MichaelKitces

@MichaelKitces

Followers

94K

Following

76

Media

21K

Statuses

131K

One nerd’s perspective on the financial planning world… CFP, #LifelongLearner, Entrepreneur-In-Denial, Advisor #FinTech, & publisher of the Nerd’s Eye View blog

Joined October 2008

Our list of "Best Conferences 2025!", and be sure to take advantage of the discount codes that several have offered to Nerd's Eye View readers! Best in: -Overall Planning: @FPANorCal -Technology: @t3techhub -Advanced Tax Planning: @AICPA Engage and more! https://t.co/bewEKQMNXQ

16

17

60

What is a favorite piece of advisor content you've read this year? As 2025 comes to a close, it leaves me so thankful once again to all of you, the ever-growing number of readers who continue to regularly visit the Nerd's Eye View Blog! https://t.co/MWjNgzBQuP Thank you to the

kitces.com

The most popular financial advisor articles and podcasts of The Nerd's Eye View Blog in 2025, from tax planning to estate planning, career development and more!

0

0

1

How To Give Better Financial Advice That (Actually) Sticks: Clients come to advisors for more than “just” advice alone, neuropsychologist Dr. Moira Somers highlights the wide range of additional influences that can impact the client’s receptivity to advice, from their own

2

0

16

Follow A Marketing Cadence That Sticks: Kristen Luke shares a guide for creating a quarterly tactical marketing plan that can help an advisory firm stay on track to meet its annual client growth goals https://t.co/3LGDDHyxya (Advisor Perspectives) #advicers #advisormarketing

kitces.com

This weekend reading kicks off with a report finding that advisory firms are hiring and developing newer advisor talent rather than experienced advisors.

1

0

8

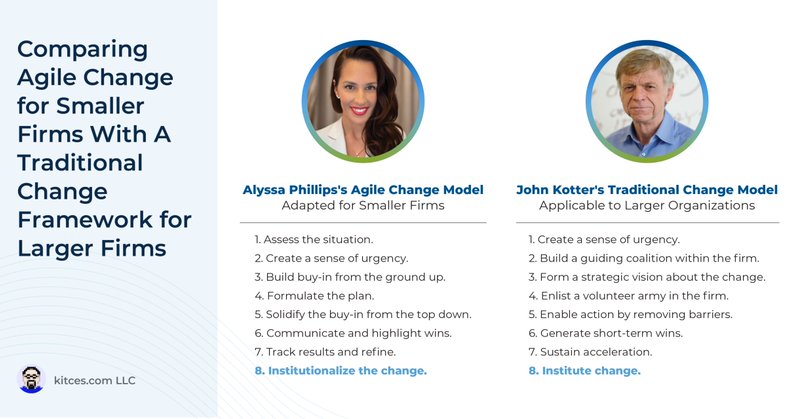

While Kotter's model may work well for larger firms with ample resources and people available to enact change, it can be less effective for smaller organizations. Those at smaller firms who want to promote change may benefit from a framework based on an "Agile Change" model

kitces.com

An "Agile Change" model adapted for smaller advisory firms, based on John Kotter's change framework, to communicate and institutionalize change.

2

0

3

Protecting An Investment Portfolio From A Possible #AI Bubble: How advisors can help nervous clients feel empowered amidst concerns that a potential AI-fueled bubble could lead a dramatic market downturn, from reconfirming a match between their asset allocation and liquidity

kitces.com

This weekend reading kicks off with a report finding that advisory firms are hiring and developing newer advisor talent rather than experienced advisors.

0

1

3

This #WeekendReading kicks off with a report from The Ensemble Practice finds that advisory firms are predominantly hiring and developing newer advisor talent rather than directly hiring experienced advisors. https://t.co/3LGDDHyxya

#advicers

kitces.com

This weekend reading kicks off with a report finding that advisory firms are hiring and developing newer advisor talent rather than experienced advisors.

0

0

1

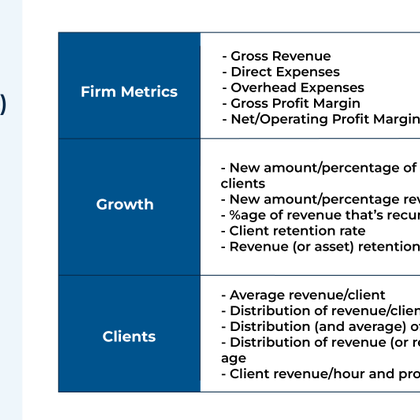

Just because there’s revenue doesn’t mean there’s profits, and there are too many clients to just keep it all straight in your head. As a financial advisory practice grows, it becomes increasingly important measure and track more information about the business, so it can be

kitces.com

What are the Key Performance Indicator (KPI) metrics that financial advisors should use to track the health of their business, from revenue to AUM & more.

0

1

20

Just as a financial plan helps ensure a client's near- and long-term goals are met, an effective succession plan can increase the chances that a founding firm owner will reap the financial benefits of selling their firm to the next generation and that their firm will continue to

kitces.com

Combining the founder's vision, strategy, and economics along with check-ins will help ensure that parties are on the same page in the succession planning.

1

0

2

Whew, this is FASCINATING. The SEC may be taking the position that when an advisory firm is sold, "recommending" that clients stay and go to the acquirer constitutes a paid "endorsement" to clients (compensated by the acquirer). Why does it matter? Because under the SEC's new

citywire.com

RIAs selling their practices might get a deficiency letter if they neglect to disclose certain financial aspects of an M&A deal to clients.

14

1

46

In turns out that 'just' making a whichever-CFP-professional-answers-the-phone available to consumers (enabled with technology to serve a very high volume of them) doesn't necessarily drive more value for clients? It's not the mere access to a CFP professional that creates the

citywire.com

Schwab has disclosed that it would stop offering its Intelligent Portfolios Premium program beginning in the first quarter of 2026.

0

1

52

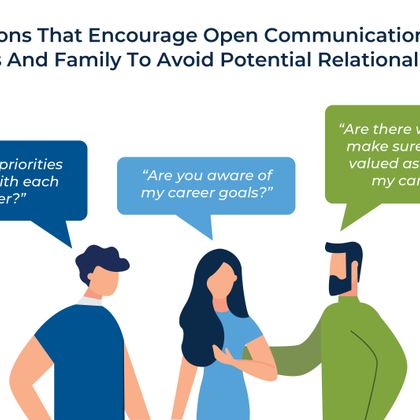

Understand your current mindset, discuss intentions. 🧘♂️💡Thinking about career goals is not necessarily enough; employees need to take ownership of their careers to achieve the career goals they seek. Career growth can be achieved with an ownership mindset, and finding places to

kitces.com

For financial advisors, advancing your career starts with taking ownership, building positive habits, and solving high-impact problems for your organization.

0

0

5

Another interesting step in the direction of "do #AdvisorTech platforms really need to be all-in-one, or can an AI layer that has agents that go retrieve data from various source systems allow advisors to have an 'integrated' whole without needing to actually integrate all the

citywire.com

Jason Quinn, Advisor360's COO, said the new system will allow users to access both the company's own applications and third-party point solutions that advisors want to integrate.

1

0

6

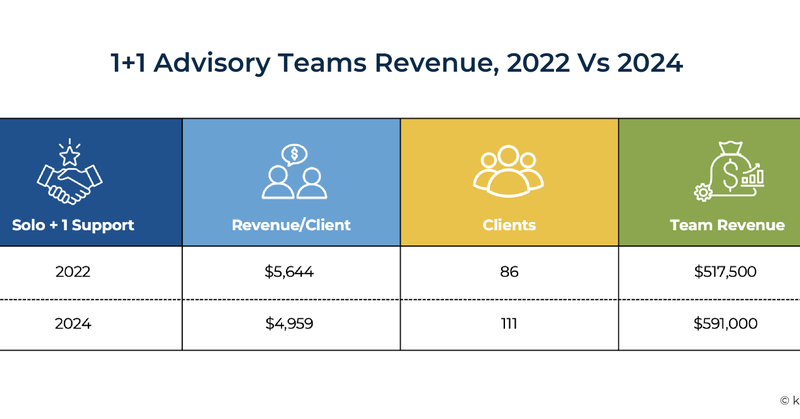

Historically, the "capacity crossroads" emerged around $250,000 to $400,000 in annual revenue, or 30–40 clients. This crossroads also implies a risk, as hiring too early can lead to financial strain, while hiring too late can result in burnout and a decline in service quality.

kitces.com

Research highlights how much more effective teams have become, particularly with automation and process improvements, shifting capacity crossroads for advisors.

1

0

19

Advisors, think about your roster of clients in retirement. How many of them are underspending? The struggle to shift from Save mode to Spend mode is real for many retirees, and the result can be a retirement filled with regrets. That's why we turned to behavioral finance

0

1

6

Common reasons clients underspend: "What if I need this money later?", doom forecasting, and a saver identity that makes spending feel like betrayal. To address these barriers without undermining client agency or triggering defensive reactions, advisors can reframe spending as an

0

0

2

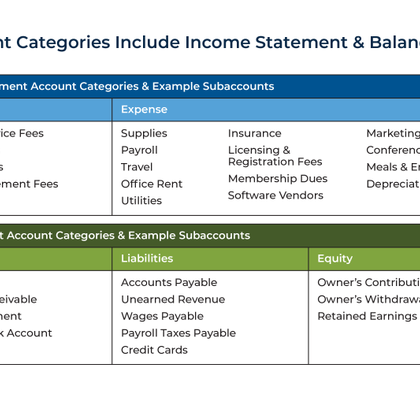

The point of the Chart of Accounts is not just to have a system for organizing the firm's financial data, but to be able to access and use that data, to make the firm even better. How a financial advisory firm Chart of Accounts is organized, and creating the 'right' Chart of

kitces.com

Learn best practices for creating and organizing an RIA's Chart of Accounts, including a downloadable template that can be imported into accounting software.

1

2

20

There were two low and tough points for Kay Dee Cole on her journey as founder of Clarity Wealth Development. One was just being diagnosed with cancer less than 2 years of opening the business and trying to figure things out, Second was a recurrence of cancer and navigating an

1

2

2

When a client couple does announce they're planning to divorce, it can be tough to decide how to work ethically with one or both partners. https://t.co/hAZ1w24F6j This article by Shelitha Smodic highlights the many practical ways for advisors to maintain their fiduciary duty

kitces.com

Divorce can create upheaval not only with the couple but also with advisor and clients, presenting new ethical challenges around privacy, loyalty, and scope.

2

1

7

How much to pay an associate advisors these days? Firm owners can attest... compensation is a strategic balancing act of not just base salary, but benefits, bonuses, and incentivized pay that leads to a competitive package. https://t.co/uOxEyIR17t Compensation is rarely a single

1

1

15

When it comes to the advisory world, it’s “control your business, or your business will control you.” Advisors who maintained structure within their advisory business reported feeling more in control of their overall lives; those who were more reactive in their businesses felt

4

3

65