GoldSeek.com

@GoldSeekcom

Followers

30K

Following

1K

Media

2K

Statuses

31K

Since 1995, providing gold investors with the most updated gold and silver prices, news & precious metals information and financial truth! #Gold

Joined August 2011

More Downside For Gold And Silver? By Kelsey Williams As far as gold and silver are concerned, their price increases have outrun the fundamentals for now. That does not mean they cannot go higher at this point. They could. https://t.co/kOUZm6bGte

goldseek.com

As far as gold and silver are concerned, their price increases have outrun the fundamentals for now.

0

0

0

Prevaricating Powell Makes the Blunder of the Century By David Haggith Powell downplays AI bubble fears, saying today’s tech firms differ from dot-coms because they earn profits. He’s repeating history as Bill Gates warns AI hype echoes 1999. https://t.co/neXUnSrfCe

goldseek.com

So, as the roaring twenties of the new millennium sweep by us, perhaps it would be good to take note of Gates’s comments on this same nonsense.

0

0

0

Zions Bank Is A Typical Picture Of An Unhealthy Bank Being Propped Up By Avi Gilburt The commentators were opining on fundamentals, so we took a quick look at Zions. Our review suggests their claims are far from reality. https://t.co/3BqXMNiuUT

goldseek.com

We usually don’t comment on share-price moves...the commentators were opining on fundamentals, so we took a quick look at Zions. Our review suggests their claims are far from reality.

1

0

0

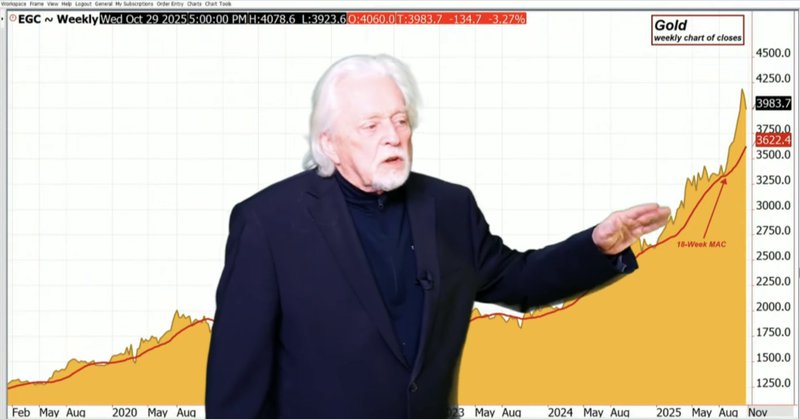

More Hints at What’s Coming in 2026 - Spot Price Analysis By Craig Hemke The gold price will now consolidate its gains again, possibly through year-end and into early 2026. https://t.co/7e05CeGJ0m

goldseek.com

The gold price will now consolidate its gains again, possibly through year-end and into early 2026.

0

0

0

Is there serious support where it counts for gold-linked Treasury bonds? You be the judge. This clip is from yesterday’s Kudlow show.

35

94

415

5min to load a dishwasher or 0.5s to for autonomous global transactions? MvX is built for agentic payments. Instant, secure, and scalable. https://t.co/T4NtYFlhUe

20

85

307

USD Rallies as FED Chair Questions Dec Rate Cut By Ira Epstein Ira Epstein discusses the Federal Reserve's decision to cut interest rates by 25 basis points and the market's reaction to this move. https://t.co/FtJ8dgnycL

goldseek.com

Ira Epstein discusses the Federal Reserve's decision to cut interest rates by 25 basis points and the market's reaction to this move.

0

0

5

The Rubio Doctrine: Neocons Are Back! By Dr. Ron Paul The “global war on terror” has been rebranded the “hemispheric war on narco-terror,” and the US military-industrial complex is rubbing its hands in anticipation of a windfall. https://t.co/pxVWSBFA67

goldseek.com

The “global war on terror” has been rebranded the “hemispheric war on narco-terror,” and the US military-industrial complex is rubbing its hands in anticipation of a windfall.

0

2

2

Why Exactly Is the Federal Reserve Cutting Rates? By Mike Maharrey The central bank is expected to cut interest rates another quarter percent and could announce a timetable to end balance sheet reduction. https://t.co/9XJRh8DF7g

goldseek.com

The central bank is expected to cut interest rates another quarter percent and could announce a timetable to end balance sheet reduction.

0

0

1

Bullion Dealer: This Is Why There Are Shortages By David Russell In October, extreme volatility returned to the precious metals markets. Despite the turbulence, both metals remain among 2025’s top-performing assets. https://t.co/zLihZ0UteQ

goldseek.com

In October, extreme volatility returned to the precious metals markets. Despite the turbulence, both metals remain among 2025’s top-performing assets.

1

1

2

Gold Bulls Take a Beating But Are They Down and Out? By Mike Maharrey If you believe gold still has long-term support, you should view these selloffs as buying opportunities. https://t.co/u0CWd5WYBZ

goldseek.com

If you believe gold still has long-term support, you should view these selloffs as buying opportunities.

1

0

4

The Awesomeness Of Gold By Stewart Thomson Dips in the price will occur, but gold will continue to reign supreme as the greatest asset of them all! https://t.co/IDQgCukNVd

goldseek.com

Dips in the price will occur, but gold will continue to reign supreme as the greatest asset of them all!

0

0

5

Indian Gold Demand Robust in September Despite High Prices By Mike Maharrey According to WGC, the festival season started on a “positive note” with anecdotal evidence indicating healthy demand for both physical investment products and jewelry. https://t.co/ysqysz7vk7

goldseek.com

According to the World Gold Council, the festival season started on a “positive note” with anecdotal evidence indicating healthy demand for both physical investment products and jewelry.

0

0

3

Axel Merk: Gold’s Surge, Dollar’s Blind Spot By MoneyMetals Maharrey interviews Axel Merk, covering the metals selloff, the recent silver squeeze, thin market liquidity, stress in private credit and why the U.S. Dollar Index can mislead investors. https://t.co/KaWapMicdd

goldseek.com

Maharrey interviews Axel Merk, covering the metals selloff, the recent silver squeeze, thin market liquidity, stress in private credit and why the U.S. Dollar Index can mislead investors.

0

0

2

Tariffs, Inch by Inch By David Haggith Being unable to get foreign suppliers to pay much of the cost by compensating with price reductions on their end, the tariffs have amounted to a massive new corporate tax. https://t.co/sBbn7UM6dK

goldseek.com

Being unable to get foreign suppliers to pay much of the cost by compensating with price reductions on their end, the tariffs have amounted to a massive new corporate tax.

0

0

2

September CPI: Better Than Expected Doesn't Mean Good By Mike Maharrey When you look at the CPI in graphical form, it’s clear that inflation has been bouncing in the same range since around mid-2022. https://t.co/pYNZOoK956

goldseek.com

When you look at the CPI in graphical form, it’s clear that inflation has been bouncing in the same range since around mid-2022.

0

0

2

Ira Epstein: Metals: Fed Begins 2 Day Meeting Presidents Xi and Trump, expressing hope for progress beyond past tensions. Additionally, he analyzes the technical patterns in the gold market, indicating a shift to a corrective phase... https://t.co/ARyDtMIvWO

goldseek.com

Ira Epstein discusses the recent movements in the metals market, highlighting a significant drop in gold from $4,400 to the $4,000 range and a decline in silver from $52 to $47 per ounce.

0

0

3

Gold SWOT: South African Gold Stocks Are on Track for the Best Year in Two Decades By Frank Holmes Gold’s ferocious rally has measures like relative strength indicating that prices have passed well into overbought territory. https://t.co/7WolSouzs6

goldseek.com

Gold’s ferocious rally has measures like relative strength indicating that prices have passed well into overbought territory.

0

0

2

Indian Silver Disruption Lasting Far Longer Than Initial Reports By Chris Marcus Last spring, at the height of tariff uncertainty, gold and silver rallied as bonds sold off. Gold and silver seem to be the last safe havens standing. https://t.co/MEMNdIaUE3

goldseek.com

Last spring, at the height of tariff uncertainty, gold and silver rallied as bonds sold off. Gold and silver seem to be the last safe havens standing.

0

0

2

The Deeper Dive: Inflation Has Become a Hidden Menace By David Haggith Sure enough, while the inflation rate did creep up a notch, it did not go up as much as expected by economists, who were largely predicting tariffs would increase inflation. https://t.co/4I4b5UEmST

goldseek.com

Sure enough, while the inflation rate did creep up a notch, it did not go up as much as expected by economists, who were largely predicting tariffs would increase inflation.

0

0

1

Technical Scoop: Whacked Haven, Expected Inflation By David Chapman After a nine-week winning streak, gold could be excused for finally taking a break. The drop was overdue, as we had noted the prolonged period of gold being overbought. https://t.co/AMJEwPJyJv

goldseek.com

After a nine-week winning streak, gold could be excused for finally taking a break. The drop was overdue, as we had noted the prolonged period of gold being overbought.

0

0

2