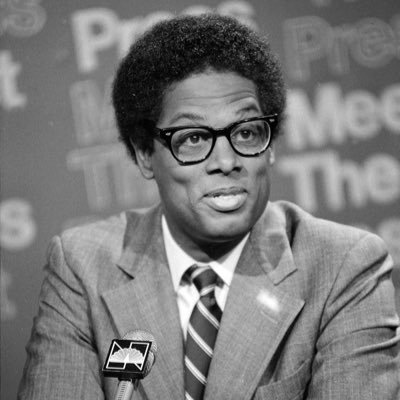

David Nicholas

@DavidANicholas

Followers

11K

Following

9K

Media

1K

Statuses

5K

Husband. Father. Entrepreneur. Defender of free markets. CEO of @NicholasWealth. PM of $BLOX $GIAX $FIAX Talk on tv. Job 5:9

Atlanta, GA

Joined July 2010

Excited to share more about our new ETFs. Thank you for your trust and support!

Introducing the newest ETFs in the XFUNDS suite! $GLDN- Nicholas Gold Income ETF $SLVX- Nicholas Silver Income ETF $WEPN- Nicholas Defense and Rare Earth Income ETF $NUKX- Nicholas Nuclear Income ETF We can't wait to share more about these exciting funds. Thank you for your

32

10

196

Thanks to @cvpayne for having me on today to talk about homeownership and the American dream.

BREAKING🚨: @CanadaKaz talks $OPEN on @FoxBusiness TODAY with @cvpayne. “Everyday we wake up at @Opendoor… thinking about how we can make the average home, for the average family, better, more affordable, less frightful.” 💭

44

88

753

Market turbulence calls for balance. Gold could help your portfolio hold steady.

5

6

141

This is for informational purposes only. It should not be considered as investment advice or as a recommendation of any particular strategy or investment product. This post is not a solicitation or an offer to buy or sell any specific security.

0

0

6

Google’s real “secret weapon” is still search: 2B+ daily users vs. OpenAI’s ~500M. And while OpenAI hopes to hit $20B in revenue this year, $GOOGL has already done $400B with $80B in free cash flow. That’s the kind of balance sheet that can outspend anyone in AI.

42

55

949

This is for informational purposes only. It should not be considered as investment advice or as a recommendation of any particular strategy or investment product. This post is not a solicitation or an offer to buy or sell any specific security.

2

0

5

Lenders can more easily work with state and local agencies to find grants and programs that may help borrowers afford a home thanks to our streamlined resources. Learn how.

0

5

42

A bitcoin rebound is incoming. The $80–85K support zone is holding, signaling a short-term bottom. I joined @Varneyco on Fox Business to discuss why I believe $BTC will be back to all-time highs by late Jan–mid February.

16

13

143

“The first lesson of economics is scarcity: There is never enough of anything to fully satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.” — Thomas Sowell

70

520

2K

Happy Thanksgiving from the entire XFUNDS team! Thank you for your trust and support of our ETFs. We pray this is a blessed year for you and your family.

2

3

168

This week's economic update I talk about the miracle of the first Thanksgiving:

nicholaswealth.com

Secure your future with Nicholas Wealth Management's expert retirement and financial planning services. Schedule a meeting with an advisor today!

2

2

28

BEFORE INVESTING YOU SHOULD CAREFULLY CONSIDER THE FUND’S INVESTMENT OBJECTIVES, RISKS, CHARGES AND EXPENSES. THIS AND OTHER INFORMATION IS IN THE PROSPECTUS, A COPY OF WHICH MAY BE OBTAINED FROM https://t.co/oThlvc9Llk PLEASE READ THE PROSPECTUS CAREFULLY BEFORE YOU INVEST.

1

0

18

Two top programs. One unforgettable night. Arkansas & Houston bring big time college basketball to the Garden State at Prudential Center on Saturday, December 20 for the 2025 Never Forget Tribute Classic! Buy your tickets today.

0

1

2

Still a lot of work to be done, but grateful for 10% up days. Keep yourself in a position to recover!

30

9

276

$IBIT short interest has plummeted. It wasn't exactly high to begin with at 2% of shares, but it's almost back to where it was in April bf rally. Traders tend to short into strength and cover in downturns, according to S3 Partners, who added in all ETFs for context..

22

59

506

$BLOX up ~ 7.5% today Beautiful! Who else bought the dip last week?

9

6

91

Governor Ron DeSantis just endorsed Blaise Ingoglia for CFO! Watch the video below to learn why Governor DeSantis says, “This is one of the easiest choices Conservatives will ever have!”

0

0

4

“This time is different” It always feels that way when markets are selling off, but I would encourage you to fight the urge to feel like something has fundamentally shifted and the markets can’t recover. (In this case particularly crypto markets) Markets always recover. One

24

17

212

It’s really perplexing how bearish the sentiment was on Wall Street going into $NVDA earnings. I still think many are underestimating how big the market and profit potential driven by AI will be. The market isn’t even pricing in the demand for autonomous driving and the boom that

10

7

131

$NVDA huge beat on revenue and earnings. They prove once again that the AI spend is not slowing down. Well done!

8

8

142