David Alexander II

@Mega_Fund

Followers

3K

Following

8K

Media

1K

Statuses

8K

Partner @anagramxyz | prev MD @BinanceLabs, OG @ConsenSys | Research @MetricsDAO | Chaotic Neutral 🌑

Joined October 2011

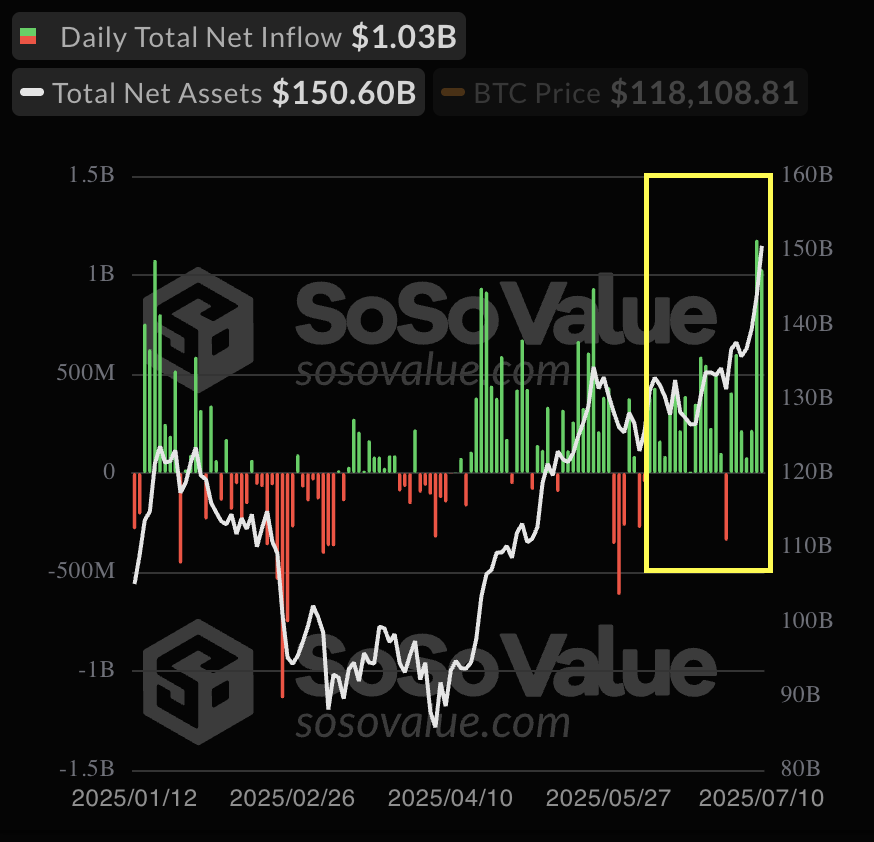

Last week, $ETH ETFs posted their highest inflows ever at over $908M, a 314% increase week-over-week. This also accounted for 29% of all inflows in 2025. This week, we're already on pace to shatter that record and surpass $1B for the first time.

Yesterday saw the second highest daily inflows into $ETH ETFs ever, with over $383M pouring in. This pushes the weekly total to $703M, the highest weekly volume of 2025. And we still have one more day to go. Buckle up 😈

1

3

10

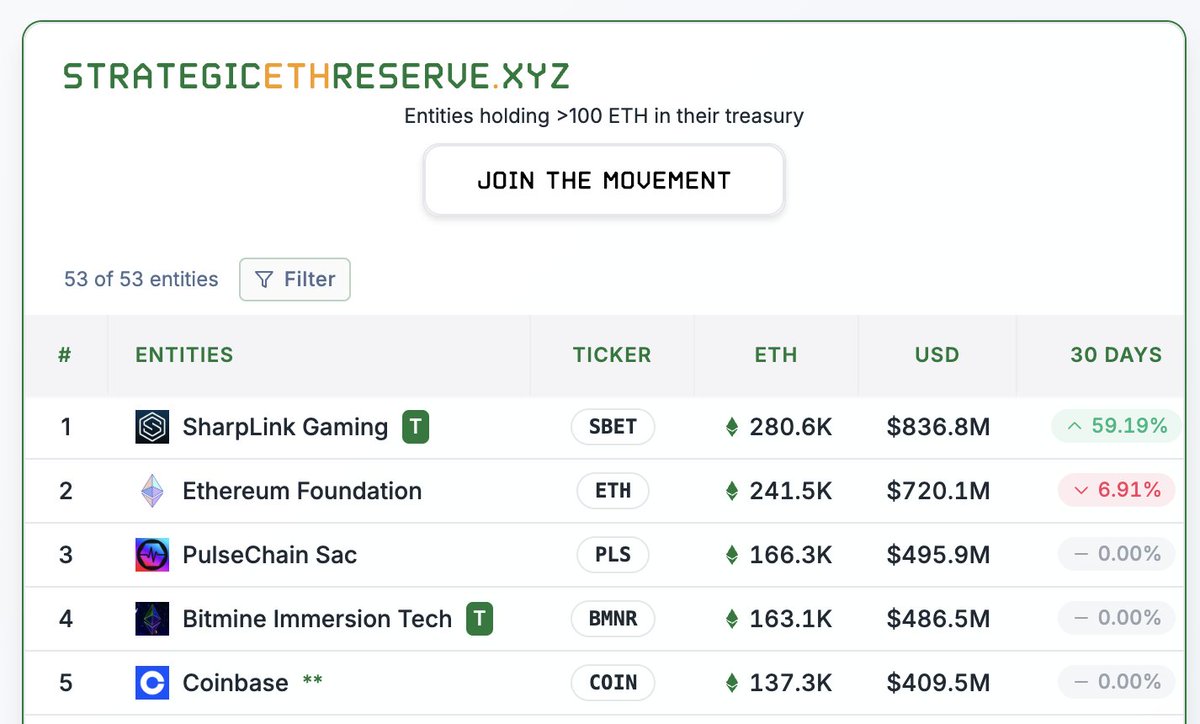

In less than 2 months, @SharpLinkGaming has become the largest ETH treasury on the planet, amassing over 280,000 $ETH (~$836M) and surpassing @ethereumfndn. In June alone, SharpLink increased their ETH holdings by a staggering 59%. Meanwhile, the underlying $SBET stock is up

2

5

48

Historic week for $BTC ETFs. For the first time ever, Bitcoin ETFs had back-to-back days with over $1B in net inflows:. Thursday, July 10th: $1.17B.Friday, July 11th: $1.03B. Notably, @BlackRock's $IBIT accounted for 84% ($1.85B) of all inflows during this period. This pushes

0

0

6

With little fanfare, @Ripple's $RLUSD stablecoin has surpassed $500M in total circulating supply. RLUSD has grown by 63% since June and has quickly lept into the top 20 stablecoins in terms of total supply. It also processed over $1.8B of trading volume in June. RLUSD is pegged

1

2

7

Onchain lending continues to accelerate. There are now more than $28B in total open loans across the ecosystem, the highest total ever. Borrowing activity grew by 30% ($6B) in June alone. There are now 9 different protocols with at least $1B in open loans, including:. @aave

3

13

41

Quietly, @eulerfinance has grown its lending business by over 1200% in 2025. The protocol now manages $1.2B in active loans and $2.2B in deposits, generating $50M in annualized fees. This growth has catapulted Euler to the 5th largest active lender in the entire space. h/t

7

12

82

Stablecoins are being used as a medium of exchange now more than ever. In June, fiat-backed stables like @circle USDC and @Tether_to USDT shattered previous records, processing over 236M transactions. This represents a 28% increase month-over-month, coming off a previous all-time

2

2

8

No one is talking about it, but @PancakeSwap led all DEXs in total monthly volume for the second straight month, accounting for 45% ($153B) of all DEX volume in June. The protocol shattered its previous record from May ($98B), growing 56% month-over-month.

2

2

8

Traditional markets are up. But blockchain is dominating. Over the past year:. S&P 500: +11% .$QQQ: +11%. $COIN: +36%.$BTC: +67%.$CRCL: +217%.$HOOD: +242%. And we're just getting started. h/t @artemis

0

3

8