Oana Labes

@IAmOanaLabes

Followers

20K

Following

104

Media

987

Statuses

10K

Strategic Finance Coaching, Financial Planning & Business Intelligence | Join 400,000+ reading on socials and newsletter | MBA | CPA | Entrepreneur

Financiario.Com

Joined January 2023

And cash flow is the proof behind the story. If this helped you:.1. Follow @IAmOanaLabes for sharp strategic finance insights.2. Join 55K+ execs reading my free newsletter: https:3. Repost to share this insight.

the-finance-gem.beehiiv.com

Get my strategic finance gems and viral infographics delivered every other Saturday morning. Join 400,000+ readers across Linkedin, X and email.

0

0

0

If this helped you:.1. Follow @IAmOanaLabes for sharp strategic finance insights.2. Join 55K+ execs reading my free newsletter: https:3. Repost to share this insight.

the-finance-gem.beehiiv.com

Get my strategic finance gems and viral infographics delivered every other Saturday morning. Join 400,000+ readers across Linkedin, X and email.

0

0

0

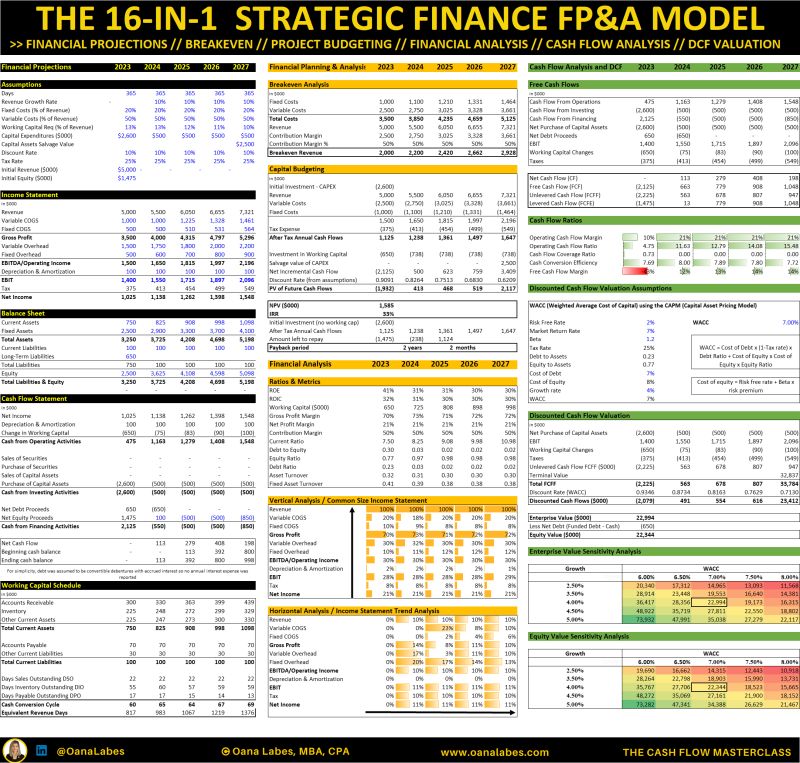

If this helped you:.1. Follow @IAmOanaLabes for sharp strategic finance insights.2. Join 55K+ execs reading my free newsletter: https:3. Repost to share this insight.

the-finance-gem.beehiiv.com

Get my strategic finance gems and viral infographics delivered every other Saturday morning. Join 400,000+ readers across Linkedin, X and email.

0

0

0

If this helped you:.1. Follow @IAmOanaLabes for sharp strategic finance insights.2. Join 55K+ execs reading my free newsletter: https:3. Repost to share this insight.

the-finance-gem.beehiiv.com

Get my strategic finance gems and viral infographics delivered every other Saturday morning. Join 400,000+ readers across Linkedin, X and email.

0

0

0