Galvanize

@GalvanizeLLC

Followers

1K

Following

37

Media

65

Statuses

189

A pure-play, global asset manager focused on delivering compelling returns through deep specialization in energy and the business of decarbonization.

San Francisco, NYC, London

Joined August 2021

Decarbonization, manufacturing + defense tech rely on rare earths. China controls 90%+. Our Global Equities team backs @MPMaterials—the only scaled US producer—working to show that rare earths can be cleaner, cheaper, and domestically scaled. @BBC

0

1

1

Our Real Estate team built custom tools to assess solar potential, electrification impact & utility benchmarks—treating decarbonization like ROI. That’s what sets Galvanize Real Estate apart. . #RealEstate #Decarbonization #EnergyTransition

0

0

0

India is set to 3x its power demand by 2050 and it’s choosing clean energy over coal. @RockyMtnInst shows solar + storage are now cheaper than fossil fuels, but India gets just 4% of global clean energy investment. That’s a gap – and an opportunity.

0

0

0

Our Co-Executive Chair @JohnKerry delivered the keynote for @BBGIntelligence, talking about markets, geopolitics and the race to lead in clean energy. Watch his full remarks here:

0

0

0

Markets may feel uncertain—but that’s exactly when opportunity emerges. Our Co-Executive Chair @TomSteyer recently shared how we’re leaning into #RealEstate with a countercyclical strategy focused on long-term value and #decarbonization. Learn more:

0

0

0

Low-carbon ≠ high cost. Our portfolio company @ForanMining is proving that carbon-neutral copper can compete at the bottom of the cost curve. Seth Kirkham spoke with Dan Myerson about why demand is rising in the US & EU. #Mining #Decarbonization #Copper #EnergyTransition

0

0

0

The 21st century economy runs on electrification—and electrification requires copper. China’s grid alone uses 20% of global copper. As AI and electrification increase, we’ll need clean, resilient supply chains to keep up. @ForanMining is building them.

0

1

3

Today’s investors want more than quarterly updates—they want a strategic partner. At @Galvanize, we bring insights, open dialogue, and collaboration. Read more from Mark Miness:

1

1

0

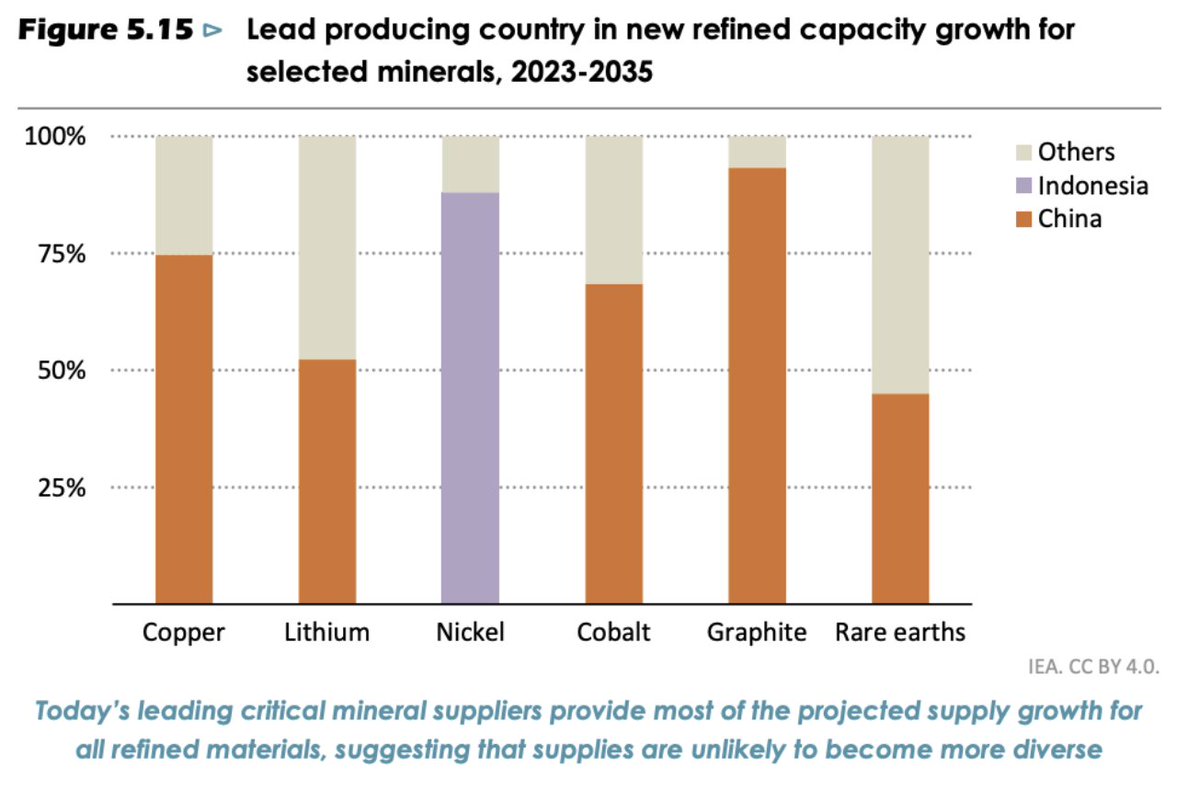

The #EnergyTransition runs on critical minerals & supply chains are too concentrated. By 2035, 90% of key minerals could come from a few producers. That’s a geopolitical & economic risk. We're investing in companies like @MPMaterials & @ForanMining.@IEA

0

2

7

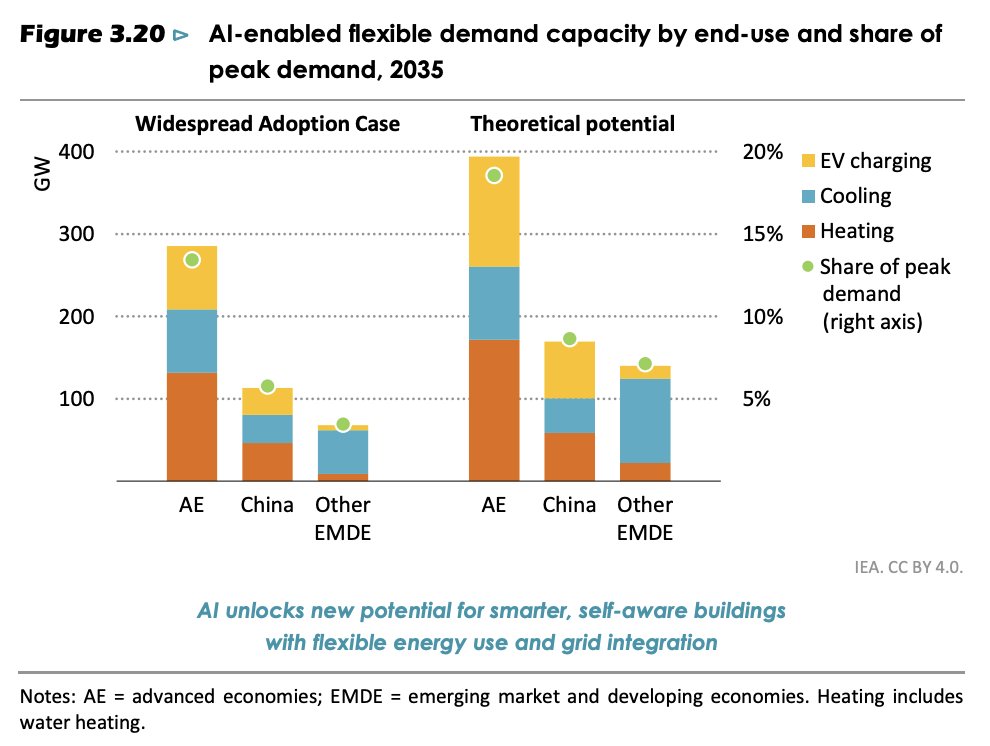

Electricity demand from AI will surge, but AI also has the power to reduce energy use and emissions across nearly every sector. We see this convergence of the AI revolution and energy transition as an investment opportunity. @IEA

0

1

2

In the global marketplace, technology wins. Our Co-Executive Chair, @TomSteyer, joined Georgia Levenson Keohane on the Capital for Good podcast to talk about how cheaper, faster, and better technologies are driving the energy transition. Listen here:

0

1

3

Our CSO David Livingston and Co-Chair @JohnKerry discussed what’s driving the energy transition: not politics, economics. Cheaper, faster and more efficient technology, global momentum, and leadership from emerging economics are accelerating it:

0

1

1