Maverick Equity Research

@Maverick_Equity

Followers

9K

Following

41K

Media

8K

Statuses

63K

Independent Investment Researcher & Investor: stocks, bonds & more 🇺🇸🇨🇭🇪🇺🇨🇦 Risk management & hedging. No hype and no advice. A Roger Federer fan ...

Vienna, Austria

Joined November 2010

This is why independent economic/investment research has a future . 👇. No fear to say/write something, no choosing words, no reluctance, no redacting something cause the boss or whomever said so, or government might do after or any of that matter . .

17

32

247

RT @Maverick_Equity: “Recession“ tariffs scare over when we check for S&P 500 earnings calls: 87% Decline in S&P 500 Companies Citing “Rece….

0

1

0

RT @Maverick_Equity: S&P 500 Q2 2025 earnings scorecard update as of August 8th 👇:. 👉 earnings growth +12.4% (not bad . at all . ). 👉 re….

0

1

0

RT @Maverick_Equity: S&P 490 vs S&P 10 - aka 'with or without you Top 10' edition via 2 Maverick charts for 10,000 words:. 👉 Net Income gro….

0

1

0

RT @Maverick_Equity: Money Market Funds (MMF) - time for another (ultra-record) update:. 👉 $7.4 trillion, just another one for the record b….

0

2

0

RT @Maverick_Equity: What about Retail Money Fund Funds Assets (MMF) - they are not peanuts as a legend says, quite a big share of the pie,….

0

1

0

What about Retail Money Fund Funds Assets (MMF) - they are not peanuts as a legend says, quite a big share of the pie, about 39%:. 👉 $3 trillion total almost. 👉 check the split by government, prime, tax-exempt . 👉 check the recession & stock bear markets patterns. Maverick key

Money Market Funds (MMF) - time for another (ultra-record) update:. 👉 $7.4 trillion, just another one for the record books = "A Trillion Here, a Trillion There, and Pretty Soon You’re Talking Real Monay!". 👉 Plenty of dry powder to buy stocks? Via JPM:.". there is more than

1

1

1

RT @Maverick_Equity: Dividends’ Share of Long-Term Total Equity Returns - across the globe & last 20 years:. 👉UK vs USA to be noted https:/….

0

1

0

RT @Maverick_Equity: S&P 493 vs Mag 7 - earnings growth since Q3 2023:. 👉 for some good quarters, it was all about Mag 7. 👉 S&P 493 joined….

0

2

0

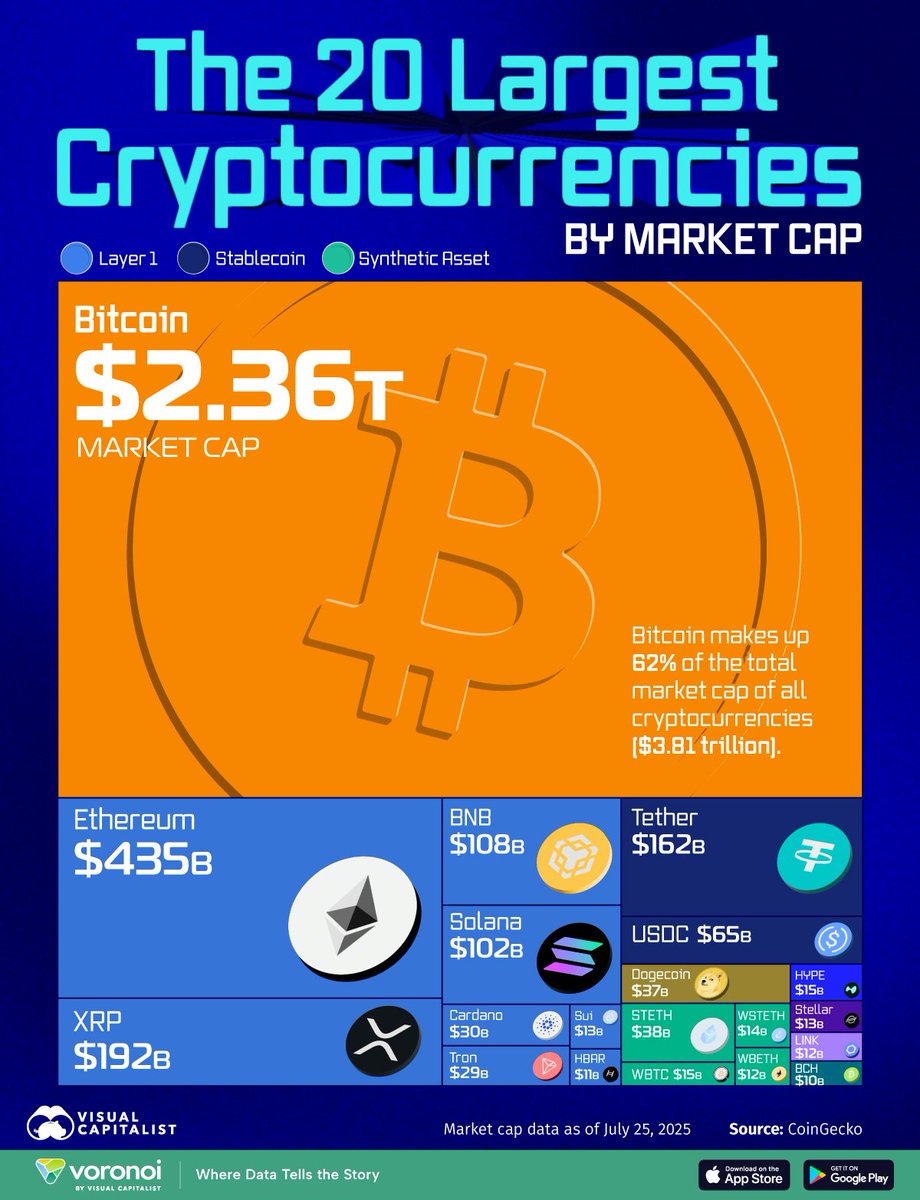

RT @Maverick_Equity: Ranked - The 20 Largest Cryptocurrencies by Market Cap:. 👉 Bitcoin remains the largest cryptocurrency with a $2.36 tri….

0

1

0

S&P 493 vs Mag 7 - earnings growth since Q3 2023:. 👉 for some good quarters, it was all about Mag 7. 👉 S&P 493 joined the party a bit lately, though not yet fully into it - still Magnificent 7 earnings growth . Chart: BofA Quant

S&P 490 vs S&P 10 - aka 'with or without you Top 10' edition via 2 Maverick charts for 10,000 words:. 👉 Net Income growth (g): top 10 companies pulling away massively, especially since 2023. 👉 Weight (w): Hence a 40% weight of the Top 10 companies - went parabolic since 2020 &

1

2

3

RT @Maverick_Equity: World Stocks valuation by sectors (MSCI World):. 👉 record 23% share of MSCI World sectors trading at 10x EV/Sales (Sal….

0

1

0

Dividends’ Share of Long-Term Total Equity Returns - across the globe & last 20 years:. 👉UK vs USA to be noted

S&P 500 valuation via Free Cash Flow (FCF) Yield since 2005 (after CAPE 3 measures, tweet below):. 👉 trades below even the -2 Standard Deviation (SD), both on a Market Cap & EV basis, 2.5% and 2.51% .👉 quite some to go for the -1 SD at 3.57% (market cap basis), and 3.12% (EV

0

1

2

World Stocks valuation by sectors (MSCI World):. 👉 record 23% share of MSCI World sectors trading at 10x EV/Sales (Sales jep, not EBIT, earnings or so). 👉 = basically a return and above the 2000s Dot-Com heights - sure, now there is way more cash flow behind . but still .

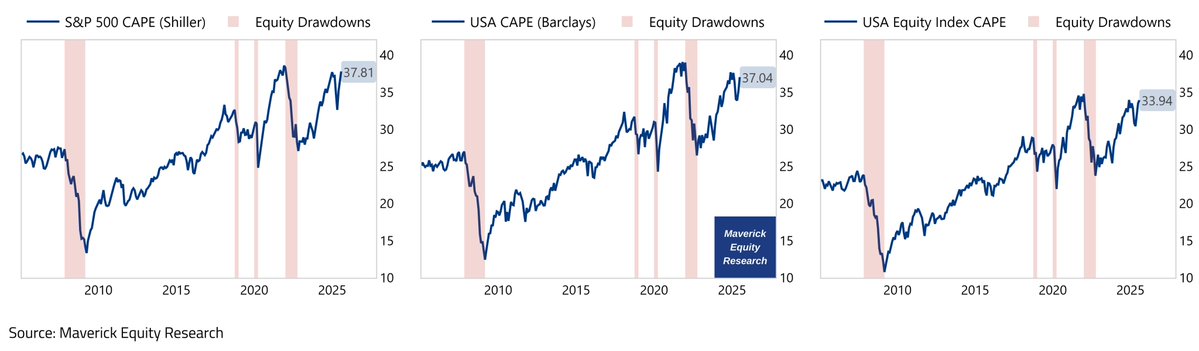

U.S. Equities Valuation via a rare Maverick Chart for 10,000 words - 3 key CAPE (Cyclically Adjusted P/E) measures and related drawdowns:. 👉 S&P 500 CAPE (Shiller) = 37.81 = an inch from crossing 38 = only the 3rd time in history & now higher than 98% of historical valuations

1

1

5

P.S. Market Concentration will be the main subject of one of the next Maverick Special Reports . in case you missed the previous ones, titles below, free on the website to read (link in bio). ✍️ Maverick Special Report #7: Margin Debt (Leverage/Borrowing) by Retail Investors

0

0

1