Bitmidas

@BitMidas

Followers

2,461

Following

76

Media

885

Statuses

2,279

15-year veteran, focusing on macro-trading BTC. Sharing observations on Crypto & Marco's economy and providing statistics in the hope to aid your strategy.

Mars

Joined March 2022

Don't wanna be here?

Send us removal request.

Explore trending content on Musk Viewer

Cohen

• 311680 Tweets

#GucciCruise25

• 213066 Tweets

#LeeKnowXGucci

• 200422 Tweets

Liverpool

• 114683 Tweets

Villa

• 102948 Tweets

Aziz Yıldırım

• 97307 Tweets

OpenAI

• 96084 Tweets

Spurs

• 76548 Tweets

Martinez

• 71568 Tweets

ChatGPT

• 62803 Tweets

Diaz

• 61791 Tweets

GPT-4o

• 54265 Tweets

Gomez

• 50570 Tweets

Mourinho

• 47710 Tweets

gracie

• 40536 Tweets

Klopp

• 30733 Tweets

Lions

• 27331 Tweets

#KızılGoncalar

• 26528 Tweets

Lamine

• 26096 Tweets

#AVLLIV

• 23956 Tweets

Vitor Roque

• 23452 Tweets

Duran

• 23069 Tweets

Aleaga

• 22226 Tweets

Meek

• 20416 Tweets

Nunez

• 18206 Tweets

Goff

• 14842 Tweets

Watkins

• 12669 Tweets

Raphinha

• 12396 Tweets

Last Seen Profiles

👀

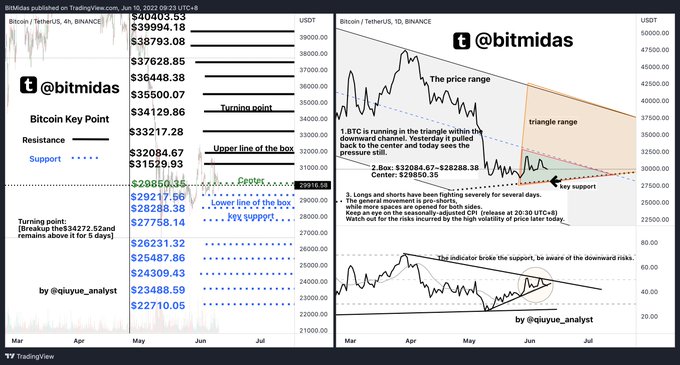

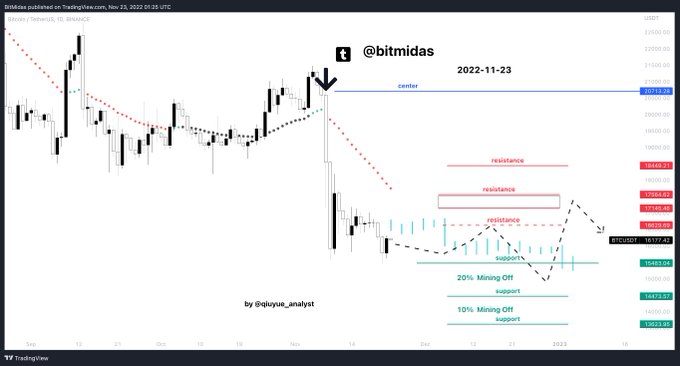

#Bitcoin

Trend Analytics | Mar.16th, 2022

⚠️ Market will be bumpy when it's close to breakout

Let's keep watching at $39876.76 $BTC & Fed's decision on interest rates

🧐See the detailed analysis here👇

72

57

143

📢

#BTCUSDT

Analysis June 9

Yesterday, there was a net outflow of funds, estimated at around $80 million. The long/short ratio remained around 2, with no significant overall changes in the intraday data. The center acts as resistance and the market tends to explore the lower…

7

117

119

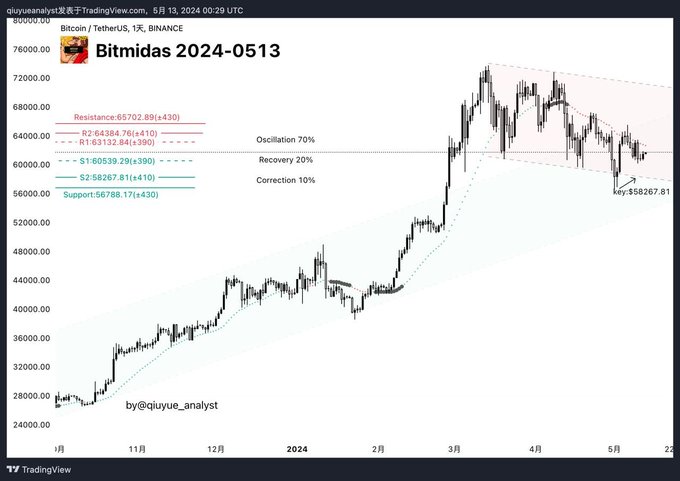

📢

#BTCUSDT

Analysis June 1 📈📉

Yesterday, BTC failed to break above $28,305 and experienced a pullback. The price was suppressed between $28,305 and $28,156, breaking the short-term balance based on previous intraday supports. It reached a low of $26,839.01 but found support…

14

115

116

👀

#Bitcoin

Trend Analytics | Apr.14th, 2022

📐Price is trying to break out of the triangle between $42199.63~$39760.99, with a maximum diversion between $42409.07~$39475.43.

🎯Keep a close look at the triangle and the support at $38263.17.

#BTC

#daytrading

2

5

17

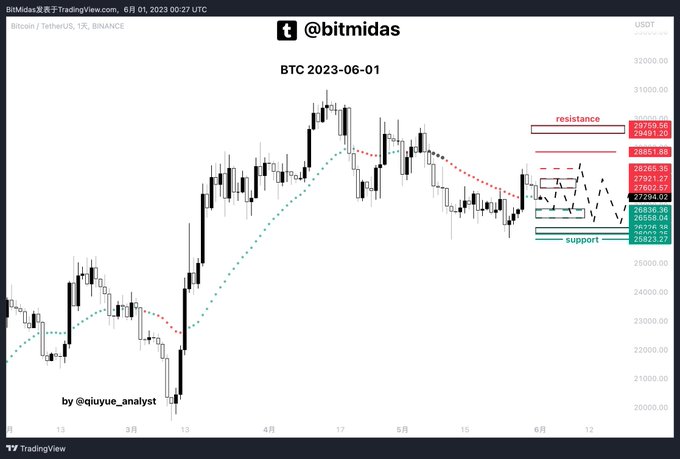

Signals were given on Friday.

#bitmidasrecap

#BTCUSDT

#Bitcoin

Trend Analytics | June 10th, 2022

$BTC Box: $32084.67~$28288.38

🎯 Center: $29850.35

The general movement is pro-shorts, while more spaces are opened for both sides in the box.

Monitor the seasonally-adjusted CPI to be released at 20:30 UTC+8.

FYI👇

#bitmidasdaily

1

1

2

7

3

27

Our chief analyst

@qiuyue_analyst

shares his opinion on how macroeconomics impact BTC and cryptos as a whole. Read the digest and hopefully, it'll help you get prepared for the extreme uncertainty. 🌪️

0

3

18

#Aptos

is definitely a promising asset. What's your idea on the performance of $APT / $USD?

✔️Follow

@BitMidas

+ RT + Like

✔️Comment down below

We're

#Givingaway

free $APT to 10 lucky followers.

#bitmidasgiveaway

16

8

15

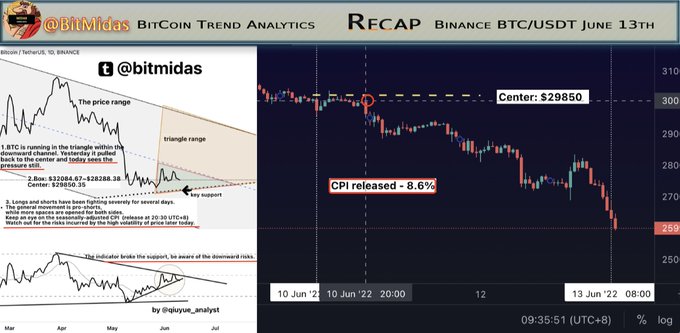

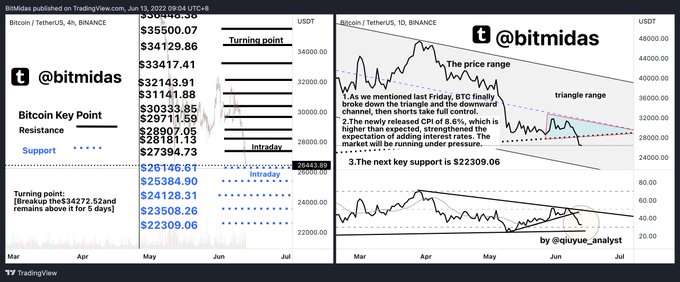

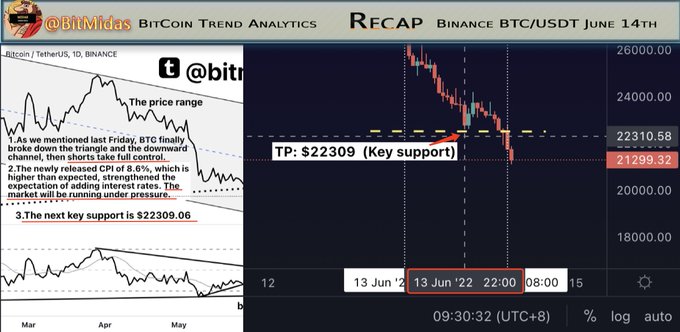

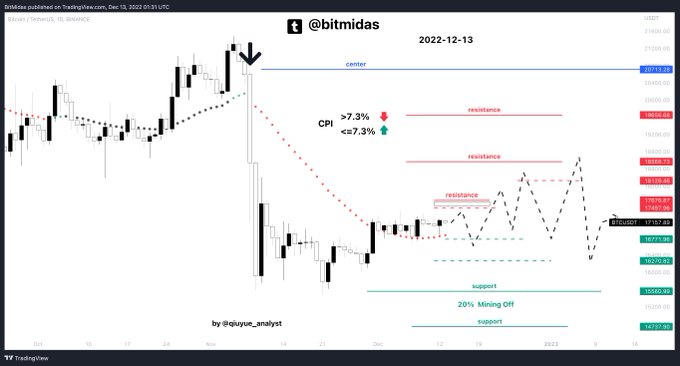

#Bitcoin

Trend Analytics | June 13th, 2022

$BTC Box broken down - mentioned last Friday.

CPI is higher than expected, which strengthened the expectation of adding interest rates.

The market will be running under pressure.

The next key support is $22309.06

FYI👇

#bitmidasdaily

0

1

11

👀

#Bitcoin

Trend Analytics | Mar.14th, 2022

Congestion range: $43912.8~$37017.70

Keep an eye on the center at $39615.5

Multiple testing against $37140~$37017.70

⚠️First target below adjusted to $35351.31~$35009

🧐See the intraday analysis here👇

1

1

8

#Bitcoin2023

May 8

2/ Due to the failed support at $29663, capital did not follow through, leading to a net outflow of around $360 million. Short-term resistance at $29846 continues to suppress the price, with support at $29014-$29183 becoming the range for consolidation.

1

1

2

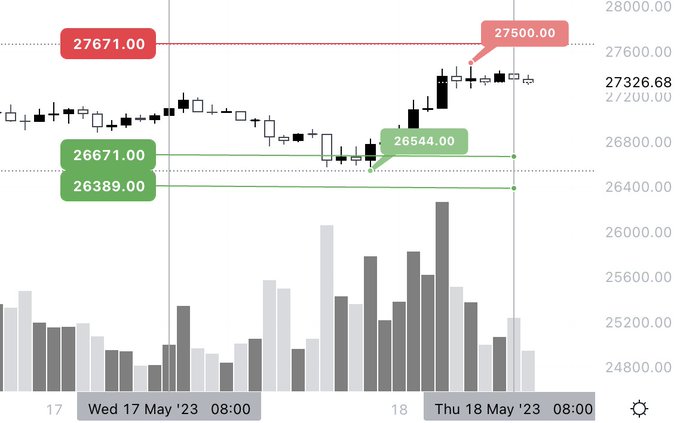

#Bitcoin2023

May 18

1/ Yesterday, BTC showed a weak intraday trend, dipping to $26544 but finding support near the intraday support level.

2/ The market stabilized after Biden's commitment to the US debt ceiling, easing risk-avert sentiment. BTC and US stocks reversed their…

#Bitcoin2023

May 17

$27,000 lost its supportive function as a result of too many tests yesterday. Short-term weak consolidation. Today a narrow range is between $27,389 and $26671. Debt ceiling and interest rate hikes are still uncertain. Set protections.

0

1

1

0

0

2

$ETH Mar 9, 2023

Intraday range:

$1474/$1497/$1515 - $1566/$1592/$1620

Heavy resistance at $1666

Key support at an area between $1455 - $1423.

#CryptocurrencyMarket

#ETH

$ETH

0

1

5

👀

#Bitcoin

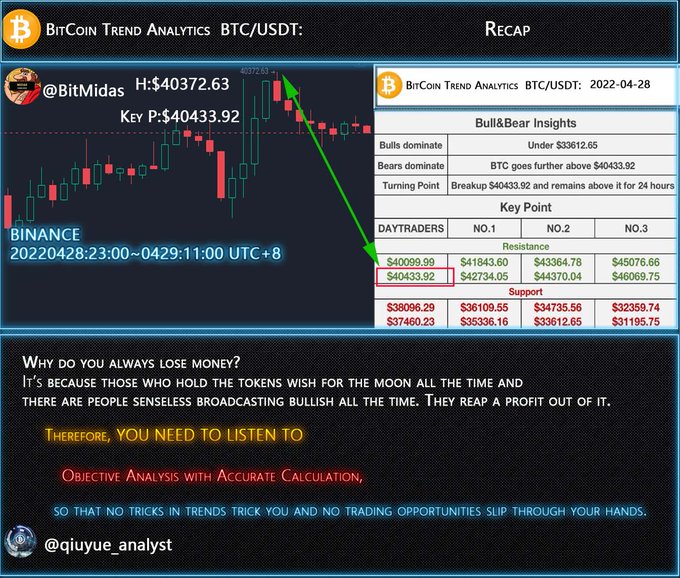

Trend Analytics | Apr 28th, 2022

A breakout could happen anytime in 1-8 days.

🚨Range: upper at $42734.05, center at $40433.92, lower at $37460.23.

Keep looking at how the price goes against the center.

Very important msg, read the chart. 👇

#BTC

#bitmidasdaily

1

1

7

1/

#bitmidasrecap

Yesterday,

#Bitcoin

broke down the key support level of $27817 and dropped to a lowest of $27262. It weakly rebounded after testing the lower support at $27219. The rebound did not stand above $27817, which results in weakness.

#Bitcoin2023

May 8

2/ Due to the failed support at $29663, capital did not follow through, leading to a net outflow of around $360 million. Short-term resistance at $29846 continues to suppress the price, with support at $29014-$29183 becoming the range for consolidation.

1

1

2

2

1

1

#Bitcoin

Trend Analytics | Oct 24, 2022

Intraday movement is ready to challenge higher targets.

The consolidating range now is between $20755.26-$19248.58.

Monitor $19985.96.

See Details👇

#bitmidasdaily

1

2

7

#Bitcoin

Feb 14 2023

The key support today diverts to $21361.59. BTC continues running in the box. The expected CPI annual rate is 6.2%. Scenarios are displayed in the chart.

Only by breaking out the box and taking hold of $22667 could it ends the correction.

Updated TP 👇

0

2

3

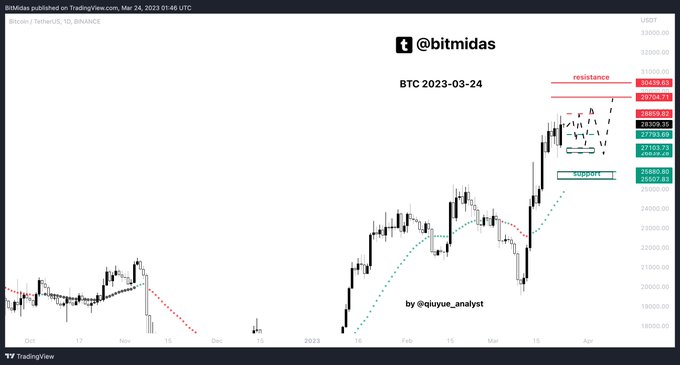

#Bitcoin

Mar 24, 2023

BTC maintained at $27,000, rebounded to $28,868 due to positive news from the US stock market, with Secretary Yellen reassuring banks and providing additional liquidity. The overall trend remains bullish with net inflows and support levels moving higher.

1

2

6

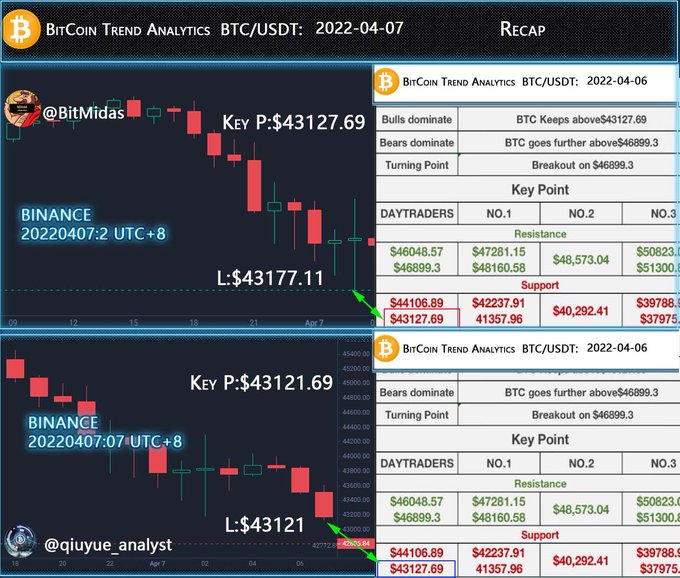

We provide daily target points for trading across all market conditions.

#bitmidasrecap

#BTCUSDT

#Bitcoin

Trend Analytics | June 13th, 2022

$BTC Box broken down - mentioned last Friday.

CPI is higher than expected, which strengthened the expectation of adding interest rates.

The market will be running under pressure.

The next key support is $22309.06

FYI👇

#bitmidasdaily

0

1

11

0

2

5

#Bitcoin

Trend Analytics | Oct 26, 2022

Battleground broke up. Capital inflow has pushed up target points, lifting the consolidation range.

Taking hold of the intraday support will bulls keep challenging resistances.

See Details👇

#bitmidasdaily

1

3

6

#Bitcoin2023

May 6

The market is still recovering and consolidating around the $29539-$29663 resistance. The core resistance is now between $32-35k. While the market is still waiting for the next CPI data, the overall trend is bullish as liquidity is expected to increase.

0

3

4

#Bitcoin

Trend Analytics | Oct 27, 2022

Strong short-term bull run.

The consolidation range is formed between $20782.41-$20831.62.

Breakout the long-term support channel requires a test.

The market expected next interest rate hike: 75bp(87.3%),50bp(12.7%)

TP👇

#bitmidasdaily

0

3

6

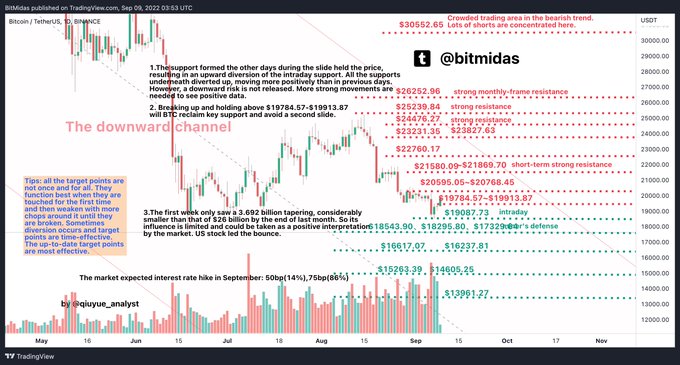

#Bitcoin

Trend Analytics | Sep 9, 2022

Breaking up and holding above $19784.57-$19913.87 will BTC reclaim key support and avoid a second slide.

However, a downward risk is not released.

Keep monitoring the tapering process.

Details & TP👇

#bitmidasdaily

3

1

3

#Bitcoin

Jan 6, 2023

Unaffected by the ADP data, BTC performed quite well, testing the starting point of the weekly resistance at $16987. It keeps chopping between the daily target range before widening to $17486~$16226.

#bottomseeking

👇

#cryptomarket

2

2

5

#bitmidasmacro

☕️

Inflation keeps decline, and we're approaching the end of the Fed’s dot plot. The market is over optimistic, while new risks emerge on the real estate.

As liquidity's pushing up the risk assets, we need extra cautious in strategies.

0

1

2

#Bitcoin

Feb 17, 2023

The gap is filled by more capital inflow. The mid-to-long-term bullish trend continues. On the day frame, it’ll test and take every resistance step by step. 1-2 days are required to recover the loss of the bulls.

#bottombuilding

👇See chart for details

6

2

5

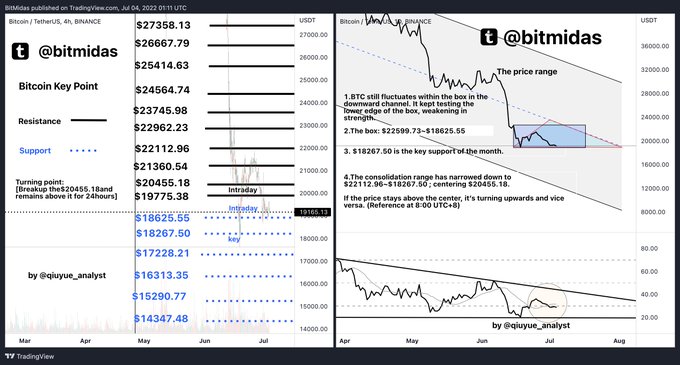

#Bitcoin

Trend Analytics | July 4th, 2022

The consolidation range narrows down to:

✡️$22112.96~$18267.50(also the key support of the month), centering $20455.18.

The box today: $22599.73~$18625.55

FYI👇

#bitmidasdaily

0

0

3

0

1

5

#Bitcoin

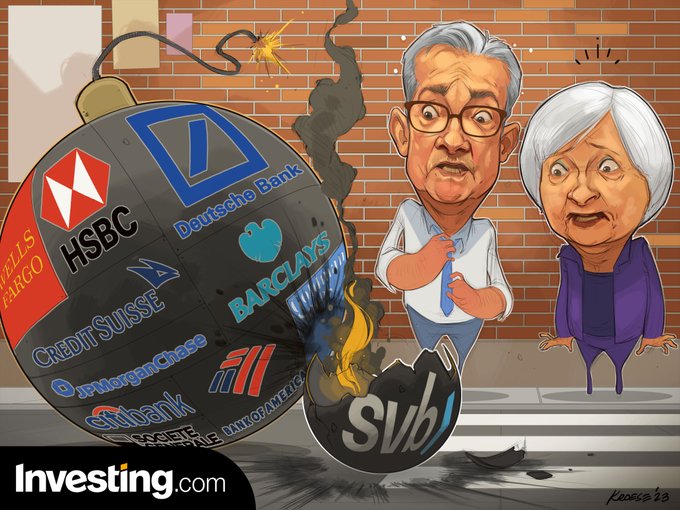

Mar 10, 2023

Silicon Valley Bank crashed and drag down the S&P500. BTC saw a capital outflow of over $5 billion. Day-frame bearish trend continues. $17034 is the bottom of this small bullish trend. More negative news in the air.

Updated TP 👇Long-term

#bottombuilding

0

1

5

#Bitcoin2023

May 17

$27,000 lost its supportive function as a result of too many tests yesterday. Short-term weak consolidation. Today a narrow range is between $27,389 and $26671. Debt ceiling and interest rate hikes are still uncertain. Set protections.

0

1

1

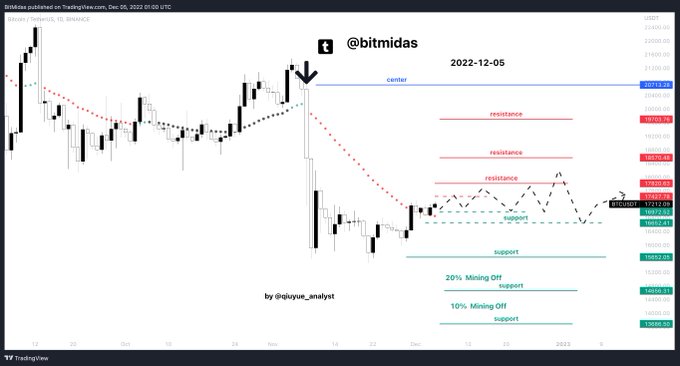

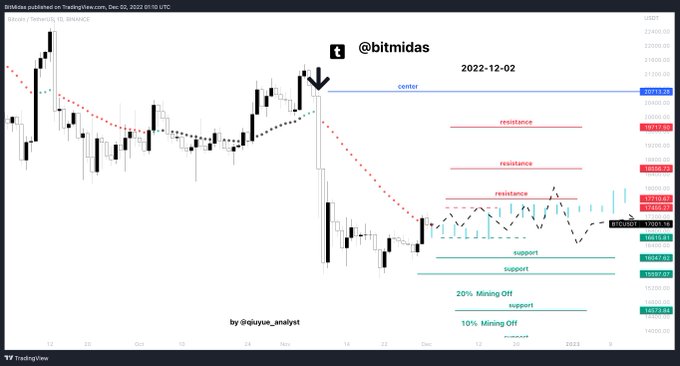

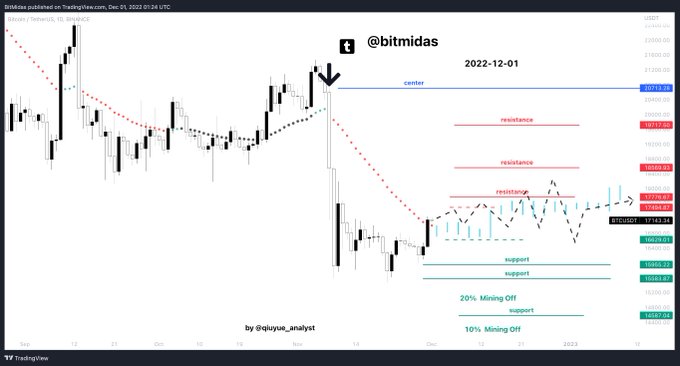

#Bitcoin

Dec 2, 2022

BTC rejected from the formulated resistance at $17455.27. It’s trying to seek the bottom while testing resistances. Still heavy resistance above without liquidity increase.

Range today: $16615.81-$17455.27

High volatility upon unemployment

TP & Details👇

1

2

3

#Bitcoin

Dec 9, 2022

The short-term resistance now is $17427. Breakout here will $BTC jump to as high as $18266.

Keep watching CPI stats and FMOC meeting next week.

All the short-term S/R are easily broken with large capital inflow. Set protections.

Updated TP & Details👇

0

1

5

#Bitcoin

Trend Analytics | Oct 28, 2022

The breakout needs to be tested. The center remains the axis of oscillation.

When intraday support is not broken, it’ll hold up on the center several times. Otherwise, it’ll break down to $19600.41.

See Details👇

#bitmidasdaily

1

2

5

#Bitcoin

Feb 21, 2023

The bullish trend continues on the day frame. Today the intraday support is $24636~$24483. The key resistance of $25331 weakens, another test could be a breakout.

#bottombuilding

👇See chart for details

1

1

5

$ETH Feb 24, 2023

Intraday range: $1614- $1675/$1709

key resistance diverts to 了$1735~$1749

#cryptocurrency

0

1

3

#Bitcoin

Dec 30, 2022

A short-term support has formed at $16453, and a mild resistance at $16760. The former is quite near the breakeven point at $16203.

Breakout is hard to happen above 18k or below 15k. Macro matters still.

Updated entry points👇

#bottomseeking

0

1

4

👀

#Bitcoin

Trend Analytics | Apr 26th, 2022

A range before a breakout has formed: upper at $43357.55; center at $40949.95; lower at $38369.03.

Daily Traders: 🔼$40128, $40949; 🔽$38369.03

Read the chart. 👇

#BTC

#bitmidasdaily

#DYOR

4

0

5

The Federal Reserve wants to temporarily provide a large amount of liquidity to offset the panic, and take this time window to continue tightening and avoid recession, but they are facing a delimma.

#bitmidasmacro

0

0

2

#Bitcoin2023

Apr 11

1/ BTC broke up the resistance of $29732 and is trying to sustain the $29000 level, with a net inflow of around $1.3 billion (potentially including virtual funds) and a bullish market trend. Long-term investors remain optimistic.

3

1

5

With a pessimistic outlook of a possible recession, many markets began to seek the bottom. A lift on lockdown in China will improve the condition of the global supply chain.

#HOPE

1

1

5

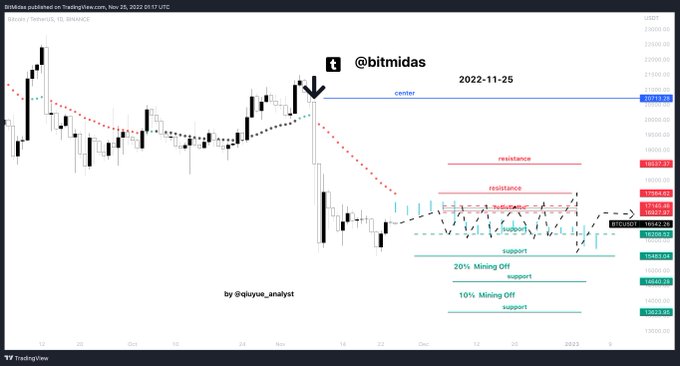

#Bitcoin

Nov 25, 2022

The macro expectation is getting positive. $BTC went back into chops between $16927.97-$16273.49 today.

$18500 is heavy resistance. If confidence is restored, a breakout range could again forge between two hardcore points 15000-18500.

See Updated TP 👇

1

3

3

👀

#Bitcoin

Trend Analytics | Mar.31st, 2022

CCI and RSI hit the support and bounce back from yesterday, possibly leading to a test on the half-year resistance.

⛳️Keep watching:

Half-year resistance $48645.1

Support of the indicators

👇

#DYOR

🎯

#intradaytrading

2

0

4

👀

#Bitcoin

Trend Analytics | Mar.18th, 2022

Dawn Before The Breakout! Center at 40106.56!

Keep a close look at the movement between 41879.55~40106.56 within 3 days from now.

🧐See today's full analysis here👇

0

2

3

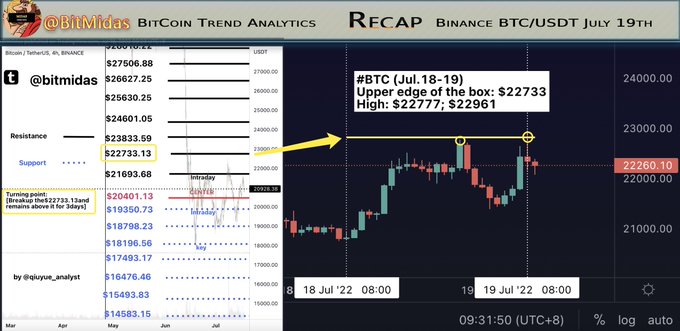

The top edge of the box was tested 2 times from yesterday after the flip of the intraday range.

#bitmidasrecap

#BTCUSDT

#Bitcoin

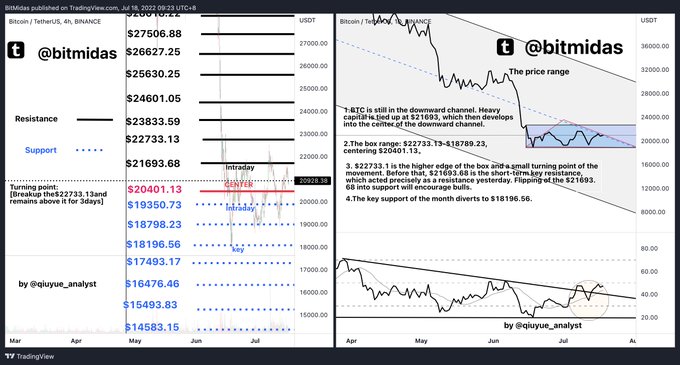

Trend Analytics | July 18th, 2022

Heavy capital is tied up at $21693, flipping of which into support will encourage bulls.

$22733.1 is the top edge of the box & a small turning point of the movement.

Fed's rate hike of 75bp (70%)/ 100bp (29%)

Details👇

#bitmidasdaily

1

0

1

1

1

2

👀

#Bitcoin

Trend Analytics | Apr.2nd, 2022

🔥Half-year resistance ($48645.1) will be a stronghold for both sides.

CCI and RSI30 are recovering from the support;

RSI, KDJ, CCI will move within the channel (see chart)

See price points👇

#DYOR

#intradaytrading

2

0

3

#Bitcoin

Nov 24, 2022

$BTC hasn't taken hold of $16629 yet. It will likely keep chopping, given the confidence boosted by CZ.

Technically, there’s still heavy selling pressure above in a 3-7d frame downtrend. A large gap exists between MA5-MA20.

See Updated TP & Details👇

0

0

2

#Bitcoin

Mar 13, 2023

The concern of a liquidity crisis of SVB triggered a short-term depeg of USDC and BTC plummeted to the 19625 support. Fed shore-up-confidence move boosted a bull run today. Taking hold of $22986 will enhance bulls.

Updated TP 👇Long-term

#bottombuilding

1

1

4

#Bitcoin

Feb 3, 2023

Taking hold of the 23k support ($23303~$23056 as of today), BTC is going to test the intraday resistance at $24515 again. The testing however is different from that of yesterday, breaking down the 23k support will it come back further.

Updated TP 👇

1

1

2

#Bitcoin

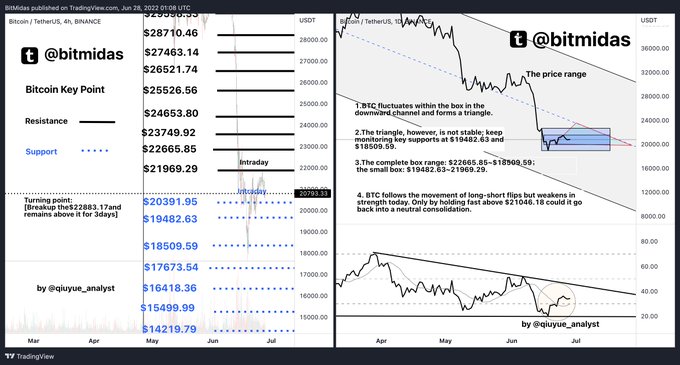

Trend Analytics | June 28th, 2022

BTC fluctuates within the box in the downward channel and forms an unsteady triangle...

✡️The box range is depicted in the chart.

It follows the movement of long-short flips but weakens in strength today. See charts.

👇

#bitmidasdaily

0

4

4

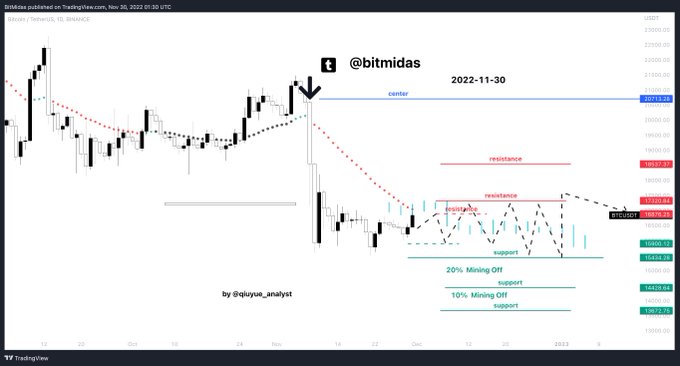

#Bitcoin

Nov 30, 2022

BTC support and resistance show convergence. The key support lifted to $15900.12 today and resistance at $17320.84. A higher spring could be achieved upon breakout.

Macroeconomic data release these days. Could be volatile.

See Updated TP & Details 👇

0

2

4

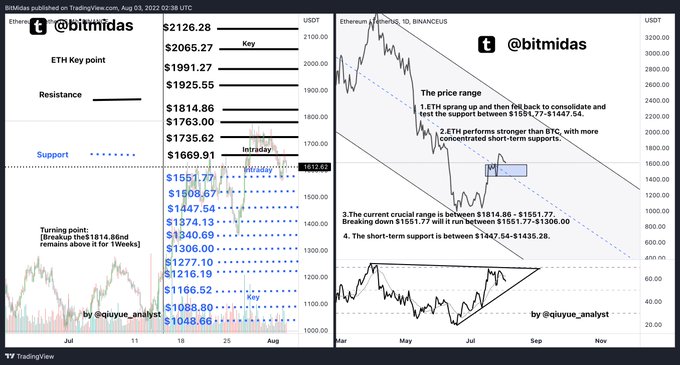

Considering the importance of $ETH in cryptos, we'll add ETH analysis once per week as part of our analysis portfolio based on the algorithmic statistics. More tokens are in consideration.

Drop tokens you'd like to see in the comment below.👇

#ETH

Trend Analytics | Aug 3, 2022

2

0

3

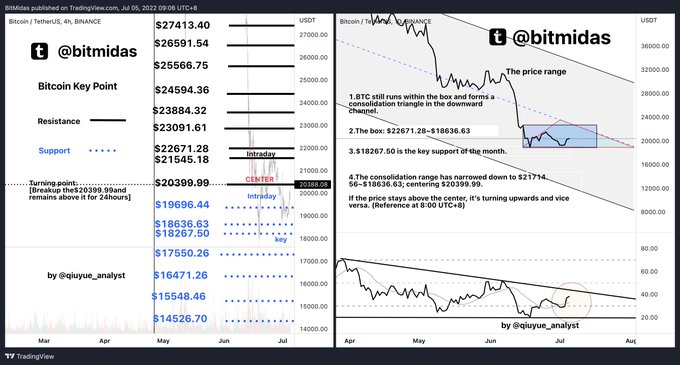

#Bitcoin

Trend Analytics | July 5th, 2022

The box today: $22671.28~$18636.63

$18267.50 is the key support of the month.

See the chart for the details of the consolidation range.👇

#bitmidasdaily

2

1

3

‼️Announcement

To lower reading barriers, we're going to simplify charts on the daily analysis and add more interesting topics around crypto, macro, or businesses. Some of the TPs will be released in our community, which is going to be built soon.

Stay tuned with us

@BitMidas

1

2

3

#bitmidasrecap

day-framed support target reached when volatility died down.

#Bitcoin

Mar 24, 2023

BTC maintained at $27,000, rebounded to $28,868 due to positive news from the US stock market, with Secretary Yellen reassuring banks and providing additional liquidity. The overall trend remains bullish with net inflows and support levels moving higher.

1

2

6

0

1

2

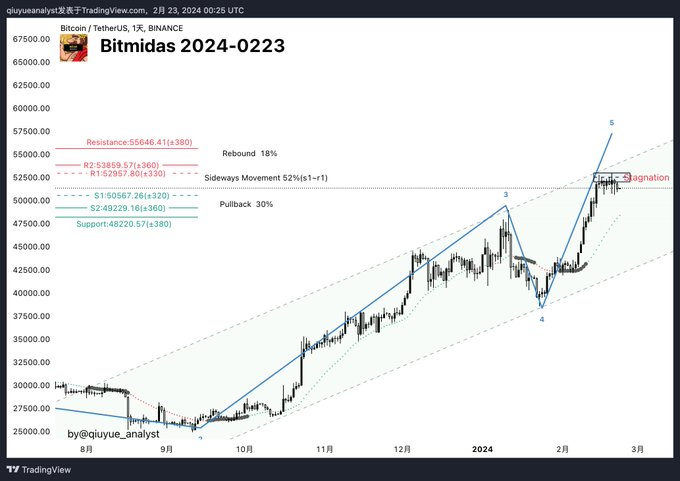

#Bitcoin

Trend Analytics | May 9th, 2022

#BTC

is still gaining speed and moving quickly down the slope, forming a bearish impulse wave.

$32211.78 is the next target of the slide.

Reference to the points👇

#BTC

#bitmidasdaily

1

1

4

👀

#Bitcoin

Trend Analytics | Apr 25th, 2022

BTC to choose the direction very soon.

Daily Traders: 🔼$40739.24 🔽$38369.03

Read the chart. 👇

#BTC

#bitmidasdaily

#DYOR

1

1

4

#Bitcoin

Jan 30, 2023

The short-term key support now comes to $23189~$23000; resistance at $24964~$25000. Much more capital inflow sustained the daily-weekly uptrend and bulls take hold in the short and mid term. The next target would be monthly resistance around 27k. Updated👇

1

2

3

#Bitcoin

Jan 11, 2023

Short-term upward testing continues. The intraday resistance diverts to the $17630~$17735 area. The weekly trend could be reversed if the $18099~$18561 area is flipped into support based on our updated data.

#bottomseeking

👇

#Cryptos

#Bullish

0

1

2