Allez Labs

@AllezLabs

Followers

963

Following

514

Media

131

Statuses

324

Data and risk experts, in DeFi risk management since 2019. We’re hiring data engineers and analysts, dm us

Joined June 2024

RT @AllezLabs: Allez Vaults just crossed $30M TVL 🚀. Why?.📊 Live rate tracking.⚡ Instant response to utilization swings.🧠 Smart multi-marke….

0

4

0

⚙️ Looking Ahead. @Hyperdrivedefi is just getting started. → August brings new markets and fresh collaterals. → Volatility is on the rise, so stay sharp and actively manage your positions.

0

0

3

🚀 @Hyperdrivedefi July 2025 Insights. July was defined by rising utilization across all three markets, new collateral listings, and active risk management by users - even through shifting market conditions. Here’s the breakdown👇

1

4

16

Allez Vaults just crossed $30M TVL 🚀. Why?.📊 Live rate tracking.⚡ Instant response to utilization swings.🧠 Smart multi-market allocation.🎯 Boosted by @KaminoFinance Season 4.✅ Zero fees. Top yield unlocked, time to put your capital to work 💸. Now on

3

4

17

RT @AllezLabs: 🚀 @KaminoFinance July 2025 Monthly Report just dropped:. July hit a record $9.11 B in monthly volume, powered by surging sta….

0

3

0

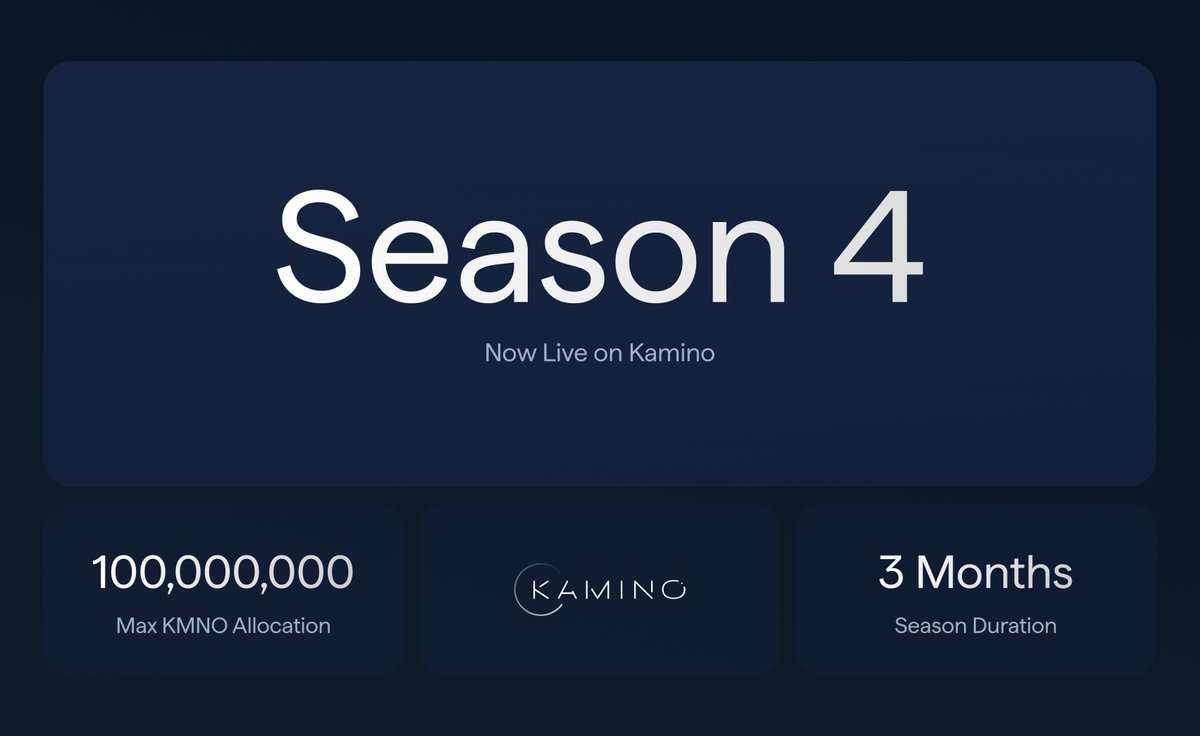

Kamino Season 4 is live ⚡️. This time, rewards unlock in just 3 months, and they all go to Kamino Earn vaults 🫗. 🎯 Allez USDC vault: 24.41% APY.📊 Allocates across 7 markets to optimize risk/reward.🚀 You can further boost your yield by staking $KMNO. 👉 Now on

1/ Kamino Season 4 is now live. A full overhaul of Kamino's rewards system, Season 4 will have a fixed KMNO allocation, a fixed duration, and transparent user rewards. Season 4 Hub: Welcome to a new era ⤵️

3

2

27

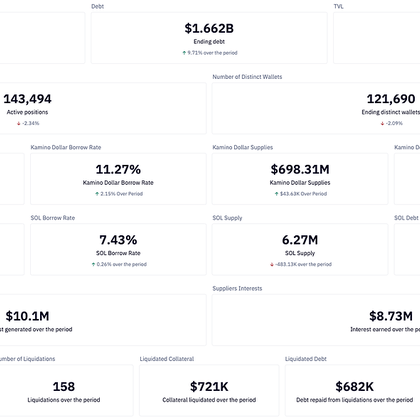

That’s a wrap for Kamino in July, a breakout month across all fronts 🚀. If you want to dive deeper into the data, trends, and vault flows:. 📘 Read the full monthly report here ⬇️.

gov.kamino.finance

Kamino Lend Monthly Report July 2025 📌 Kamino Lend continued to expand in July 2025: TVL rose at a double-digit pace as liquidation activity stayed low. This report highlights the principal growth...

0

0

8

🚀 @KaminoFinance July 2025 Monthly Report just dropped:. July hit a record $9.11 B in monthly volume, powered by surging stablecoin demand and rising new markets. Here’s the full breakdown of what happened and how 👇.

3

3

14

RT @hyperdrivedefi: The $USDhl Primary Market is live on Hyperdrive!. Use $BTC, $ETH, or $HYPE as collateral to borrow $USDhl, or deposit i….

0

4

0

RT @syntetika_io: We’re proud to unveil @AllezLabs - a premier research and risk-advisory firm, as a strategic partner and investor in Synt….

0

216

0

Excited to partner with the innovative team at @syntetika_io as they tokenize institutional Bitcoin strategies ! Our risk modeling expertise will help ensure their innovative approach to structured crypto products scales safely and efficiently. 🚀.

We’re proud to unveil @AllezLabs - a premier research and risk-advisory firm, as a strategic partner and investor in Syntetika!. Founded by minds who contributed to @aave, @KaminoFinance, and @BlockAnalitica, Allez brings institutional-grade expertise in Quantitative risk

0

6

25