Granite - Never sell your bitcoin

@GraniteBTC

Followers

6K

Following

845

Media

187

Statuses

1K

The safest way to borrow against your Bitcoin. No rehypothecation, soft liquidations, offline position tracking. NEVER SELL 🪨

Join early access →

Joined October 2023

Our users tell us this is the best DeFi loop on @Stacks. Would you agree? 🔂. 1. Deposit sBTC on Granite.2. Take out an aeUSDC loan for <1% APY.3. Add to @Bitflow_Finance's STX / aeUSDC pool for >24% APY.

2

3

21

RT @hodlstxbtc: Granite(@GraniteBTC) aeUSDC Market Summary! (As of 2025.8.14) 📈. TVL: $25M 🚀. Total Collateral: $14M (sBTC @ $123,538). Sup….

0

2

0

The institutions are coming 👀. Founding contributor @blaize_w joined @NuggetsNewsAU to talk about why Granite's non-rehypothecation + soft liquidations are a game-changer for large borrowers 🐳

0

0

5

Should variable interest rates concern you?. CeFi likes to create FUD when it comes to variable interest rates. As @blaize_w explains, DeFI gives you far better rates on average 🪨

1

2

7

Granite was built from the ground up to be the safest way to borrow against your #bitcoin. 🪨 No rehypothecation.🪨 Proactive account health notifications.🪨 Soft liquidations to minimize losses.

3

3

20

With LP incentives now paid in $STX, this opens up a number of opportunities for more advanced DeFi strategies 👇.

Did ya hear? @GraniteBTC upped rewards to 24%+ APY for lending aeUSDC! Rewards paid in STX. Yield ideas:.🔸liq stake STX rewards in @StackingDao for 8-10%.🔸supply stSTX/btc collateral on @ZestProtocol .🔸borrow aeUSDC on Zest (~3%).🔸lend aeUSDC on Granite.🔸loop 🔁. Profit 💰

2

2

19

Whether you are Earning or Borrowing, there's never been a better time to get started on Granite:

granite.world

Deposit Bitcoin and borrow stablecoins safely and easily.

0

1

10

With this update, Earn rates have jumped up from 15.91% last week to 24.61% this week! 📈. It pays to be early to Granite, and we have a big announcement coming soon that will prove it. Get started:

granite.world

Deposit Bitcoin and borrow stablecoins safely and easily.

0

1

9

That's all for now!. We have a BIG announcement coming soon, so keep following @GraniteBTC so you don't miss it 👀. (Hint: 🫵 ).

1

0

5

5. @GrimaldoRemade comes at us with another technical deep dive on Account Health, which is arguably one of the most important metrics to track as a borrower!.

𝗪𝗵𝗮𝘁 𝗬𝗼𝘂𝗿 𝗔𝗰𝗰𝗼𝘂𝗻𝘁 𝗛𝗲𝗮𝗹𝘁𝗵 𝗦𝗰𝗼𝗿𝗲 𝗥𝗲𝗮𝗹𝗹𝘆 𝗠𝗲𝗮𝗻𝘀. Using @GraniteBTC to borrow against your $BTC? .Then you’ve seen that Health Score, but what does it actually mean?. Let’s break it down. 9/9🧵👇

1

0

5

4. For many protocols, liquidations can be a sore subject, but Granite's soft liquidations are changing the game. @Frizling's deep dive on liquidations gave solid explanations and solid examples, making the entire process much less scary!.

Who said liquidations had to suck?. What if I told you there’s a way to earn discounted Bitcoin and help secure a lending protocol at the same time?. That’s exactly what @GraniteBTC just made possible . 🪨. 🧵 👇

1

0

5

3. @CyborgMyster doesn't just provide a deep dive on our growing TVL, they also lay out some compelling strategies to maximize your APYs by using a combination of StackingDAO + Granite + Hermetica, and more!.

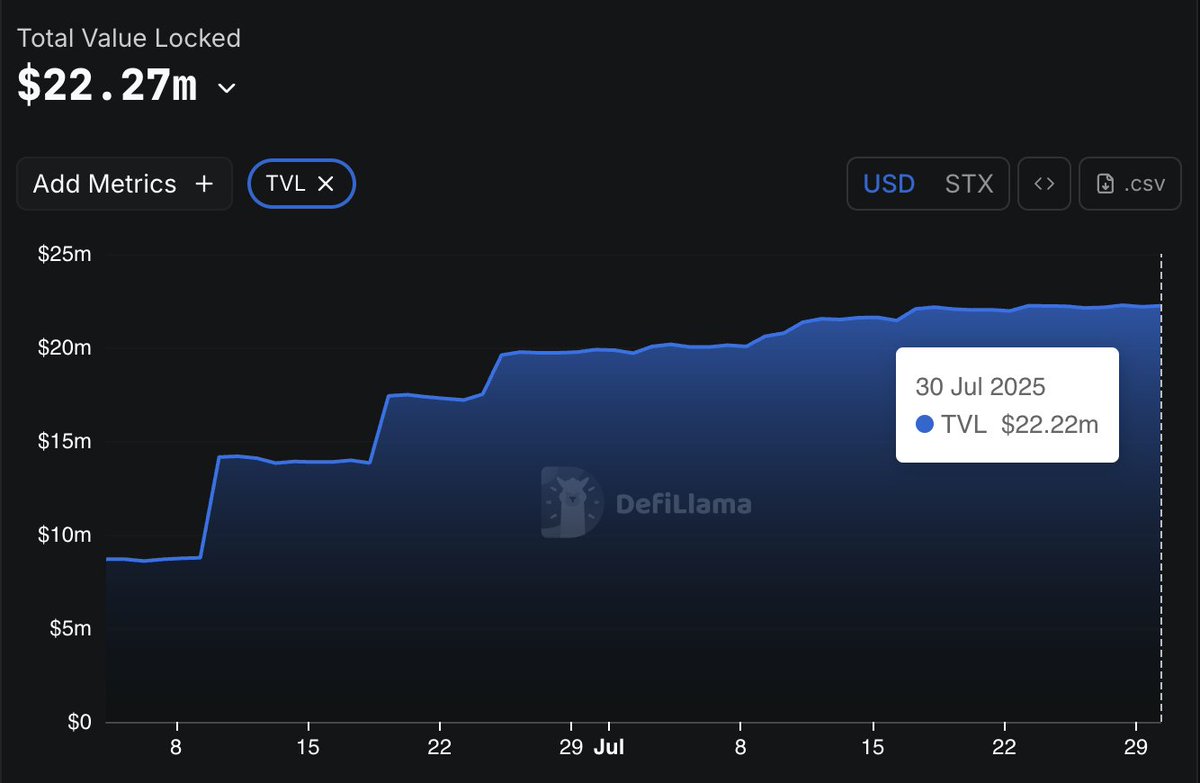

Want your BTC to WORK for you? @GraniteBTC on @Stacks is your ticket to safe, high-yield DeFi 🚀. TVL jumped up 185% from $8M to $23M since June. Granite is now the #3 largest protocol in Stacks! 📈. Let’s unpack why Granite’s blowing up & how YOU can stack yields 🧵 1/

1

0

4