Aptus Capital Advisors

@DrawdownPatrol

Followers

317

Following

6

Media

96

Statuses

233

Specialists in risk-mitigated investing, using options to reduce the portfolio drag of bonds https://t.co/nzHaXYhQWo

Fairhope, Al

Joined July 2020

Happy 5th birthday to the Aptus Collared Investment Opportunity ETF (ACIO)! We see it as an ideal vehicle to empower portfolios with more equity capture while risk-neutral + improved tax efficiency. Learn more about the Fund’s standardized performance: https://t.co/qkzL9aQgQ6

0

1

2

"Minimizing unnecessary distributions is one of the easiest wins available." via Brian Jacobs https://t.co/qRlzspBBdy

0

0

0

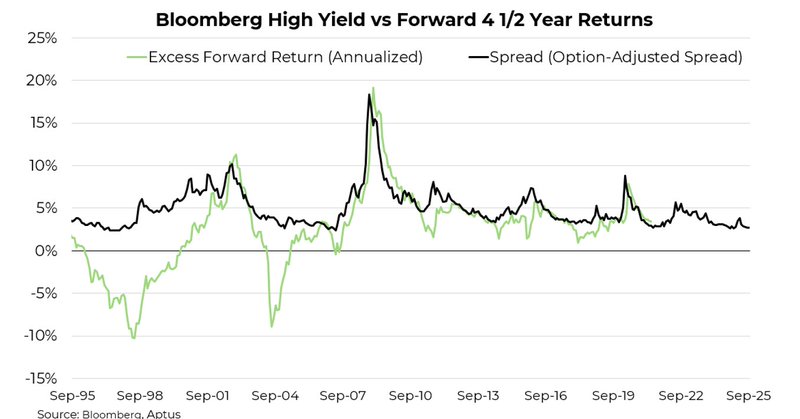

"Historically, the best opportunities in high yield have come when fear is high, not when risk appetite is." via Brian Jacobs

aptuscapitaladvisors.com

At today’s levels, we think high-yield credit offers little value to investors. The yield of the Bloomberg U.S. Corporate High Yield Index sits at just 2.6% above Treasuries of similar duration,...

0

0

0

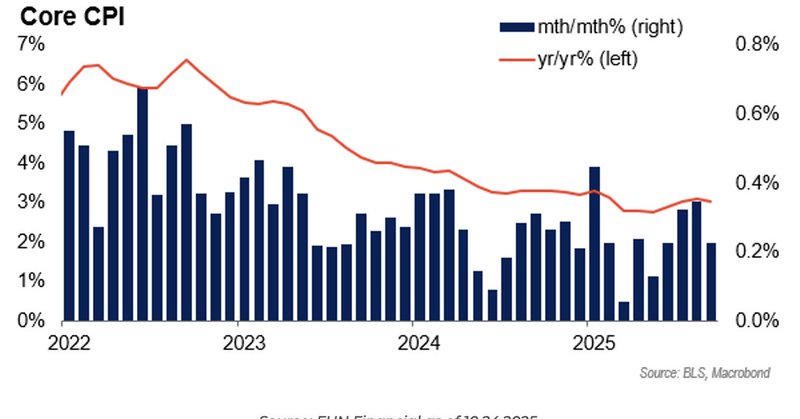

"While the Fed did not need evidence of subsiding inflation to justify a cut, it can’t hurt and will make it easier to cut again in December." via John Luke Tyner

aptuscapitaladvisors.com

The September CPI report, delayed for more than two weeks, was finally released this morning. The September Inflation data is an important number used to calculate the 2026 Social Security cost-of-...

0

0

0

Excited to deliver defined outcome exposures at a more reasonable 25 bps https://t.co/7LyT6D76Zt

0

1

0

"If the objective of investing is to preserve and/or grow purchasing power, then risk tolerance should be thought of differently." via JD Gardner https://t.co/mtEWs71j02

0

1

2

"There are whipsaw risks involved with both scenarios but the end result likely leads to the same place: stickier long-term yields." via John Luke Tyner https://t.co/oYQ0Eiw415

0

0

0

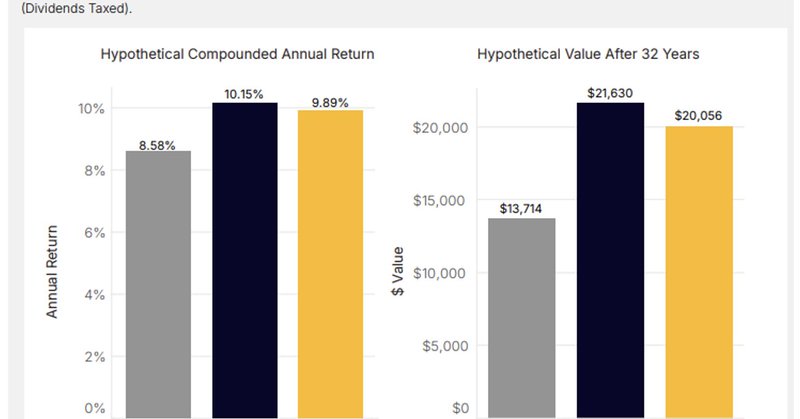

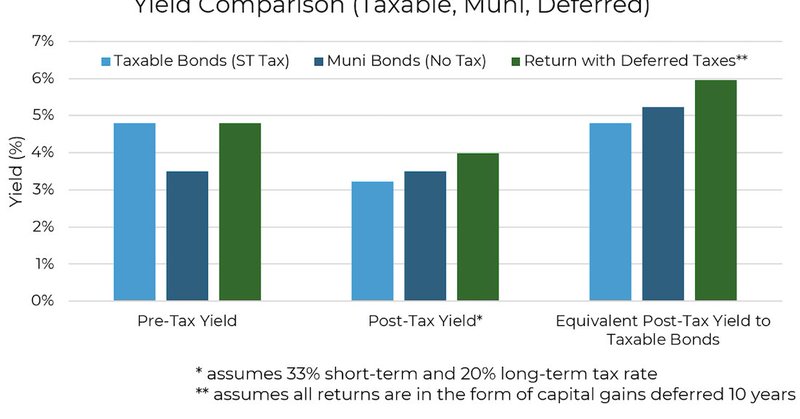

"By deferring income and letting your capital work, you turn what would have been an immediate tax bill into future growth that will be taxed a lower rate." via Brian Jacobs https://t.co/89ckiGd1U4

0

0

1

"At some point, the Fed’s commitment to the 2% inflation mandate will begin to lose credibility, as they perpetually say they will meet mandate in two years while continuing to not deliver." via John Luke Tyner https://t.co/vrH7SixjLt

0

0

1

"New ETF innovations address the last mile of tax inefficiency and give investors the chance to keep more of what markets deliver, which is the whole point." via Brian Jacobs

aptuscapitaladvisors.com

Over the past two decades, ETFs have become the vehicle of choice for investors. They are liquid, transparent, low-cost, and viewed (often correctly) as highly tax-efficient compared to mutual funds....

0

0

0

"Many of the supply/demand imbalances in the municipal market are improving, and it could be argued that they have been overdone." via John Luke Tyner https://t.co/xug2x4U8Fn

0

0

0

"A high margin-to-stock market cap ratio might indicate more fragility, but it won’t tell you when the next correction will hit." via Brian Jacobs https://t.co/IuKdUbCdPl

1

0

0

"In this new age of the market, we are firm believers that tails will occur more often – both negative AND positive." via David Wagner https://t.co/YK6t5iR9e8

0

0

0

"The presence of hedges, and the convexity in their payoff in a left tail, allows us to own the risk confidently." good reminder whether stocks are at highs or at lows via JD Gardner https://t.co/s1yQWscDIP

0

0

3

Thankful for family, friends, and freedom. Hope you have a wonderful long weekend!

0

0

0

From our Brian Jacobs via @CBOE "By integrating options-based tools, data-driven market signals and tax-aware implementation, advisors can create more stable, flexible and behaviorally resilient portfolios." https://t.co/SdLHonutCw

0

1

1

Our Brian Jacobs talking with Ryan Nauman about the dueling risks of drawdown and longevity, and innovation in ETFs that are helping tackle both https://t.co/GEGsQTpfBX

0

0

1

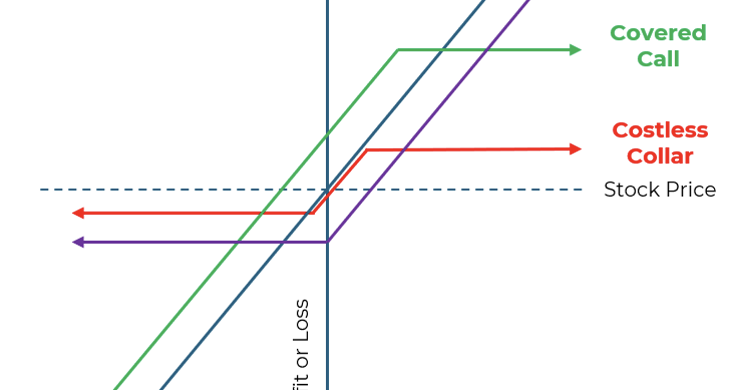

"Flexibility allows for the possibility of capturing more upside in favorable markets while still offering some downside defense when needed." via Brian Jacobs

aptuscapitaladvisors.com

In the world of options trading, the term “zero-cost collar” often suggests a strategy that offers downside protection without any costs to the investor. However, while the strategy may not require...

0

0

2

"The boring reality is that the term premium reflects the hedging properties of government bonds." via John Luke Tyner https://t.co/9z9HLEaej9

0

0

0

There's no way to show the full gratitude we have to the families of those who made the ultimate sacrifice, for our benefit

0

0

1

"An investment approach that focuses on total return while limiting taxable distributions opens the door for better portfolio construction across taxable and tax-advantaged accounts." via Brian Jacobs

aptuscapitaladvisors.com

When investors evaluate fixed income strategies, the first question is usually about yield. What’s the income? What’s the payout? That focus is understandable. Yield is easy to measure, and there’s a...

0

0

2