FinezzaHQ

@FinezzaHQ

Followers

31

Following

0

Media

152

Statuses

896

Lending Process Management And Analytics Software for High-Growth Lending and Fintech Companies.

Joined September 2019

Bank of India recently declared INR 226.84 crore loan fraud by a single business! 🚨. How can lenders identify potential risks early?. Explore 6 critical red flags every loan officer should monitor in bank statements before approving loans: .

finezza.in

Learn how lenders can use technology to spot suspicious transactions in bank statements and weed out fraud and poor creditworthiness.

0

0

0

Automation can cut loan processing costs by 70% than traditional methods. Here are 6 ways how that happens:. #FinTech #Finezza #DigitalLending.

finezza.in

A lending software solution can reduce operational costs by up to 5x compared to manual processes by improving compliance and reducing risks.

0

0

0

Hidden AI biases create unfair loan rejections and legal risks for lenders! . 5 proven methods to audit algorithms for fair lending decisions: . #FairLending #BiasDetection #FinTech

0

0

0

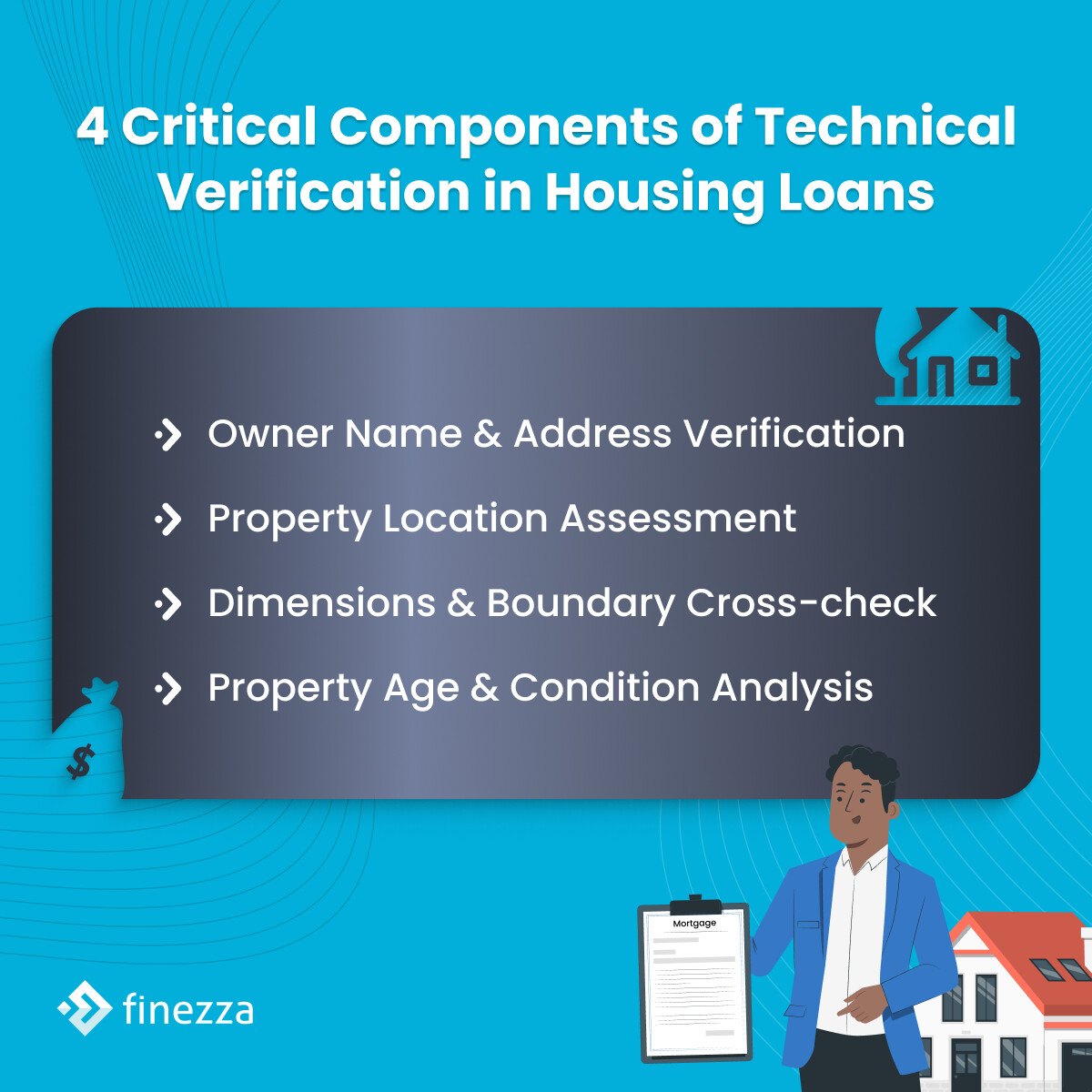

Poor technical verification exposes lenders to inflated property values & legal risks! 🏠. 4 critical components every housing loan verification must include: . #HousingLoans #LendingTech #RiskManagement

0

0

0

Hidden AI biases create unfair loan rejections and legal risks for lenders! ⚖️. 5 proven methods to audit algorithms for fair lending decisions: . #FairLending #BiasDetection #FinTech

0

1

1

Traditional loan approvals take weeks, driving borrowers to switch providers! . 6 ways modern LOS cuts approval time by 60%: . #LoanOrigination #LendingTech #DigitalTransformation

0

0

0

Mortgage fraudsters use fake documents & stolen identities to trick lenders!. Top 7 red flags every lender must monitor to prevent fraud: . #MortgageFraud #FraudDetection #LendingTech.

finezza.in

Learn seven red flags that expose mortgage loan fraud and see how lenders use AI to catch fake docs, straw buyers & more.

0

0

0

Traditional loan management systems can't keep up with modern borrower expectations!. 5 key trends reshaping the future of digital lending: . #LoanManagement #DigitalLending #LendingTech

0

0

0

EWA loan defaults are rising as traditional credit scores fail to assess borrowers without credit history! 📊. 5 alternative approaches to evaluate EWA risk beyond credit scores: . #EWALoans #CreditScoring #FinTech

0

0

0

Mortgage fraudsters use fake documents & stolen identities to trick lenders! 🚨. Top 7 red flags every lender must monitor to prevent fraud: . #MortgageFraud #FraudDetection #LendingTech

0

0

0

Traditional invoice financing keeps MSMEs waiting weeks while lenders handle manual paperwork! ⏰. Our latest article highlights how AI automation speeds up the entire process: . #InvoiceFinancing #AIAutomation #MSMEFinance

0

0

0

160M+ Indians lack credit history & remain outside formal financial system! 📈. But alternative data from utility bills to mobile usage is revolutionising digital lending. Learn more: . #DigitalLending #FinTech

0

0

0

Struggling to choose between proprietary vs SaaS loan management systems!. Complete comparison across 7 key factors to make the right choice:. #LoanManagement #SaaS #LendingTech

0

0

0

Automated loan systems can perpetuate biases from historical data, creating unfair lending decisions!. 5 essential steps to detect and prevent this bias in loan processing: . #FairLending #BiasDetection #FinTech

0

0

0

Automation can reduce loan processing costs by 70% compared to traditional methods. Here are 6 ways how that happens: . #FinTech #Finezza #DigitalLending

0

0

0

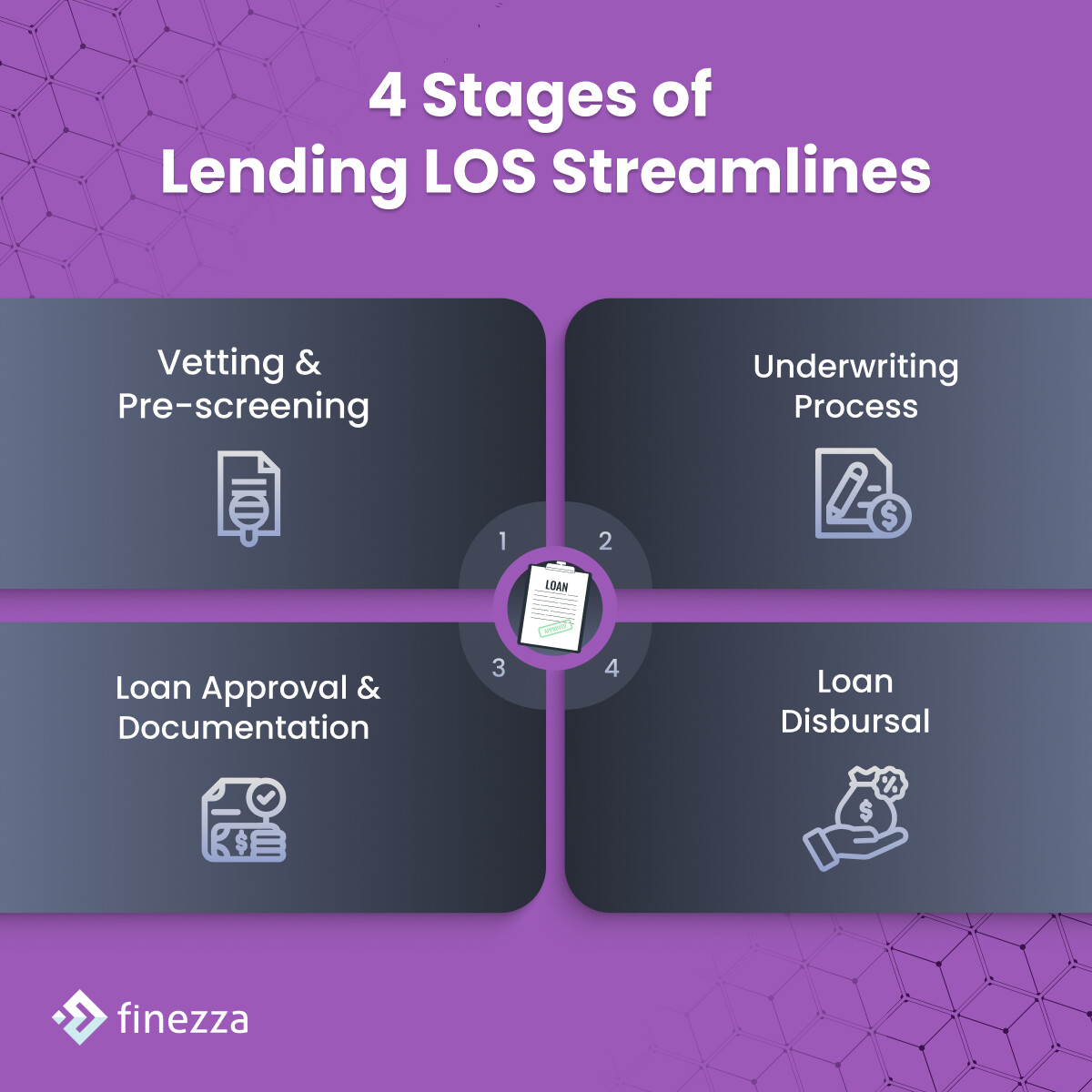

Manual loan processes create delays at every stage—from pre-screening to disbursal! ⏱️. How LOS automates the critical lending stages for faster approvals:. #LoanOrigination #LendingTech #DigitalTransformation

0

1

1

EWA loan defaults are rising as traditional credit scores fail to assess borrowers without credit history! 📊. 5 alternative approaches to evaluate EWA risk beyond credit scores: . #EWALoans #CreditScoring #FinTech

0

1

1

Education loans, with a 3.6% NPA ratio, are highest among all personal loans NPAs per RBI's 2024 report! 📈. With ₹1.23L crore outstanding (90% overseas), lenders need smarter approaches. Here are 7 strategies for just that…. #NPAManagement #FinTech

0

1

1

Traditional underwriting fails to assess personal loan risk accurately, causing rising NPAs! 📊. 3 ways advanced tech is transforming credit decisions: . #CreditUnderwriting #AIinLending #FinTech

0

0

0

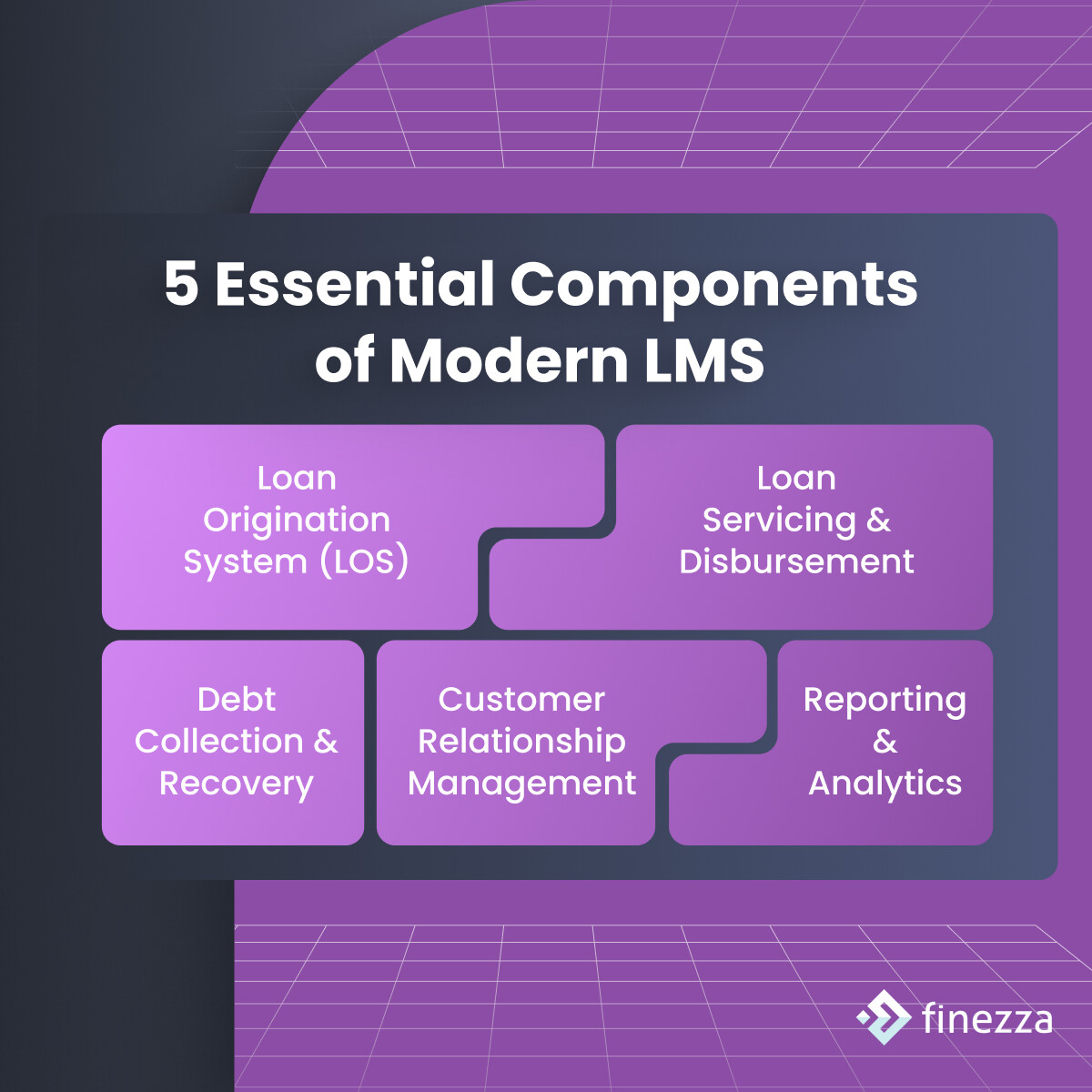

Traditional loan management can't handle growing credit demand efficiently! 📊. 5 essential components every modern LMS needs for end-to-end optimisation: . #LoanManagement #LendingTech #LMS

0

1

1