Caleb Franzen

@CalebFranzen

Followers

61K

Following

150K

Media

19K

Statuses

67K

Analyst.

Join Cubic Analytics:

Joined June 2020

This is my complete bear market playbook for Bitcoin. I don't relish sharing this. I hope it's all useless. But if I'm right (BTC stays under the 2-day 200 MA cloud), then this could be the most important report that I've ever published. https://t.co/h4kVFBkthJ

substackfwd.xyz

Analyzing key data on the economy, the stock market, and Bitcoin.

13

12

136

Another Bitcoin pump gets dumped. Just when it felt like bulls had a chance to tighten their grip. It's a chop fest within a 2.5 month downtrend.

13

8

73

Power your home for less. Generate clean energy from the sun and save every month with Tesla Solar.

0

381

4K

Without question, equities are still in a bull market. How do I know? First of all, a bunch of indices, sectors, & thematic ETFs are making new all-time highs, but... Stocks are making new ATHs relative to Treasuries. This SPY/TLT scenario is what I outlined in November.

4

3

40

The MSTR/IBIT ratio is going to be a secret weapon. If it keeps making new lows, like it has been, then that's a sign of low bullish conviction and decreasing risk appetite. If investors were really bullish on BTC over the short-term, wouldn't they be loading up on MSTR? (yes)

$MSTR underperforming $IBIT, once again. Like clockwork at this point. Here's the chart of MSTR/IBIT... Currently down -66% from the high print last November.

14

4

54

$MSTR underperforming $IBIT, once again. Like clockwork at this point. Here's the chart of MSTR/IBIT... Currently down -66% from the high print last November.

6

3

27

“Fantasy Life i” NOW ON SALE! This is your other life! Enjoy an adventure that transcends time and space!

2

5

120

@StockMktTV But in an ideal situation, it would be nice to see these stocks participate meaningfully by breaking above key structural levels. Because what kind of bull market is it without speculative tech/software/IPOs? If/when these go, that'll be great uptrend confirmation.

0

0

7

@StockMktTV All of these "high-risk" and speculative areas of the market still haven't produced the breakout that we'd expect to see during a bull market environment. That doesn't mean we aren't in a bull market. Clearly, we are. Look at financials, industrials, equal-weight, value, etc.

1

0

8

The coming years will split companies into two groups: those that become AI-native and those left catching up. The innovators who harness AI now will define the winners of tomorrow. Follow me for strategic insights on leading through the AI revolution.

16

21

229

$ARKK is a great risk-on barometer for the stock market. Personally, I want to see it break above this 50% to 61.8% range, like I talked about on the podcast last week with the guys at @StockMktTV. It can happen. Some might even expect it to happen. But we need to see it.

3

3

22

The S&P 500 is retesting its AVWAP from the all-time highs.

4

2

19

S&P 500 futures don't look bearish, whatsoever. Very similar to gold's setup, which already achieved the breakout. Let's see if stock market investors can hit the home run going into the Santa Claus Rally...

9

5

47

Let me ask this question differently... Suppose you had $1M to invest & decide to make three purchases of $333.33k to DCA. You do not know what path the price will go, but suppose it ends up the way I've drawn it. Would you rather make those 3 DCAs in green or in blue?

18

2

28

Our CRM was built for businesses that want to grow smarter.🌱 Automate tasks, manage leads, and close more deals!

13

19

285

Bitcoin's bear flag (regression channel) is invalidated. That's a win for the bulls, finally. Ideally, their next accomplishment will be a higher high above $94.7k (intraday highs on December 9th).

22

16

145

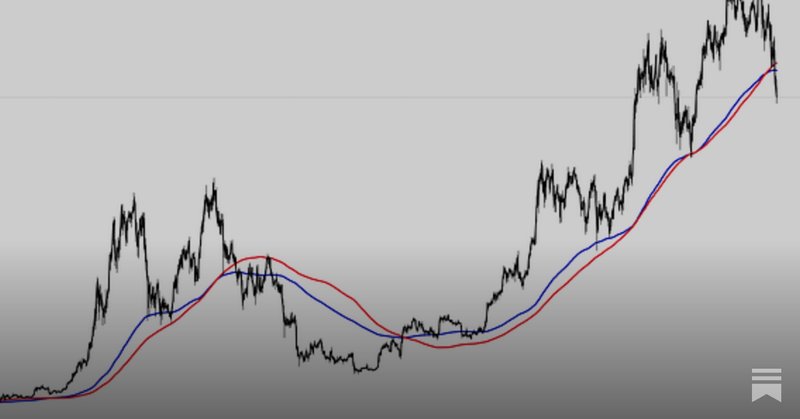

Why is this AVWAP so important? B/c it's rare for investors to be in profit during a downtrend. If price > AVWAP from the highs, then the average investor from the highs is in profit, which means that the downtrend is likely over. Another key level in the $97k to $102k range.

1

1

20

It's too obvious. Since the all-time highs, Bitcoin is in a downtrend. That's a fact. By using the AVWAP from the ATHs to measure the aggregate cost basis since the highs, a new uptrend could begin with the price of Bitcoin breaking above the AVWAP. That level is $101.5k.

5

4

51

Our playbook for executing as an AI-first company: - AI principles that come before deployment - Governance that accelerates, not slows down - 2x2 framework for choosing the right bets - Three-tier value lens: productivity → automation → net-new work Read more.

0

1

7