Erik A. Otto

@ErikOtto2

Followers

7,131

Following

375

Media

178

Statuses

2,865

#Scifi author. Biotech Investing. #AI Safety. Looking for collaborators to co-produce Detonation screenplay adaptation. Tweets not advice.

Charlottesville, VA

Joined April 2015

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

jeonghan

• 232505 Tweets

#JollibeeBESTFest

• 136163 Tweets

#JollibeeXBINI

• 135146 Tweets

READY FOR JOLLIBINI

• 119182 Tweets

#TrainAccident

• 60092 Tweets

梅雨入り

• 59748 Tweets

पश्चिम बंगाल

• 53957 Tweets

Boom Boom Bass

• 39061 Tweets

रेल मंत्री

• 35212 Tweets

Railway Minister

• 26597 Tweets

अश्विनी वैष्णव

• 16614 Tweets

マッサマン

• 15736 Tweets

Ashwini Vaishnaw

• 14652 Tweets

Happy New Week

• 12882 Tweets

線状降水帯

• 11445 Tweets

無痛分娩

• 11336 Tweets

#JxW_THISMAN

• 10985 Tweets

#꿈에서_디스맨_정한원우를_본적있나요

• 10752 Tweets

JxW LAST NIGHT OUT NOW

• 10540 Tweets

Last Seen Profiles

Here are some notes on a few stocks I like that I haven’t seen getting much attention on

#biotwitter

. Not investment advice.

$LRMR – I think 50 mg has a good shot at showing FXN increase because of dosing schedule and prior data. In general I think therapeutic window and margin

10

13

110

My new book has been released! DETONATION has been awarded the Kirkus Star (awarded to 10% of the books they assign for review).

#scifi

#ai

#greatreads

#fiction

“…highly entertaining and absorbing…” —Kirkus Reviews (starred review)

Discover it here:

5

11

49

This is going to cast a dark cloud over CAR-T for immunology unfortunately. Has to be very safe for indications outside of oncology. $CABA already down >30%.

9

10

44

Dear biopharma CEOs, be advised that $CRBP is what can happen if you don't dilute your investors and give away upside with a wall-crossed pipe.

5

3

41

@bradloncar

In 2021 many disappointments but the following were wow moments for me. New modalities in this list that I'm surprised aren't getting more attention.

Paxlovid

$NTLA

$CLDX CDX-0159

$TVTX IGAN

$PDSB triple combo

$LIFE Atyr1923

$PRQR Ushers syndrome

$MRUS MCLA-158

$XENE Xen1101

1

5

38

This is ludicrous. Can you imagine having only 5 years on the market to generate ROI of a drug that costs >$1B to develop (and >90% of drugs fail)? Virtually all drug development would essentially stop.

4

4

28

Congrats to $STML holders. Despite today's 150% premium I think Menarini got a good deal considering expansion opportunities in CMML, XPO inhibitor etc... Bodes well for

#biotech

. Lots of other diamonds in the rough out there $xbi $ibb

2

0

29

@alexriesart

Adrian Tchaikovsky’s final architecture series seems to meet that criteria. Some similarities to Hamilton’s style. Also really like Tchaikovsky’s expert systems novellas.

1

0

29

Everyone get your picks in for

#biopick2024

! With the sector resurgence 2024 should be a lively year. Test your mettle at finding those multibaggers!

I also enjoy participating in this long-running biotech contest, which is more about portfolio

#Biopick2024

is now open.

Rules:

1. Only 1 pick (+1 alternate if you feel your 1st pick might not meet criteria)

2. Must be >$1.0 by eoy 2023

3. Biotechs only (*medical devices allowed)

4. Deadline 31-Dec

5. Must be listed on US exchange

Click to enter:

38

20

65

0

4

28

30% average return is exceptional, and I would argue more important than win rate. And not a small n there. In my experience Jonathan is also completely transparent, open to dissent, and a class act.

Everyone on

#biotwitter

should be following him

#ff

5

1

26

As far as insider buys go, this $LIFE one is pretty significant, not just is size, but because it's Paul Schimmel, founder or co-founding director of $ALNY, $ALKS, Cubist, $RGEN.

2

7

28

@adamfeuerstein

If so, in one fell swoop, FDA forcing US health care system to swallow huge cost with uncertain benefit.

3

1

25

$GLTO strategic alternatives. Glad management is taking the responsible approach. Lots of upside from here IMO. Here is my thread on $GLTO 👇

6

2

24

Thought I would highlight $PTGX for one of my episodic

#biotech

threads. Bought a fairly sizable position last week. They have three early stage (P1/P2) products, one partnered to J&J. Seems like it is not well followed and way oversold. 1/9

3

1

20

There is no way in which this will help anyone; disruptive to western mfgs, less developed countries won't be able to develop the capabilities anytime soon, will massively curtail future innovation and will disincentivize pharma from saving the world.

BREAKING: White House reviews whether to lift intellectual property shield on Covid-19 vaccines - sources (via

@kaylatausche

)

54

143

329

3

0

20

@buysidebio

Numbers are good but for context they have a rebate program that drives sales in last month of every quarter. So March comparators should be Dec and Sep.

2

0

20

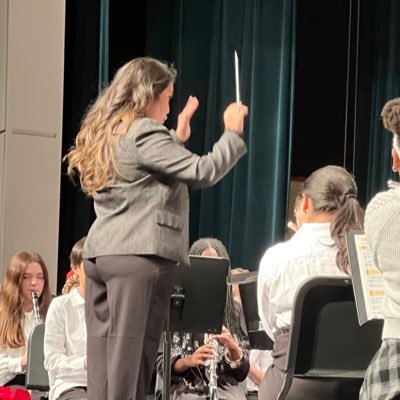

A visual from the pitch deck for the

#screenplay

adaptation of my novel Detonation. This is in the cold open.

#scifi

#agi

4

1

27

I strongly disagree w latest

@AppleHelix

bear thesis on $GBT AA. The fact that 64% were on HU shows that the benefit is additive. Vox has to be "reasonably likely" to predict clinical benefit. I think it is highly likely, and unlike other Hb modifiers, without safety risk.

2

5

18

For anyone wanting a distraction I'm offering my short story TRANSITION for free for a limited time. It’s a 60-90 min kindle read, dealing with themes of family, personal isolation and what it means to be human.

#COVID19

#scifi

#sciencefiction

4

4

19

@bradloncar

This doesn't list all the programs but reviews a lot of the different modalities and has citations of other reviews. Probably not the nice summary you're looking for but possibly a place to start if nothing better shows up.

1

2

19

@bradloncar

I just don't see how waiving IP rights helps anyone. Tech transfer takes many many months. All this does is throw everything into disarray and disincentives pharma

2

1

17