Jeremy

@JeremyWS

Followers

7K

Following

4K

Media

3K

Statuses

20K

EM Macro … FX/Rates/Vol/Credit

London

Joined April 2009

After a 7yr hiatus…. I’ve finally gotten around to writing some thoughts on the markets whilst travelling about this week…. Focused mainly on $ Rates/FX and some glaring disconnects. 2024 looks likes it’s going to be a super interesting year. GL.

9

11

91

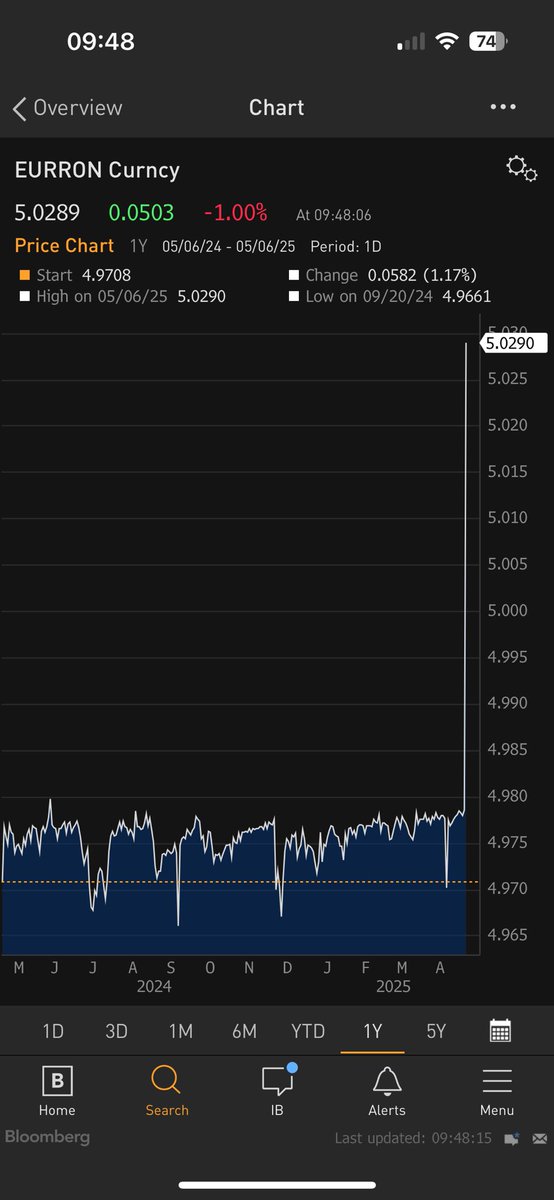

The NBR has sold ~7bn EUR in the past few days (more than 10% of their reserves) trying to slow this EURRON. Much like w Turkey, liquidity is being drained fast and implieds are starting to spike aggressively. 1m to 15% and 1y to 10% still seem achievable. Chart 1month Implieds.

EMFX really popping off these days… now it’s Romanias turns. EURRON breaking through the long held 5.00 level and marching higher fast. Fast money and macro all over this pushing. let’s see the response.

2

2

29

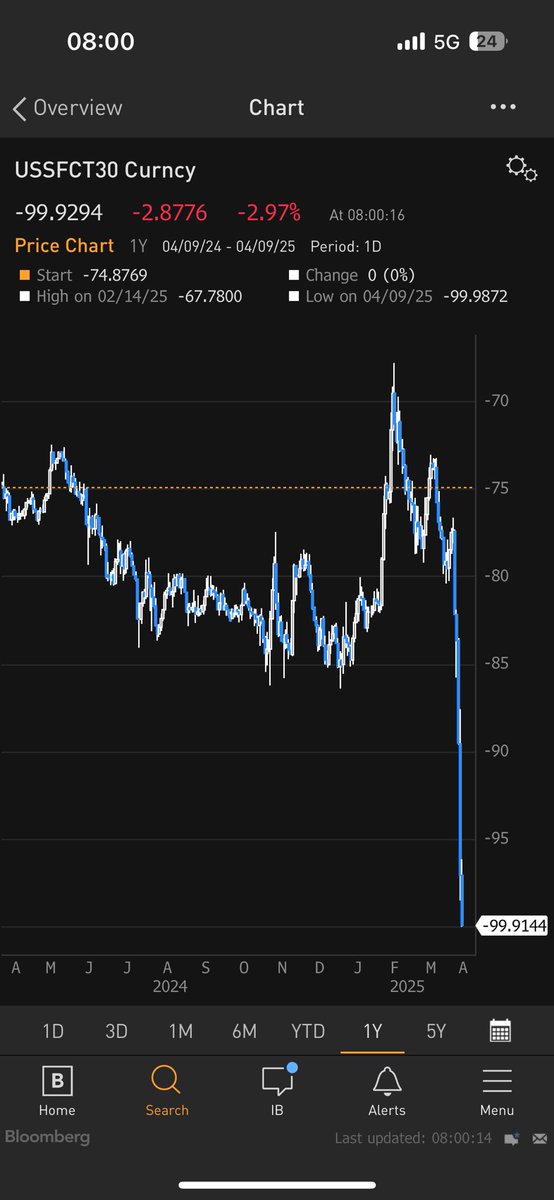

Think drift the fix slowly as a soft retaliation this week , up to around 7.25, by end of week. they then hoping it pressures markets enough to bring sense to trump but idk about that… reprice to 7.75 seems inevitable eventually.

0

0

1

With USDTRY spot market functionally frozen, the only tool to chase/hedge is CDS. trading up at 325 now (post roll). A game of hot potato tho, as not that clean… fx fwds pushing higher again… TKY once again seems trapped with no good options to choose from

USDTRY remembering Erdogan does stupid things when he feels strong… carry:vol metrics have pulled so many into this trade

2

1

20