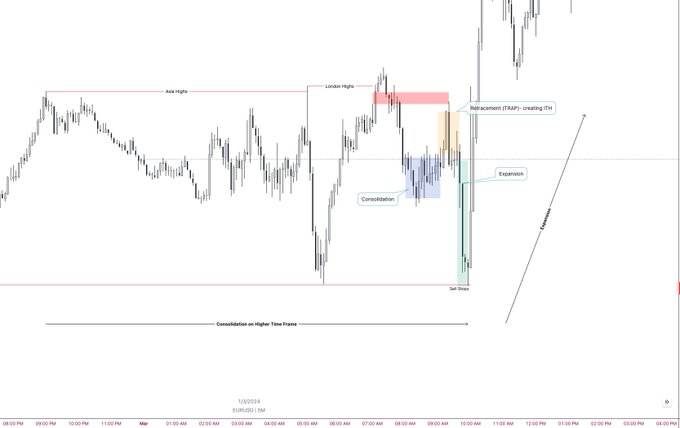

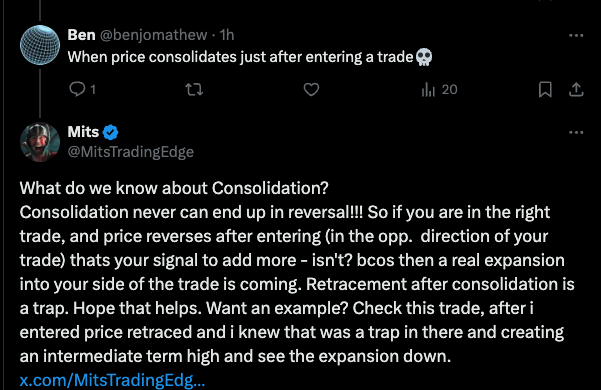

Consolidation ❌ Retracement/Reversal

Consolidation ✅ Expansion

Expansion ✅ Consolidation/Retracement/Reversal

Something very significant to understand when you are trying to read price action and not act emotionally. thanks for

@benjomathew

for raising the question.

1

0

12

3

3

23

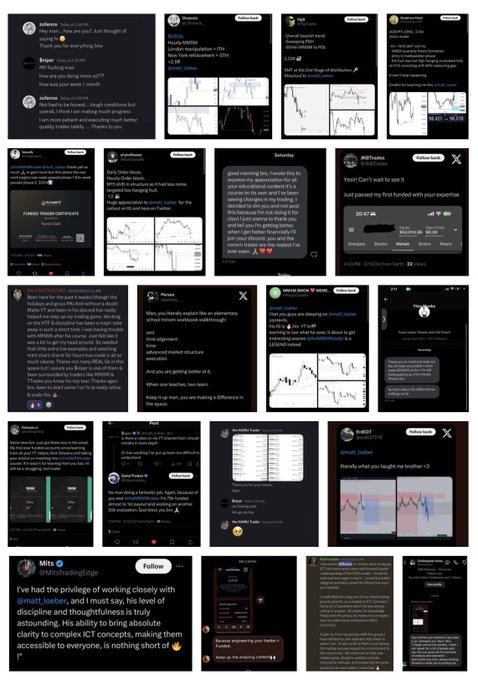

@theMMXMtrader

You unleashed a tempest with your course. Each model a thunderclap, each concept a bolt of lightning, igniting minds with unprecedented force.

I am ready for the next bro.

4

0

23

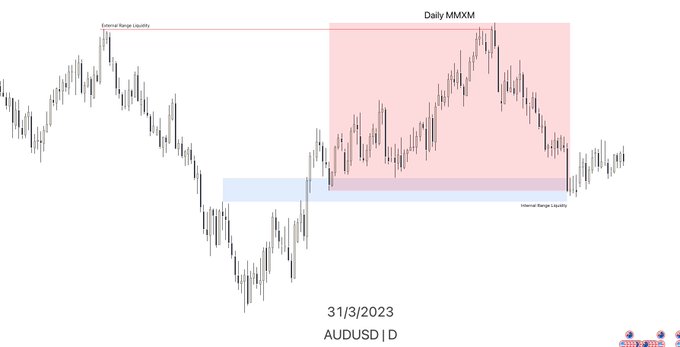

Quick video going through the GU trade.

- HTF Order flow ✅

- Narrative (SMT with EU and DXY bearish correlation and supporting PD arrays ) ✅

- MMxM model ✅

- Adv. Market Structure ✅

- Entry setup ✅

1

3

17

Always wait for price to come into premium for shorts or discount for long before getting in.

If it doesn't then leave it alone there will be better A+ setups.

Sneaking in for a quick trade puts in that indiscipline and creates a behaviour which can be damaging on a long run.…

1

1

17

Redelivered and Rebalanced. If you want to know more about this, watch

@theOTEtrader

last Yt video.

3

2

16

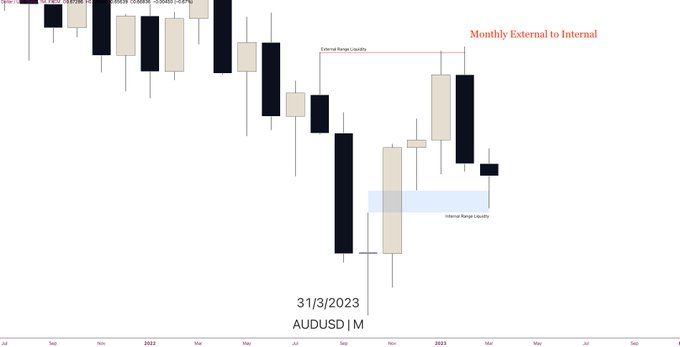

When DXY consolidates as you saw in the month of January and February, we can look at the individual currency charts (6A1!) to identify trade opportunities with Exotics.

@theMMXMtrader

course covers this in detail by comparing the strong and weak currency and identifying the…

1

0

15

Simple trading model using Timeframe alignment - love it.

1

0

15

This would be an epic video. Calling the play beforehand it plays out. (Already got a peak 🥰🤩)

1

0

14

Something very significant to understand when you are trying to read price action and not act emotionally. thanks for

@benjomathew

for raising the question.

1

0

12

There are typically 4 common issues traders struggle with. There could be many, but lets narrow it down to:

A - Understanding the Order flow.

B - Understanding the market structure.

C - Narrative or the right PD arrays to use.

D - Not having a proper trading model.

(FOMO, Risk…

A

49

B

18

C

50

D

59

2

2

11

So excited about this. Let’s go baby.

1

0

11

@Adi_MMXM

same trade

1

0

11

Clean as a whistle.

@matt_loeber

Why is

@matt_loeber

keen on CAD pairs?

Look at CAD futures and you can see a clear DOL which can push the xxxCAD pairs

1

2

29

1

0

11

How To Trade With The Trend | Market Maker Buy Model | ICT Concepts via

@YouTube

Beast if a video from

@matt_loeber

1

0

10

Appreciate your responses. Let's look into each aspect one by one.

Understanding the Order flow is the basics to model your trading plan. You need to know where price is intending to go which gives you the confidence to put in your hard earned money.

Price does only two things…

1

1

10

You can anticipate a smart money reversal during a kill zone. This is one of the reason we keep hearing the term a particular session making low/high of the day. I am not saying every time, but the probability of smart money reversal are in the highs during KZ. Check your charts…

1

0

10

Oh the vicious circle you get yourself into... bingo brother.

every individual is different when it comes to execution and emotion in trading. best is to learn a strategy and make it your own.

1

0

8

You unleashed a tempest with your course. Each model a thunderclap, each concept a bolt of lightning, igniting minds with unprecedented force.

Let’s go…….

2

0

7

@Richthebull008

Down - failed to take previous high and as well failed to respect the bullish FVG (now an iFVG)

0

0

7