The Indian Investor

@Anvith_

Followers

19K

Following

63K

Media

7K

Statuses

32K

Proud Nationalist 🇮🇳 | India First | Investing | Financial Freedom | All Views are Personal | No Buy/Sell Recommendation | DYODD.

📢 Telegram ➡️

Joined March 2014

📢 Join my FREE Telegram Channel for stock market updates, analysis & concall insights. 🚫 No Buy/Sell Recommendations. DYODD.

0

0

27

Warren Buffett's golden rule for building lasting wealth is simple but powerful:. Rule No. 1: Never lose money. Rule No. 2: Never forget Rule No. 1. In a world chasing quick wins, Buffett reminds us that true success lies in protecting what you earn. Whether you're investing,

0

0

4

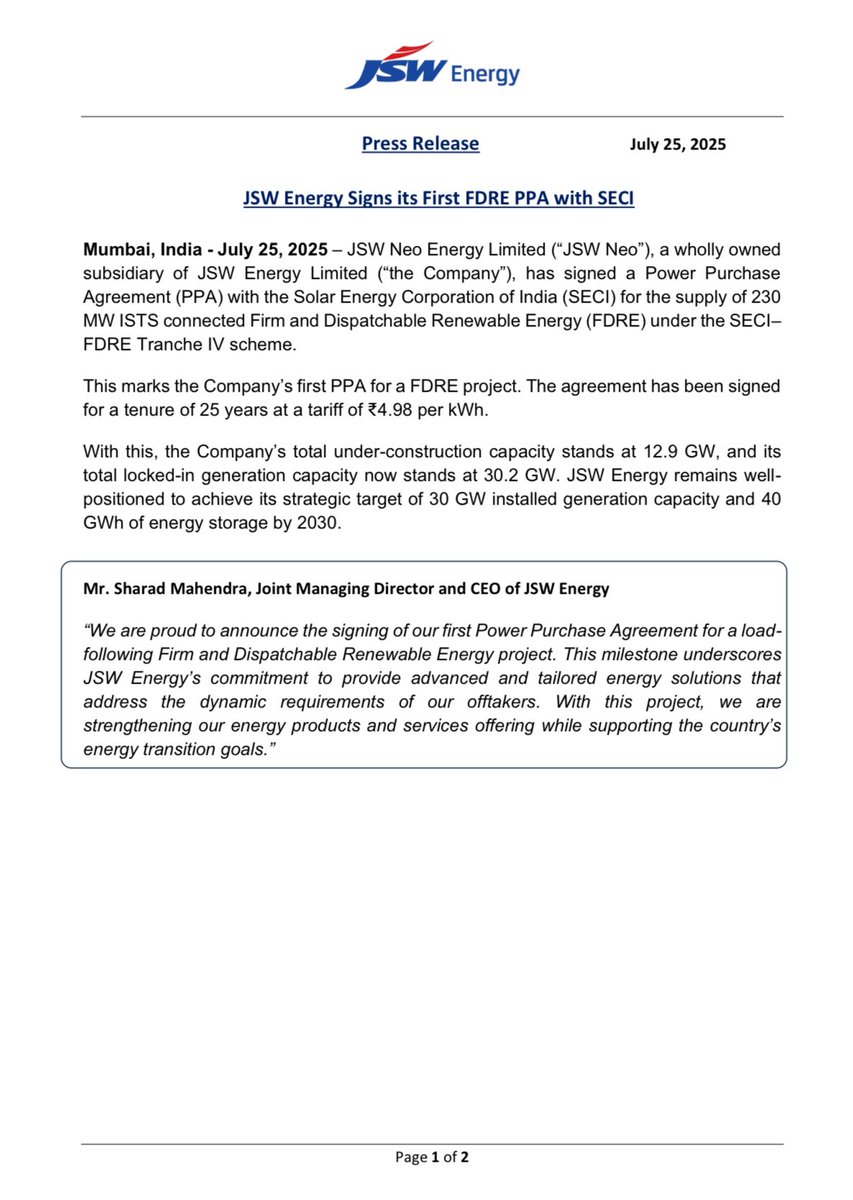

⚡️ JSW Energy signs 25-year PPA for 230 MW FDRE project at ₹4.98/kWh, boosting capacity to 30.2 GW. #JSW #JSWEnergy #BESS

JSW Energy ⚡️☀️🔋📊 📚 . 🇮🇳 India’s silent renewable leader is building a clean energy powerhouse. 💼 Q1FY26 Execution.• Commissioned 261 MW RE (189 MW solar + 72 MW wind).• Total installed capacity now: 12.8 GW.• Q1 capacity addition: 1.9 GW. ☀️ Clean Energy Core.•

0

2

9

💻 Infosys – Q1FY26 Highlights & Outlook | From Nuvama. Solid delivery | TCV robust | FY26 rev guidance raised. ▪️ TCV: $3.8 Bn (▲46% QoQ | ▼7% YoY) – 28 large deals won. AI/GenAI Tailwinds.▪️ 300+ AI Agents built – major traction in BFSI, onboarding, KYC.▪️ Infosys is now AI

Indian Tech Sector Set for Strong Growth, Poised to Cross $300B by FY26 - Nasscom. 🔹 IT Giants: TCS, Infosys, HCL see early signs of demand recovery.🔹 Growth: 5.1% in FY25, up from 4% last year .🔹 Revenue Target: $282.6B in FY25, crossing $300B in FY26 .🔹 Software Exports:

2

0

5

Zomato’s Multi-Engine Growth Is Kicking In. Across food delivery, quick commerce, B2B SaaS, and supply chain — every vertical is scaling fast. Let’s decode the Q1FY26 performance 👇. 🍽️ Zomato (Food Delivery).▪️ Revenue grew from ₹2,256 Cr to ₹2,657 Cr.▪️ Clocked a steady 18%

🛍️ Blinkit > Zomato: Quick Commerce > Food Delivery?. A structural shift is underway at Zomato Ltd – and the numbers speak for themselves. Let’s break it down 🧵👇. ▪️ For the first time ever, Blinkit 🥇 has outpaced Zomato’s core food delivery biz in revenue in Q1FY26. ➡️ Quick

0

1

12

Vanguard’s ₹62,200 Cr India Exposure – What They’re Betting On. The global passive investing giant Vanguard Fund holds stakes in 41 Indian stocks. Let’s decode the top holdings by value 👇. 🏦 Top 3 Bets: BFSI + IT. ▪️ HDFC Bank – ₹16,387 Cr.➡️ Flagship exposure to India’s

What Did Vanguard Buy in India This March (Q4FY25)?. Global giants don’t chase FOMO. They create it. 🆕 Fresh Buys – March Quarter (Q4FY25).🔹Eternal – ₹2,463 Cr | 1.1% stake ( zomato ).🔹APL Apollo Tubes – ₹443 Cr | 1.0% .🔹Reliance Power – ₹170 Cr | 1.0%.🔹Home First

3

0

10

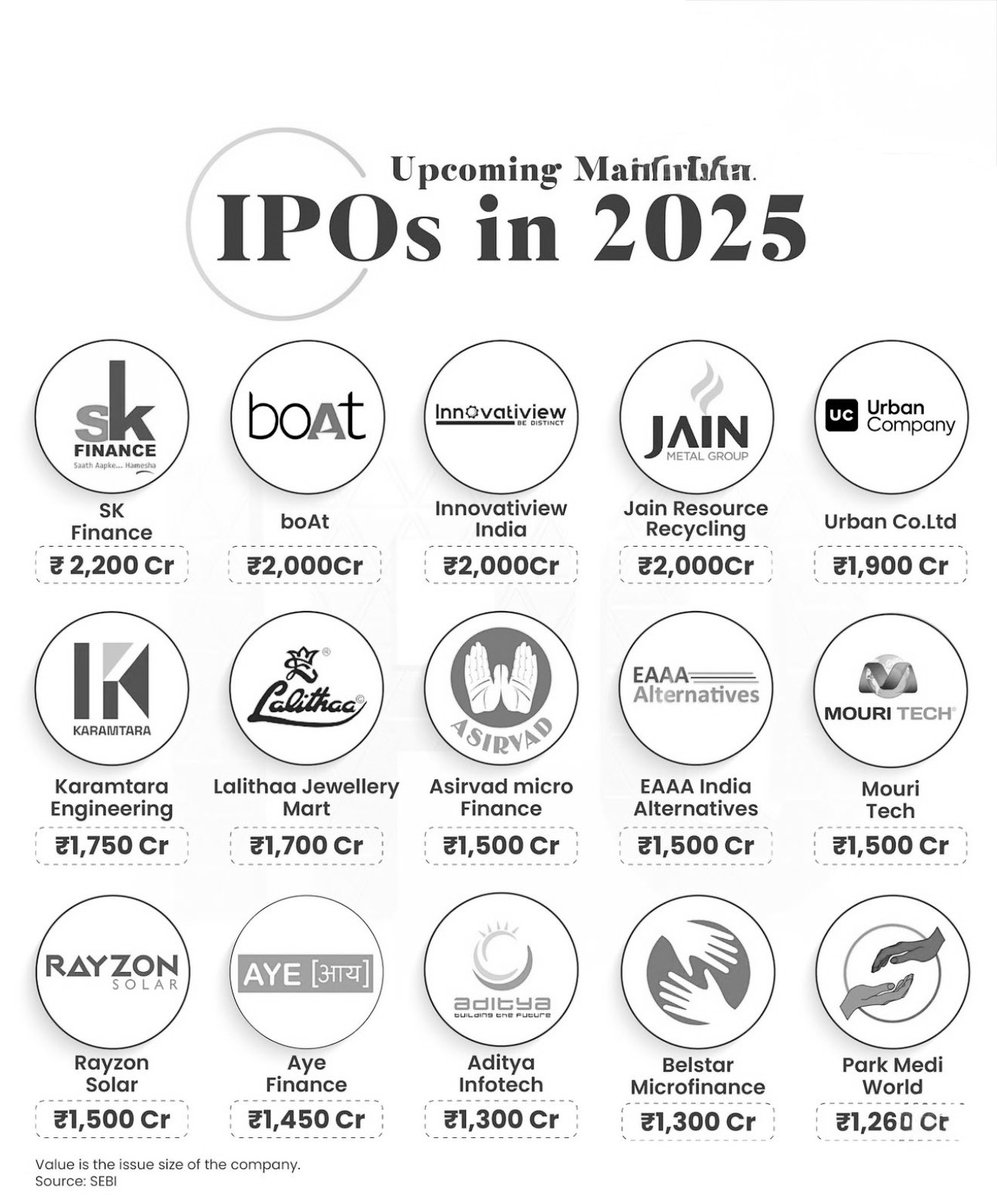

India’s IPO Pipeline is Heating Up in 2025. Over ₹28,000 Cr worth of fresh equity listings are lined up across consumer brands, fintech, microfinance, solar, and tech. Let’s break it down 👇. 💎 Biggest IPOs in the Queue. ▪️ SK Finance – ₹2,200 Cr.➡️ NBFC with strong rural

Smart Money Tracker - Sector Rotation Isn’t Random. It’s Predictable. - Smart money moves first. Performance catches up later. - Let’s build a data-backed framework to spot sector trends early and ride momentum before consensus catches up. 🔄 Sector Cycles Rotate Fast.-

0

1

27

🥇 Top Performing Multi-Cap Mutual Funds – 3-Year CAGR that’s quietly beating benchmarks 🧵. 🔹 Why Multi-Cap Funds Deserve Attention.▪️ SEBI mandates at least 25% allocation to large, mid, and small caps.▪️ This forces fund houses to go beyond comfort zones.▪️ The result? A

Top Stocks Bought, Sold & Fresh picks by Mutual funds – May 2025 | Smart Money Tracker. - Every buy/sell has a signal. Here's where India’s top fund managers are rotating capital ⤵️. 1⃣ Top New Entrants – Fresh Conviction. Largecap Universe.🔹Adani Green – Backed by green infra

3

1

17

Companies Giving Out Super Profits 💰🔥.Strong earnings. Solid tailwinds. Sectoral leadership. Let’s decode the silent profit machines delivering consistent alpha 👇. 🔹 Zydus Lifesciences – Pharma growth with innovation.▪️ Specialty portfolio expansion (Desidustat, Lipaglyn).▪️

📢 Zydus Lifesciences Q3FY25 Result Analysis & Guidance : . 🔥Beats Estimates || Strong US formulations growth ⬆️. 📊 Key Financials:.💰 Revenue: ₹5,269 cr (▲17% YoY) vs ₹4,505 cr.📈 EBITDA: ₹1,387 cr (▲26% YoY) vs ₹1,102 cr.📊 EBITDA Margin: 26.3% vs 24.5%.🏦 Net Profit:.

3

4

16

🌎 Indian Mutual Funds Betting Big on Foreign Stocks!.Domestic equity funds are no longer just desi—many are making meaningful allocations to global giants. Here's a look at the top Indian funds with high foreign equity exposure (as of June 2025):. 🧵Let’s decode the trend 👇. 1.

Top Stocks Bought, Sold & Fresh picks by Mutual funds – May 2025 | Smart Money Tracker. - Every buy/sell has a signal. Here's where India’s top fund managers are rotating capital ⤵️. 1⃣ Top New Entrants – Fresh Conviction. Largecap Universe.🔹Adani Green – Backed by green infra

6

5

28

RT @AshishMeher7: 🧵 “Warren AI” is here — and it’s picking Indian stocks better than any human could. I tested 5 Propicks AI strategies so….

0

26

0

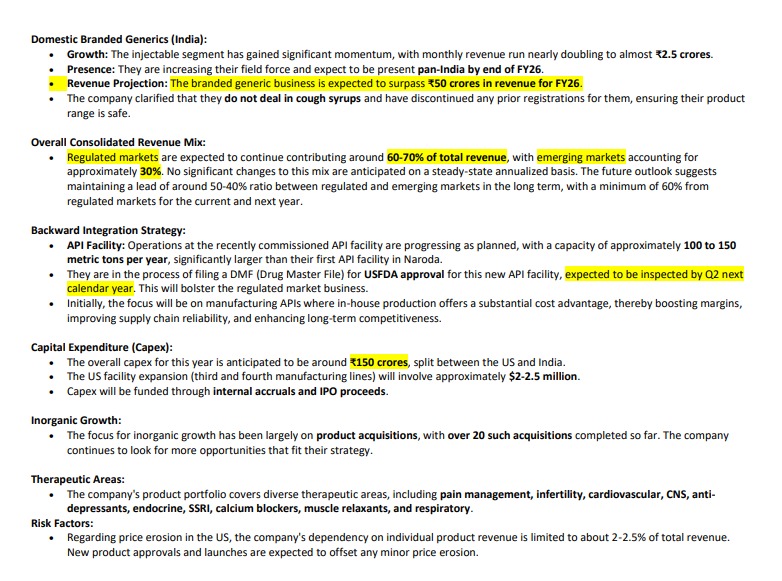

RT @selvaprathee: Senores Pharmaceuticals Ltd – Q1FY26 Result Analysis | Investor Presentation Highlights. 🌟 Broad-Based Growth | Branded G….

0

10

0

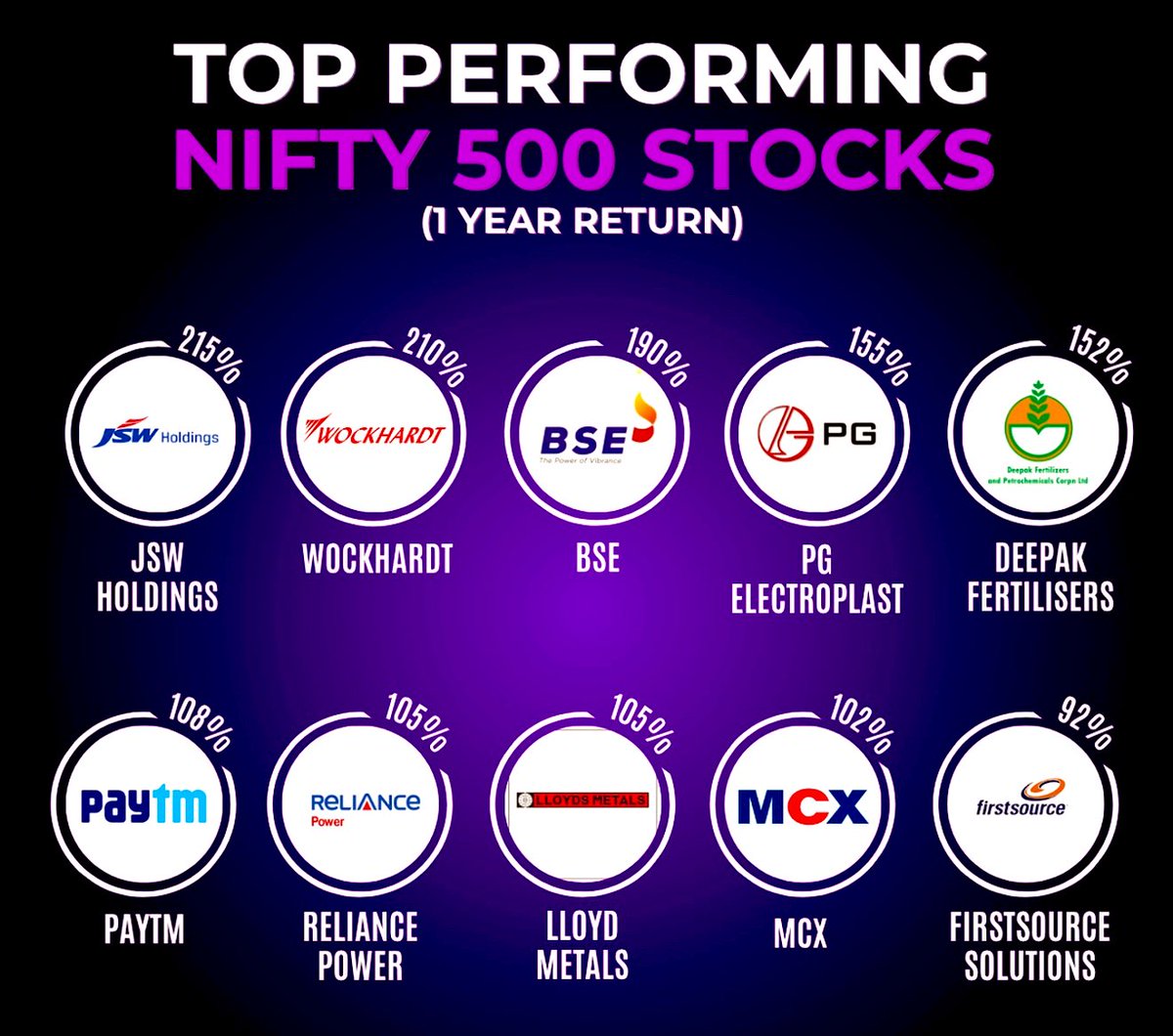

Top Performing Nifty 500 Stocks – 1-Year Return.(As of July 2025). Missed these rockets? Let’s decode what drove the rally in each. 🔹 JSW Holdings – +215%.Holding co. of JSW Group (Steel, Infra, Energy). Re-rating on NAV discount narrowing + group valuation boom. 🔹 Wockhardt

Smart Money Tracker - Sector Rotation Isn’t Random. It’s Predictable. - Smart money moves first. Performance catches up later. - Let’s build a data-backed framework to spot sector trends early and ride momentum before consensus catches up. 🔄 Sector Cycles Rotate Fast.-

2

4

12