Keyrock 🔑🪨

@KeyrockTrading

Followers

11K

Following

2K

Media

651

Statuses

2K

Keyrock is a global crypto investment firm offering industry-leading solutions in Market making, OTC, and Options for digital assets.

Joined August 2017

Stablecoin Payments, The Trillion Dollar Opportunity. Read how Stablecoins could drive $1T in payments. Written with @Bitso and expert insights from @Circle @Ripple @Sphere_Labs @OndoFinance @FDLabsHQ @BVNKFinance @ConduitPay @gnosispay @MANSA_FI.

keyrock.com

From legacy payment systems to the stablecoin infrastructure transforming the global payments stack.

17

89

336

We'll attend @rwasummit by @centrifuge. And we may have a big announcement to share… 👀. September 16 - 17.Stay tuned.

1

2

33

Read the full update:

keyrock.com

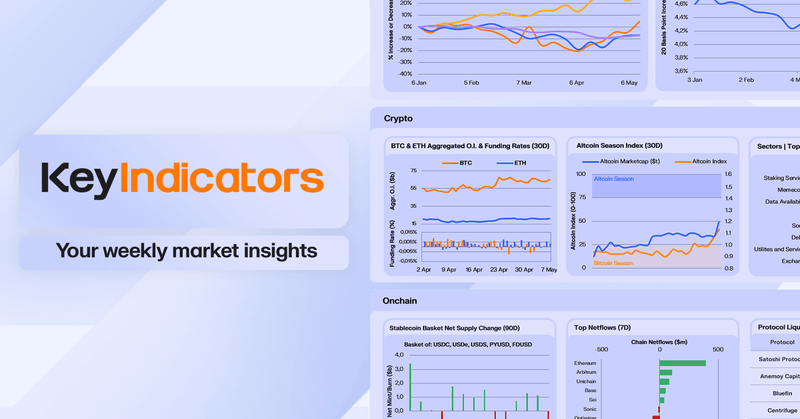

Every Monday, we deliver a concise yet comprehensive briefing to help you navigate the week ahead.

0

0

0

RWAs shone, with sector AUM up 6% WoW, powered by @centrifuge 206% surge following a $1b Grove allocation into its AAA CLO fund. RWAs are becoming DeFi’s growth engine. If institutional allocations keep pace, they could overtake yield platforms as DeFi’s core driver into Q4.

1

0

0

Stablecoin rates fell as inflows outpaced demand this week. USDC APY was down 11.3% WoW amid $1.26b @aave deposits. WETH yields slipped 6.5%, even as supply contracted, underscoring muted ETH borrow appetite.

1

0

0

Join our Telegram Channel for Weekly Market Insights. 📊.

t.me

Every Monday, Keyrock researchers provide a weekly roundup covering macro trends, crypto developments, and on-chain events from the previous week, along with forward-looking analysis and trade ideas....

1

0

0

RT @KeyrockTrading: Keyrock Offsite, Athens - 2025 🇬🇷. 180+ people, 1 week in Athens. More than an offsite: it was laughter, ideas, late-ni….

0

1

0

We're growing fast, and hiring. From senior roles to fresh talent, ambitious minds have the chance to shape the future of digital assets with us. Explore open positions 👇.

keyrock.com

Our team consists of more than 30 nationalities speaking multiple languages and embracing a decentralised mindset.

1

0

1

Our latest livestream was packed with insights, with Stablecoin Payments at the center of the discussion. Missed it? The recording is now available. With Arnold Lee (@Sphere_Labs), @reidbenj (@Bitso), @JuliaMorrongiel (@BVNKFinance) & our @stefwynendaele.

0

1

3

Read the full update:

keyrock.com

Every Monday, we deliver a concise yet comprehensive briefing to help you navigate the week ahead.

0

0

1

Crypto OI surged to ATHs of ~$218b, reflecting a wave of renewed market participation. While @binance still dominates, @Bybit_Official and @bitgetglobal now hold significant share. ETH and alts now account for 55% of OI, with ETH alone at 34%, showing clear rotation from BTC.

1

0

1