Cavendish

@Cavendish_plc

Followers

3K

Following

1K

Media

642

Statuses

5K

Cavendish is a full-service investment bank and trusted advisor to ambitious growth companies and their investors.

London

Joined July 2013

With the merger of Cenkos Securities and finnCap Group completed, we are pleased to announce today the launch of Cavendish, a full-service investment bank for ambitious growth companies and their investors.

2

2

4

The Cavendish Quarterly Consumer Note for Q2 2024 focuses on the travel sector, exploring M&A activity driven by renewed consumer spending, positive economic trends, and the ambitions of buyers and sellers. #travel #consumer #traveltrends

0

3

1

Cavendish is delighted to have acted as Sole Sponsor to FTSE 250 company, @bankofgeorgia plc on its 304m acquisition of @AmeriaBankCJSC, a leading universal bank in Armenia, significantly enhancing BOGG’s presence and growth opportunities.

0

11

12

Cavendish is pleased to announce a £5.5 million placing, subscription and retail offer for @XerosTech Technology Group plc securing vital funding to drive forward their commercialisation strategy. #technology #sustainabletechnology

0

3

3

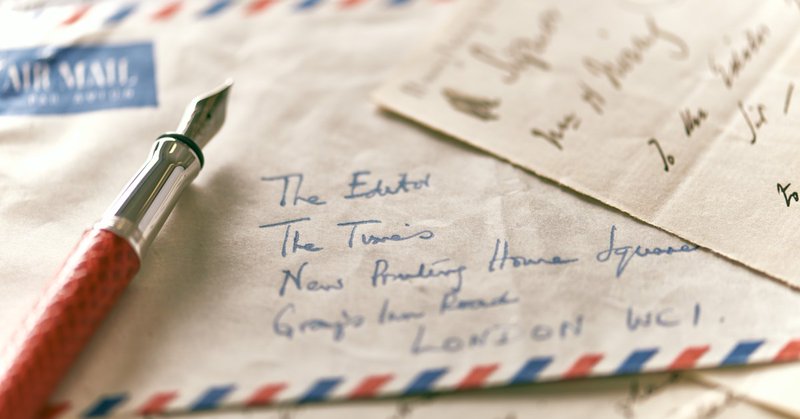

Julian Morse, co-CEO of Cavendish and Howard Leigh, Senior Partner are among the signatories to a letter in today’s The Times. The letter: "Plea for British-style ISA", urges the Government to introduce a British ISA in next week’s spring Budget.

thetimes.com

Sir, The prime minister is urging the police to control the protests in London (“Save Britain from mob rule, Sunak tells police”, Feb 29). Regardless of which side is supported, the protesters should

0

1

3

Cavendish is thrilled to have advised @Rockpool_UK and its portfolio company, @EcElectronics, in raising new debt facilities from @ShawbrookBank to finance the acquisition of Liad Electronics. #DebtAdvisory #Finance #Acquisition #UnitrancheFinancing #PrivateEquity

0

0

5

Cavendish has acted as sole financial adviser to a consortium of climate-focused private equity impact investors, comprising of @Carbon_Direct, Lightrock, @GenZeroT and Kibo Investments, on its refinancing and takeover of @VelocysPLC. #Sustainability #impactinvesting

0

0

1

Cavendish is pleased to announce its appointment as Nomad and Sole Broker to MP Evans Group plc (MPE) (market capitalisation: £392m) a key player in the global palm oil industry. #sustainability #growthbusiness

0

0

1

Since Jan 2022 Cavendish has raised over £105m across 13 secondaries & an IPO in feed additives, representing over 25% of all activity in the #lifesciences sector where approximately £400m* was raised in 2022/3. We look forward to growing our healthcare franchise further.

0

0

1

During 2023, the Cavendish Consumer team in supporting our clients across diverse services such as private growth capital, M&A, and Plc Strategic Advisory within our various consumer sub-sectors. As we start 2024, we aim to expand the services we offer our clients. #consumer

0

0

2

Cavendish advises STM Group on a £39.8m cash offer from Pension Superfund Capital via Jambo SRC (Bidco) & £4.5m MBO of STM Group's SIPPs business. #financialservices #growthcompanies #rule3

0

0

1

Cavendish has acted for Opportunities Ltd's successful £3.4M direct subscription. The additional funds will provide the company with additional resources with which to pursue its stated investing policy. @DowgateWealth #financialservcies #growthcompanies

0

0

0

£23.3bn in enterprise value returned to AIM tech shareholders in 6 years, incl. 10 takeouts in 2023. As UK valuations gain appeal, we analyse trends in AIM tech since 2017. Amid global uncertainties, a fascinating journey unfolds. Read report (£) - #tech

0

0

1

Cavendish is delighted to have acted as nominated adviser in connection with @edenresearch recent Placing. The Company has raised £9.9m through a placing and retail offer. #growthbusinesses #technology #agritech

0

0

1

Cavendish is delighted to be acting as sole Financial and Rule 3 Adviser for Smoove PLC in relation to its all-cash offer from ASX-listed PEXA which is fully detailed here: #businessservices #technology #rule3 #growthcompanies

0

0

1

Cavendish has assisted @ShieldTx in securing $27M for Accrufer® growth, debt repayment, and future investments, enhancing its market potential. #healthcare #pharmaceuticals

0

0

0

Highlighting the strength of British #Entrepreneurship and innovation. In today's Evening Standard, learn how we are supporting ambitious growth and investment companies to foster economic resilience and optimism.

standard.co.uk

City Voices: Growth companies need more support

1

1

3