Eden

@EdenRahim

Followers

3K

Following

5K

Media

626

Statuses

6K

Biotech Portfolio Manager, Options Strategist, Indie Films & Philosophy ~You cannot have truth in a way you catch it, but that it catches you ~ Kierkegaard

Toronto

Joined April 2010

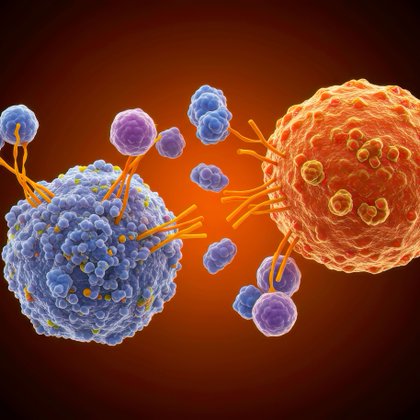

Everyone knows about AMT-130. If approved, most patients who can get it will get on it. $QURE … $CLPT will gap to new heights

4

3

56

1/3 The $XBI is +77% 8-months off April low. What is the typical trajectory of #biotech Bulls during the 1st 2 years? Here is a look at all prior 12 occurrences since biotech's birth in 1980. In 9 of 12 they begin slowly then a few gained speed in 2nd year. In 2 of 3 that

2

0

5

29 years ago I was at #ASH in Orlando when Greenspan uttered his now infamous "IRRATIONAL EXUBERANCE" WARNING and the market tanked forcing us young PMs to scramble for damage control. Of course the market recovered and launched in to back to back +20% years into the blowoff

0

0

1

The % of #biotech stocks above the 50-DMA has matched the Feb 2024 peak while the % above the 200-DMA at 77% has broken out to a multiyear high. I mentioned previously, going back 30 years, a reading of 80% is only seen at the start of biotech new bull markets in 1995, 2003, 2011

Over past 25 Years, new #biotech bull markets have been signaled by rare impulsive breadth thrusts that see the Percent of bios above 200-DMA surge from 10% or less to 80% within 6 months. At a 73% currently we are nearing 80% threshold ONLY seen during new bull markets &

0

0

3

The #biotech bull forges upward with new multiyear extremes for the % of Bios within 5% of a 52-week high at 39%, the highest reading since Feb 2021, and the % within 5% of a new Low at 2%, matching levels of short term peaks in Feb 2024 & Feb 2023. New Highs have expanded

0

0

5

Updated from 5 months ago, $XBI Short Interest as Percent of Units O/S stands at 115%. Still elevated Short Interest, but down as % of units June 13th zenith for this cycle of 143%. #biotech has predictably marched upward relentlessly with bushfires of FOMO beginning to erupt

The mid-June 143% of $XBI units short as percent of Units outstanding, is highest since April 3rd 2020 Covid crash low reading of 155%. XBI subsequently rallied from $75 to $170 (+125%) at the Feb 2021 peak, from where our hangover persists. Similarly, after low in July 2014

2

0

8

$LEGN hit a 52-week low today while the $XBI & $IBB are @ multi-year highs LEGN trades @ 0.17X cumulative 10-year analyst consensus. The 5 peers, with like revenue forecasts, were acquired for 0.32 to 0.49X. LEGN's Year 4 multiple is just as absurd. $JNJ Everyone wins in M&A

2

1

8

Today i'll focus on 2 Options based sentiment indicators on the $XBI : 1) 10-Day CALL-to-PUT ratio & 2) 25-Delta Call-to-Put SKEW. --> The C/P did spike almost to the sell threshold around 2.5X but has settled back down to neutral. --> Similarly, the SKEW spiked up to warning

1

0

3

Over past 25 Years, new #biotech bull markets have been signaled by rare impulsive breadth thrusts that see the Percent of bios above 200-DMA surge from 10% or less to 80% within 6 months. At a 73% currently we are nearing 80% threshold ONLY seen during new bull markets &

2

9

68

It was a dream come true chatting with you all a couple hours after at the restaurant. About Ronnie Platts exceptional vocals on par with Steve Walsh and Brad Delps and Lou Gramms, and so many other things. Kerry Livgren remains among the greatest Lyricists of all time.

Rama, ON - you were incredible. Thank you and goodnight from KANSAS! Kitchener, ON - Sunday night, we bring the show Down the Road to you.

0

1

6

@EdenRahim, Portfolio Manager at Next Edge Capital, joined @BNNBloomberg to share his hot picks in biotech. Watch the interview here: https://t.co/XBhPXzaame

#AlternativeInvestments #NextEdgeCapital #Biotech

bnnbloomberg.ca

Eden Rahim, portfolio manager & options strategist at Next Edge Capital, joins BNN Bloomberg to share his Hot Picks in biotech.

1

2

3

10 day Equity Put-Call ratio at 0.52. Not exactly a low risk point to enter the market as risk dukes it out with FOMO. $SPY $QQQ $IBB $XBI $MTUM

0

0

2

Today was the S&P's worst breadth day ever for an "up" day. Since 1990, the S&P has never had weaker breadth on a day that it closed positive. The index closed up 0.23% with a net advance/decline line of -294. There were 104 stocks up and 398 down. 🤮

190

423

2K

Addison Barger just hit the first pinch-hit grand slam in World Series history.

285

2K

29K