Calculus

@CalculusFinance

Followers

12K

Following

16

Media

27

Statuses

68

First multi - agent LP intelligence system on BNB Chain. Real yield. Real execution. DC: https://t.co/LCyaqoPj2X

Joined June 2025

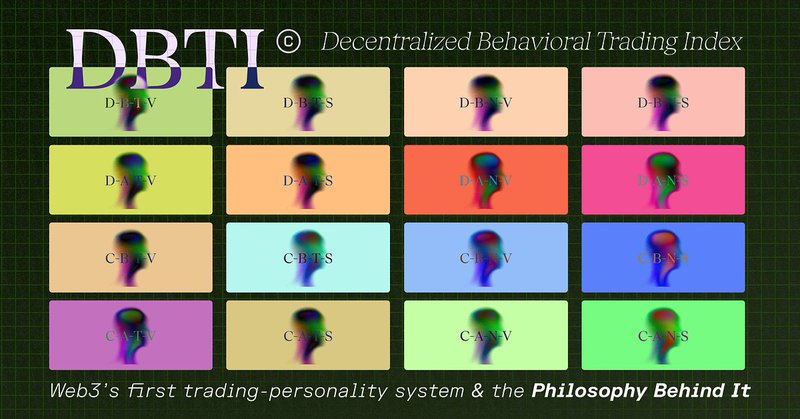

We don’t just trade markets. We trade as who we are. DBTI is a system that asks: “What does a strategy feel like when it gets you?” A human-centered approach to algorithmic LPing: https://t.co/jNEdkAEJsB

medium.com

When Strategy Aligns with Personality, Humans Find Certainty Amid Uncertainty

8

1

21

DBTI Battle Royale begins. 4 weeks. 16 teams. 1 winning team. Round 1: Free-for-all — top 8 types advance Round 2: Matchups chosen by the community: 8 -> 4 Round 3: Semifinals: 4 -> 2 Round 4: The Final Showdown: 2 -> 1 This is not a simulation. Every LP position earns real

12

0

13

In a market like this, the alpha might be just within you. Champs, stay positive, stay resilient — just like your LP positions with Calculus. Discover your trading Characters with DBTI and unlock AI-powered LP strategies tailored to you. Early birds get the worm, smart trader

9

1

12

We build strategy systems that can be trusted — because they’re verifiable. Our latest smart contract audit is now live, conducted by @Beosin_com. Result: Passed ✅ Status: No critical or high-risk vulnerabilities. Report: https://t.co/UdzNqV7yW6 Transparent infrastructure.

10

1

16

Just took the DBTI test — turns out I’m the Community Bartender. Anyone need a drink after today’s market? Test your DBTI here: https://t.co/5pZQUCyVDA

10

2

21

Fit → Trust → Adoption AI should learn about you, not the other way around. With DBTI as the core of our SENSE agent, your personality, wallet behavior, and asset mix shape a personalized LP strategy—built just for you. Powered by CALCULUS Intelligence — always learning,

10

3

20

@CalculusFinance 🤝 @BOOM_FND A new link between real-world signals and policy-bound execution. AI → Incentive → Plan → Yield This is what it looks like when agents talk across layers. #BNBChain #AIinDeFi

12

2

25

Remember LP Dracula? He didn’t use Calculus. Now he’s back… ...to warn you not to end up like him. Rest In Pieces or Rebalance Smart You decide. #DeFiHalloween #CLMM #Calculus #Aiagents

16

2

24

Campaigns with edge meet LPs with execution. @XerpaAI x @calculusfinance AI-driven strategies, on-chain results. Let’s optimize capital — everywhere. #AIAgent #AI #DeFi #CLMM #LP

<Partnership Announcement> XerpaAI × Calculus We’re joining forces with @calculusfinance, the first multi-agent LP intelligence system on BNB Chain. Together, we bring AI-driven growth + on-chain intelligence, turning real yield into real execution. Smarter campaigns. Verified

10

0

16

5/ Vision: From vaults → agents. A vault stores. Calculus trades. Coordinated agents execute as one unified LP — explainable, modular, non-custodial. Built natively for @BNBCHAIN. Follow us for upcoming deep dives into: Each agent type How policy-bound Plans evolve

0

1

1

4/ Roadmap Stage 1 – Intelligence ✅ → 180d on-chain learning + risk profiling → personalized strategy + auto-rebalancing Stage 2 – Studio → Plan approval flow, A/B tests, attribution by Fee/IL/Cost Stage 3 – Network → Conditional plans, agent-to-agent services Stage 4 –

1

1

1

3/ Our answer: LP Coordinates — not guesswork. Range balances Fee Density ↔ IL Risk (sweet spot ≠ too narrow or too wide) Frequency impacts execution cost (too high = gas/slippage loss) ⛓️ Agent pipeline → non-custodial, policy-bound Plans: Sense = PPA+MMS Synth = SSO

1

1

1

2/ ❌ The problem today: Capital stuck in staking (2–8%) External MMs are costly or opaque CLMMs punish bad LPs (missed fees, IL) TVL & points ≠ health Vaults = one-size-fits-all, no strategy explainability

1

1

1

3/ Framework — LP Coordinates (not guesswork): • Range balances Fee density ↔ IL exposure (sweet spot ≠ too narrow/too wide) • Frequency controls execution cost (avoid high-frequency no-go zones) Agent pipeline → policy-bound plans you sign (non-custodial): Sense =

0

0

0

2/ Problem: capital stuck in staking (2–8%); external MMs are costly/opaque. Retail is gated; CLMM is unforgiving (bad ranges ⇒ IL & missed fees). TVL/points ≠ health; one-size vaults can’t adapt or explain Fee–IL–Cost.

1

0

0

From vaults → agents. A vault stores; Calculus trades. Coordinated agents execute as one market maker on @BNBCHAIN. Pay-per-action. Math projects yield. Automated, customized market-making for everyone. Let’s farm like it’s 2030.

42

958

572