Cork Protocol

@Corkprotocol

Followers

4K

Following

3K

Media

301

Statuses

2K

The tokenized risk protocol. Hedge, trade, and earn on the risk that stablecoins, LSTs, & LRTs lose their peg. Accelerated by @a16zcrypto CSX and @OrangeDAOxyz

Ethereum

Joined March 2024

🍾 Cork has launched its beta on Ethereum Mainnet! We’re introducing a new DeFi primitive that tokenizes the risk of depeg events. With our key launch partners @lidofinance, @ether_fi, @ethena_labs, and @skyecosystem, Cork is initiating a new phase of DeFi defined by more

97

112

570

The DAT playbook in one thread

Why is everyone launching Digital Asset Treasury (DAT) companies? Let’s explore the fundamentals of the DAT model and why it is a beautifully orchestrated arbitrage ponzi that has accumulated over 80b$ of crypto assets 👇 The arbitrage method The core objective of a DAT is to

0

1

7

The DAT playbook in one thread

Why is everyone launching Digital Asset Treasury (DAT) companies? Let’s explore the fundamentals of the DAT model and why it is a beautifully orchestrated arbitrage ponzi that has accumulated over 80b$ of crypto assets 👇 The arbitrage method The core objective of a DAT is to

0

1

7

The DeFi edge belongs to @katana

0

0

6

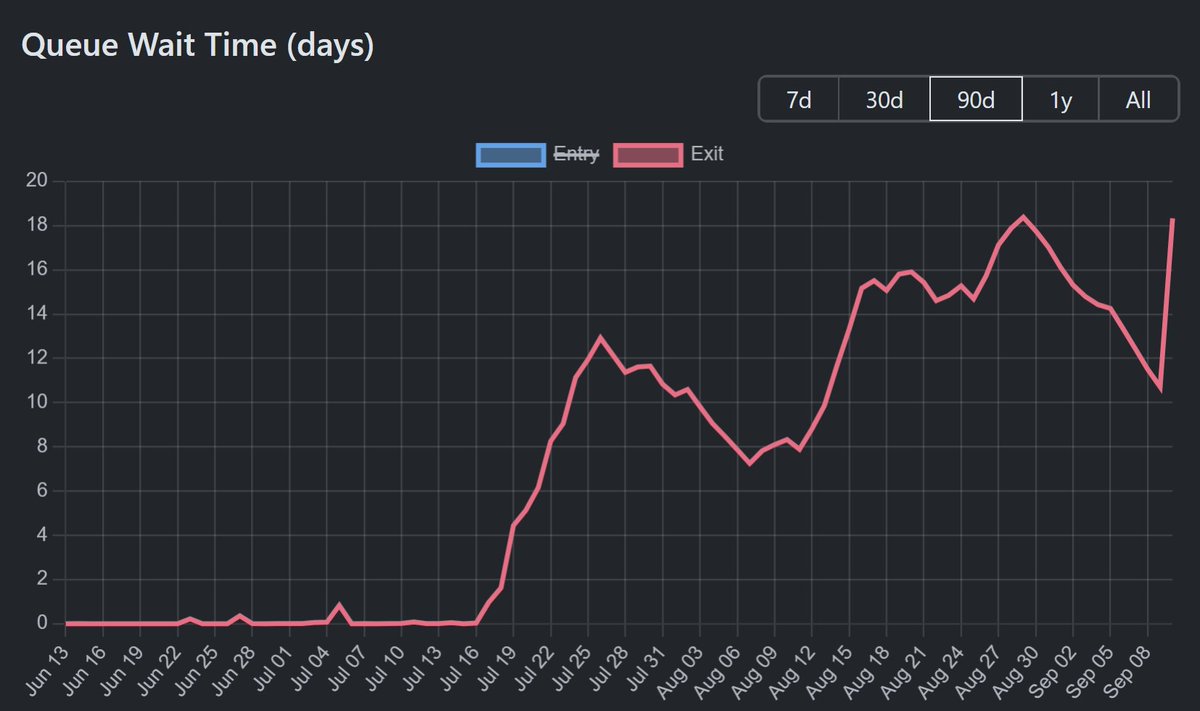

As the validator exit queue reach new all-time-highs, it is time for us to re-underwrite the duration risk and liquidity profile of LSTs/LRTs Recently @Kiln_finance rotated 700k ETH and are about to rotate another 900k ETH for security reasons. This results in continued exit

3

4

19

Understand the risks behind DATCOs like @Strategy in @robdogeth’s new OpEd!

OPINION 🗣️ Are crypto treasury companies a marvel of financial engineering or a ticking time bomb? via @robdogeth

https://t.co/A6bxcPGpwn

1

2

11

Understand the risks behind DATCOs like @Strategy in @robdogeth’s new OpEd!

OPINION 🗣️ Are crypto treasury companies a marvel of financial engineering or a ticking time bomb? via @robdogeth

https://t.co/A6bxcPGpwn

1

2

11

Anyone can find yield in DeFi Few can price the risk behind it

1

1

17

DATs add votes. But they don’t add weight. In the long run, only strong protocols and real adoption matter. Still, this is one of the most important trends in the crypto x TradFi merge. Full story here 👇 https://t.co/Zh6RLgieBD

cork.tech

DATs use NAV arbitrage to boost crypto yield per share. This post explains the mechanics, risks, and why they’ve attracted $80B+ in assets.

0

0

2

So why are DATs everywhere? Because they open new pockets of capital. They’re a crypto-flavored IPO. HYPE, ENA, SOL all have DATs with hundreds of millions. And more are coming.

1

0

2

Most ETH DATs avoid it. But Saylor’s Strategy is sitting on $5.2B in debt. If they lever up into a downturn, the unwind could hit like a 3AC repeat. That’s the tail risk.

1

0

1

That’s why calling DATs a “ponzi” is half true. The yield depends on new buyers keeping the premium alive. But the structure works in both directions, mint on the way up, buyback on the way down. The only real blowup risk? Leverage.

1

0

1

DATs live off the spread between NAV and market cap. If mNAV > 1 (stock trades above NAV): DATs issue shares, buy crypto, and boost holdings per share. If mNAV < 1: They buy back stock, selling crypto to boost per share value. Accretive both ways.

1

0

1

Think of DATs as yield ponzis in a tuxedo. They’ve stacked $80B already and the game is still on. Time to see what’s under the suit 🧵

1

1

15

Duration risk is the hidden killer in DeFi. It wrecked $stETH loops with a 12-day exit queue. It blocks RWAs from scaling into trillions. If DeFi can’t solve duration, it can’t become real credit markets. Read the full deep dive 👇 https://t.co/MbRhwTpdoS

cork.tech

Learn how duration risk disrupts looping trades, limits RWA adoption, and the solutions shaping the next growth wave.

2

1

10

Duration risk is the hidden killer in DeFi. It wrecked $stETH loops with a 12-day exit queue. It blocks RWAs from scaling into trillions. If DeFi can’t solve duration, it can’t become real credit markets. Read the full deep dive 👇 https://t.co/MbRhwTpdoS

cork.tech

Learn how duration risk disrupts looping trades, limits RWA adoption, and the solutions shaping the next growth wave.

2

1

10

Ethereum is not the World Computer anymore It is the Internet Debt Machine 55% of stables sit on L1 80% with L2s $8B in RWAs live today Bond market, but onchain

0

1

16

Every dollar that enters DeFi will eventually touch a vault

0

0

5