ValueEquity

@EquityValueIn

Followers

15K

Following

4K

Media

2K

Statuses

6K

differentiated insights for value investing . Thats it

earth

Joined August 2024

Emerging sectors will be contributing >27% Industrial capex , almost will be equal to the top capex players in Oil and gas , the quality on yield in this manufacturing will be better source: ionic wealth @abhymurarka

0

2

23

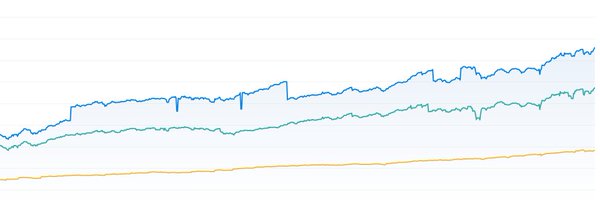

This is the rate of change pessimism tracker , for sectors in pain

Q2FY26 pessimism rate of change tracker update: 1) Chemicals , there are no sector wise trends visible yet , there continues to be some pressure on pricing and spreads in some chemicals , and some have come to longer term discounted valuations as the margins have weekend ,

0

0

14

Considering the pain in Chemical stocks , if you remember the 21-22 peak cycle , the word CAGR has gone away from their concalls today there is far more rationality , there is tremendous pressure on prices , which makes it a rational time to study the names and keep the level

2

1

43

Ever feel like no tote could meet all your needs? I did too, until I found the Siena Pro Tote Plus! Whether I'm running errands, heading to work, or going out, this tote fits everything—without losing its sleek style.

28

35

160

This is very true , the some export facing business are really feeling the brunt , to be honest it is a matter of time , they need to remain focused on their core strengths , these will make a comeback post Tariffs trigger

Was reading the concall of Garware Hi-Tech Films. The challenges faced by promoter feels very real. Genuinely tough times - especially when they’re asked questions for which they have no answers, particularly around tariffs. No fundamental business issue, yet the company may

0

0

13

Data centers capacity addition trends ,Mumbai dominates , 61% by 2027

0

0

13

Deep value can remain deep value if there is no inflection point or trigger , just because a stock is cheap run by a good management cannot be the only reason to buy , the question is what is the future rate of change that leads this company to discover the value and unlock a

0

0

38

Installed and planned nuclear capacity in India , 100 GW is quite an ambitious target , seems to me if 100 GW through nuclear which is humongous if happens , India would be a large consumer of Uranium global value chain ( >50%)

1

2

18

Sleigh the season with the most personal gift around. Get them a Cameo video!

0

66

775

Value chain of who players that Enable the digitization of retail, very interesting on which player participates where in this process

0

3

25

TAM Landscape for New Age End-to-End Horizontal E-commerce Enablement Platforms

0

4

26

All the so called "budget " themes of last year in Railways , defense and many other sectors have again faced steep correction , it is a important thing to understand that themes when become consensus ownership , I mean just look at the number of shareholders in IRFC and some of

0

2

43

Nuclear bill ( Shanti) and what changes for the Nuclear sector with the entry of private players and a more open sector , all important data points

0

2

26

Capabilities based investing is usually not seen in the P&L but the balance sheet , a lot matter on what the company is doing with todays cash flows for tomorrows earnings at a better trajectory , capabilities expansion is what is a major enabler for return ratios and incremental

0

3

30

Quadrant analysis of sectors on Trade , import and export intensity

0

1

29

I want to Compete with the opportunity set , I am an individual investor and as even Stan druckenmiller says , I actually want to compete with the best performing stocks for the three year period across segments , and that would mean the process based reward for me Finding the

4

4

46

Full Self-Driving Supervised improves US road safety by over 80%, saving lives & preventing injuries

0

5

43

I want to Compete with the opportunity set , I am an individual investor and as even Stan druckenmiller says , I actually want to compete with the best performing stocks for the three year period across segments , and that would mean the process based reward for me Finding the

4

4

46

Very true , Don't be a foolish contrarian , be one that knows the cost of being contrarian , and is either going to be rewarded with much larger time adjusted payoffs or keep the allocations in check , being contrarian for sake of it is a bad strategy

“Contrarian investing is way overrated. It is intellectually cool to not be with the crowd but the crowd makes money 80% of the time. I have found contrarian thinking just to be contrarian can be a death trap.” Stanley Druckenmiller Spot on and you gotta be flexible

1

2

38

Rashi Peripherals Promoter doing SIP looks like into his own company

Rashi Peripherals , a company worth reading , they are a large electronics distributor , as proffered partners for many electronic majors in India , probably may see surge in volumes as the data center pick and shovel theme I have owned this stock for a year , with close to

1

3

54