Miles Pember

@MilesPember

Followers

267

Following

7K

Media

25

Statuses

589

In October, I celebrated my 3-year anniversary at Chainlink Labs. If there's one lesson these 3 years in crypto have taught me, it's this: stay laser-focused on winning, and the results will follow. Our 2024 results speak for themselves, and we're just getting started.

11

26

336

RT @chainlink: Swift. Depository Trust and Clearing Corporation (DTCC). Euroclear. Clearstream. Central Bank of Brazil. JP Morgan. State St….

0

632

0

DeFi proved its value and resilience in 2022, and I'm excited to see what 2023 holds. Working in crypto has been the opportunity of a lifetime, and I'm optimistic the best is yet to come.

hbr.org

In the past year, crypto markets dropped from $2.9 trillion in value to around $800 billion. In the wake of the collapse, crypto lenders and exchanges have been accused of fraud and other wrongdoing....

1

0

4

RT @jchervinsky: It's honestly shocking how resilient DeFi has become. In March 2020, protocols were threatening to break left and right,….

0

334

0

The need for neutral, private digital currency has never been higher.

It’s hard for me to openly criticize a company I used to love and gave so much to. But @PayPal’s new AUP goes against everything I believe in. A private company now gets to decide to take your money if you say something they disagree with. Insanity.

0

0

2

RT @chainlink: 1/ #Chainlink Economics 2.0 consists of programs focused on:. • Increasing user fees paid to Chainlink service providers.• R….

0

192

0

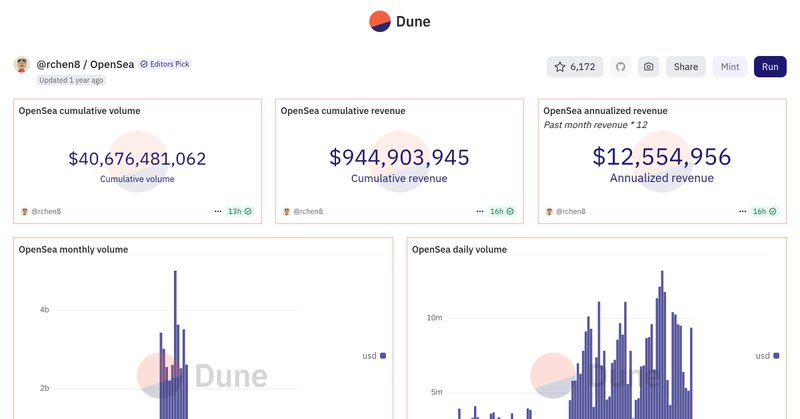

Shout out to @richardchen39 who created the dashboard I sourced my data from, with some minor tweaks. The dashboard can be found here:.

dune.com

Dune is the all-in-one crypto data platform — query with SQL, stream data via APIs & DataShare, and publish interactive dashboards across 100+ blockchains.

0

0

0