John Matrix (FlawInTheMatrix)

@FlawInTheMatrix

Followers

24,591

Following

89

Media

2,811

Statuses

14,686

Chasing Pips | Multi-Funded | Daily value

Joined July 2012

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Islam

• 336679 Tweets

#ดวงใจเทวพรหมSportsDay

• 316447 Tweets

#ufc302

• 256880 Tweets

NARS WITH FREENBECKY

• 178827 Tweets

安田記念

• 163149 Tweets

Dustin

• 155716 Tweets

#おうちでNEWS万博

• 114665 Tweets

Strickland

• 109362 Tweets

ロマンチックウォリアー

• 58701 Tweets

ナミュール

• 36406 Tweets

#阪神タイガース

• 31666 Tweets

ソウルラッシュ

• 26534 Tweets

ガイアフォース

• 23181 Tweets

セリフォス

• 19562 Tweets

土砂降り

• 18238 Tweets

ステラヴェローチェ

• 11952 Tweets

Last Seen Profiles

@JoshuaA10007

@I_Am_The_ICT

Trust me

- Hasn't flexed 1 Lamborghini

- Hasn't flexed 1 holiday in bali or dubai or Maldives

- Hasn't flexed a wild lifestyle

Only thing he has flexed is the precision in his techniques and monster traders he producing for free...

Game changer.

27

49

1K

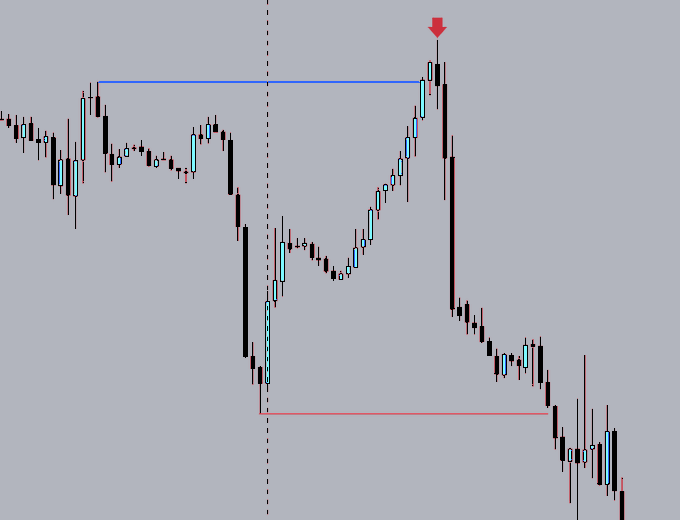

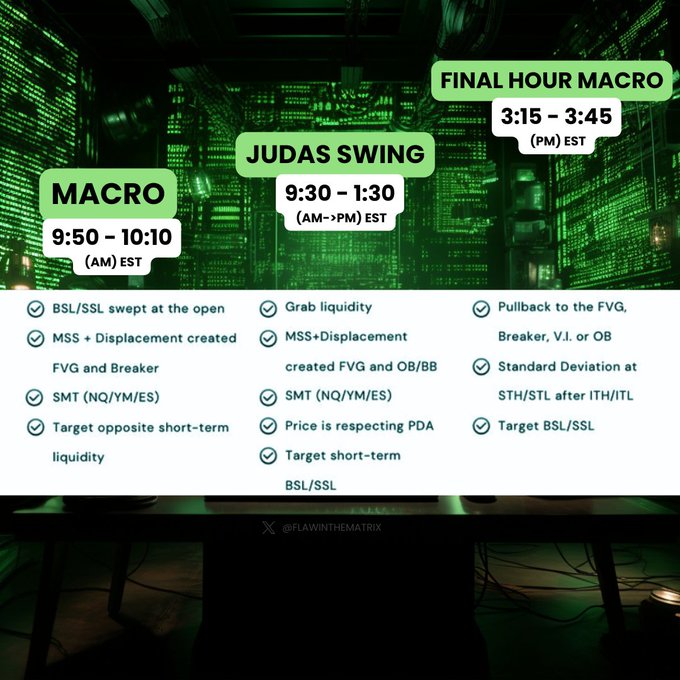

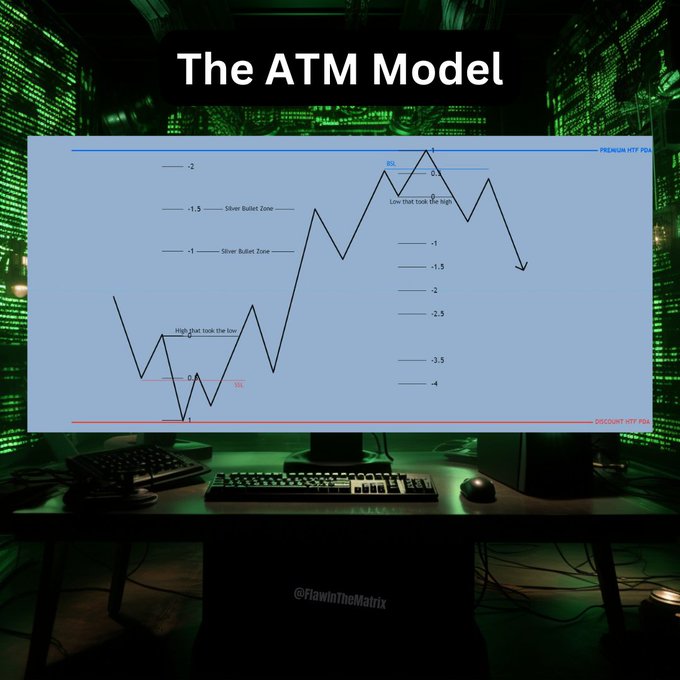

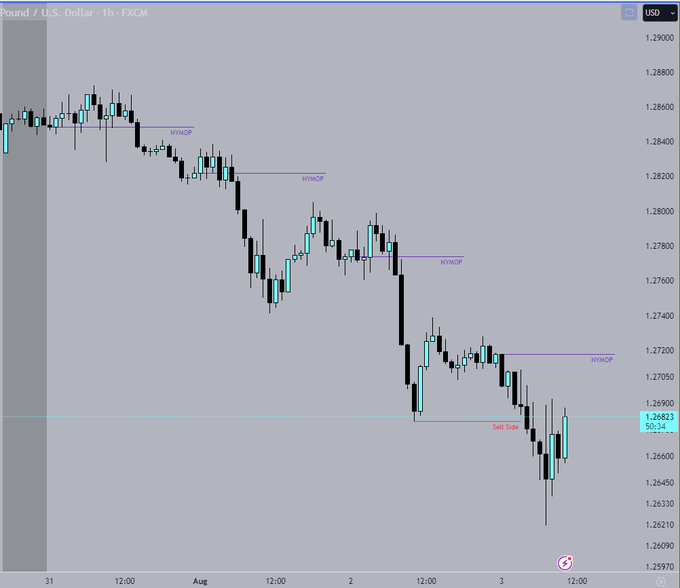

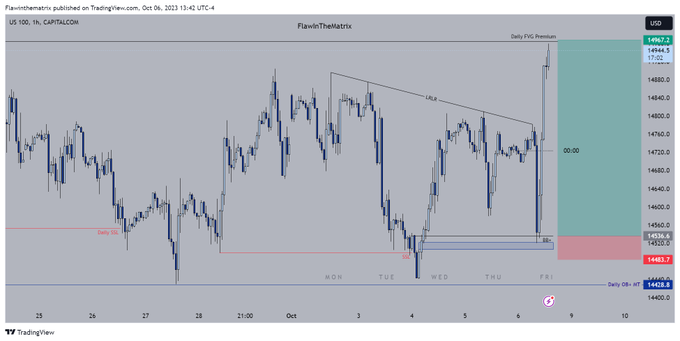

I'm sharing this one last time.

My A++ setup.

- Time of day

- HTF point of interest

- LTF run-on stops

- market structure shift over or under ITH/ITL

Only when these 4 are ticked do I have a trade idea.

Entry techniques.

- FVG

- OB

- BB

#tradingstrategy

56

213

1K

@I_Am_The_ICT

One told me the tweets mean nothing without execution.

I say he shows a video after of execution

They then say its a demo

I say demo and real the same.

They then say pre-recording

It never ends.

So now your a time traveller.

49

18

933

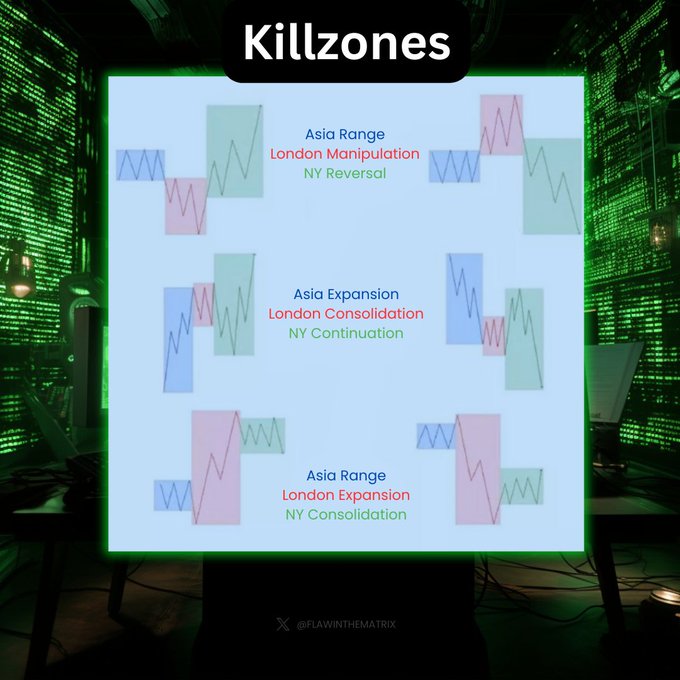

This is probably the most slept on

@I_Am_The_ICT

concept there is 🫠

I'm guilty of sleeping on these but not anymore, I used to use them when I was at peak for my game 📸

Weekly profile templates 💎

🧵🧵

$ES $NQ $YM

$USD $EUR

#TRADINGTIPS

#tradingstrategy

46

182

632

@I_Am_The_ICT

Just an ordinary guy with a humble beginning that mastered the market with precision.

As I said before you never sold us a lifestyle just a promise of precision.

7

14

576

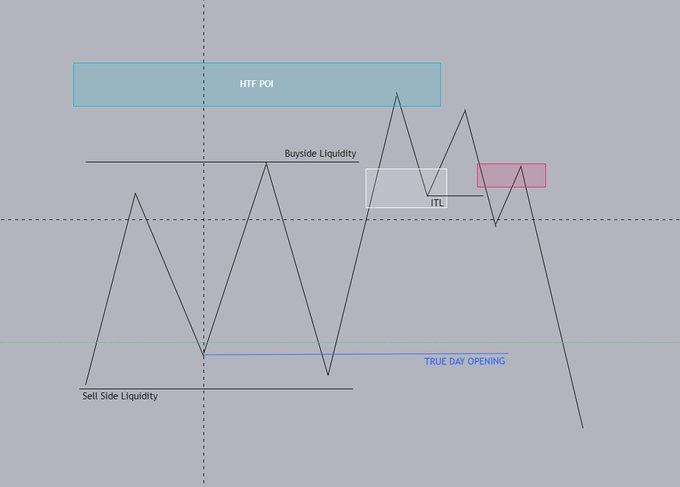

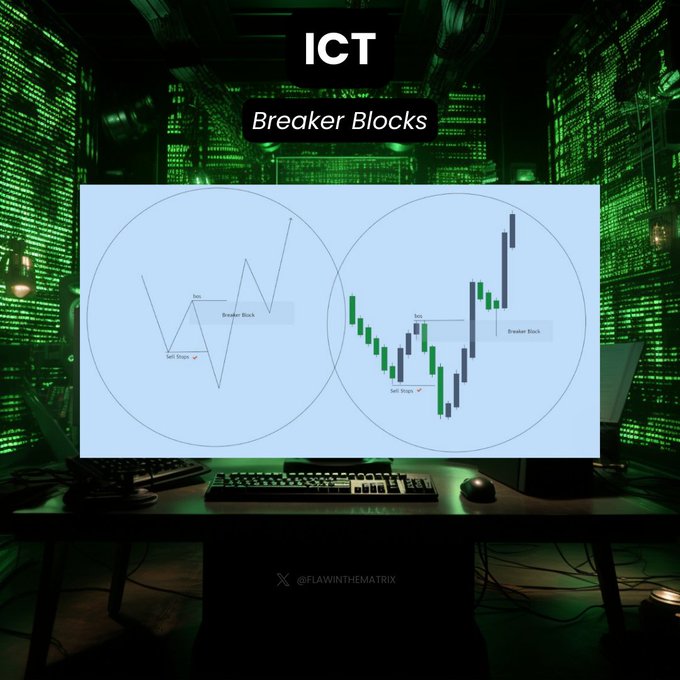

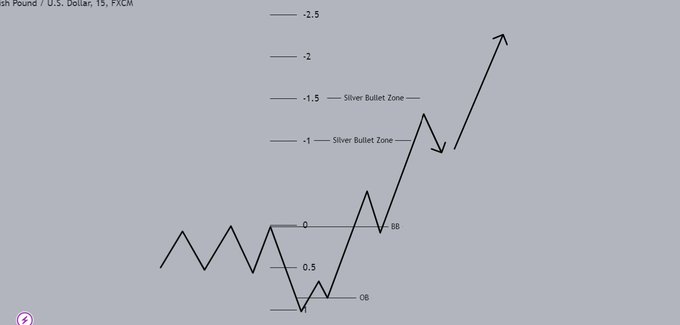

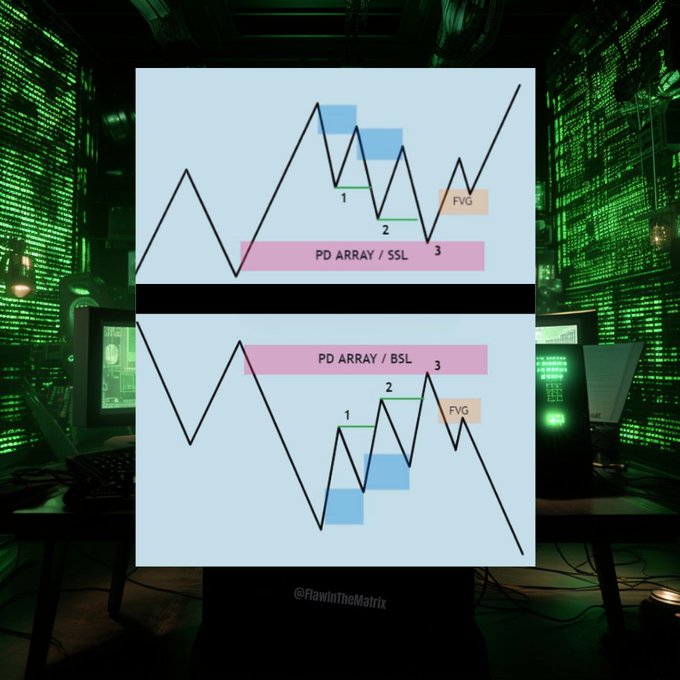

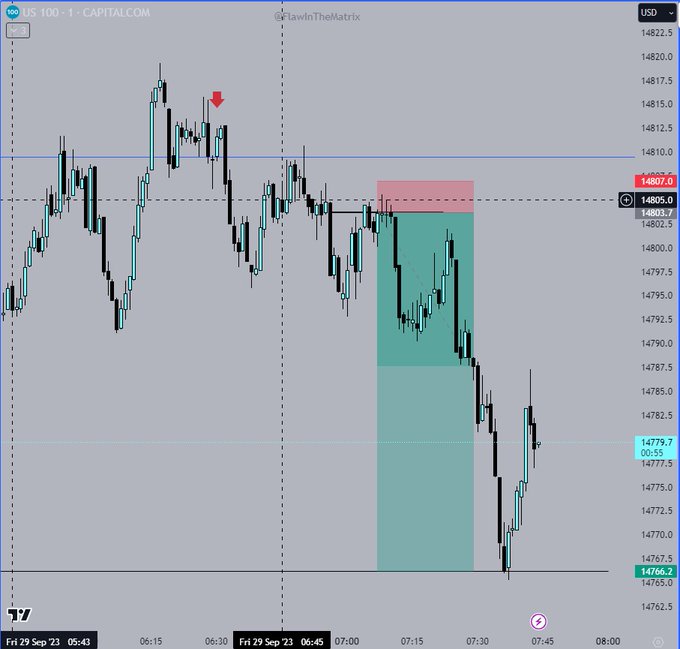

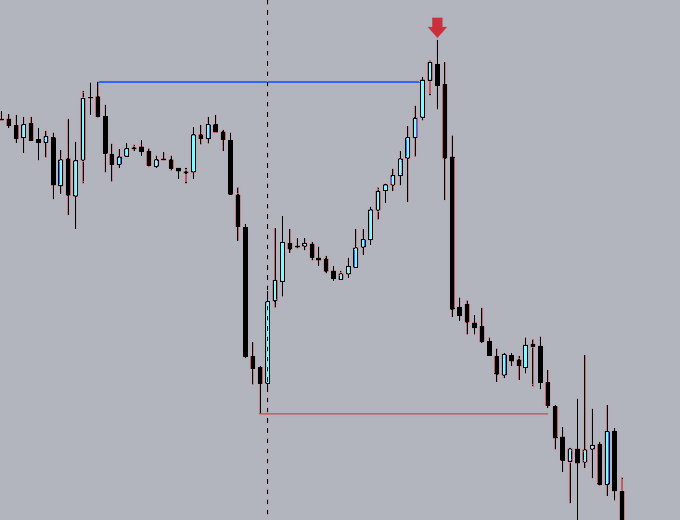

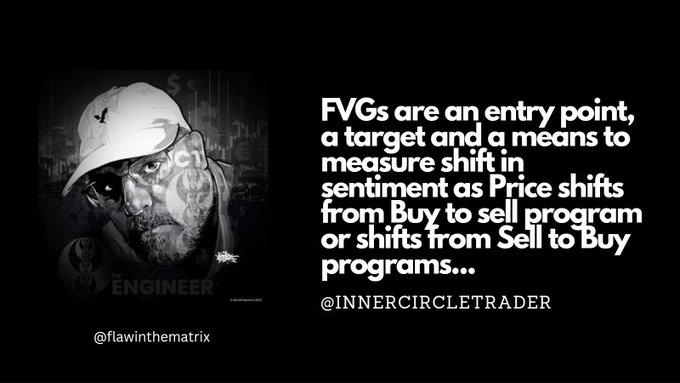

This is the best representation that I could make for a

@I_Am_The_ICT

Breaker block concept.

(With the unicorn algorithmic pattern having the FVG cutting through it)

I hope this helps someone.

#tradingstrategy

36

75

593

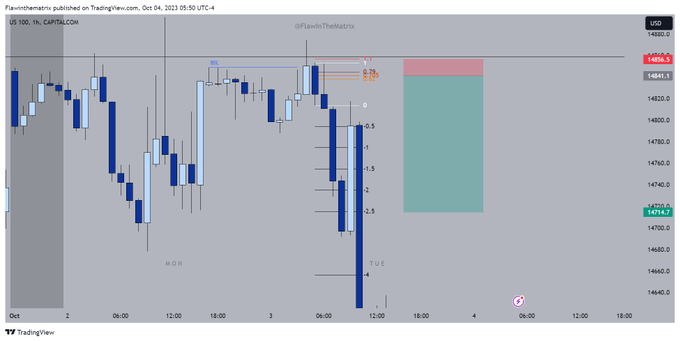

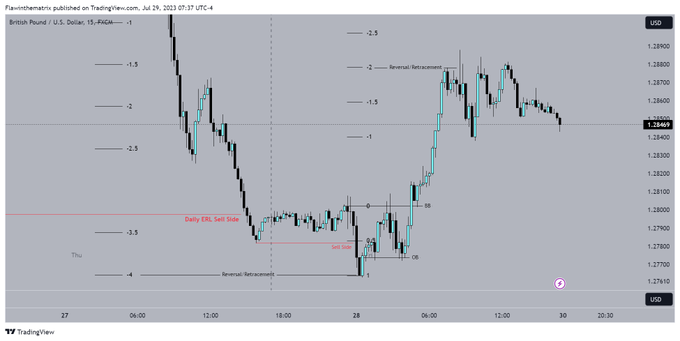

For my struggling followers.

@casper_smc

new strategy.

Rules-

15M TF

No bias is needed

Liquidity taken

Displacement

Enter 0.62% retracement

Exit -0.27 extension

Enter after 7am EST

35

84

548

I'll give you this one for free because I feel you slept on this one 💎

#TRADINGTIPS

#tradingstrategy

31

61

517

If you had to ask me to draw

@I_Am_The_ICT

YouTube 22 mentorship in the simplest form here it would be.

Note the white box in the image are a balance BISI/SIBI creating the ITL/ITH

Red box is FVG entry after MSS.

#TradingView

#TradingStrategies

#Trader

56

129

509

"If you treat the 4hr and 60min as your daily chart and study 5 min structure a whole new world opens to you." - Inner Circle Trader

Treating the 4H candles like a daily 💎

I'm showing you recently a whole new world 🌎

#TradingView

#TRADINGTIPS

#tradingstrategy

24

82

518

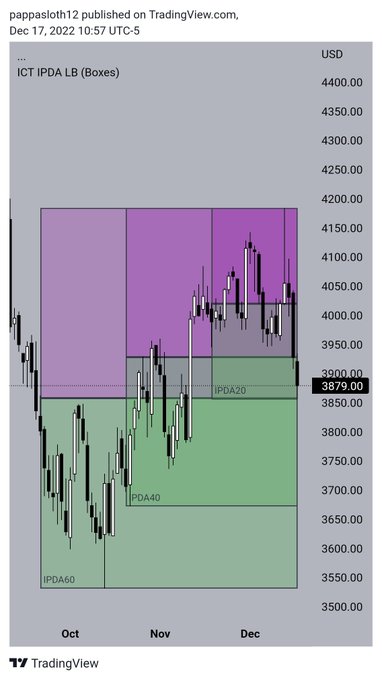

Saw a post earlier from

@traderdaye

Yearly =

Q1 = A

Q2 = M

Q3 = D

Monthly

W1 = A

W2 = M

W3 = D

Daily

00.00 - 6.00 = A

6.00 - 12.00 = M

12.00 - 18.00 = D

But you break them down again each 6 hour into a 90 min cycle 🤔

Another test on the cards

#tradingstrategy

27

140

492

INDEX FUTURES THREAD 🧵🧵

INCLUDES;

OPENING RANGE

AM TREND

PM TREND

INTRADAY PROFILES 💎

Credits to the mentor -

@I_Am_The_ICT

$ES $NQ $YM

44

180

487

🎉Giveaway Time!

I got 3x $10K funded trading challenge accounts to give out.

For a chance to win follow these steps:

1: Follow

@Propfirmcheck

2: Follow

@myflashfunding

3: ❤️Retweet, comment, like this post

4: ❤️Retweet, comment, like

@Propfirmcheck

giveaway post

🎁The

383

346

374

Anyone that is still lost simply as possible I can make it.

Futures-

4H candles

London traders = 2 am

NY am traders = 6am/10am candle

NY pm traders = 2 pm candle

Forex-

London = 1 am candle

NY = 5 am candle

$ES $NQ $GBP $USD $EUR

#tradingstrategy

#TRADINGTIPS

31

128

461

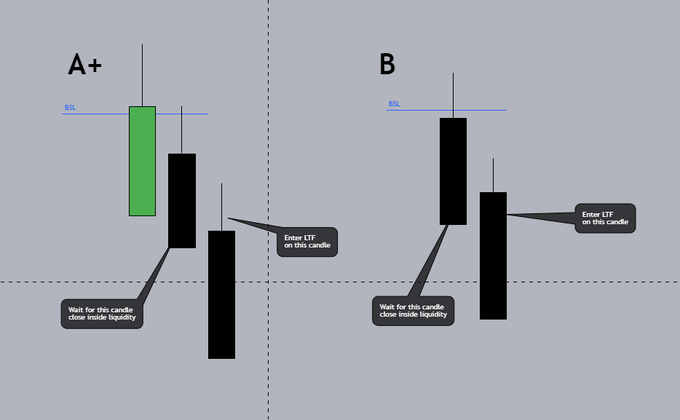

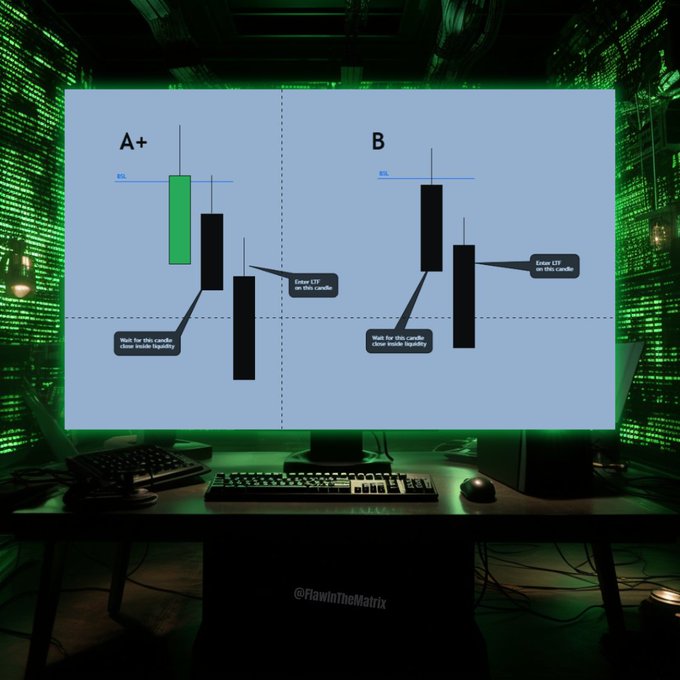

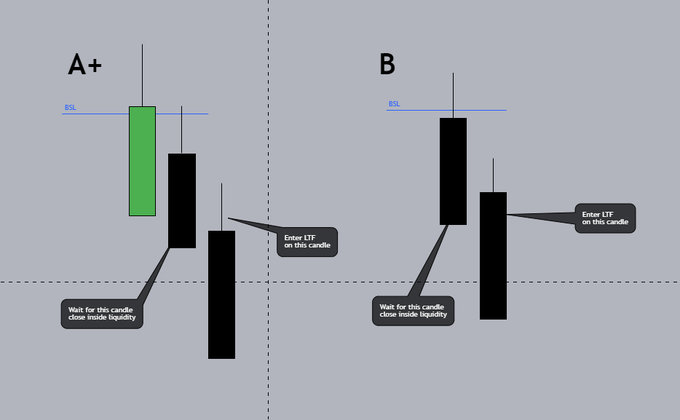

I really am trying to make this as clear as possible.

You are WAITING for the opposing direction candle to close inside liquidity.

buyside you wait bear candle to CLOSE.

Sellside you wait bull candle to CLOSE.

If you are on 4Hr, you wait 4 hour to close, 1Hr you want for

Visual representation of my last couple of posts 🧠

Thank you

@JosephW71016085

for working with me on this for the last couple of days 🤝

I use;

1Hr > 5min

15m > 1min

A+ & B is my own conclusion. Please go over your own charts and decide yourself.

I hope this helps you

19

78

352

36

83

455

🎉 Giveaway Alert with propfirmcheck & fundingpips 🎉

Hey guys, i have been working with my friends over at

@Propfirmcheck

to be able to give away 4x $10K funded trading challenge accounts! 🎁

Here's How To Enter:

1️⃣ Follow

@propfirmcheck

&

@fundingpips

2️⃣ Like & Retweet this

412

354

386

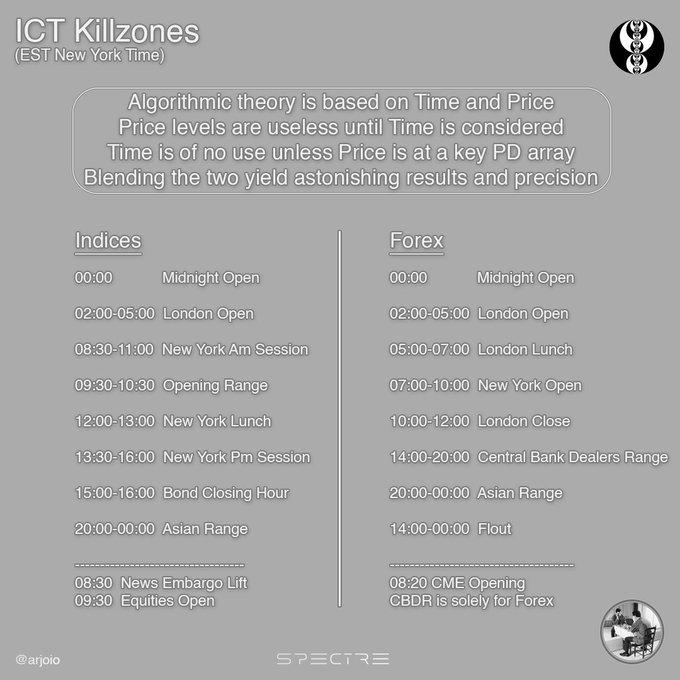

Key times to trade:

Mark the highs and lows for

• 2am-5am - London session

• 7am-10am – New York session

• 7PM-9PM - Asia session

And any intraday high/low right before equities open at 9:30

From

@arjoio

notes about episode 3 22

@I_Am_The_ICT

always been pointing at 9.30 😅

18

109

432

I can't make it more black and white than this.

It can happen on the same candle that takes liquidity (B), but I prefer the look of these ones.

Go to your charts and find them.

1H > Execute on 5min

15m > Execute on 1min

I hope this cleared anything up for people.

Good

Visual representation of my last couple of posts 🧠

Thank you

@JosephW71016085

for working with me on this for the last couple of days 🤝

I use;

1Hr > 5min

15m > 1min

A+ & B is my own conclusion. Please go over your own charts and decide yourself.

I hope this helps you

19

78

352

24

94

432

Guess you all want to know what's on my checklist to be backtesting.

HTF POI-

4H/1H/15M

PD array

Liquidity

TIME OF DAY

LTF-

Liquidity run

MSS over/under ITL/ITH

Entry technique (Mine OB/FVG/BB)

I've just given you a retirement plan here.

#tradingstrategy

14

82

416

Study 1 📝

Note the 90 min cycle...

Why 90 mins... 24 hours ÷ 4 = 6Hr

6Hr ÷ 4 = 90 mins...

Q1 = Accumulation

Q2 = Manipulation

Q3 = Distribution

Note - Macros seems to start the phase.

MMXM cycles 🤔

$ES $NQ $YM

#tradingstrategy

#TradingStrategies

22

92

411

Tried to present this step by step thought process using the filter candle theory.

Daily > 1Hr > 5min

It's not really rocket science and not the next ground break discovery, but from what I've seen, it will help boost probability and hopefully your win rate.

All we are

30

68

412

My strategy/plan:

HTF 4H/1H

LTF 5/3/1mins entries

5 handle SL

5-10 handle target (BE @ 5 handles be prepared to take profit)

9.30 - 11 am

What I use;

OB

FVG

BB

IMBALANCE

LIQUIDITY

MMXM

PO3

(Studying $DXY LTF confirmation to get me in the 90% club)

$ES

#tradingstrategy

24

75

395

If you're an

@I_Am_The_ICT

trader and not utilising this for your questions, then you need to start.

25

77

384

@I_Am_The_ICT

PD arrays I use.

You don't need all of them.

In reality, you need only 1 or 2 to be profitable.

$ES is used for the example.

A Thread 🧵🧵

31

114

375

Keep getting asked the same question-

ITH/ITL = intermediate-high/low

CE = Consequent encroachment

OB = Order block

RB = Rejection block

BB = Breaker Block

FVG = Fair Value Gap

SSL = Sellside liquidity

BSL = Buyside liquidity

#TRADINGTIPS

#tradingstrategy

15

72

359

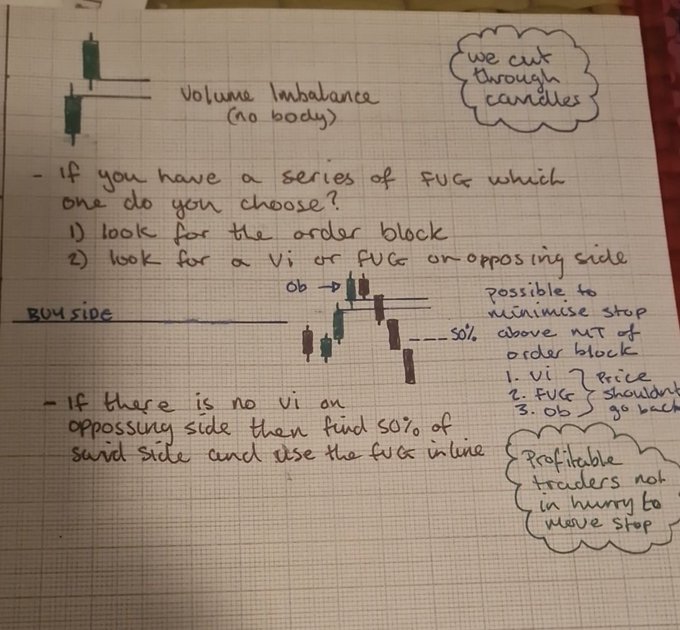

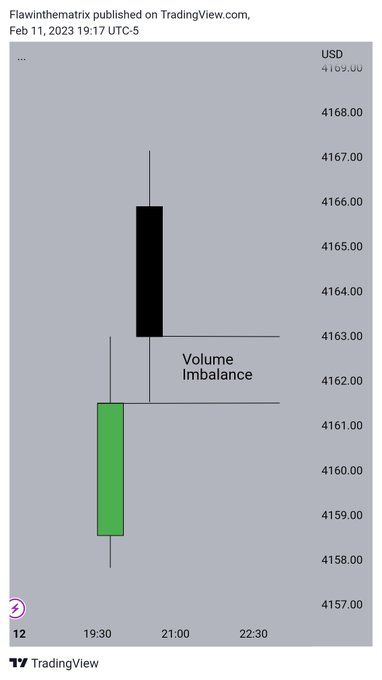

For the newbies.

Volume imbalance (glitch in the matrix)

Where there is no body overlapping just wicks.

@I_Am_The_ICT

concept.

7

40

360

Keep seeing comments on seasonal tendencies here's the 🦄

April - may = spring

September - November = fall

@I_Am_The_ICT

#TRADINGTIPS

12

125

366

In the mornings I work a part-time job cleaning a gym.

This covers my bills and takes pressure away from trading.

We all got to start somewhere. I had to start from the bottom again.

I'm here with you in the trenches.

#tradinglife

#authentic

48

4

347

Visual representation of my last couple of posts 🧠

Thank you

@JosephW71016085

for working with me on this for the last couple of days 🤝

I use;

1Hr > 5min

15m > 1min

A+ & B is my own conclusion. Please go over your own charts and decide yourself.

I hope this helps you

19

78

352

All you

@I_Am_The_ICT

macros traders...

Think about this;

Each macro comes prodomently .50 - .10

This is an hourly candle close and hourly candle opening

Every candle has a power of 3 👁

The final hour well think of the daily power of 3 💎

#TRADINGTIPS

31

67

347

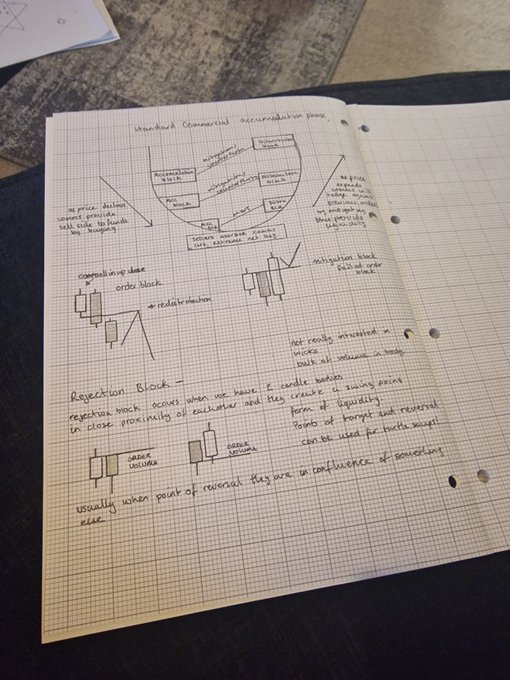

10 mins out 3 hours and 1 page of notes 💎

It's me vs me.

@I_Am_The_ICT

has opened the gates for the inner monster.

#trading

#TradingView

13

35

304

My strategy right now-

4H/1H HTF POI

ICT YT MODEL ENTRIES (5M MAINLY) X MMXM

I REPLACE FVG WITH ORDER BLOCKS AND BREAK BLOCKS OCCASIONALLY.

Other confluences-

AMD (power of 3)

Weekly profiles (sometimes)

#tradingstrategy

#Trader

32

51

287

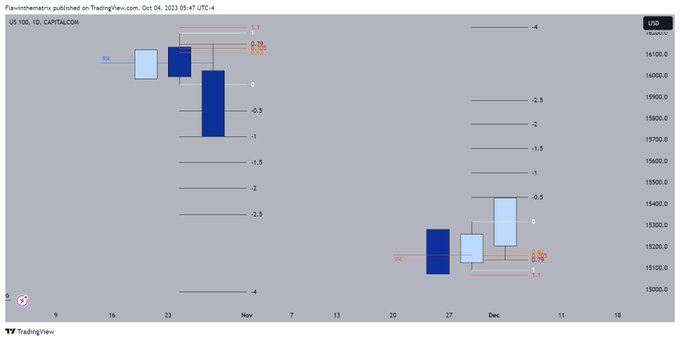

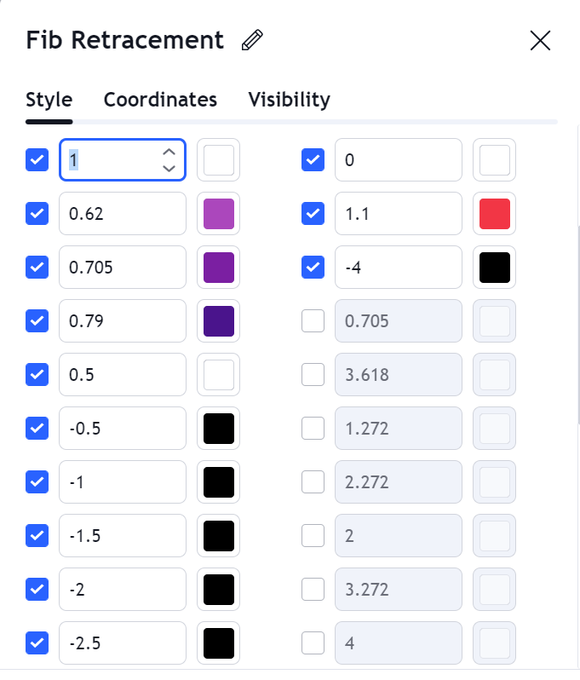

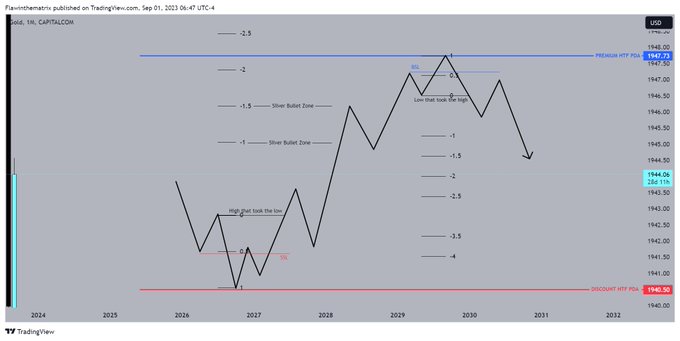

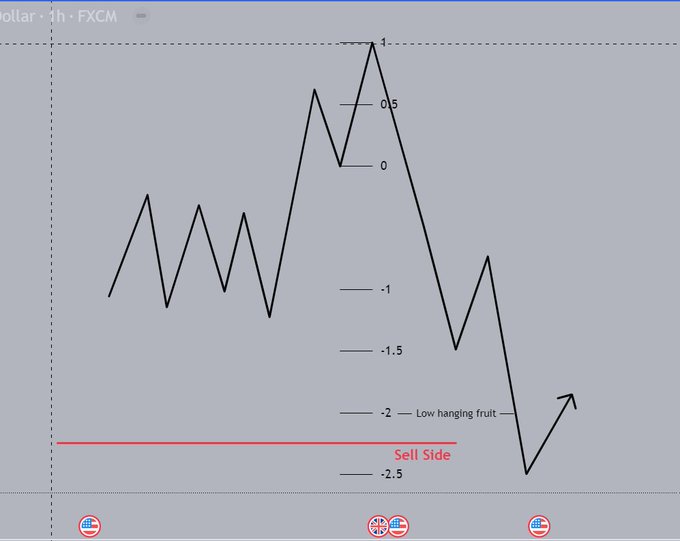

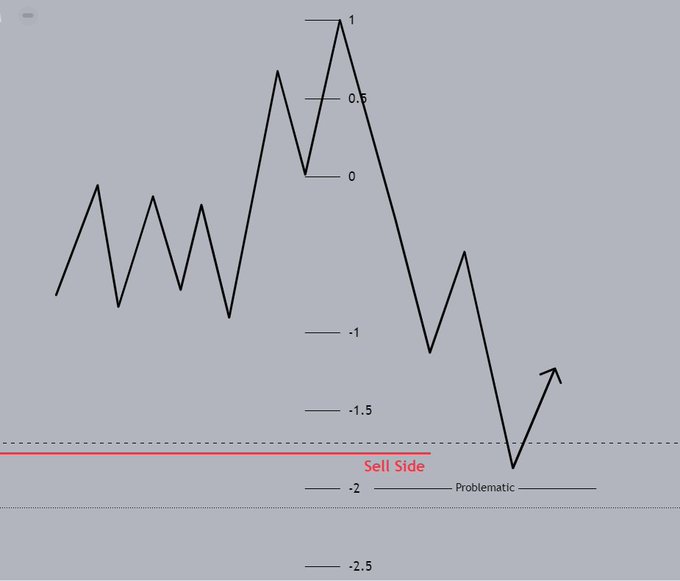

When to use bodies and when to use wicks?

It's probably one of the biggest questions asked

The answer comes from your draw on liquidity, whether it's internal or external draw

In this example, you can see you want -2 before your DOL as an easy target 🤝

Credits

@TraderDext3r

15

78

300

As a trader, I recommend this;

Watch;

@TTrades_edu

daily bias video

@_amtrades

weekly expansion

These 2 combined will tell you which way when to sit still

Couple that with

@TraderDext3r

Standard deviations theory

This week I would of hit 100% WR if it wasn't for FOMO

14

60

289

On a strange old trail

@I_Am_The_ICT

concepts;

9.30 - 11am time window

9.50-10.10 macro

DXY inverse correlation

Order flow entry drills

Have I just narrowed my whole career to 20min - 90min time window 🫣🤔

Data collection tonight 💎

#tradingpsychology

#tradingstrategy

19

41

288

"If you're a seller, you want to be a seller above the new York midnight opening price...If you're a buyer , you want to be a buyer below the new York midnight opening price" -

@I_Am_The_ICT

I think just concept alone would save a lot of your headaches.

(Take 2)

17

52

282

Here have juliettes course for free save your self $127 from this poorly clown 🤡

A to Scam 🤣💀

#tradingstrategy

#TRADINGTIPS

26

64

273

Borrow these times of

@arjoio

For the homework, if you trading FX please adjust your time of opening etc

11

81

258

Sometimes studying

@I_Am_The_ICT

concepts I sit and think this can't be real 🤯

Just backtesting $ES and $DXY between 8.30-11 am NY (mainly 9.30-11 am)

This be real crazy...

Would need hardly any bias by looks of it.

🧵🧵

#tradingstrategy

#TradingView

#trading

16

46

262

Let me clear this up for the study

All times are in New York

Futures-

2 am 4H candle (if you trade London)

6 am 4H candle (8.30 open in this candle)

10 am 4H candle (after equities opening volume)

2 pm 4H candle (PM session)

FOREX BELOW.

#TRADINGTIPS

#tradingstrategy

20

55

262

I think this went over all your heads 🤯

$ES $NQ $YM

$GBP $USD $EUR

#TRADINGTIPS

#tradingstrategy

6

38

263

For all you new people in my following...

I am in the trenches with you.

I was 6 figures funded in 2021. I lost everything to greed.

I am back at the bottom starting again 💎

#tradingpsychology

#TRADINGTIPS

In the mornings I work a part-time job cleaning a gym.

This covers my bills and takes pressure away from trading.

We all got to start somewhere. I had to start from the bottom again.

I'm here with you in the trenches.

#tradinglife

#authentic

48

4

347

20

7

263

Okay so let's put together my last 2 posts in an example with my

@MyFundedFX

challenge.

300K

8% phase 1

5% phase 2

8% Max DD

5% Daily DD

0 time limit but let's use 30 days (20 trading days)

[Thread]

#tradingpsychology

#TRADINGTIPS

#tradingstrategy

20

64

255

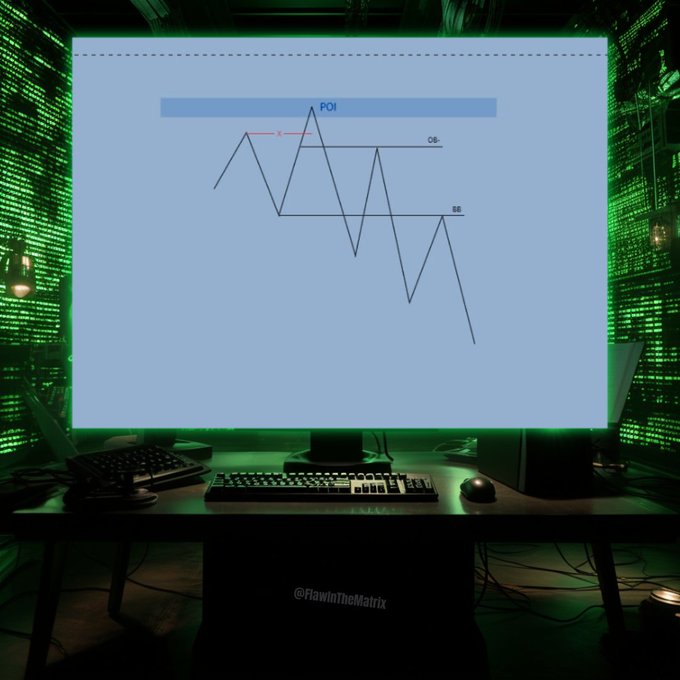

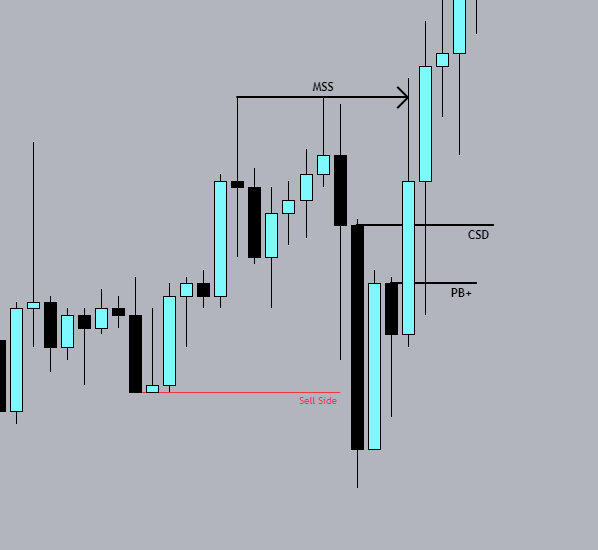

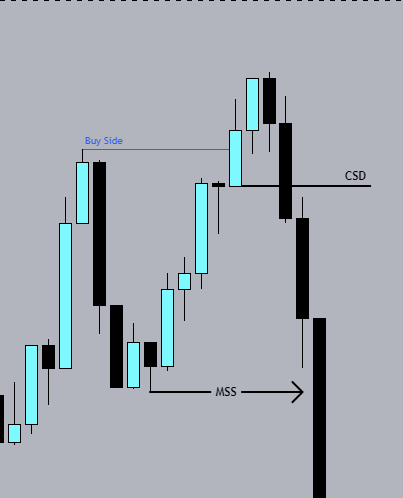

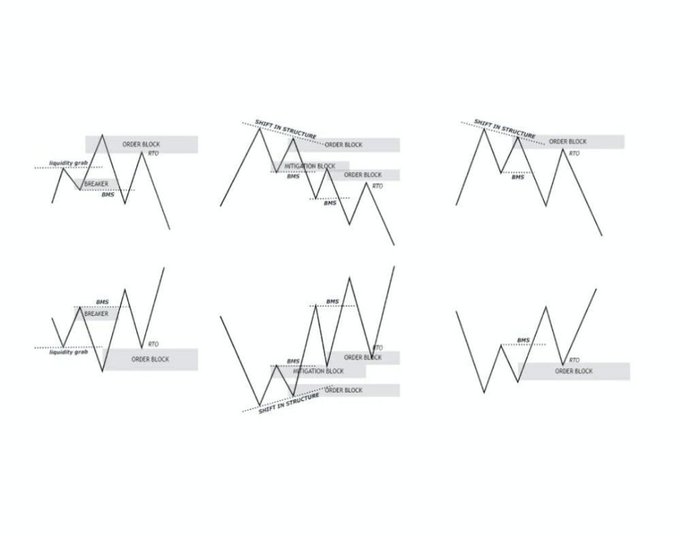

Does any of these look familiar by replacing a PD array?

3 x

@I_Am_The_ICT

entry techniques.

Have been my background on PC for 2 years 🫣

#TRADINGTIPS

#tradingstrategy

#tradingpsychology

17

59

256

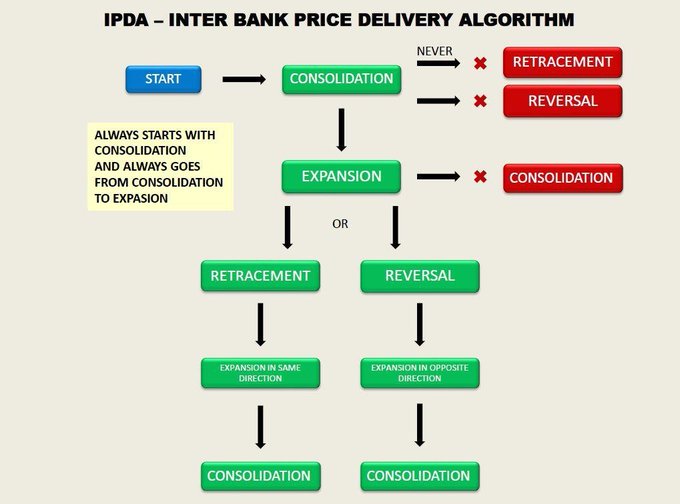

Before you all start panicking...

@I_Am_The_ICT

is not showing you anything new in 2023.

The ALGO won't change

Only 11% of you made it through the 2022 mentorship.

Out of that 11%... 90% will still fail.

So why are you panicking 😅

19

10

257

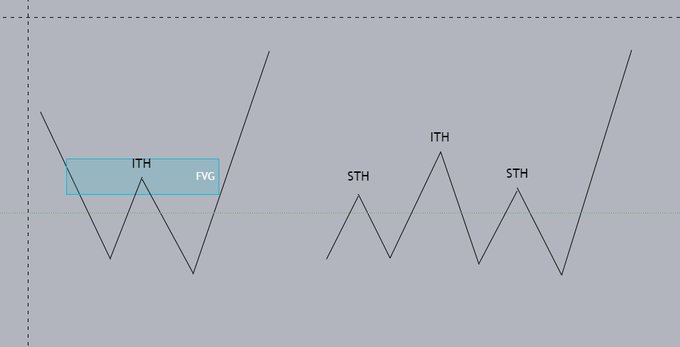

There are 2 types of intermediate high/low 💎

I prefer the FVG version.

#tradingtips

#marketstructure

#TradingView

ITH (Intermediate high)

14

50

239

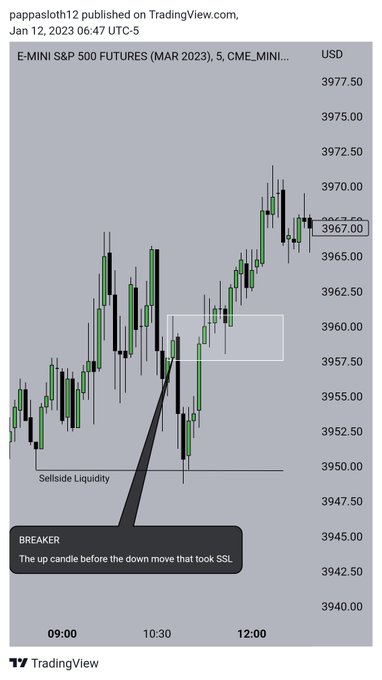

@I_Am_The_ICT

trade yesterday had 5 confluences.

You only need 1 way but I'm about to show you the same trade and 4 different ways to be in.

Breaker block.

19

41

237

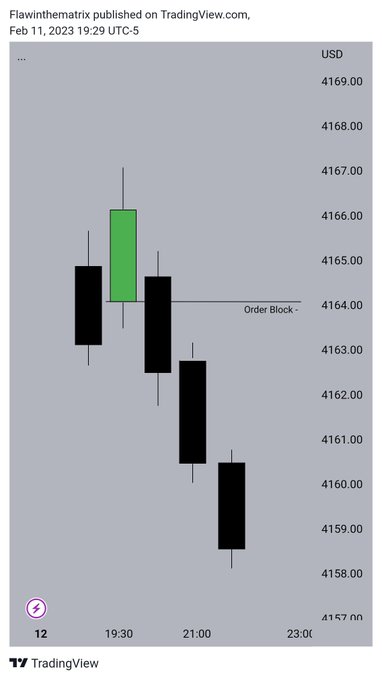

Visual representation of an order block.

A change in the state of the price delivery.

Higher probability when coupled with an FVG

Can be a series of consecutive candles.

@I_Am_The_ICT

concept. I feel he has more to teach on these but this is everything I've learnt so far.

11

30

235

Only 1H 15mins through

@I_Am_The_ICT

live session episode 1

2 and a half pages of notes.

I'm absorbing every little part of this.

Submit to time.

I've done this in sections that fit my life I'm in no rush.

#Trader

10

11

233

"If you treat the 4H and 1H as your daily chart and study the 5M structure... a whole new world opens to you. Test it and see" -

@I_Am_The_ICT

Facts. Most of my work comes from these 3 Time frames.

#trading

#Trader

11

26

230

What I've noticed with

@_amtrades

weekly profiles is;

- 4Hr+ PD arrays for reversals

- 1Hr PD arrays for continuation throughout the week

- 1Hr/30min CSD will save you alot of heart ache.

- News doesn't always give you high and low of the week but is where LRLR will come.

20

26

228

My mind is blown...

Ever since

@I_Am_The_ICT

mentioned in his space about SMT divergence between SP NAS and DOW in the fall between Sept - Nov leading to a bullish seasonal tendency.

This explains why my long-term reversal short never worked. Also why bull days are bigger.

6

30

226

**UPDATE**

The 4 quarters of the day

Q1 = 18.00 - 00.00 = A

Q2 = 00.00 - 6.00 = M

Q3 = 6.00 - 12.00 = D

Q4 = 12.00 - 18.00

Think about what falls in these times

Future traders think about what Q4 is...

Thanks again

@traderdaye

$ES $NQ

#TRADINGTIPS

#tradingstrategy

26

58

223