Yash

@BasedTrader_

Followers

14K

Following

30K

Media

960

Statuses

14K

Ex - Research Professional; Pro Trader Trades - Stage 2 Set-ups | Flags | Episodic Pivots | IPO bases Trolls will be Blocked! #AbolishSTT

Mumbai

Joined October 2020

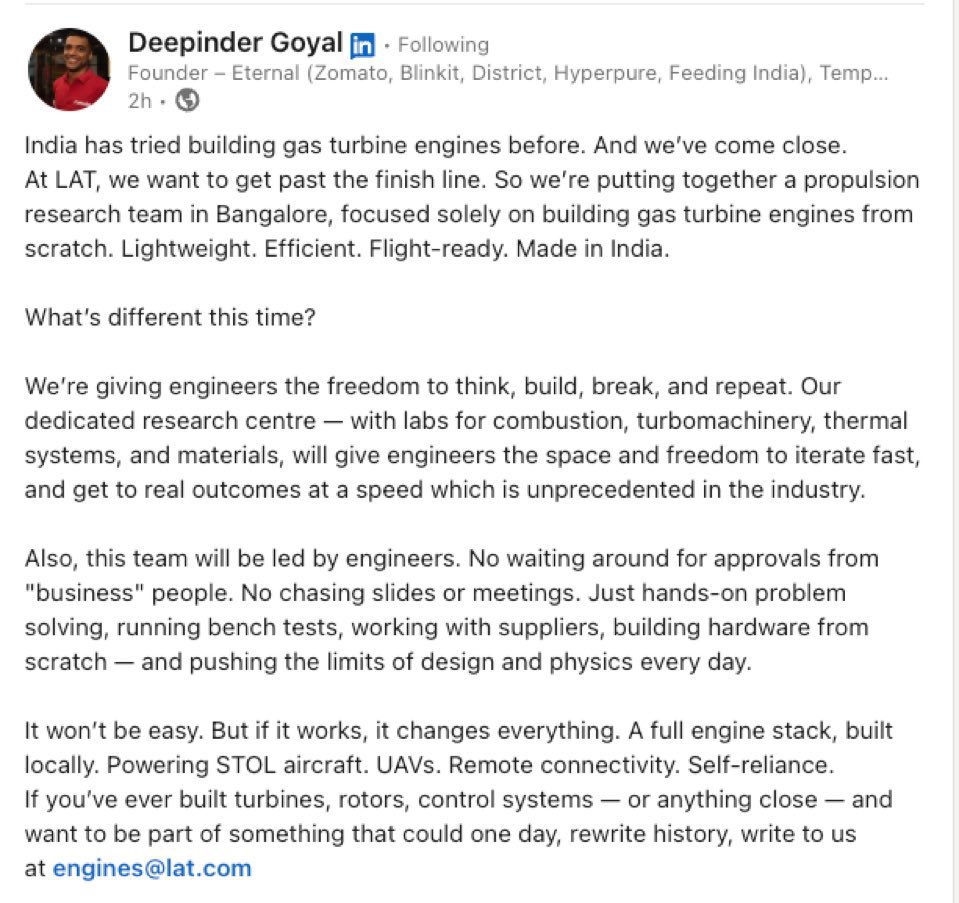

One month since I left my job and got into full-time trading and I have been up 29.4% since then. Big winners include 63Moons, BlackBuck, Kernex, Pgel, KRN and Deepak. God and the Market has been kind 🙏.

49

9

615

RT @finallynitin: I recently received a voice message from @AnkurPatel59 about one of his projects, asking me ten things about trading that….

0

54

0

okay i gotta say this: most rebuttals to these babas who question women's purity are weak forms of whataboutism and often, borderline non-sequiturs. they're similar to how men deflect by saying, "what about your father/brother?" when women point out problems caused by men . 1/3.

Meet Khushboo Patani, former Major of Indian Army and sister of bollywood actress Disha Patani and see her language. But why did she get triggered like this by the statement of #Aniruddhacharya ? Hope she is not relating it with her own story.

1

2

12

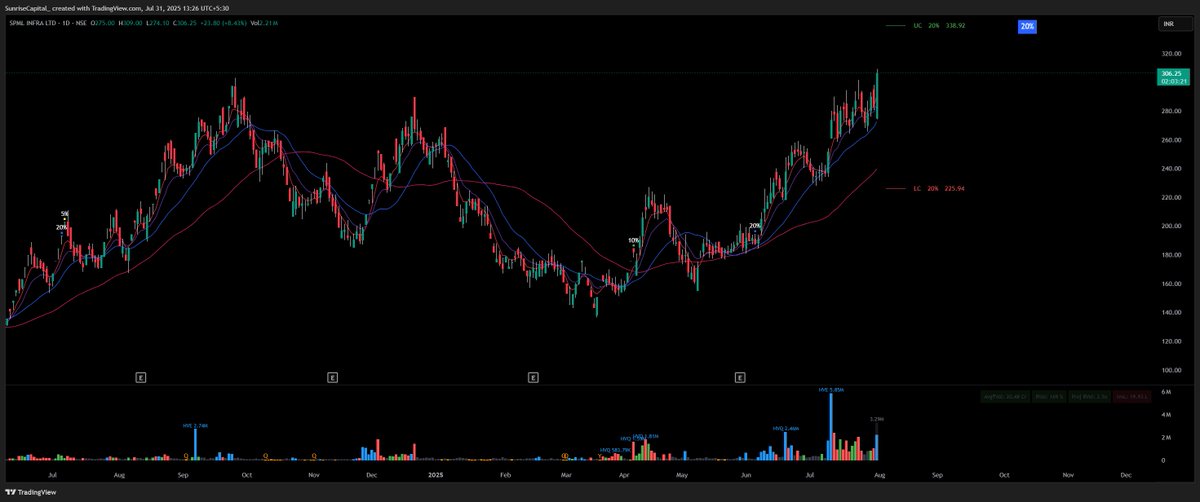

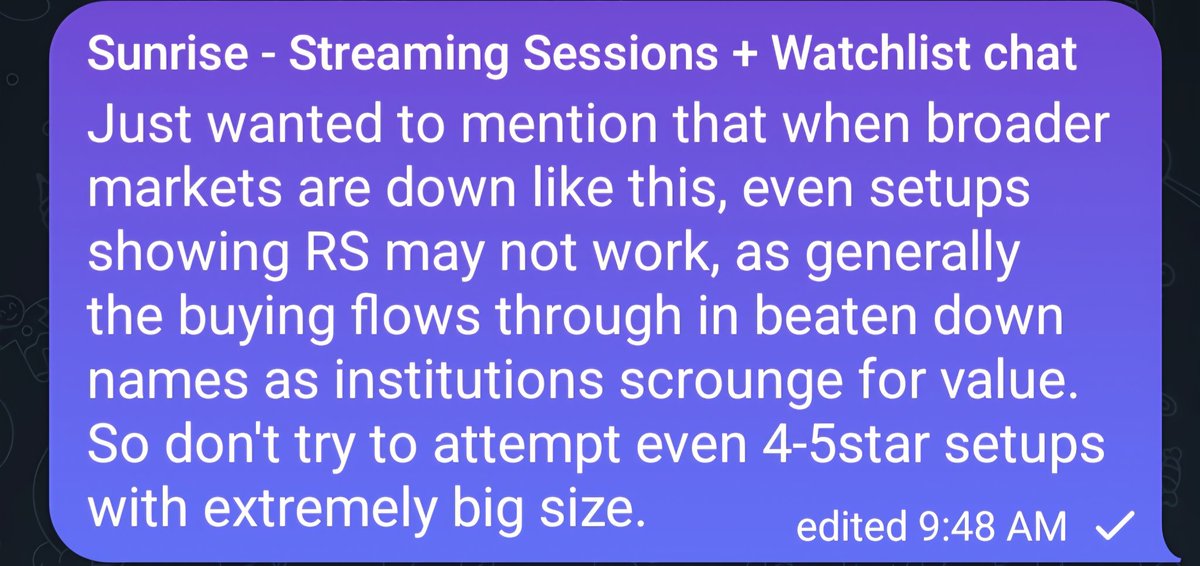

Shared with subscribers also -

0

0

7

Women in India haven't been safe at homes, schools, hospitals, roads since decades. But now women are being raped in moving ambulances. We need some serious introspection.

🔴#BREAKING | 26-year-old woman raped in moving ambulance in Gaya, Bihar police arrests 2 within hours; Union Minister Chirag Paswan questions law and order.

1

3

29

Weekend is here. Time to watch this video and enhance the learning curve.

If you are an aspiring trader looking to truly understand technical aspect of markets from first principle basis, do watch this video fully. Shared with subs on sunday night and top priorities were SAMBHV, ADVAIT, DIGITIDE etc. Rejection of setups along w reasons also covered.

1

0

35