Ambly.io

@AmblyApp

Followers

80

Following

13

Media

27

Statuses

46

Find the best option to buy in 3 taps. 🔗👇

Joined November 2024

PSA: DO NOT USE OPTIONS PROFIT CALCULATOR TO PLAY EARNINGS. YOU WILL GET CRUSHED. Do this instead. #optionstrading $PLTR

0

2

6

The beauty of options - asymmetric risk:reward.

🚨 Someone just turned $10k → $3 MILLION with $SPY puts. The S&P 500 just had its biggest 2-day loss in 52 weeks, dropping -10.45%. But the 528 Put went up +26,650% 🤯. #OptionsTrading

0

0

0

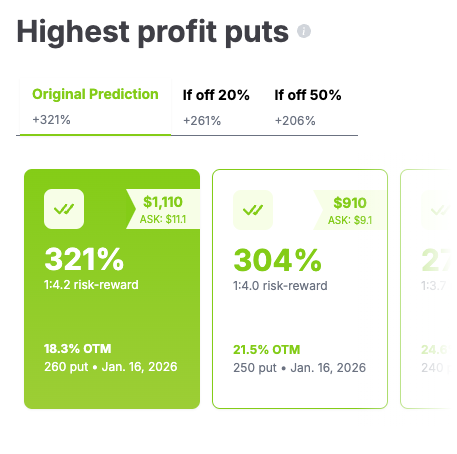

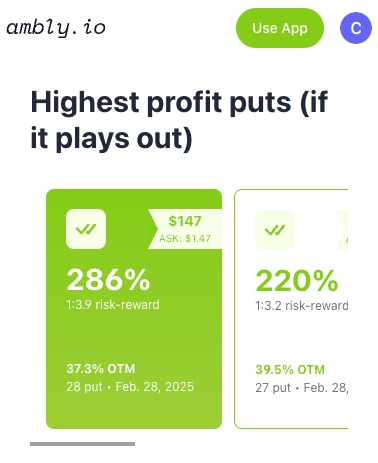

If timing off 50%, 3:1 risk-reward still available:

app.ambly.io

Trade options like a world-class poker player.

0

0

0

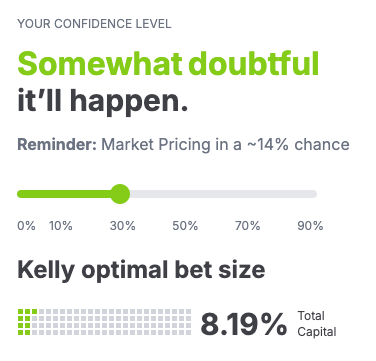

Options market pricing in a 14% chance of a 33% $ACN pullback by EOY. 4:1 risk-reward available. Could make sense to play it if you believe there's actually a 30% chance this would happen.

$ACN is a good short. insane valuation, AI will take a bite out of both of their main businesses over time. it's just an old dead bloated company that will shrink over the next decade.

1

0

3

Try free to simulate other scenarios!.

ambly.io

Thoughtful options trading, made ridiculously easy. Find the best options for a prediction. Actionable insights in just 3 taps.

0

0

0

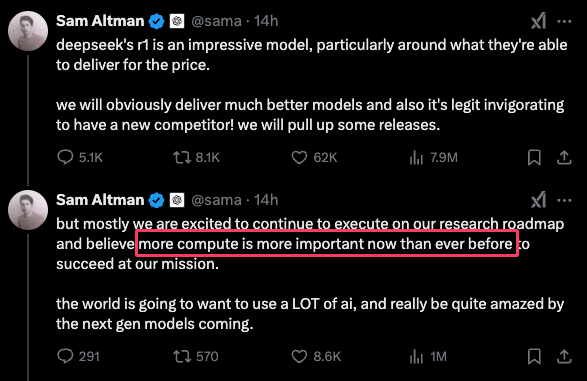

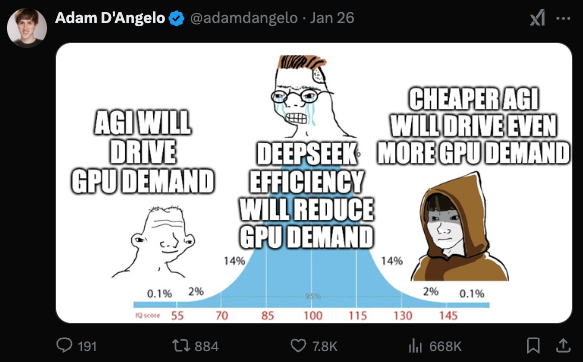

@adamdangelo (one of few OpenAI Board Members, CEO of Quora, ex-CTO of Facebook). "Cheaper AGI will drive even more GPU demand"

6

0

0

RT @EpicTradeAlerts: 🚨 Someone just turned $10k into $850k from $NVDA puts. Nvidia ($NVDA) just had its 3rd biggest 4-day LOSS in 52 weeks….

0

2

0

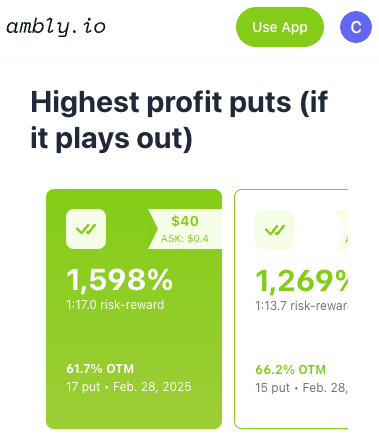

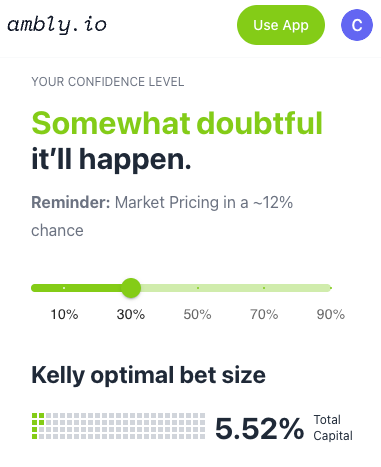

Markets pricing in ~12% chance $IONQ down 50% by end of Feb. 1:4 risk-reward options available if this happens (~300% gain). Nerfed Kelly criterion suggesting 5.5% allocation if you're 30% sure this will happen. But what if $IONQ goes down to its Mid-Oct levels of $10 before

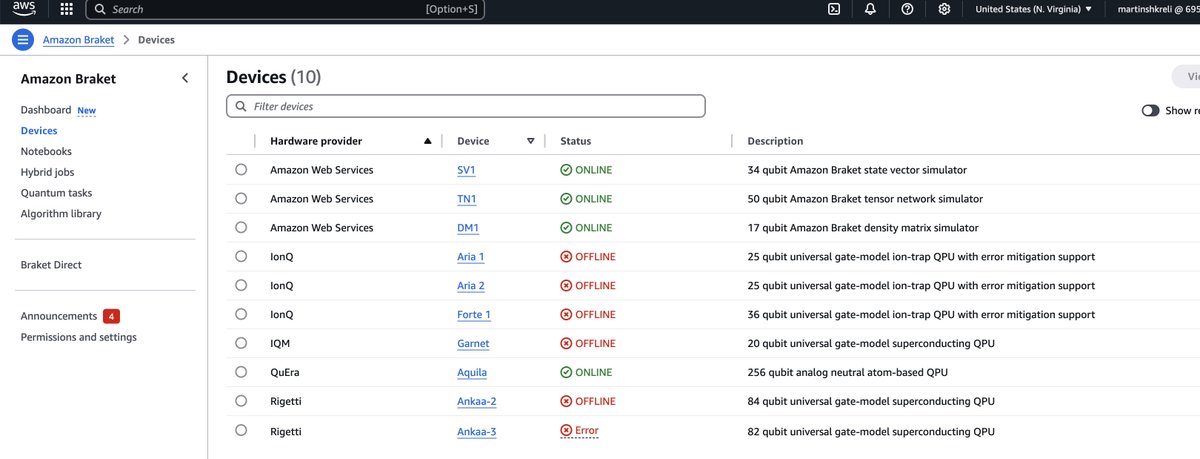

another day and $IONQ and $RGTI shitty/tiny QCs are offline. but the stock are up? this is one of the best shorts i've seen in my career. we are further away from quantum than even I thought: check out the Los Alamos roadmap from a while back for a laugh.

1

0

6