Material Indicators

@MI_Algos

Followers

29,450

Following

2,878

Media

8,764

Statuses

12,990

#FireCharts , #tradingsignals , #Crypto market data & svcs CoFounders @Mtrl_Scientist @teamblacknox #BTC No Financial Advice. Join us

USA

Joined February 2020

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Jerusalem

• 133697 Tweets

Janones

• 89274 Tweets

D-Day

• 86656 Tweets

Jalisco

• 75960 Tweets

Star Wars

• 62541 Tweets

Rachadinha

• 55458 Tweets

Nikolas

• 54460 Tweets

Normandy

• 52398 Tweets

NEVER LET GO D-1

• 48248 Tweets

Día Mundial del Medio Ambiente

• 35231 Tweets

Boulos

• 33402 Tweets

Meral Akşener

• 32775 Tweets

対象の3作品

• 31484 Tweets

James Biden

• 28557 Tweets

Jim Crow

• 27301 Tweets

Conselho de Ética

• 26833 Tweets

Byron Donalds

• 19248 Tweets

Giovanni van Bronckhorst

• 18861 Tweets

Adobe

• 17397 Tweets

EL X VENIR 6 MILLONES

• 15386 Tweets

Sister Act 2

• 13671 Tweets

Hochul

• 12751 Tweets

Sabalenka

• 11865 Tweets

Kanté

• 11259 Tweets

Luxembourg

• 10543 Tweets

Last Seen Profiles

The last time

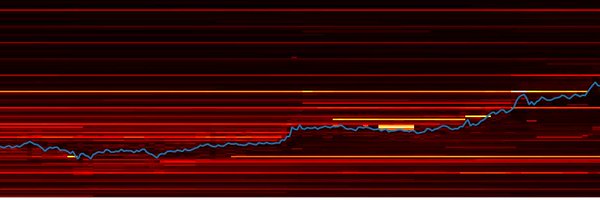

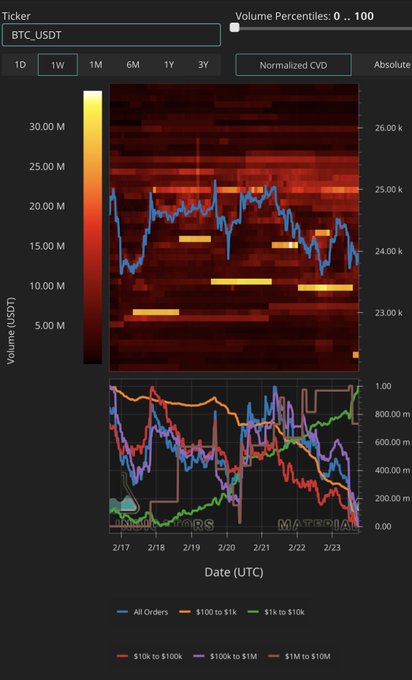

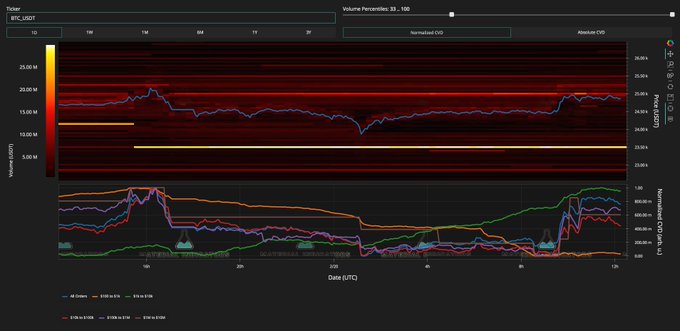

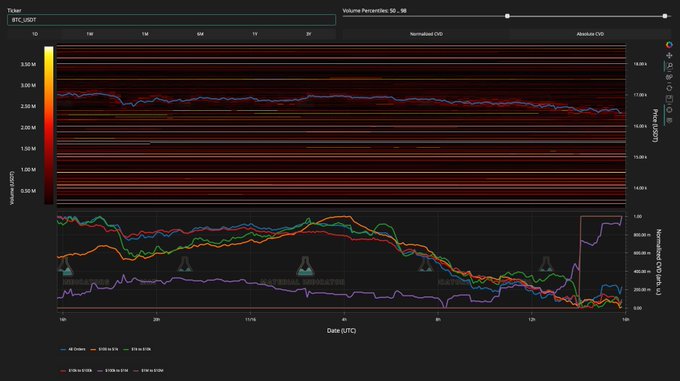

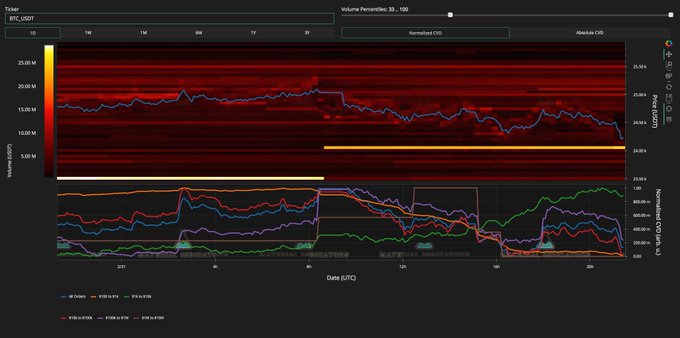

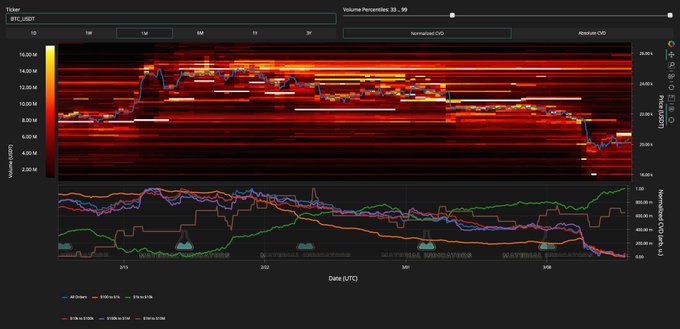

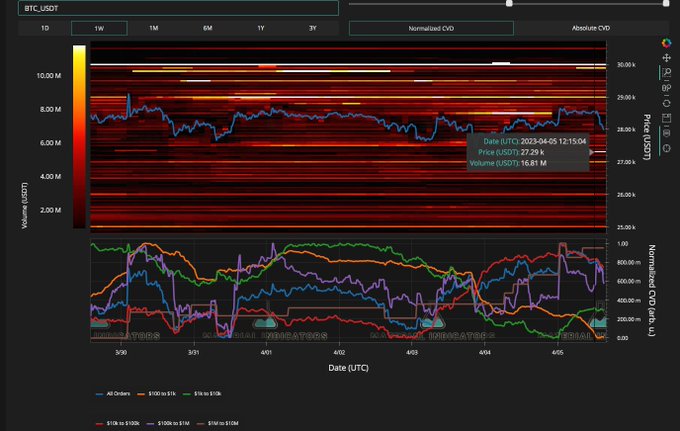

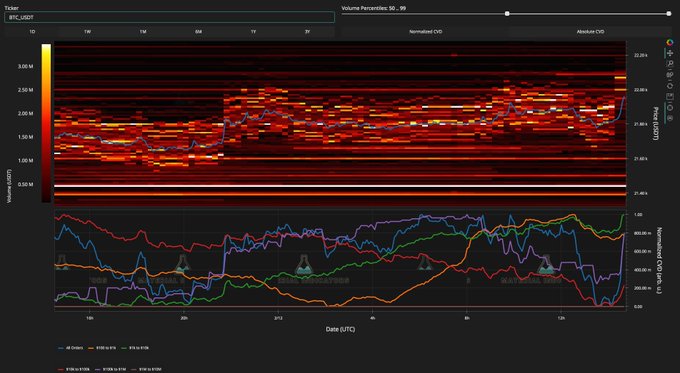

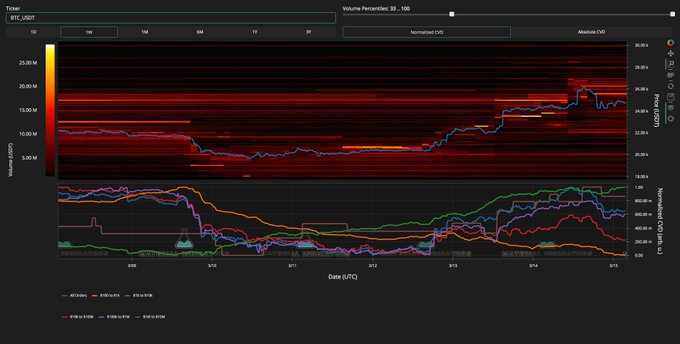

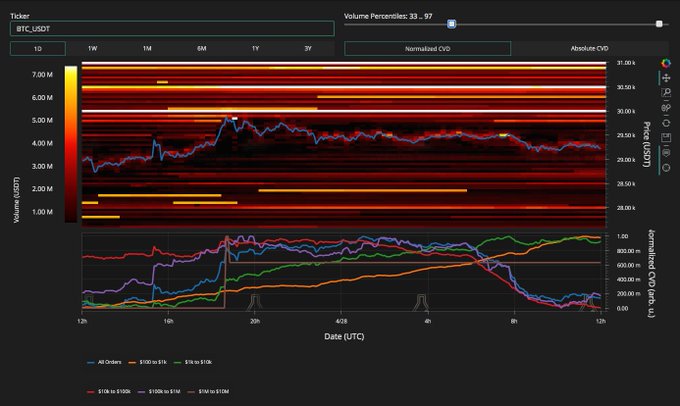

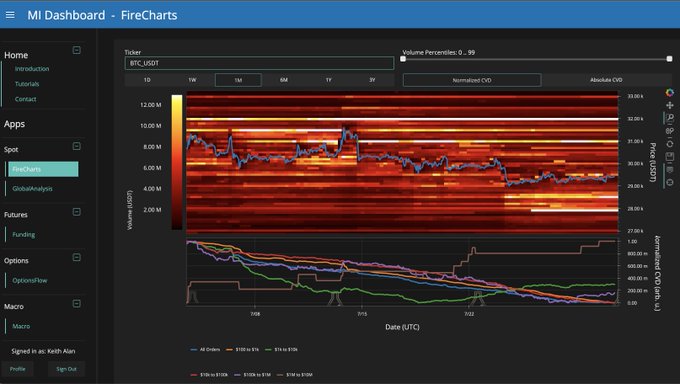

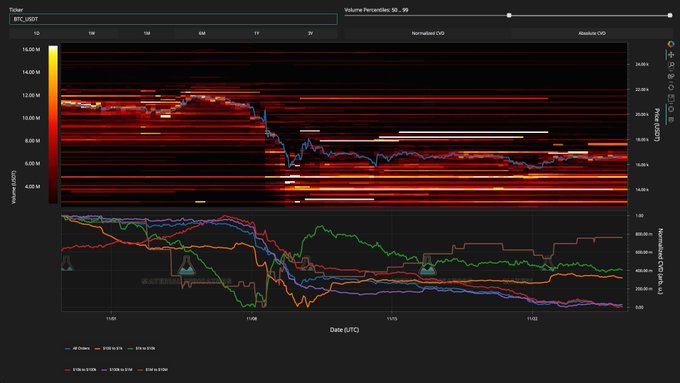

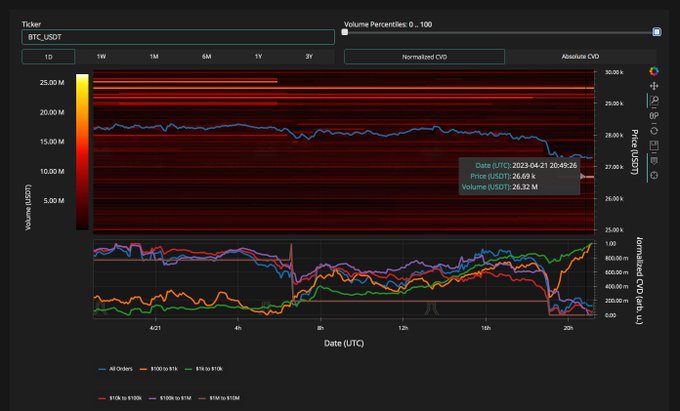

#BTC

had a sell wall this large directly above the active trading range was Nov 2020. It was literally the same amount at the same price level. Over $100M in ask liquidity was eaten to kick off the bull run. Don't think a breakout from here will do the same, but...

212

129

873

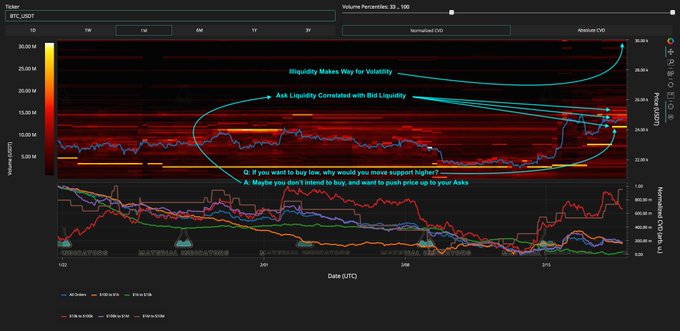

The notorious

#BTC

buy wall moved AGAIN!

It appears they are trying to push price into their own asks. If they can attract enough buyers to clear $25k there's little friction to $26k and thin air to $30k.

No clue how long they can do this. Happy to play along.

#RiskManagement

.

72

95

698

#FireCharts

2.0 (beta) shows "they" just cleared a path to $25.2k, but "they" also pulled the notorious bid wall and moved it down to ~$23,450.

#RiskManagement

for the W.

18

39

329

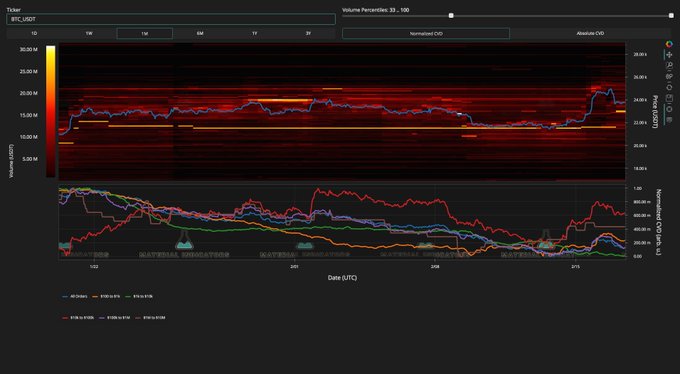

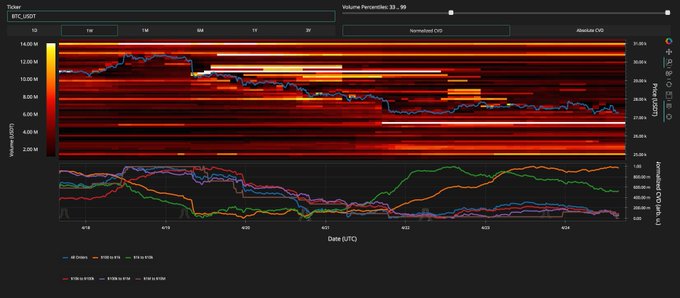

In Q1/2023 we identified a block of bid liquidity moving around the order book that, at times, was successful in attracting more bids to help fuel the

#Bitcoin

rally. It seemed evident that it was the same entity because there were no time gaps between buy walls that moved, they

23

45

308

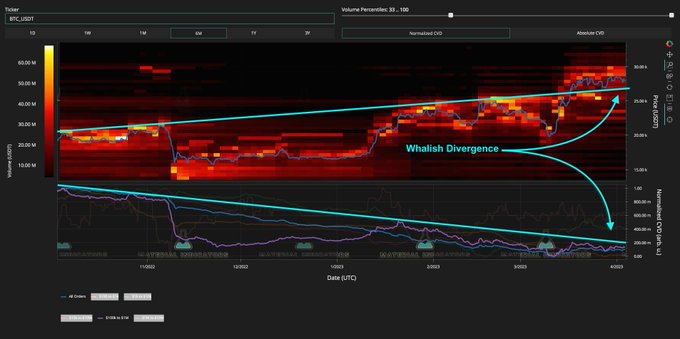

3/3 They are attempting to create what looks like a bull market breakout. We already have 2 rejections so if they get it, it's a bonus.

IMO, the goal was to raise the distribution range and drop ask liquidity on to bull market maxis.

#MissionAccomplished

#WhalishDivergence

9

21

290

If the Notorious B.I.D. wall at $22,250 holds, I expect it to be part of the weekend whale games. I would not be trying to catch knives. Expect

#BTC

to retest lows or potentially move to price discovery before a legit Bull Market Breakout.

#FireCharts

#NFA

18

27

246

Sorry for a light day of updates. Dropped everything when my kid called me from lacrosse practice with a fractured wrist. Heartbreaking to see this happen a week before her first game, but her positive attitude is inspiring. This chart was nice to come home to.

#FamilyFirst

40

4

251

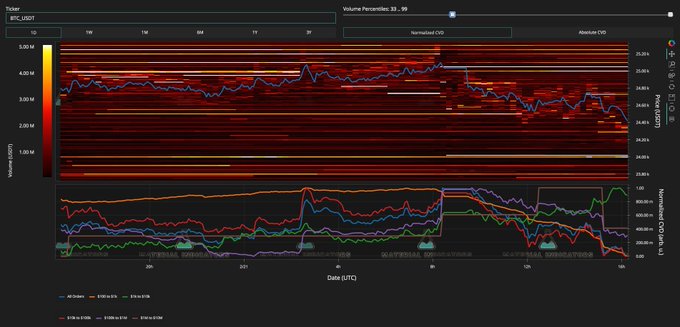

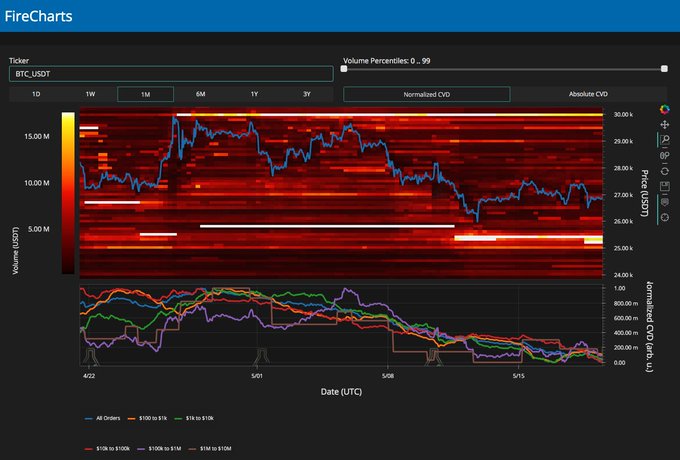

Update on the range set by the Notorious B.I.D.

#FireCharts

shows ask liquidity laddered up to ~$26.5k and it appears liquidity in that range is getting trickled into the active

#trading

range and replenishing resistance at $25k. Want to see more bids above $24k to retest $25k.

14

17

211

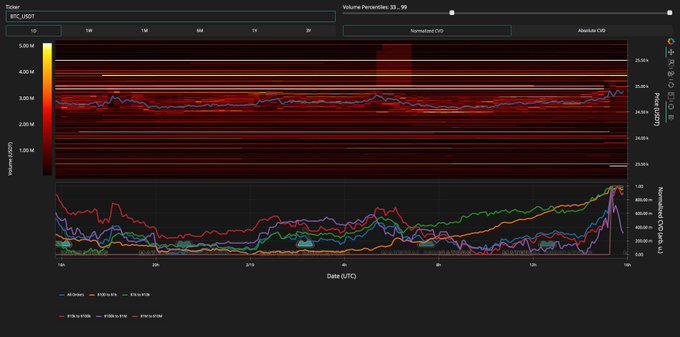

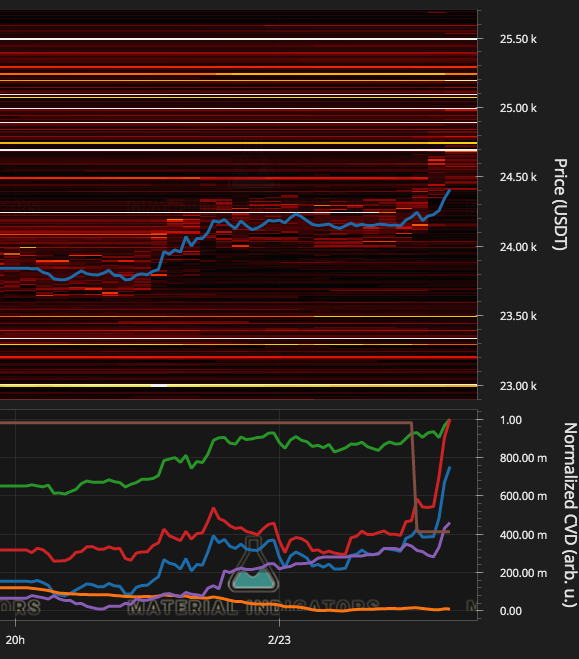

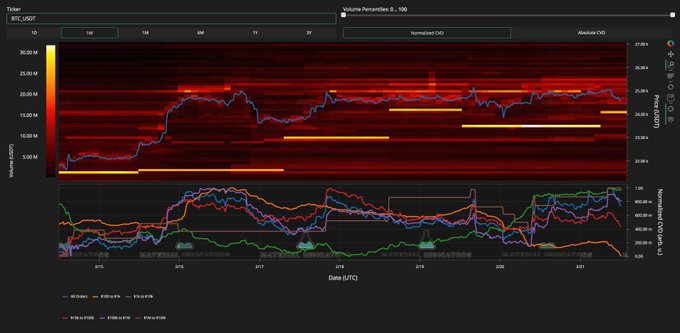

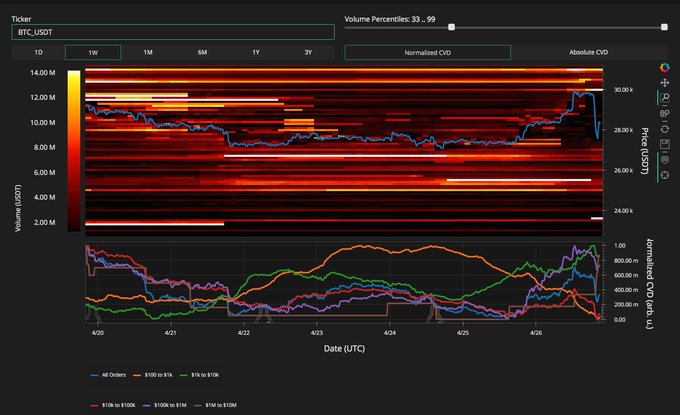

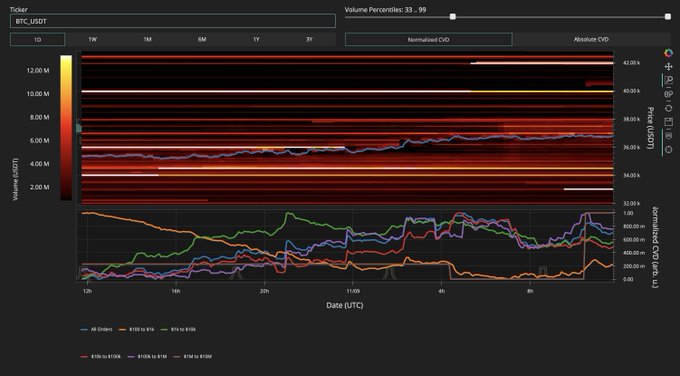

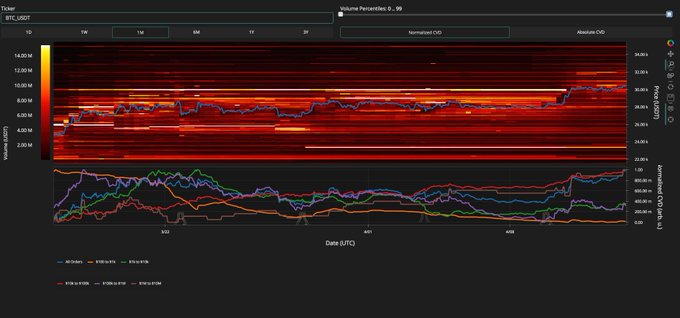

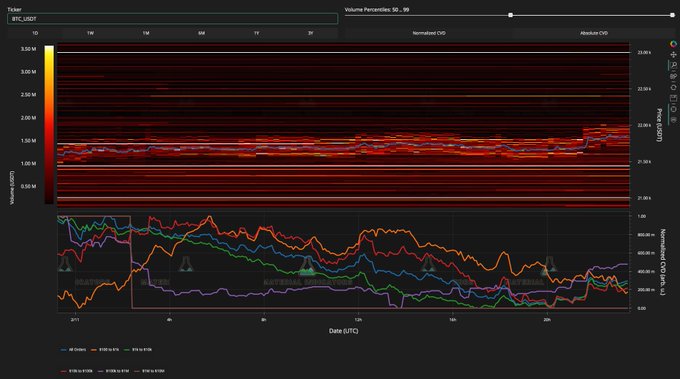

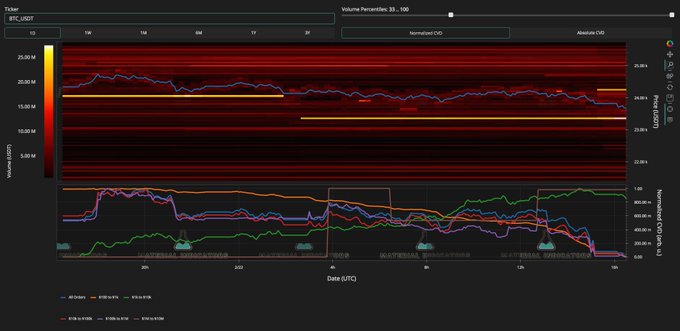

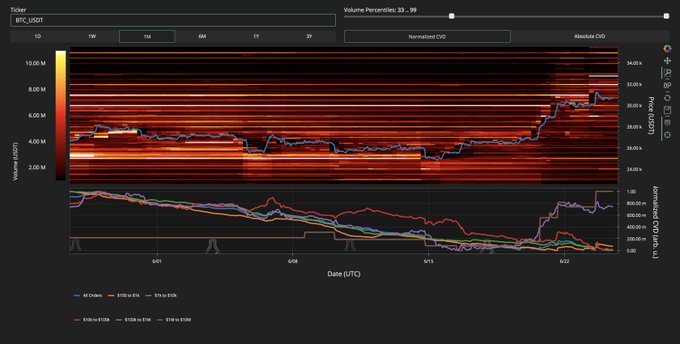

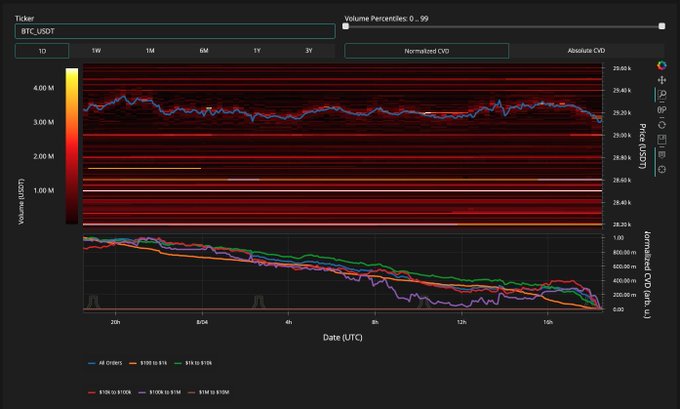

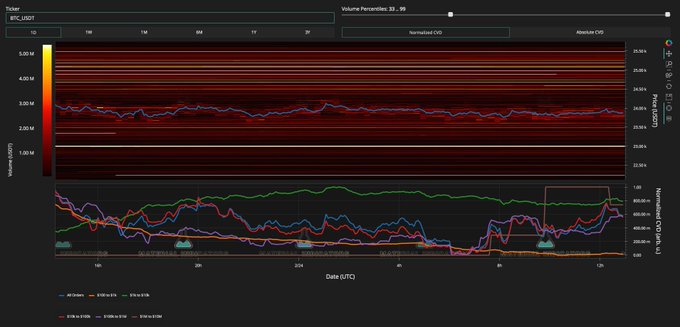

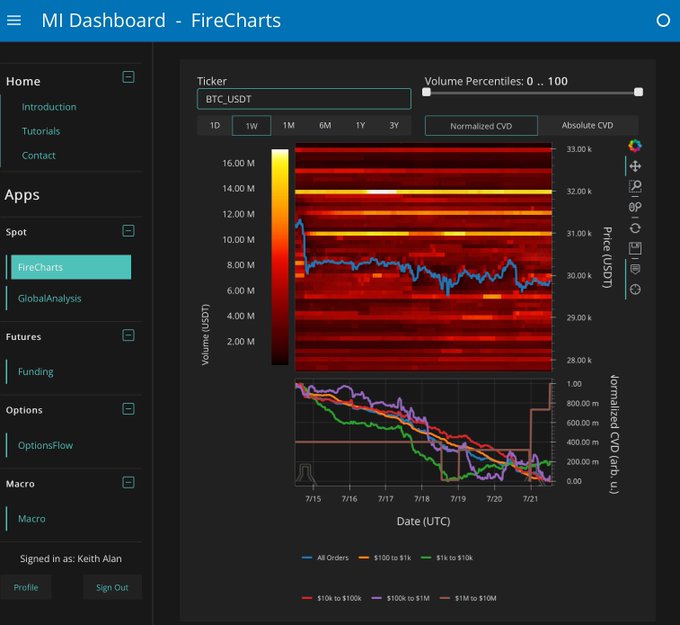

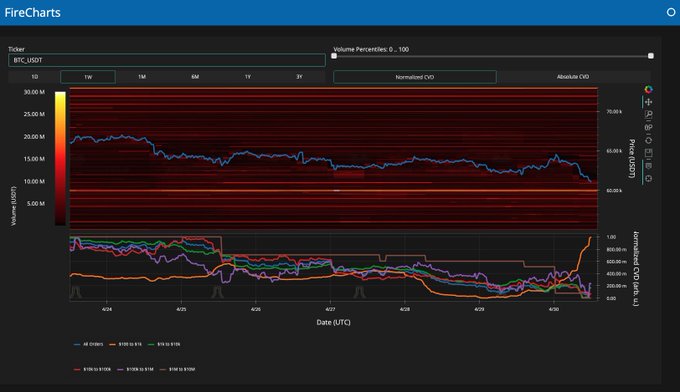

Retail is selling...

Meanwhile

#Bitcoin

Whales are still buying aggressively.

#FireCharts

#DataVisualization

#SwimWithThePod

9

40

208

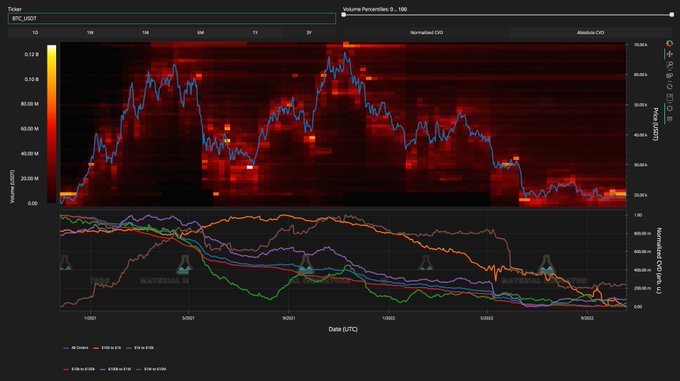

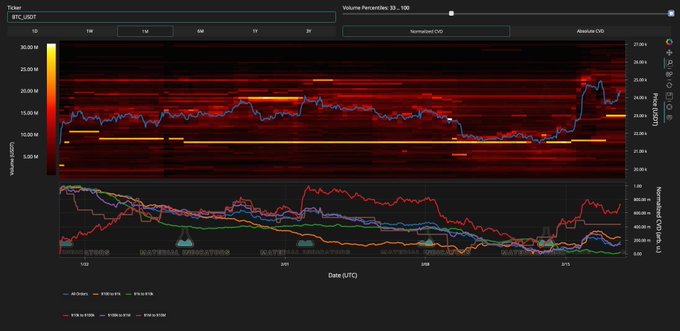

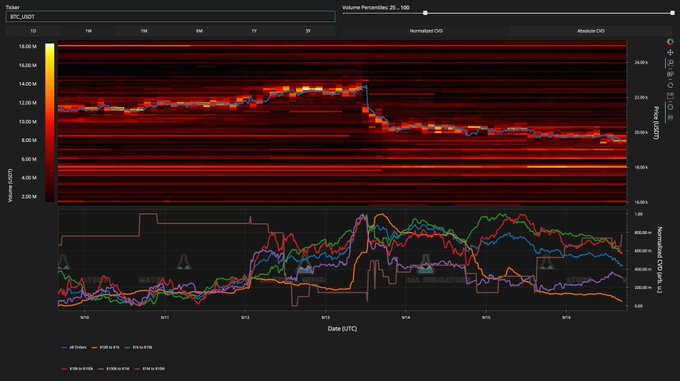

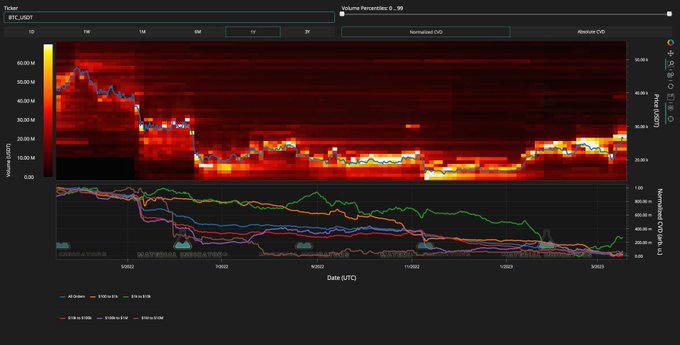

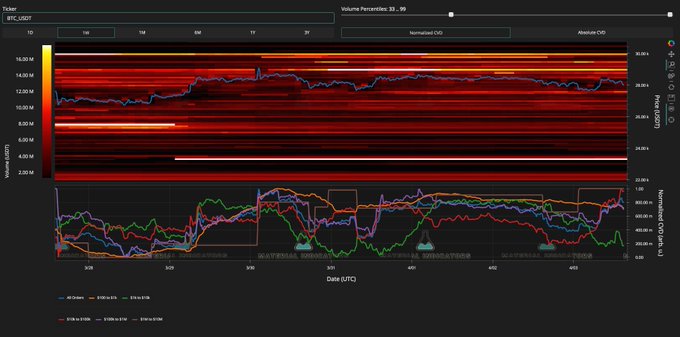

Historically, the purple class of whales seen on

#FireCharts

CVD with order sizes between $100k - $1M has had the most influence over

#Bitcoin

price action. They've been buying since June 18th. They are currently selling the pumps.

18

34

196

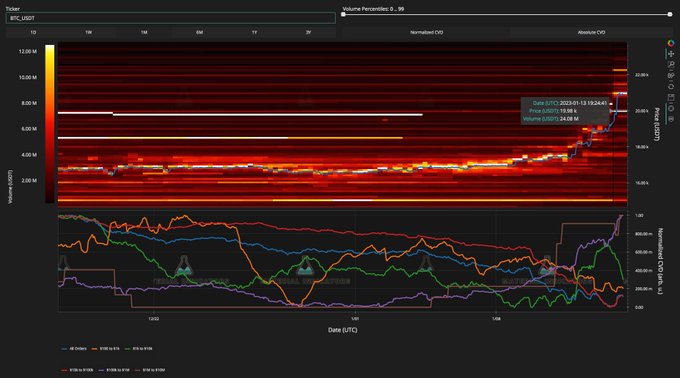

Feels like

#Bitcoin

is hovering on

#hopium

. If you are trading the volatility, don't give it all back. I trust the $24M at $20k almost as much as I trust

@SBF

. Be sure to TP along the way.

Call in it a night. Gimme a like if you want me to share more

#FireCharts

over the weekend.

11

18

189

The notorious

#BTC

buy wall we've been tracking for 5 weeks just strategically moved again, this time just above the 21-Day Moving Average. This entity seems to be playing the Technicals level by level.

If you can identify the game, you can mitigate some risk and play along. 😎

12

22

195

Switched to Absolute CVD Value to confirm that the Notorious B.I.D. wall was filled.

#FireCharts

23

11

186

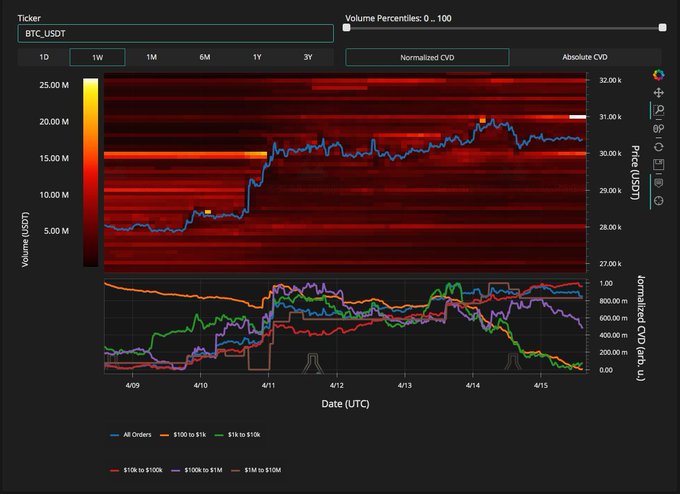

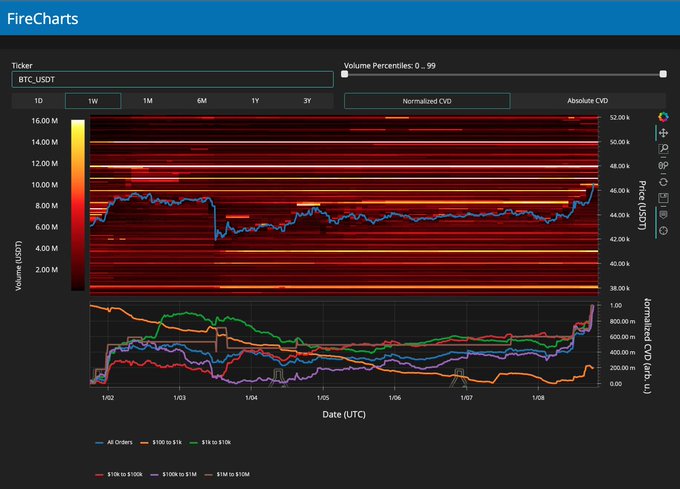

After the push above $30k,

#BTC

liquidity is diffused in both directions. There are no massive buy/sell walls, in fact the so called walls that appear on

#FireCharts

are rather thin. Bullish momentum is growing so we could see a push higher. Wed CPI and Thu PPI Reports could

9

29

182

I'm not even sure how to comment on this move other than to say, "You can't say I didn't warn you", but I'm not much of an "I told you so" guy so let me share some thoughts...

ICYMI,

#BTC

Price wicked down to $25,873 and even though the 200-Week MA has been reclaimed, the

12

22

170

#FireCharts

shows ~$25M in

#Bitcoin

bid liquidity that was stacked above the 200 Week MA, was moved down to ~$23.3k, presumably to defend the Monthly Close coming Friday after a fresh PCE report.

Meanwhile price is pumping.

If bulls run out of momentum before clearing $28k,

6

25

167

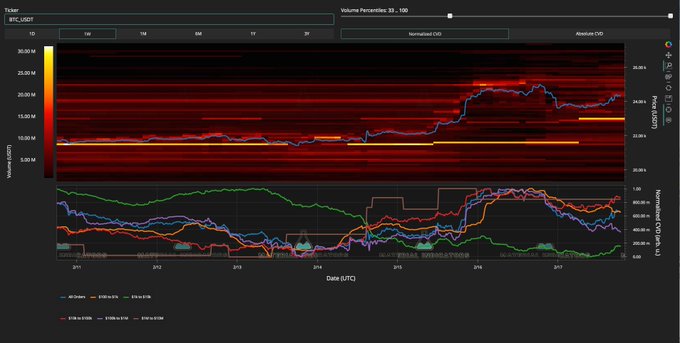

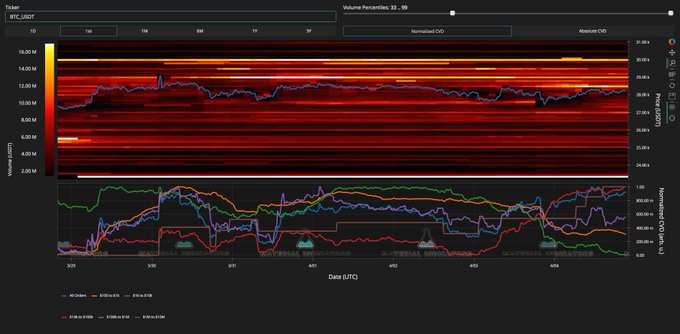

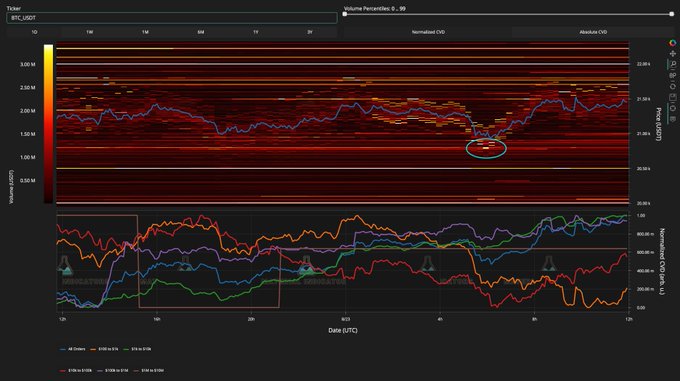

Did some markups on

#FireCharts

2.0 (beta) to illustrate how the Notorious B.I.D. Wall is manipulating

#Bitcoin

PA. If they wanted to get filled at $23k they would have.

If you are

#trading

in this environment, know your invalidations. As always,

#RiskManagement

for the W.

18

20

173

From a TA perspective this should be a local top, but Notorious B.I.D. is still running the

@binance

order book. They are distributing

#BTC

ask liquidity out of the $25k - $25.5k range into the active

#trading

zone so resistance is thinning. Watching

#FireCharts

for the next move

11

13

175

1/2 Watching

#BTC

liquidity move around the game board on

#FireCharts

2.0 (beta) and wondering if the Notorious B.I.D. wall at ~$24k will hold or spoof.

What do you think?

28

9

163

#FireCharts

shows whales sizing up the sell wall at $26k. Expecting another wild weekend of

#crypto

whale games with volatility extending through the March 22

#FOMC

Meeting and

#FED

rate hike decision.

20

16

159

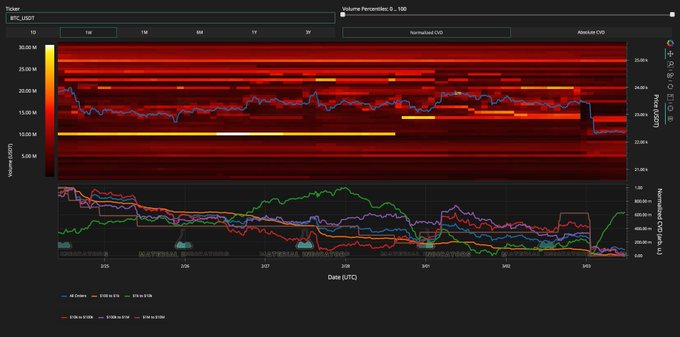

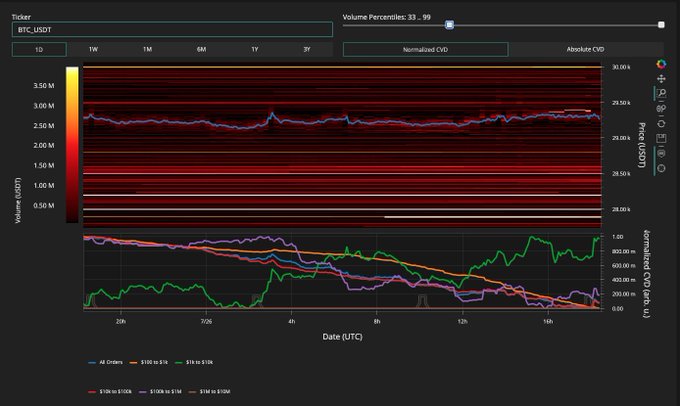

A bit surprising how many times local support has been tested and replenished over the last month. While I think that consolidation is generally a good thing, I don't think that what we are seeing in this range is as bullish for

#Bitcoin

as it may seem.

Out of context, prolonged

14

24

157

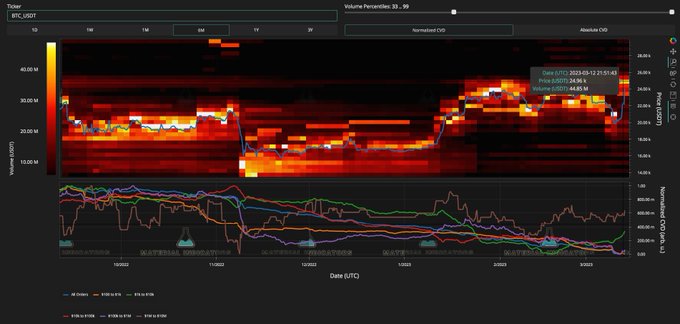

#FireCharts

shows the $25M Buy Wall just moved down to the $23.6k range. Still can't confirm whether this is the entity we named Notorious B.I.D. back in Q1, but I can tell you we've seen this game played before with buy walls this size, moved this frequently, through this exact

14

24

163

If

#Bitcoin

was really near THE BOTTOM, do you think there would be a liquidity gap between $18k - $18.5k, and wouldn't you also expect there to be solid bids at least to the June low at $17.5k?

#FireCharts

I have no more questions.

30

27

153

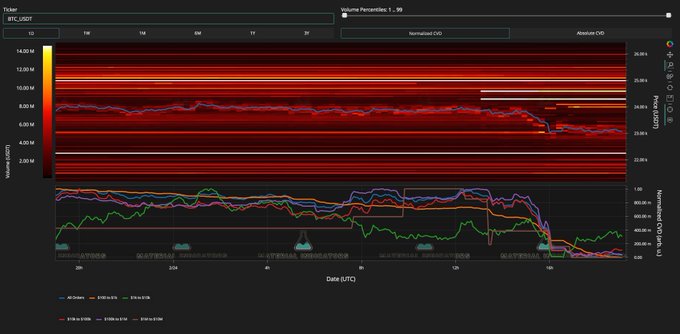

Expecting rejection at $25k and a dump to clear the way for volatility around the 8:30am ET

#Jobless

Report, but they just laddered asks up to $28k. If they clear $25k they can exploit the upside illiquidity fast.

If you can identify the game, you can mitigate risk.

#FireCharts

10

21

160

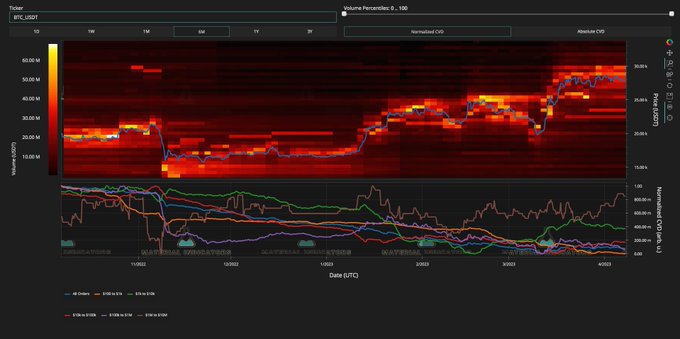

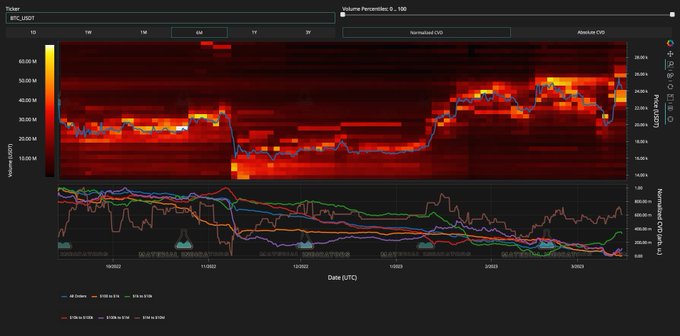

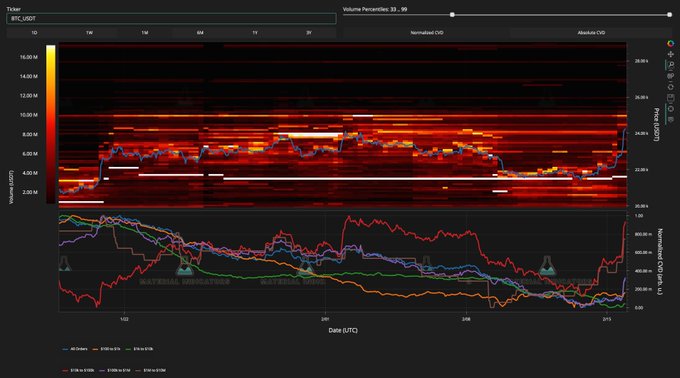

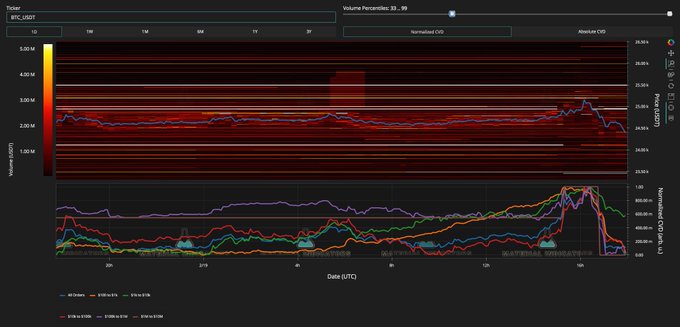

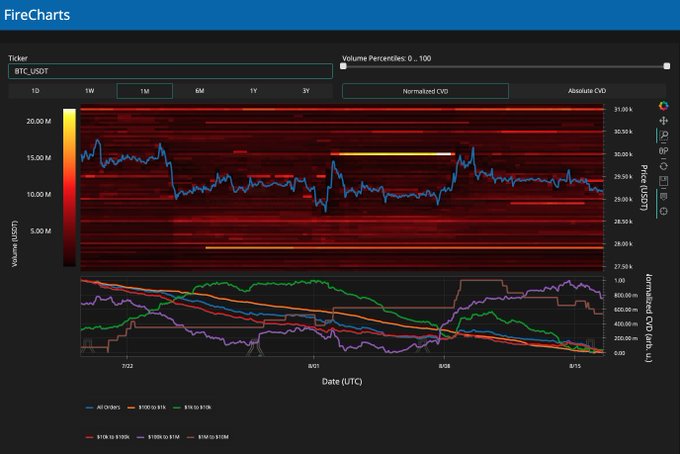

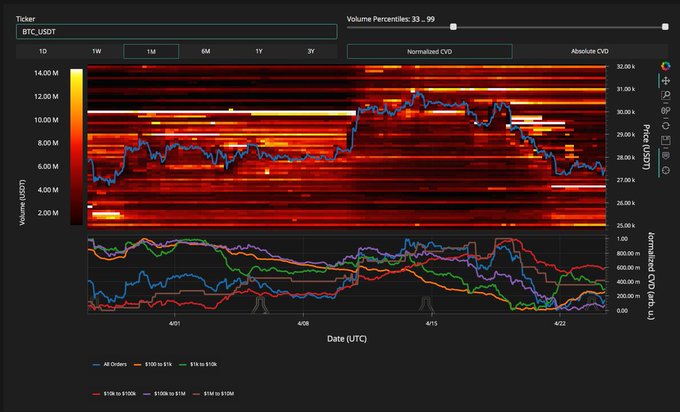

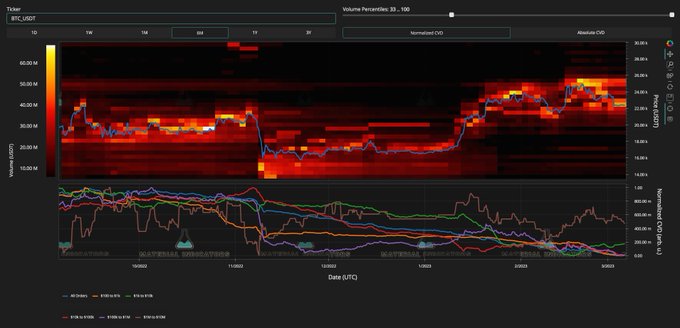

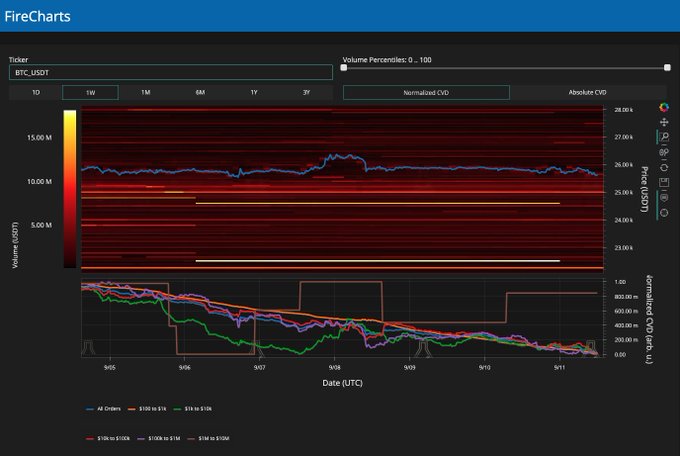

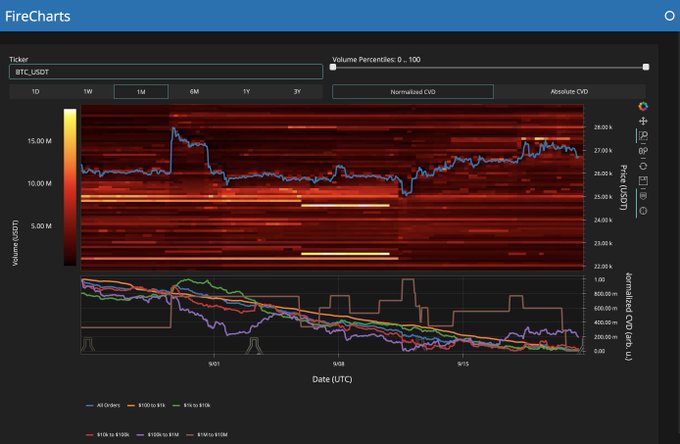

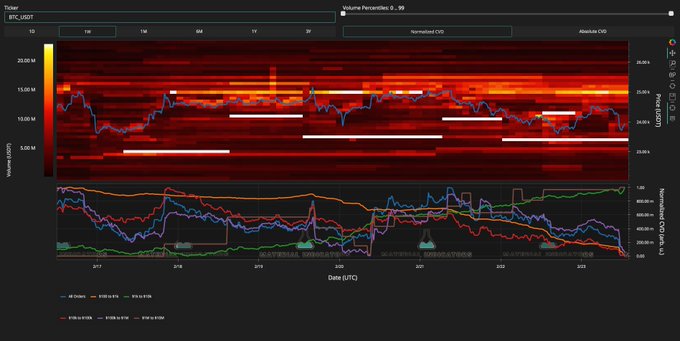

When in doubt zoom out!

#FireCharts

binned CVD shows a

#WhalishDivergence

between

#Bitcoin

PA and order flow data.

TLDR: Purple whales have been selling the rallies.

16

23

156

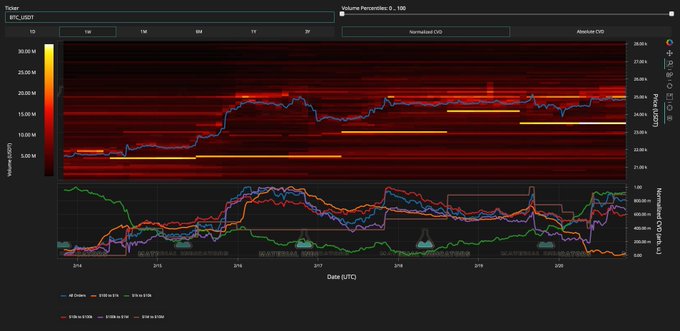

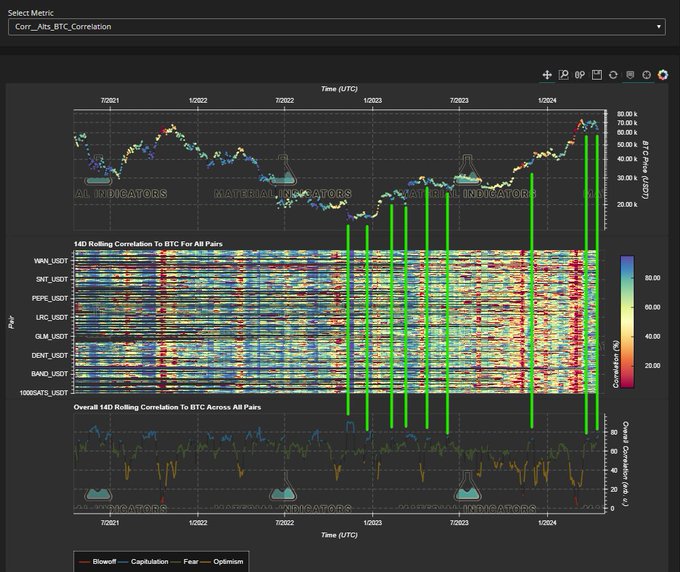

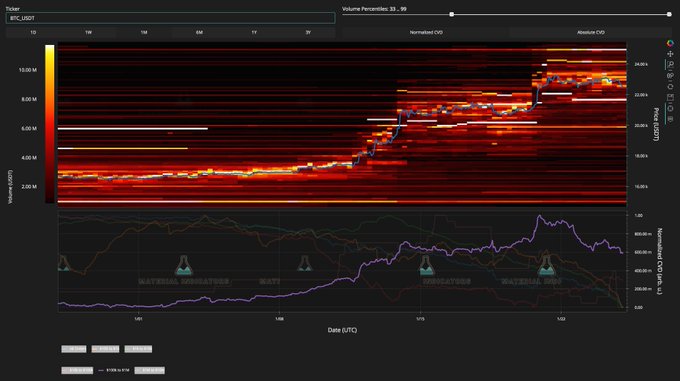

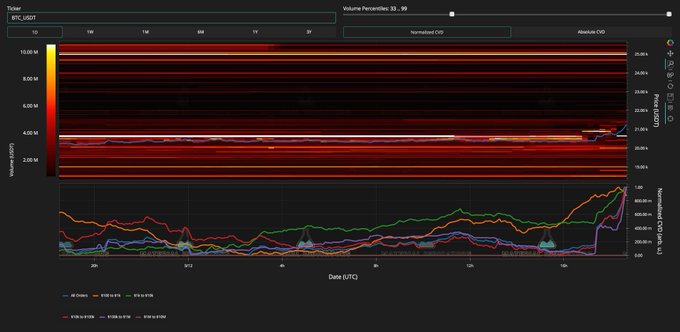

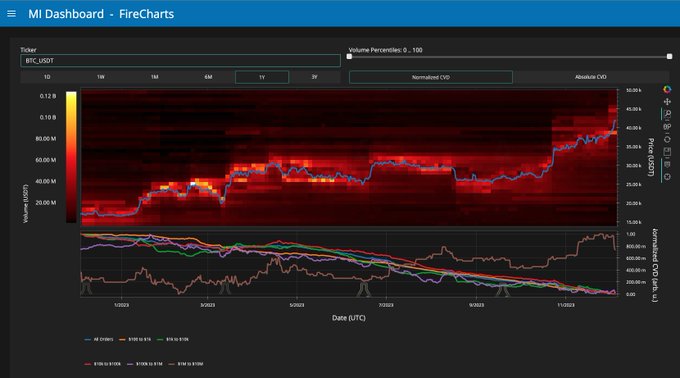

1/8 🧵 FireCharts 2.0 (beta) shows up to 3 years of order book and order flow history. If we look at a monthly view of the

#BTC

order book with the CVD Normalized it appears that Brown MegaWhales are buying, but all other classes have been selling.

You have to ask yourself why?

12

28

158

GM,

I hope you didn't start the day as

#ExitLiquidity

.

#BTC

flushed about $32M out of the range and left a black hole of upside illiquidity. If bulls can reclaim $29.5k before ask liquidity returns, there is very little friction between here and the mid $30s.

#FireCharts

11

20

154

Just as I was about to post that

#BTC

support was about to get tested, a $10M iceberg appeared just above the Notorious B.I.D. wall just before it got hit.

Scalping the range (responsibly)...again.

#RiskManagement

16

14

153

#FireCharts

shows

#BTC

ask liquidity from the $29k-$30k range laddering down into the active

#trading

range. Meanwhile new bids appear to be trying to maintain support around $27.6k and hold the range for another attempt at $30k.

We still don't have a confirmed breakout or

7

17

151

#BTC

lost key technical support levels and the order book looks shitty. The local R/S Flip zone is the last stand between a retest at the trend line. Meanwhile, Trend Precognition is indicating a down trend. Will see if that changes after the W close.

Time to

#PracticePatience

9

11

150

If you are wondering why yellow is buying

#BTC

here and brown mega whales haven't, it's not likely retail vs smart money. It's because liquidity between here and $29.1k is so thin that the slippage on a whale sized order would be significant so they are literally forced to make

9

12

144

#FireCharts

shows ~$195M in

#Bitcoin

bid liquidity between here and ~$13k on the

@binance

order book. Will continue to monitor for significant changes.

21

13

138

#FireCharts

shows ~$75M in

#Bitcoin

ask liquidity between here and $25k. A cool CPI Report could get them to move some or all of that sell wall higher and let price run and squeeze shorts.

#NFA

10

18

139

#FireCharts

shows

#BTC

support and a significant block of resistance moving upward in the order book.

Support is anchored by new plunge protection at $33k. Meanwhile resistance at $40k has moved up to the $42k range.

There is no denying the fact that price has been challenging

11

23

140

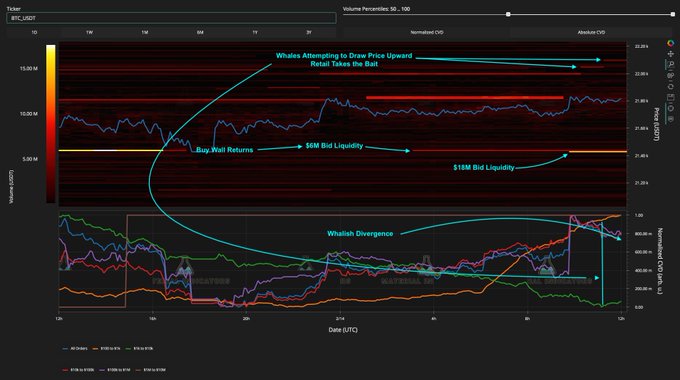

#FireCharts

shows

#Bitcoin

whales trying to lure retail in at higher levels ahead of the

#CPI

as purple whales sell into retail bid liquidity. Also note that the buy wall has returned to the $24.4k range in 2 levels. If the $6M up top gets hit, I expect the lower $18M to rug.

#NFA

7

22

141

#FireCharts

shows

#Bitcoin

price and liquidity continuing to erode and a critical test of support is eminent. IMO...

Losing $29k would be purely psychological.

Losing $28.5k would be technical.

Holding $28.3k is critical.

Losing the buy wall at $27.9k would cause a cascade.

11

25

138

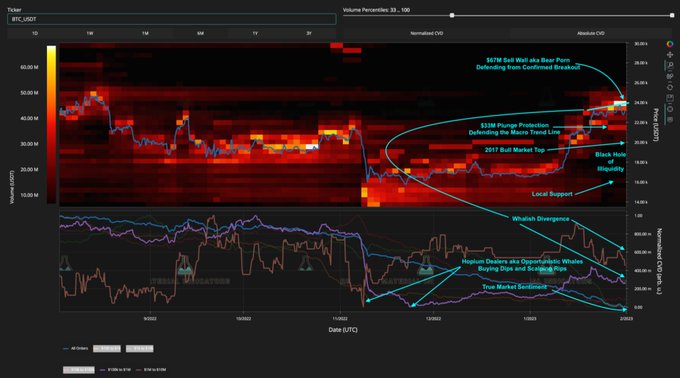

I had some fun marking up

#FireCharts

to make you guys a cheat sheet to help you interpret the recent

#Bitcoin

PA and order flow.

#NFA

Yes, you can use the term "Whalish Divergence".😎

16

24

137

Somebody stacked ~$45M in

#BTC

ask liquidity above $20.5k If more bids coming above $20k, or the lower end of the ladder gets hit, don't be surprised if some of it gets pulled and moved.

#FireCharts

10

20

137

#BTC

bid liquidity is stacking under $30k and some ask liquidity is adjusting upward. These are either signs that bulls are building momentum or the bait for a trap. Manage your risk accordingly.

#FireCharts

8

12

138

#FireCharts

shows

#BTC

bid liquidity filling in and brown mega whales market buying. Likely a choreographed attempt to push the distribution range up in the short term.

Personally still treating this as

#BearMarketRally

until proven otherwise.

#NFA

5

17

136

#FireCharts

shows

#BTC

bid liquidity stacking in the active trading zone and a solid sell wall developing at $27.5k.

5

17

131

#FireCharts

shows that $16.8M in

#BTC

bid liquidity just showed up to defend

#BTC

from a lower low on the Weekly chart.

9

15

132

#FireCharts

shows an open lane back to the $30k range, but if

#Bitcoin

bulls can't push over this little bit of resistance soon, a trip to $26.7k range becomes increasingly more likely.

12

23

134

With a $26M sell wall at $31k, the

#BTC

weekend range seems well defined. We should volatility in the range increase as we approach the W candle close. Enjoy your Saturday.

#FireCharts

9

11

135

#Bitcoin

managed to close February with a green Monthly candle, but IMO nothing for bulls to celebrate. Trend Precognition A1 Algo is flashing a tentative short on the monthly, but the order book is still being manipulated. For me, a pump above $25,270 would invalidate the signal

6

9

136

Gooooooood Morning!

#FireCharts

CVD shows some aggressive buying as

#Bitcoin

ask liquidity ladders higher.

Don't

#FOMO

into a trap. Stick to your plan.

6

18

134

#FireCharts

shows

#Crypto

Weekend whales seem interested in trying to exploit the upside illiquidity in the

#Bitcoin

order book to sell higher.

Personally, I'm fine with that.😎

Expecting volatility to continue through Tuesday's CPI Report.

Enjoy your weekend.

#SwimWithThePod

9

14

133

~$150M+ in

#Bitcoin

bid liquidity laddered down to $25k. It's good to see some depth, but also need to see some density closer to the active trading range.

If bulls can't reclaim $29k, bears are going to push for a retest of the 200-Week Moving Average.

Will continue to watch

9

17

132

#FireCharts

shows a new block of ask liquidity suppressing

#Bitcoin

price, likely trying to push price into their bids in the $27.3k - $26.7k range.

#NFA

14

17

136

#FireCharts

shows

#BTC

liquidity is actively moving around the order book and whale CVDs are on viagra.

Blocks of ask liquidity have been getting roof pulled before they get hit and are laddering higher.

Meanwhile bid liquidity is filling in the $43.3k - $45k range. Plus there

5

19

132

Liquidity dampens volatility

~$175M in resistance is stacked from $25k - $27k.

#BTC

bids are filling in above the buy wall at $22k

If liquidity thins and price gets close to a buy/sell wall, I expect some or all to be moved.

#FireCharts

PPI & Retail Sales Reports @ 8:30am EDT

14

21

133

#FireCharts

shows sell walls stacking just below Technical Resistance at the 100-Week Moving Average. IMO,

#Bitcoin

Bulls need to print full candles above the 100-WMA to validate a breakout. While such a move would fit the bull narrative, it goes against some important

12

27

125

25,000 Followers! Thank you CT for helping us reach another milestone with $0 advertising budget. I'm truly humbled by the support and engagement with my daily

#FireCharts

post.

If you see the value in the

#DataVisualization

tools and

#TradingSignals

we provide, I have a gift

6

7

128

I don't trust that little bit of

#BTC

support at $29k.

Watch for rugs.

The great shakeout continues.

#FireCharts

6

15

129

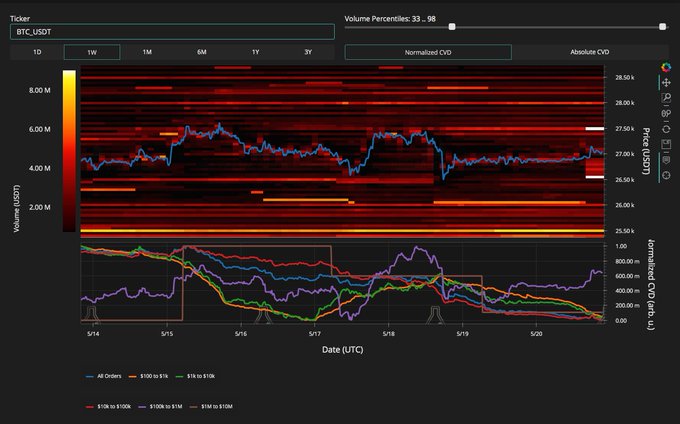

Historically, purple whales with $100k - $1M market orders have had the most influence over

#Bitcoin

price action.

#FireCharts

9

13

132

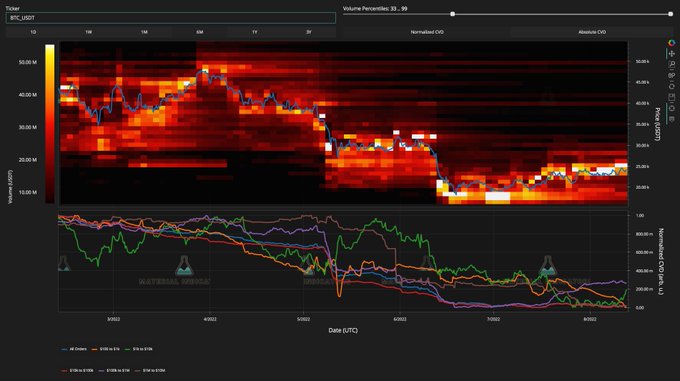

1/7 This looks like a classic

#bearmarket

rally. Since the economic and geopolitical factors influencing the market haven't bottomed, it's hard to believe the market has reached the macro bottom.

This 🧵 will discuss how this rally set up and how to identify THE Bottom.

#NFA

6

33

130

Here's a look at the

#BTC

order book on

@Binance

ahead of the Economic Report. Thin liquidity facilitates volatility.

#FireCharts

14

11

127

Zoomed out to a monthly view of liquidity in the

#BTC

order book to gain some perspective. The highest concentration of bid liquidity in the range is currently at $25k, but it's a relatively small buy wall.

For me, the LL at $24,750 is the line in the sand. If it holds, we could

10

13

124

#FireCharts

shows ~$17M was pulled out of the

#BTC

buy wall and it doesn't appear to have been moved in the order book.

Perhaps it was placed as a conditional limit order that won't appear until price reaches their condition, perhaps they took it off the exchange, or maybe they

11

19

121

Lot's of catching up to do this week around appointments, but will do my best to keep you in tune to the market.

After multiple hard rejections from the 200-Week MA,

#BTC

should test support. Note that Notorious B.I.D. is parked on the .618 fib, and Monthly close is tomorrow.

6

11

128

#FireCharts

shows

#BTC

is sitting on top of ~$60M in bid liquidity aka support, yet bulls just don't have enough momentum (or perhaps sentiment) to rally yet. Watching to see if new liquidity gets added or if existing liquidity moves to push price up/down from here.

8

14

129

#BTC

took out $29.5k last night, but so far bulls haven't been able to muster enough momentum to advance.

All eyes are on the monthly close which could open the door to some volatility. To prepare for that, we need to know what the possibilities are.

I've been saying for

4

19

126

#FireCharts

reveals that someone is working hard to defend the lower lows. Looking for a push above the prior high ~$21.7k. If we don't see more

#BTC

bids coming in above $21k, the downside illiquidity (dark areas) will be exploited.

9

17

127

If you are wondering how or why

#Bitcoin

has been able to defy gravity and repeatedly recover the range despite the fading momentum, consider the fact that 9825 BTC that the U.S. DOJ seized from Silk Road are actively being distributed into the market across multiple exchanges.

22

23

128

1/7 Despite the fact that we are for the first time in a long time,

#FireCharts

is showing the kind of concentrations of bid liquidity that have historically served as launch pads for strong rallies, this still looks like a strategically choreographed distribution game to me.

6

16

129

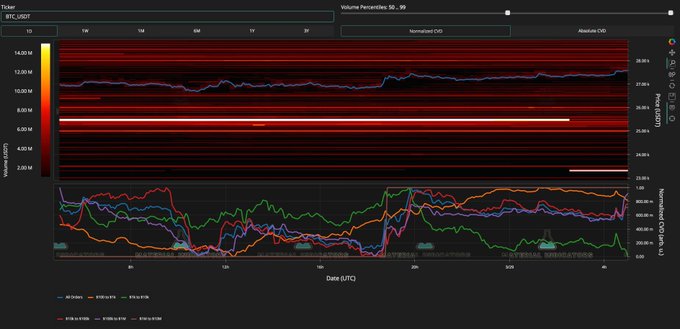

#FireCharts

binned CVD shows the smallest order class (orange) has bought > $45M in

#Bitcoin

via market orders through this dip over the last 24 hours.

Pro Tip: That ain't retail.

7

17

126

Looks like more than half of that $45M sell wall is gone. Most of it was trickled into the active trading range and bought. Now ~$20M in

#BTC

ask liquidity remains concentrated between $20,480 - $20,630.

#FireCharts

4

14

118

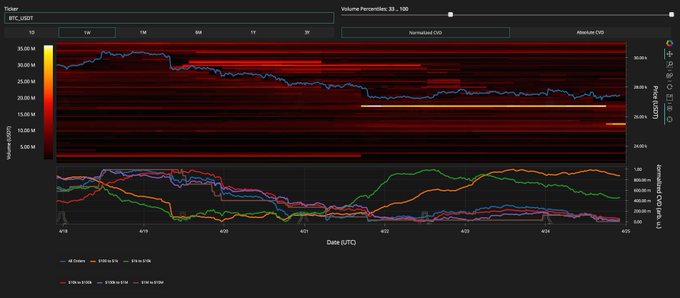

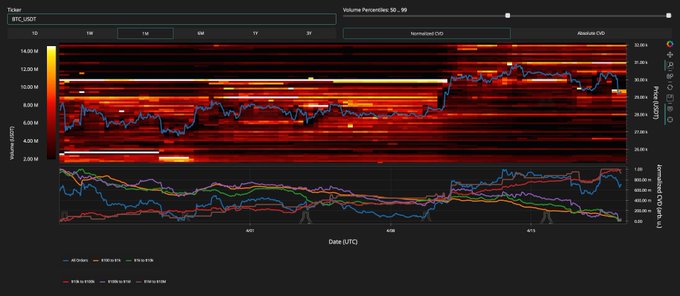

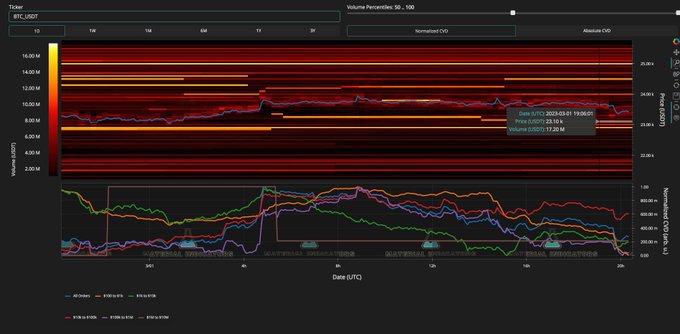

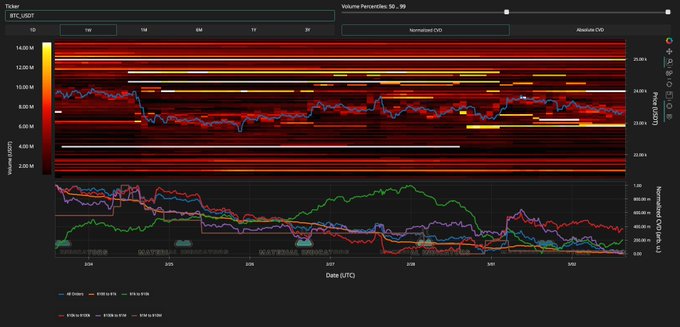

Seeing where there is a lack of liquidity in the order book is just as important as seeing where buy and sell walls exist. Volume Percentile filtering in

#FireCharts

2.0 (beta) makes that easy.

If

#BTC

bulls can push above $18k there is very little friction up to $20k.

7

14

116

If you scroll through the feed you'll see how we used

#FireCharts

2.0 (beta) over the weekend to spot liquidity movement and identify ranges that were likely to get exploited.

If my tweets helped you over the weekend, please LMK how I helped you so I can deliver more value.

13

5

121

Cooler than expected Jobless Report =

"Higher for Longer", both of which are moving targets. Notorious B.I.D. Wall is still propping up the distribution range, but they are losing momentum. If they pump again will

#SellTheRip

. Expect them to lower the wall to attract more bids.

7

8

122

#FireCharts

shows

#Bitcoin

liquidity is pretty thin in between walls which sets up for some weekend volatility. We never trust new large walls to hold, however, the $26M in bid support that just appeared may be weekend plunge protection.

Enjoy your weekend!

9

9

122