Robert Koschig

@KoschigRobert

Followers

1K

Following

904

Media

125

Statuses

608

If you are into DePIN, @BreakingDePIN next week is the place to be. If you need more details- @hotspotty is the place to go. See you all next Tuesday !

🎙 New Podcast Episode! We just dropped an episode with @BallandiesMC diving into the @BreakingDePIN Unconference happening in Zurich this Sept 16–17! This isn’t your average DePIN event! It’s where AI meets DePIN, with industry, researchers, and builders all in one room.

0

0

0

Consequently, CXT buybacks moon as well:

.@Covalent_HQ paid API calls have doubled. From ~2M/day on average this summer → ~4M/day now. Free tier usage stayed flat over the same period. Goes to show that demand for paid on-chain data is rising again.

0

0

2

The ticker is @safe

6

7

26

gud read on DePIN x DeFi, or how they put it: "@USDai_Official attempting to create the AI petrodollar"

2

0

3

Tradfi calls this "efficiency gains", c/t calls this "ETH lost the plot": ETH volume (#txs) and avg. $-Price similar to 2021 this year so far, whilst $-fees down ~95%:

2

1

5

If Hype trading fees are blockchain rev (per this chart), is BNB on top w buybacks of ~$1B BNB quarterly? What about unichain/uniswap? Let's leave blockchain fees as what people pay for txs. July L1/L2 fees: ~$200M (based of 120 of 450+ L1/Ls). HyperEVM: ~0.15M (see @Blockworks_)

1

0

5

And just as we speak, @okx burns another 65M OKB. Not sure where they bought it back (circulating supply was 60M since last buyback), but now you know: total will be 21M - the remaining 279M is on their burn address. Price? +130%.

Buybacks are everywhere: @pumpdopefun, @HyperliquidX ...who is leading? CEXs top the list: ~$ 5.9B YTD, more than all DEX fees combined! Unbelievable, or? Let's break down @binance, @okx, @kucoincom, @Gate_io, @bitgetglobal, @MEXC_Official, @WhiteBit, @bitfinex, @HuobiGlobal 👇

0

0

2

For more, @BIS_org has a great paper on CEX buybacks and valuations - the conclusion is well worth a read:

0

0

1

Binance aside, @HyperliquidX tops DeFi buybacks and is beating all other CEX tokens (OKX too many question marks). @JupiterExchange, @pumpdopefun & @aave also rival top CEX buybacks.

1

0

2

Next in line: Gate burned ~$ 125M of GT , pledged to be 15% of net profit Whitebit: $ 91M WBT, 1/3 of trading- and 5% of other fees Huobi: $41M HTX, 50% of revenues MEXC: $15.6M MX, 40% of profit Bitfinex: $ 12.6M LEO, 27% of revenue Kucoin: $ 2.1M of KCS, 10% of profit

1

0

1

OKX and Binance make up >90% of the CEX buy-backs. #3: Bitget: $~270M BGB burned YTD (~ 5% supply), reportedly tied to GetGas fees, though the formula isn't public

1

0

0

OKX isn’t the market leader, but tops buybacks: $3.3B in OKB removed this year, pledged as 30% of spot fees. Based on volume, that implies >1% fees. Price action (last buyback >40% of supply w/o any move) + non-zero burn address raises some questions.

1

0

0

Binance burned $2B in 2025 so far. Once tied to 20% of profits, this amount is now set by Autoburn (depends on BNB stats). With est. $17.5B in revenue for all '25, Binance is on track to burn >20% of revenue. More:

coinlaw.io

Binance User Statistics 2025: Growth, Market Share, and Global Reach

1

0

0

Buybacks are everywhere: @pumpdopefun, @HyperliquidX ...who is leading? CEXs top the list: ~$ 5.9B YTD, more than all DEX fees combined! Unbelievable, or? Let's break down @binance, @okx, @kucoincom, @Gate_io, @bitgetglobal, @MEXC_Official, @WhiteBit, @bitfinex, @HuobiGlobal 👇

1

0

2

It's even more like 70%+ if you consider all related fees (see https://t.co/1x9mdJ84mT)...but then you also see stats including HYPE's trading income into blockchain fees, so idk what 'total blockchain fees paid' actually means these days

40% of all blockchain fees are paid to send USDt 🤯 That's across 9 chains: ETH, Tron, TON, Solana, BSC, Avalanche, Arbitrum, Polygon & Optimism. Hundreds of millions of people in emerging markets use Tether's digital dollar USDt daily, to protect their families from local

0

0

1

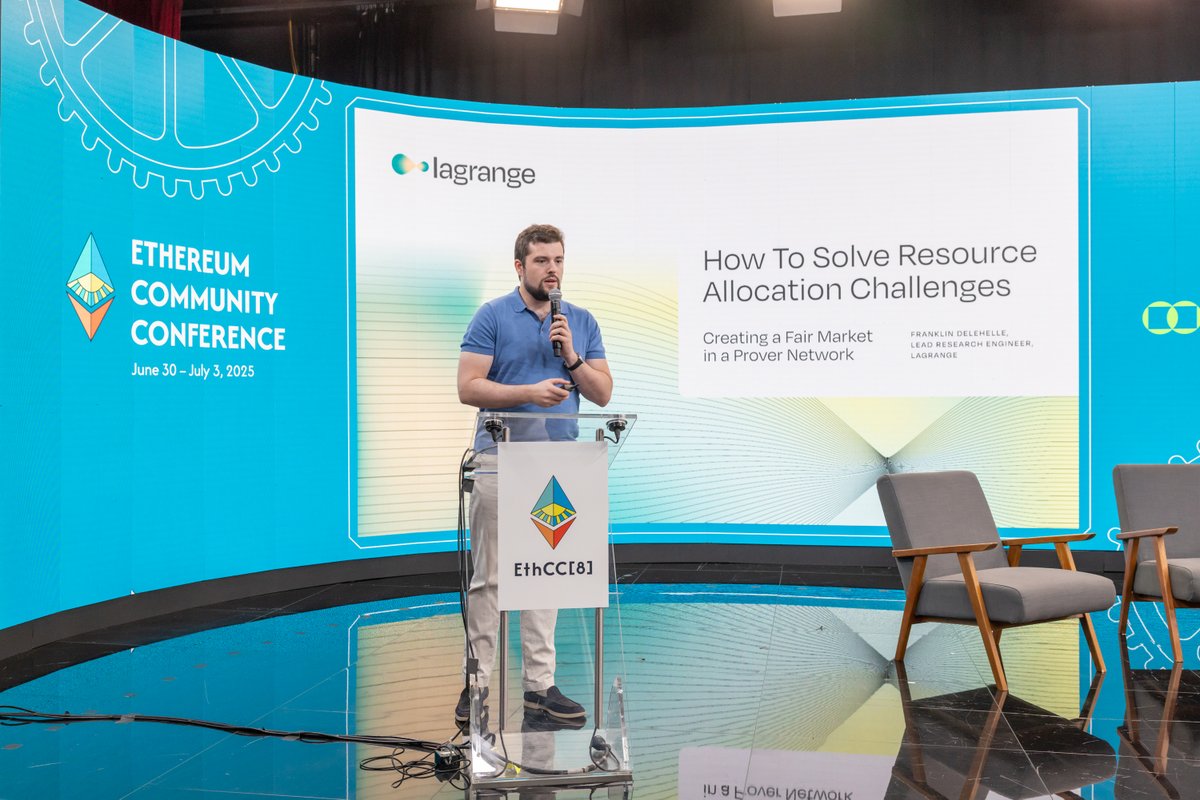

Another great summary. If your protocol needs to match compute supply and demand and the jobs are all or nothing, check out this approach!

🧠 Token Engineering @ EthCC Series [2/12] Today’s talk: “Scaling Ethereum by Optimizing ZK Prover Networks” by Franklin Delehelle from @lagrangedev. This is part of our series covering key talks from the Token Engineering Track at @EthCC 2025. #TEatEthCC2025 ⚙️ The Challenge:

0

1

6

Impressive numbers by @ICN_Protocol in @MessariCrypto's latest report: 1k+ enterprise customers 7M ARR up to 80% more efficient vs. AWS and co https://t.co/J2gX3m7qmc

messari.io

With over 1,000 customers and $7 million in ARR, ICN is demonstrating early traction as a decentralized backend for storage-intensive applications beyond Web3 use cases.

2

0

2