Fernando Leibovici

@LeiboviciF

Followers

3K

Following

6K

Media

162

Statuses

2K

Economist at @stlouisfed @STLFedResearch | International trade and macro | Economics PhD from @nyuniversity | Views my own, not those of the Fed | 🇺🇸🇦🇷🇨🇦

St Louis, MO

Joined July 2017

Trade and the Risk of Trade Disruptions 🌍📦 International trade expands what countries can consume and produce — but also heightens exposure to shocks that interrupt access to world markets. New paper with Tasso Adamopoulos: How these risks reshape sourcing, production, and

3

8

16

Takeaway: Trade policy is not only about prices or market power, it is also about managing exposure in an uncertain global environment. 🌐

1

0

0

✦ Quantitatively: • Trade risk reduces openness and shifts production toward domestic agriculture • Food security deteriorates when access is disrupted • Optimal tariffs and subsidies are higher for food importers • Productivity improvements reduce exposure and lower the

1

0

0

📈 Our framework shows why: • When access to staples is risky, protection comes from a need for resilience, not from standard terms-of-trade motives • Exposure risk makes low-productivity domestic production more attractive than standard models imply

1

0

0

📊 We document: • Higher food insecurity among countries more reliant on imported staples • Systematically higher agricultural protection among food importers — even where productivity is low

1

0

0

We study the importance of these channels in the context of food, where dependence on imports makes disruptions especially consequential. For availability, prices, and food security — a concern that drives sustained attention from global organizations and policy institutions. 🍚

1

0

0

Disruption risk also reshapes policy. When goods may not arrive in bad states, governments have incentives to insure against those shocks — not because of standard terms-of-trade motives, but because of resilience. In our framework, this leads to higher optimal tariffs and

1

0

0

We build a multi-country model where firms choose suppliers before trade costs are realized. If imports may fail to arrive in bad states, relying on them becomes riskier — and resilience becomes central to sourcing decisions. 🧭

1

0

0

Trade and the Risk of Trade Disruptions 🌍📦 International trade expands what countries can consume and produce — but also heightens exposure to shocks that interrupt access to world markets. New paper with Tasso Adamopoulos: How these risks reshape sourcing, production, and

3

8

16

📣 Thoroughly revised version of my paper on "Tariffs and Monetary Policy". https://t.co/ri5GUZO4fc 👇

1

12

87

China's role in innovation is shifting, from factory to exporter of advanced tech & IP. I talk with @stlouisfed Open Vault about strategy, patenting, and the balance between openness and resilience. Stay open, fix weak spots.

stlouisfed.org

China has focused on innovation and is moving from being a low-cost producer to a high-tech producer and exporter. An economist explains the trajectory.

2

3

8

A nice visualization illustrating our estimates of who bore the cost of tariffs on European wines along the supply chain. Thanks to the staff at @BeckerFriedman for the great design.

0

12

36

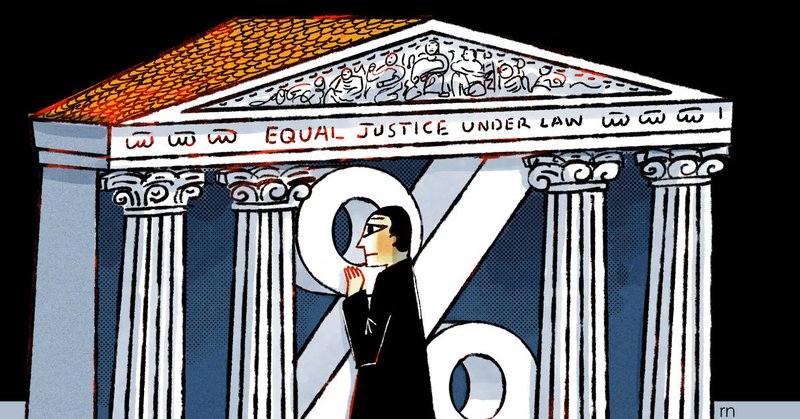

Today’s Supreme Court arguments about the legality of the tariffs did not go well for the Trump administration.

53

34

427

Some thoughts on the tariff case before the Supreme Court, with my @PIIE colleague Alan Wolff

wsj.com

The case against his use of IEEPA is powerful. The justices shouldn’t defer to presidential power.

1

15

31

Trade JMCs: Each year, I compile a list of international-trade job-market papers. To make sure you're on my list (& save me some work), please reply with your info in the following format: Firstname Surname (School) - JMP title - homepageURL [Spatial JMCs: reply to other tweet]

18

35

92

Spatial JMCs: Each year, I compile a list of spatial-economics job-market papers. To make sure you're on my list (& save me some work), please reply with your info in the following format: Firstname Surname (School) - JMP title - homepageURL [Trade JMCs: reply to other tweet]

27

26

83

Smoot-Hawley mattered, but the dramatic jump in protection was amplified by the structure of the tariff system and the collapse in prices — not legislative escalation alone.

1

0

0

The figure above from Irwin (1996), which I post again herer, shows how effective protection jumped far more than statutory rates alone would suggest.

1

0

0