Crypto Tax Girl

@CryptoTaxGirl

Followers

34K

Following

6K

Media

232

Statuses

5K

We're here for all of your crypto tax needs! We offer crypto reports, tax returns, consultations, and a crypto tax course 🇺🇸 [email protected]

Joined February 2018

I just got accepted into @ycombinator’s Startup School and I am PUMPED! I can’t wait to work with some awesome advisors on how to make Crypto Tax Girl better. Yay for learning and improving 🙌🏼.

16

14

276

“Hong Kong applies no capital gain tax to crypto investment, making it a huge incentive for investors” . Hey @IRS take some notes from Hong Kong! 👍🏼.

Hong Kong is taking an increasingly important role when it comes to blockchain and cryptocurrencies:

11

60

230

Second distributions are coming from Celsius and here's the TDLR:. - The distributions will be made in BTC (instead of BTC, ETH, and Stock).- The distribution will be 2.53% of your claim.- Distributions will be made based on an effective BTC price of $95,836.23. Example below ⬇️.

Celsius will soon begin a second distribution of $127 million made available from the Litigation Recovery Account to eligible creditors (Classes 2, 5, 7, 8, and 9). Distributions will be made in BTC or USD, based on eligibility. For more details, please refer to this notice:.

114

3

95

Excited to announce that another baby boy will be joining our family this summer! #20weeks. (Sorry if I haven’t been good about answering your emails the last few months… now you know why 🙃)

21

2

122

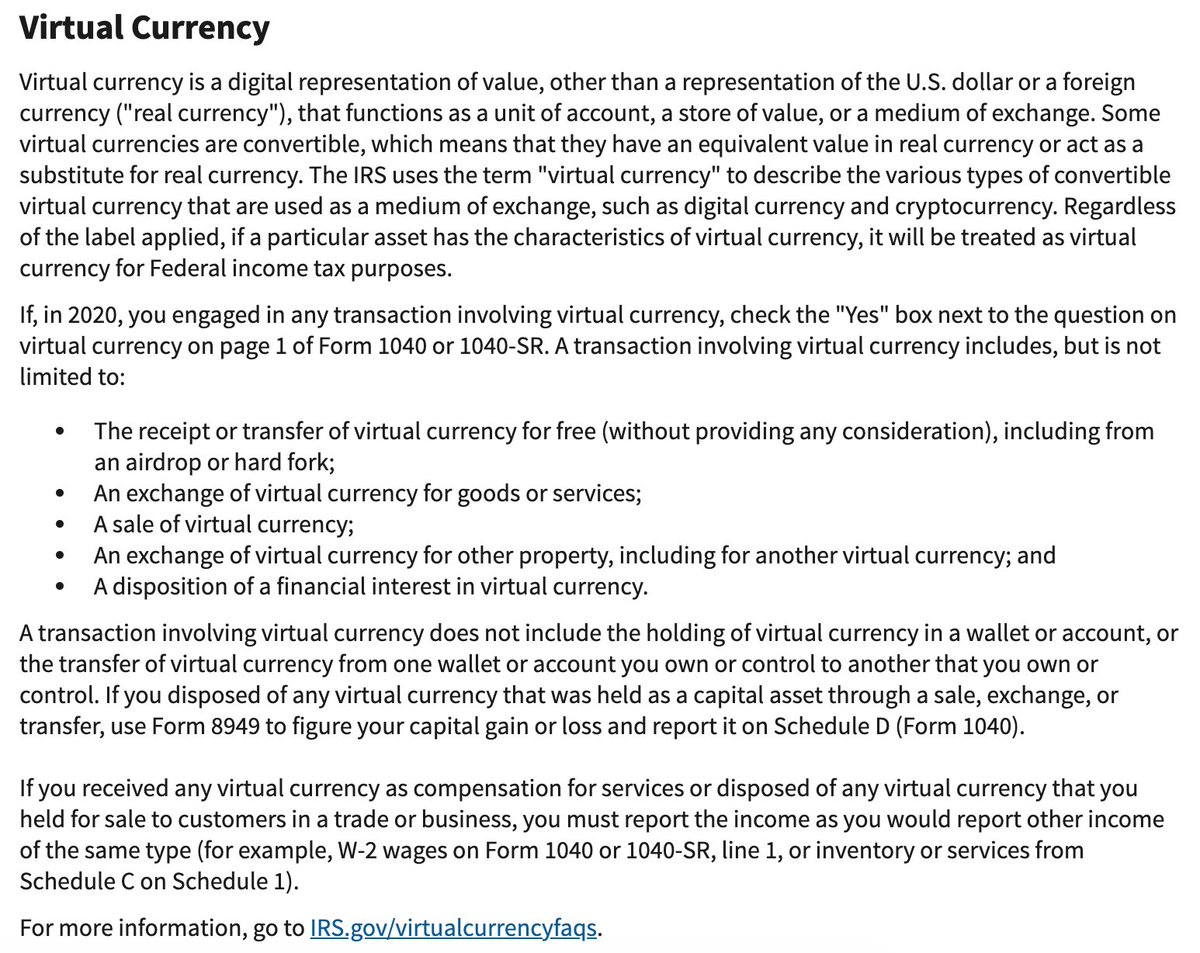

According to a recent article by @Forbes, you don't need to report crypto holdings on your FBAR:. "the Treasury Financial Crimes Enforcement Network has recently decreed that cryptocurrency accounts held by exchanges located outside the country don’t have to be disclosed.".

17

38

114