Gab

@GabGrowth

Followers

19K

Following

11K

Media

1K

Statuses

11K

I write about asymmetric investments that go unnoticed. Strong opinions, loosely held.

Deep Dives & Portfolio →

Joined August 2018

Just published my $DLO Q3 Earnings Review I cover: - Financials & Product Development - Concerns about Net Take Rates - Management Commentary, and more Link below and in bio!

3

3

45

$DLO Yet another partnership, this time with $CRCL

We’re connecting global businesses with local payment networks across 40+ emerging markets and through our integration with @Circle Payments Network (CPN), enabling real-time, low-cost conversions between digital and local currencies. ➡️ https://t.co/HpjxXbx7c1

#Stablecoins

2

4

88

$NET's turn to show to the world how important it is after $CRWD and $AMZN

2

0

28

E-commerce businesses choose different mixes of 1P v 3P because each model solves a different strategic problem. 1P-dominant: $CPNG $JD $WMT Prioritise high NPS, reliable delivery, consistent pricing and fast scale in logistics-heavy markets. Lower gross margins but higher

@CCM_Brett Yes, but it is because of the way they book revenue. $CPNG is very 1P-heavy so they book nearly the full value of each transaction while $MELI is predominantly 3P, which books only take rate/commission. GMV would be a much more appropriate comparison.

1

0

6

Article Link: https://t.co/ZQS8aLkj5i As mentioned previously, this is a paywalled piece reserved for paid subs who have been graciously supporting my content. 🙏 I will be posting a free summary piece in the coming week for non-paid subs.

gabgrowth.com

Breaking down the structural shifts and what they mean for SEA equities

0

0

3

Just published my latest piece: Takeaways from the definitive SEA report: Breaking down the structural shifts and what they mean for SEA equities. (In particular, $SE and $GRAB)

5

1

25

$SE 2024 marked an inflection point. Analysts have been under-estimating the business for nearly 2 years now, and continue to.

3

0

48

Article Link:

@GabGrowth Report in below link for those who want to read. https://t.co/pKNMgrcSyB

2

0

8

Again, the craziest part about these posts is not how dumb this guy is, but that ~3,000 people have liked the post. Stupidity is not a scarce resource on this app.

I just got off the craziest call I’ve ever had. I can’t share names or details because I don’t want to compromise anyone. But the short summary is that I have been advised confidentially that a massive, possibly multi-trillion dollar, liquidity injection is coming within 75 days.

8

0

51

$SE is no stranger to drawdowns. It has seen 6 drawdowns larger than 25% in the past 7 years. Volatility is a feature of high returns.

2

0

41

Btw, will be posting a 2 part article on Substack covering the report. It won’t be a rehashing of the report, but instead focused on generating practical insights esp for $SE $GRAB investors. These pieces take a lot of time, data extraction and modelling, so will likely be

1

0

36

Just read through the 81-page report by Temasek, Google and Bain on SEA's digital economy. My conviction in $SE and $GRAB has never been greater.

10

6

149

The irony in multi-baggers is the ones you expect to 10x rarely ever do so. Instead, the most likely investments to 10x are the ones you only underwrite to a 2-3x.

2

1

40

If you liked your stocks last week, you should love it now that it’s down 30%

2

3

36

I make the case here: https://t.co/FgjxH49cpT

gabgrowth.com

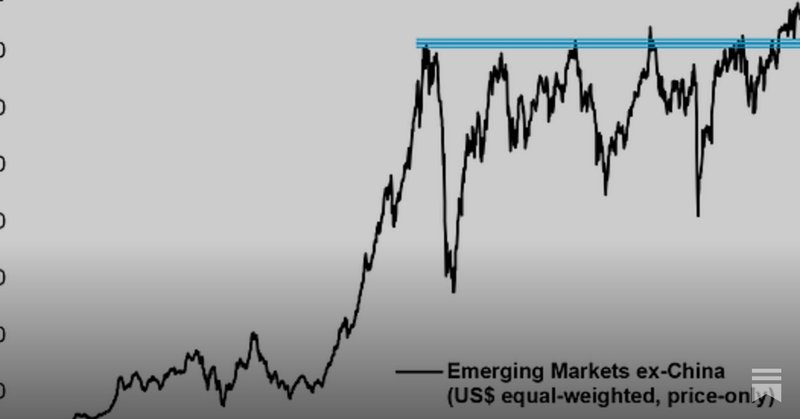

Why the Next Decade of Growth Belongs to Emerging Markets

0

0

4

Emerging Markets remain my favourite sector to be invested for the next decade. Valuations are compelling relative to developed markets and there are multiple tailwinds that cannot be halted. 1. Young and expanding labour force 2. Rapid rise of the middle class 3. Digital

8

6

50

AI is set to add nearly a TRILLION to Southeast Asia’s economy by 2030. Bet on the biggest beneficiaries $SE $GRAB

3

9

73