Lyron

@lyronctk

Followers

6K

Following

10K

Media

74

Statuses

2K

founder @SeismicSys // it's a baaad day to be a server rookie years @stanford @google

New York, NY

Joined August 2021

> Crypto is for payments and defi.> Crypto is for making markets. Accurate when we were small. Now similar vibe to “internet is for communication”. Crypto's already delivered a handful of differentiated user experiences. Many more to come WOOO

29

56

446

Stablecoin deal of a lifetime.

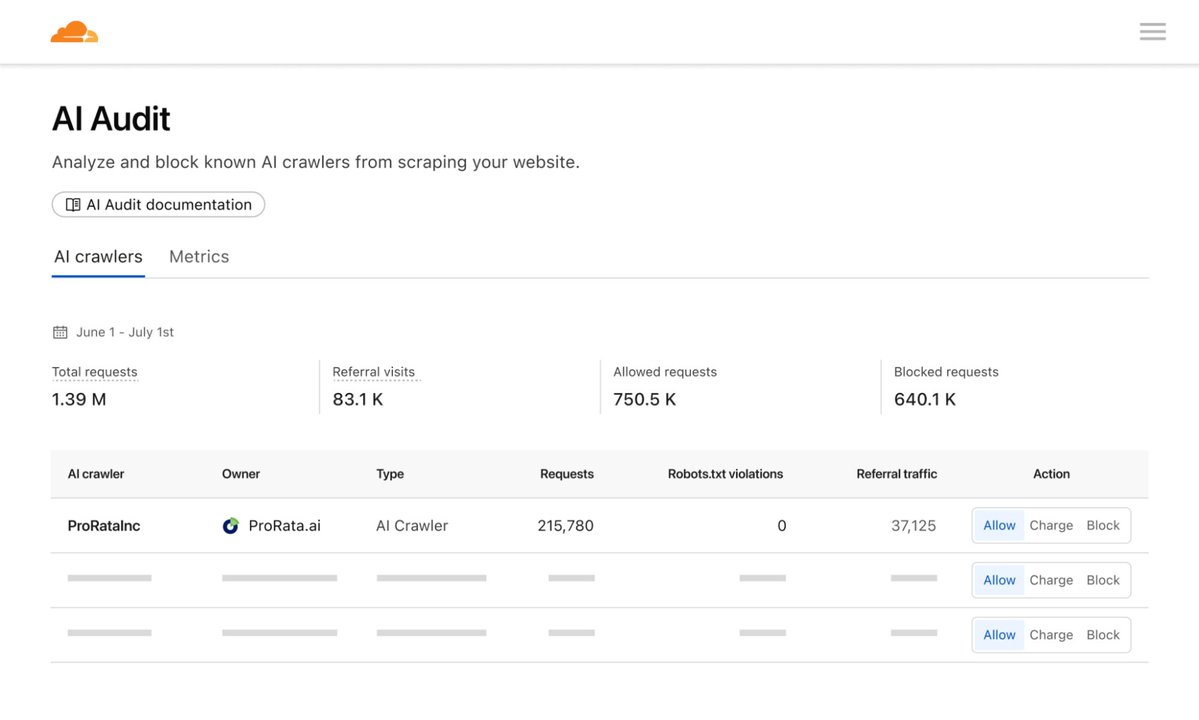

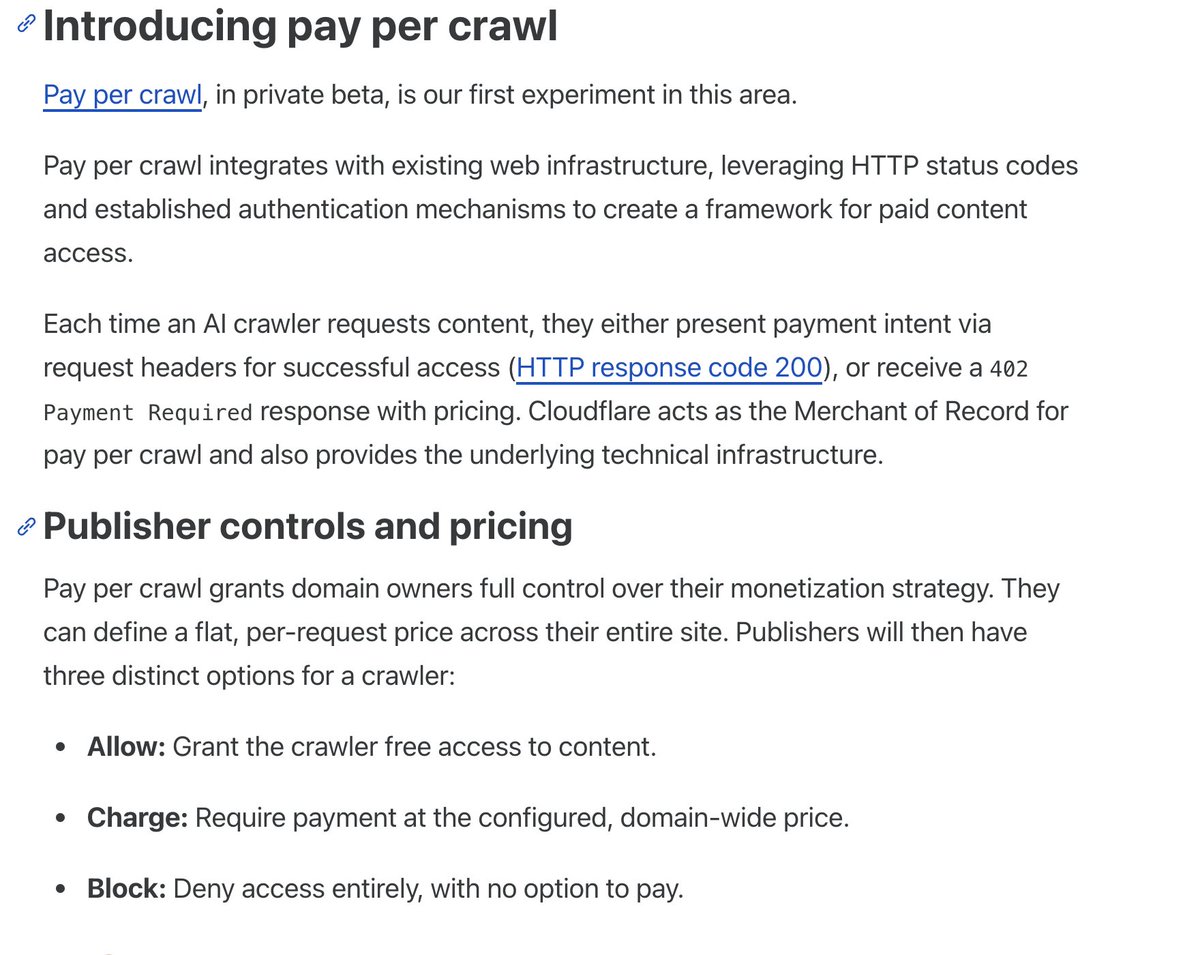

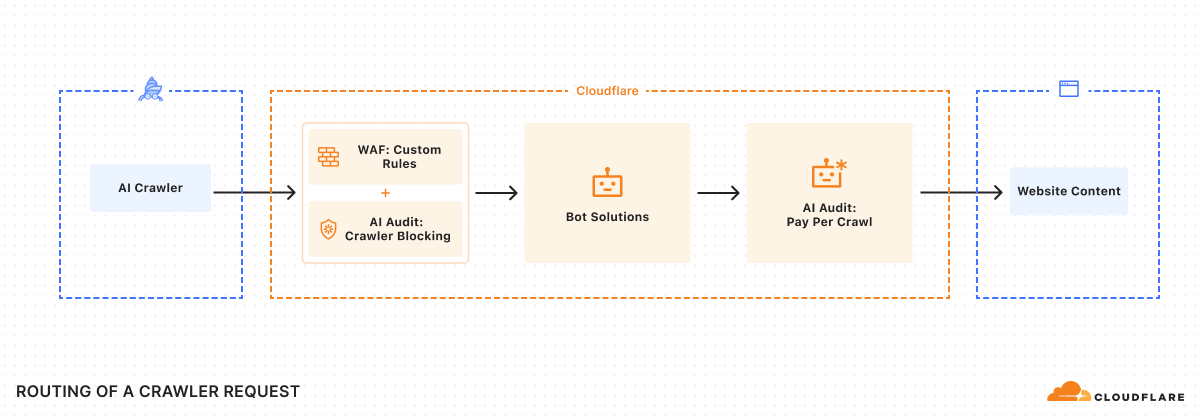

cloudflare just broke the internet's business model. they launched "pay per crawl" websites can now charge ai crawlers for scraping content. instead of "block all bots" or "let them steal everything," there's option 3: "pay me.". why this is a BIG DEAL:. every SaaS has valuable

24

13

123

Sneak peak into the next generation of crypto ads.- normal aesthetic, no hyper-stimulation dopamine bomb .- easy value prop, "free phone plan".- zero indication that it's crypto. @helium_mobile cooked

39

27

169

RT @brendanm0407: Thrilled to share that I’ve joined @reflection_ai! We’re building superintelligent autonomous systems by co-designing res….

0

9

0

RT @storysylee: <Story’s Chapter 2: AI-Native Infrastructure for the $70T IP Economy>. Today, we’re sharing what’s next for Story. We call….

0

20

0

Yeah a chain's moat is not with users or liquidity, but it's not in product or interop either. Moat is 100% at the social layer. Does building on your chain let new devs talk to big. - founders in similar verticals?.- off-chain providers (e.g. ramps)?.- VCs that like the chain?.

Phantom launching Hyperliquid perps is a huge blow to Solana's perceived moat as a pool of users and liquidity. The reality is L1s are b2b products and their moat will be being the best product for developers and amassing an ecosystem of apps and GDP that requires secure interop.

43

37

170

The unique thing about @alliancedao's founder community: the really successful people actually help you out. In most cases, really successful people can't make time to help me (random schmuck), which is super fair. But Alliance founders always do & it's game changing.

70

43

242

New batch of startups for undercollateralized lending (eg @3janexyz). Many are skeptical because Maple and Goldfinch didn’t work. What could make a difference this time?. a) First party underwriting. The company itself assesses creditworthiness of borrowers. b) Good credit.

42

37

184

The distributed workforce ideal is still a major psyops in crypto. We 10x'd in productivity when we went fully remote -> fully in person. As far as I can tell, the #1 reason is that sending someone a message on Slack feels bad but tapping them on the shoulder feels good.

74

39

213

No word on compliance from @PlasmaFDN yet, but they're in a prime spot to create the gold standard framework here. It's the #1 open question for stablecoins right now. Since their long-term advantage comes from reducing the cost of fraud / compliance / chargebacks

96

59

236