Anuditya Gupttaa

@AnudityaG100009

Followers

50

Following

2K

Media

23

Statuses

115

People call me Anuj though i prefer to be called Anuditya. also, Finance+ML enthusiast

Garhshankar

Joined August 2024

Finally deployed my 1st web-app on Streamlit, and it took quite some time, but i'm finally through😮💨. This is a loan classifier which predicts whether a customer is likely to accept or reject the loan offer(cont'd in thread. ).Do checkout👇🏻.@OpenLearn_NITJ.

2

1

4

Day-6 in the Finance League @OpenLearn_NITJ ✅️.A intro to the 'Commodities and Forex Markets' - participants, importance & various factors at play (varying from interest rates, geopolitical outlook, and demand-supply dynamics) which shape these markets. 📊Week well rounded up.

0

1

4

Day-5 in the Finance League @OpenLearn_NITJ.Where we learn 'Futures Pricing' & understand Futures v/s Options Hedging (with a fun analogy). I have one too:.Futures Hedging is for the committed-staying till the end, while Options Hedging is dating at will (without any obligations).

0

1

4

This was a completion✅️ of Day-21 and also Day-22 in the ML league @OpenLearn_NITJ.Kudos to pathfinders @VatsalKhanna55.@adexxhhh @Ratinder_999 @Kunal2417_ and Vivek sir for their super blogs. Hopefully this is the first of many more apps and now onto building another one 💪🏻📈.

4

1

6

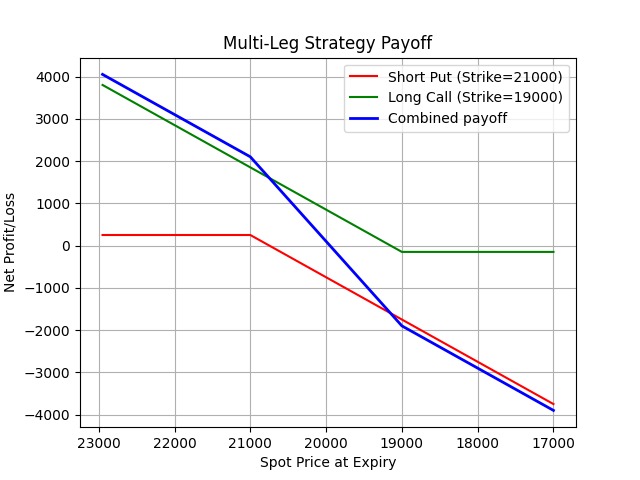

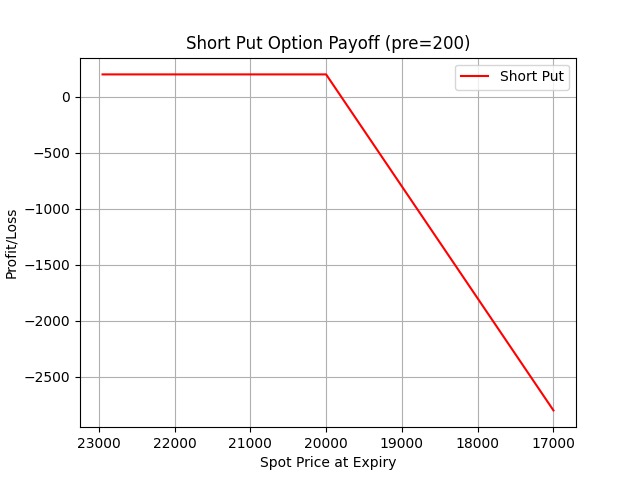

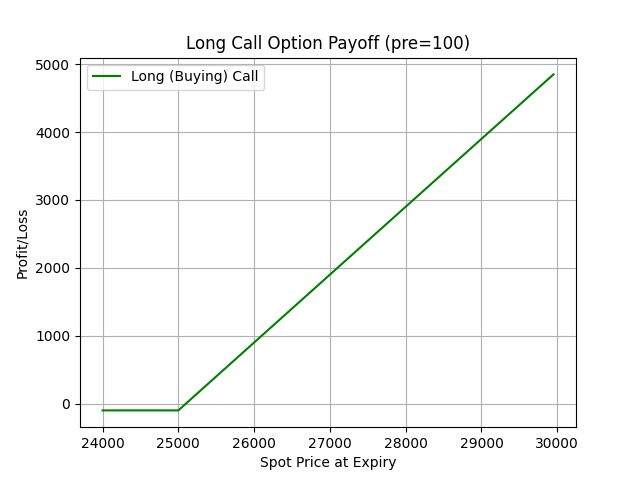

As part of Day-4 @OpenLearn_NITJ, today I plotted visualizations of the payoffs for synthetic "Multi-leg" Options' strategies using python & here are 2 of 'em, both giving us an idea of the total payoff at different closing prices (i.e. spot at expiry). Checkout in the thread. 👇🏻.

Day-4 in the Finance League📊 @OpenLearn_NITJ .A day where we take a deep dive into Options- Call & Put with both long/short position(s), alongwith Greeks and some python implementation for payoff visualizations.✅️.#ML.#Finance.Checkout here.👇🏻.

3

1

6

Day-4 in the Finance League📊 @OpenLearn_NITJ .A day where we take a deep dive into Options- Call & Put with both long/short position(s), alongwith Greeks and some python implementation for payoff visualizations.✅️.#ML.#Finance.Checkout here.👇🏻.

2

1

2

So a few completions of the past few days in the ML league @OpenLearn_NITJ.Day-19 ✅️ Guide to Feature Engineering (will share the implementation separately).and, Day-20✅️ Cross Validation, Grid Search CV & Randomized Search CV. (Posting this late, been into some prev. tasks).

0

1

6

Day-3 in the Finance League📊 @OpenLearn_NITJ where we learn the basics of 'Financial Derivatives',.4 of 'em along with their types, usage, few e.g.'s and the risks involved, with an intriguing🧠QOD to wrap up the blog & the day. ✅️.Why futures require daily MTM settlements?.👇🏻.

1

0

2

And just when you complete the blog by @Ratinder_999 sir for Day-18 and learn 'Pipeline', this snippet from KMeans Clustering (Day-11) makes a lot more sense now.💡. Yeah, connecting the dots, as they say. and building a pipeline is really handy, the explanatory blog even more👏🏻

1

1

5

Completed Day-18 in the ML league @OpenLearn_NITJ.Learnt Pipeline along with ColumnTransformer which helps in setting up a smooth workflow while working with ML models. Also built a pipeline (with Logistic Regression model) as task for the day. Checkout👇🏻.

kaggle.com

Explore and run machine learning code with Kaggle Notebooks | Using data from No attached data sources

1

1

7