Flux Finance

@FluxDeFi

Followers

51,875

Following

1

Media

68

Statuses

416

Decentralized lending meets tokenized securities.

Joined January 2023

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Ali Koç

• 309455 Tweets

#JUNmeowDAY

• 133179 Tweets

#냥이_차오른단건_준휘_생일이란뜻이야

• 132472 Tweets

#INDvsPAK

• 128009 Tweets

junhui

• 103146 Tweets

नरेंद्र दामोदरदास मोदी

• 81878 Tweets

Rohit

• 75174 Tweets

Kohli

• 69782 Tweets

Prime Minister of India

• 60417 Tweets

Alcaraz

• 54675 Tweets

Zverev

• 47242 Tweets

Jammu

• 44858 Tweets

アイナナ記念日

• 43468 Tweets

連続テレビ小説

• 38889 Tweets

Pant

• 33600 Tweets

श्री नरेंद्र मोदी

• 30257 Tweets

केंद्रीय मंत्री

• 28377 Tweets

Tuchel

• 21089 Tweets

Kazanan Fenerbahçe

• 19491 Tweets

Campus mode

• 15594 Tweets

BELOVED BELLE DAY

• 12860 Tweets

伊黒さん

• 12584 Tweets

राज्य मंत्री

• 12497 Tweets

Xbox Games Showcase

• 10361 Tweets

Last Seen Profiles

1/ Exciting news!

@reserveprotocol

has enabled Flux Finance’s $fUSDC and $fDAI to be used as collateral for its RTokens.

Blog:

4

51

164

The world's first fractional stablecoin meets DeFi lending with real world assets... 🔥

$FRAX is now live at:

@fraxfinance

2

36

94

Thanks to

@CoinbaseWallet

for listing Flux Finance as one of the top dapps in the 'earn' category of their mobile app! 🥇

Lending and borrowing stablecoins against tokenized US Treasuries is now easier than ever with Coinbase Wallet.

7

31

81

Great to see the increasing demand and impressive growth of an RToken currently backed with over 27% of Flux Finance's fTokens 📈

2

22

56

Flux Finance's US Treasuries backed stablecoin yield is coming to

@CurveFinance

, with the first fToken pool consisting of $fDAI & $fUSDC.

We welcome feedback on the proposal that would make this pool eligible for $CRV rewards. The vote is happening soon.

2

18

65

Watch

@coingecko

🦎 explain how Flux allows

@OndoFinance

's $OUSG holders to unlock liquidity in the form of stablecoins that can be used for leverage, or deployed elsewhere.

▶️

8

13

54

Lend stablecoins at Flux over-collateralized by tokenized US Treasuries from

@OndoFinance

, and earn Ondo Points! 🚀

0

14

51

Flux Finance's $fUSDC is among the first two assets in

@pendle_fi

's new real world asset based offerings!

Pendle provides a suite of tools to hedge and manage fUSDC's US Treasury-backed yields.

📰

4

15

51

USDC loans against tokenized US treasuries via Flux make up 13.5% of the collateral basket of

@HighYieldUSD

's $hyUSD, made possible by

@reserveprotocol

🧩

Noticed something?

@HighYieldUSD

's (hyUSD) collateral is brand new ✨

For the first time,

@MakerDAO

and

@MorphoLabs

joins

@FluxDeFi

to power hyUSD, a flatcoin designed to beat inflation in over 100 countries

This yield comes from the DAI Savings Rate and Morpho's Aave USDT

5

19

83

1

15

54

We look forward to hosting

@mattimost

(Head of

@reserveprotocol

) for an AMA in the Ondo DAO Discord, where you can ask and learn about the asset-backed currency revolution! 💡

📅 Monday April 10

🕛 1pm PST / 8pm UTC

📍 Ondo DAO Discord -

0

19

52

What is Flux Finance? 👀

Flux Finance is a decentralized lending protocol originally built by the

@OndoFinance

team.

The protocol is a fork of Compound V2 with additional functionality to support both permissionless (e.g. $USDC) and permissioned (e.g. $OUSG) tokens.

3

6

53

Many thanks to

@ThorHartvigsen

for sharing insight into

@pendle_fi

's recent integration with Flux, and why sustainable US Treasury-backed yield makes him so excited!

📺

3

11

41

The Flux Finance weekly snapshot is here! 📸 Stablecoin lenders are currently receiving yields of up to 4.46% APY, collateralized by $OUSG from

@OndoFinance

1

8

44

Proposals to initialize the Flux Finance markets to enable USDC and DAI lending against OUSG collateral (short-term US Treasuries from

@OndoFinance

) are now live for an on-chain vote at the Ondo DAO! You can participate at the following link:

6

35

44

Thanks to

@mattimost

for explaining how Flux Finance enables $OUSG holders to borrow stablecoins while using tokenized US Treasuries as collateral.

Host:

@CurveCap

Full Episode:

0

15

34

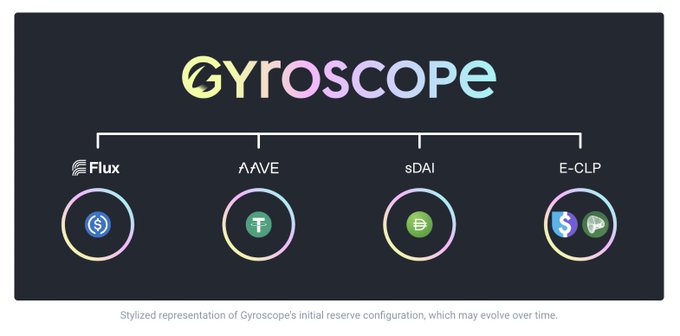

We love the money legos! 👷

Kudos to

@GyroStable

for launching $GYD, backed by $fUSDC (and ultimately $OUSG).

Congrats to

@GyroStable

on the launch of a $GYD, new decentralized stablecoin backed partly by $OUSG tokenized US Treasuries through

@FluxDeFi

21

19

105

4

8

39

Thanks to

@BanklessHQ

for highlighting Flux Finance's TVL and how $fUSDC (the receipt token representing USDC loans against tokenized US treasuries) has been composed in DeFi protocols such as

@pendle_fi

🧩

📰

3

10

33

PhoenixLabs & Steakhouse (from the

@MakerDAO

Strategic Finance Core Unit) have proposed a plan to iterate on Maker's current T-Bill strategy which would include lending $DAI against $OUSG at Flux Finance.

We stand ready to assist the Maker community in their exploration of Flux.

Cannot wait for the RFP to be posted. All the tokenized tbill crowd should be excited to see

@MakerDAO

about to open up a competitive process to onboard tokenized tbills. Huge shoutout to

@SteakhouseFi

for spearheading this process. Long-standing need

1

1

21

3

8

33

Thanks to

@tzedonn

for explaining how Flux Finance compliments

@OndoFinance

, by enabling permissionless stablecoin lending collateralized by $OUSG.

Host:

@benjamindean

Full Episode:

0

11

29

🌱 Introducing a new source of Sustainable Yield for $OUSD! 🌱

The

@OriginDeFi

community has unanimously endorsed the addition of a Flux strategy for $OUSD

Origin is now set to initiate stablecoin loans against $OUSG, a form of tokenized US Treasuries from

@OndoFinance

📈🤝

OGV Stakers, it's time to make your voice heard! 🗳

New Proposal: Add the

@FluxDeFi

fToken strategy for $OUSD

The Flux strategy would act as a proxy for earning yield on treasury bonds, as stablecoin liquidity on the protocol can be used to purchase OUSG, the protocol's

1

6

19

0

15

34

📺

@Dynamo_Patrick

explains how Flux Finance, a Compound V2 fork, honors the transfer restrictions of permissioned tokens such as $OUSG from

@OndoFinance

Credit:

2

10

30

On this day, five months ago, Flux Finance went live! 🎉

Join us in celebrating five months of accessible & permissionless yield through stablecoin loans against $OUSG, a form of tokenized US Treasuries from

@OndoFinance

3

7

31

💡 Flux is unique. Did you know...

1. The only collateral accepted is $OUSG, a tokenized US Treasury from

@OndoFinance

.

2. Stablecoin holders can permissionlessly lend against $OUSG, currently earning 4.45% APY.

3. TVL has climbed to over $64M.

2

5

27

The Flux Finance Weekly Report is here! This week brought more inflows to Flux while rates still remained steady, allowing permissionless stablecoin lenders to continue earning yield collateralized by $OUSG from

@OndoFinance

1

9

26

Another week, another Flux Finance weekly report!

$USDC $USDT $FRAX $DAI stablecoin suppliers continue earning yield lending against safe and stable collateral in the form of $OUSG (Short-Term U.S. Government Bond Fund) from

@OndoFinance

0

4

25

Grateful to

@coingecko

for the thorough exploration of Real World Assets and how the composability of stablecoin loans via Flux "could provide one of the greatest breakthroughs for the RWA space".

📰

📣 Huge thanks to

@CoinGecko

for the insightful deep-dive into Real World Assets and Ondo's market leadership with almost $200M in TVL.

We’re delighted to see such excitement for our on-chain institutional-grade products. Some highlights below 👇

17

44

159

2

5

29

📢 Flux fTokens have been selected among a small number of curated assets to be used as collateral on

@SturdyFinance

V2, with the goal of enabling leveraged yields!

Launch Partner Announcement:

@FluxDeFi

🚨

Flux's fTokens are backed by US Treasuries and will be available to use as collateral from Day 1 on Sturdy V2!

Get ready to enjoy leveraged Treasury yields 👀

Sturdy 🤝 RWA

1

2

23

1

9

26

○ Fiat

○ Stablecoins

○ Stablecoin lending

◉ Stablecoin lending against $OUSG, from

@OndoFinance

1

3

26

@UXDProtocol

🤝

@FluxDeFi

Delighted to see UXD Protocol diversifying into fUSDC with its insurance fund to earn treasuries-backed yield.

UXD Protocol has invested 5m USDC from the insurance fund into

@FluxDeFi

!

Flux Finance is a decentralized lending pool collateralized by $OUSG, US treasury bonds.

The interest earned from the pool will be used to buyback $UXP tokens.

7

12

58

0

10

24

Check out this week's Flux Finance weekly snapshot! 📸

Stablecoin lenders are currently earning Ondo Points from

@OndoFoundation

and receiving yields of up to 4.50% APY, collateralized by $OUSG from

@OndoFinance

1

3

28

3/ Flux Finance's fUSDC and fDAI offer RSR stakers a new source of non-speculative yield backed by safe and stable collateral in the form of Short-Term US Government Bond Fund $OUSG tokens by

@OndoFinance

.

2

3

28

Flux Finance is now available directly from

@MMInstitutional

's Portfolio offering, allowing organizations to easily lend and borrow stablecoins against tokenized US Treasuries within a highly trusted institutionally-compliant version of the world’s leading web3 wallet, MetaMask.

2

7

25

What is Flux Finance? 👀

Flux Finance is a decentralized lending protocol originally built by the

@OndoFinance

team.

The protocol is a fork of Compound V2 with additional functionality to support both permissionless (e.g. $USDC) and permissioned (e.g. $OUSG) tokens.

3

5

28

Check out this week's Flux Finance Friday Snapshot! 📸

Stablecoin lenders are currently earning Ondo Points from

@OndoFoundation

and receiving yields of up to 4.49% APY, collateralized by $OUSG from

@OndoFinance

2

6

27

Thrilled to see $fUSDC unlocking new possibilities for DeFi participants throughout the ecosystem 🔓

4

6

23

How many Ondo Points have you earned by lending your stablecoins on Flux?

Visit the

@OndoFoundation

dashboard to track your Ondo Points and optimize your strategy for even greater rewards!

2

3

22

Our AMA with Reserve Protocol is at 1pm PST / 8pm UTC today! See you all there 🫡

We look forward to hosting

@mattimost

(Head of

@reserveprotocol

) for an AMA in the Ondo DAO Discord, where you can ask and learn about the asset-backed currency revolution! 💡

📅 Monday April 10

🕛 1pm PST / 8pm UTC

📍 Ondo DAO Discord -

0

19

52

3

4

24

The Flux Finance weekly snapshot is here! 📸 Lenders are currently receiving stablecoin yields of up to 4.5% APY, collateralized exclusively by tokenized US Treasuries in the form of $OUSG from

@OndoFinance

2

7

24

As per

@reflexivityres

, Flux Finance, which enables lending against tokenized securities, "represents a significant advancement in decentralized lending protocols."

Overview of

@OndoFinance

: Future of RWAs?

What is Ondo Finance?

The crypto economy has seen remarkable growth, propelled by the evolution and increased integration of stablecoins like Tether (USDT) and Circle’s USD Coin (USDC). These digital currencies, pegged to stable assets

24

43

132

2

6

22

Flux enables lending against tokenized US Treasuries, while Flux fTokens unlock a whole 🌎 of possibilities.

4/ It also allows other projects to build products on top of them (and also get exposure to high yields).

For example, users can borrow against tokenized US treasuries on

@FluxDeFi

or leverage it.

But most importantly it allows us to speculate on interest rates.

2

0

7

1

6

21

An autonomous, decentralized lending protocol supporting stablecoin loans against tokenized US treasuries 👉

Projects in T-Bills:

•

@Circle

Perimeter Protocol

•

@FluxDeFi

- Stablecoins against tokenized US Treasuries.

•

@OndoFinance

- Stablecoins against tokenized US Treasuries and band demand deposit

•

@_Fortunafi

- Solutions for stablecoin issuers and trad. entities

+ more

8/28

1

5

51

1

8

23

The Flux Finance Weekly Report is here!

$USDC supply rates have increased significantly on a week-on-week basis, alongside support for $USDT being added.

These stablecoins continue to be borrowed by investors in US Treasuries through $OUSG (from

@ondofinance

).

1

4

23

3/ Flux is leveling the playing field. Any investor, with any check size, anywhere in the world, can now access yield from US Treasuries. This yield comes in the form of a stablecoin loan against OUSG, a form of tokenized US Treasuries from

@OndoFinance

.

1

2

23

🌟 Attention

@pendle_fi

enthusiasts! 🌟

10

@pendle_fi

questers will be selected by random for a chance to win $100 $PENDLE & $100 $fUSDC

Pendle users have until the 15th of September to conquer the fUSDC quest 🏆

Learn more:

Okay, things are getting real with

@FluxDeFi

👉👈

Real World Assets (RWA) are already a reality on Pendle, but you know what would be really sweet?

Campaign. Quests. Limited edition skins. Prizes.

No, really.

So who's ready for a real adventure ⚔️

11

23

84

2

8

18

8/ Flux was initially developed by the

@OndoFinance

team and is now an autonomous protocol with upgrades governed by $ONDO holders via the Ondo DAO. Flux was initialized and its supported assets and parameters selected in a vote with over 500 $ONDO investors participating.

2

1

21

It’s great to see that the temperature check for

@OriginProtocol

to integrate Flux-fTokens into the list of $OUSD strategies has passed!

0

4

18

The ease of integrating with Flux continues to broaden access to stablecoin loans against tokenized US Treasuries 🔗

Some of you already know it BUT

➡️You can access

@FluxDeFi

in "Treasuries" category on

USD-based asset, indirect exposure to tokenised treasuries bills.

Life is sweet.

1

0

7

0

3

19

The Flux Finance weekly snapshot is here! 📸 Stablecoin lenders are currently receiving yields of up to 5.14% APY, collateralized by $OUSG from

@OndoFinance

1

5

19

Friday's here, and so is your Flux Finance snapshot! 📸

Get in on the action with Ondo Points and yields of 4.44% APY on your $USDC, $USDT, $FRAX, $DAI, backed by $OUSG from

@OndoFinance

.

3

4

20