Geoff Wilson

@GeoffWilsonWAM

Followers

7K

Following

11K

Media

1K

Statuses

6K

Geoff Wilson is the founder of Wilson Asset Management @WilsonAssetMgmt @FutureGenInvest

Sydney, Australia

Joined March 2024

THANK YOU ALL for stopping the crazy tax on UNREALISED GAINS.

164

179

2K

Congratulations to everyone who fought this insane @ausgov proposal. Every Australian particularly Queenslanders have dodged a bullet. https://t.co/tQgwiYjRKj

** IMPORTANT ** Don’t Approve the release of Genetically Modified Mosquitoes. My urgent letter to the Australian Government @healthgovau The potential risks to your health and the wider community are significant!! After reading, what are your thoughts ? Please send your own

1

0

6

D1 Powerhouses Trust INMOTION Air! Minnesota • Indiana • USF • NDSU • WSU • Missouri • UND • Purdue • Iowa • Georgetown • Dartmouth • Illinois • Northwestern • Nebraska • Idaho State Batting Cages, and Turtle Backstops powered by AIR Website: inmotionair

0

0

23

Sanity has prevailed. THANK YOU to everyone who supported the fight against the illogical and flawed proposed tax on unrealised gains

197

212

2K

Taxing unrealised gains was always an illogical and flawed policy. Congratulations @mcranston1 for your tireless work on educating us all. You must will a @walkleys

Unrealised capital gains tax in super is now dead! https://t.co/gRr16g97Pw via @australian

5

4

145

Doctor @JEChalmers takes his medicine after belated backdown - the illogical policy of taxing unrealised gains is dead. https://t.co/83Eh69f4io via @australian

29

4

168

Is sanity prevailing on stopping the crazy tax on unrealised gains? Admissions now by Treasury that alternatives are being considered for the Taxation of Unrealised Gains ... This week the Senate Estimates was held. As reported by the @IttimaniL from @GuardianAus “it is good

7

2

51

The @WilsonAssetMgmt investment team is heading to Newcastle, the Gold Coast, Toowoomba and Noosa this October. They will share their market outlook, stock ideas and the themes driving portfolio decisions. You will also hear how the @FutureGenInvest companies are supporting young

1

0

6

Taxing unrealised gains must be stopped!

“Many in the Treasury, and possibly Chalmers himself, want to eventually extend the unrealised gains tax to assets outside super. That is made much easier by the way it has been structured so that individuals rather than funds pay the tax.” — Robert Gottliebsen, The Australian

6

13

66

I’ve signed. Stop the insanity of taxing unrealised gains!

APPROVED: Petition on the House of Representatives ✅Petition Request "We therefore ask the House to reject any current or future proposal to tax unrealised capital gains." See the terms, and please sign & share if you agree: https://t.co/g5tEp0vJax

4

19

132

Sign this petition to stop the insanity of taxing unrealised gains

6

9

55

Onto it. Stop this insanity of taxing unrealised gains. Sign this petition

Australia wants to Steal Money you have not even made. The Taxing of Unrealised Gains is THEFT If this is not stomped out now, they will come for your home and everything else they can think of given enough time. Please sign the petition. @GeoffWilsonWAM mate can you get this

3

22

104

Will sanity prevail? We have been trying to guide them since this flawed and illogical policy was introduced in 2023. Don’t tax aspiration by taxing unrealised gains and failing to index. What do you think?

11

12

102

What started as a campaign became a calling. @EricTrump shares this story of what Mike Huckabee said. Watch the full interview.

0

24

67

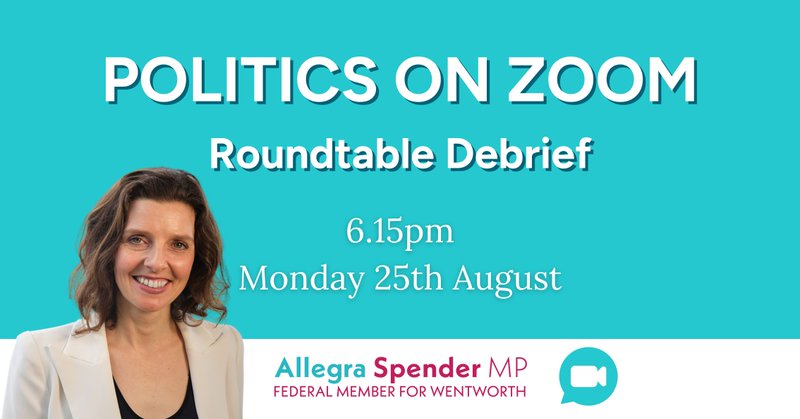

I’m looking forward to @spenderallegra answering this question “All Roundtable attendees were provided with @WilsonAssetMgmt detailed research outlining the significant negative consequences the tax on unrealised gains will have on Australia’s productivity. Did the Roundtable

allegraspender.com.au

The Wentworth community has an Independent representative in Federal Parliament who stands for the issues Wentworth cares about.

8

15

103

The @ausgov started by taxing a gain that may never occur. This must be stopped!

We warned you Labor’s roundtable was a front to raise taxes and here they go. In the last 3 years, Labor’s spending spree has added $100b to the national debt, due to hit $1t this year. Chalmers is planning 11 deficits in a row. Now he’s coming after your savings to pay for it.

12

46

257

Taxing unrealised gains must be stopped. It’s insanity!

Albo, Jim — $1 trillion in debt, $45k per Aussie, and your fix is raiding our super? With just 34.6% of the vote, you’ve got zero mandate. Tax offshore profits. Get real value for our resources. Stop treating our nest eggs like your piggy bank. #auspol #supertax #division296

21

64

344

Taxing unrealised gains needs to be stopped also!

11

39

279

Over a 24h period this week, Deck's infra peaked at near 6,000 parallel browser sessions, and made ~$30M in agentic payments. Seeing agents sustain this load of valuable actions is encouraging for what's coming in 2026 💯

11

39

177

WAM Capital’s $WAM investment portfolio continues its strong performance outperforming both indexes in FY2025. This performance allowed the Board to maintain the current full year dividend. https://t.co/FqRG7FK5ZV

5

0

13