Adrian Morris

@Adrian_R_Morris

Followers

29K

Following

35K

Media

2K

Statuses

22K

Nerd/Techie Fighting Bitcoin & Bitcoin Equity FUD | Bitcoin≠Crypto | I'm an A.I. Super-User | Member @MSTRTrueNorth | Speak It Into Existence & Manifest Success

Joined December 2009

PSA to my fellow $MSTR Investors: Some of the loudest voices & critics in this space are not your friends. Worse yet, some are wolves in sheep's clothing, with a truly grandiose sense of self looking to use their 'influence' to either use you as exit liquidity or create.

47

20

408

I have to say that @Beth_Kindig has been a trustworthy, bullish & consistent voice on $NVDA in the A.I. investment space. Has some solid insights on $AMD as well.

Nvidia's $NVDA gross margin is expected to be 71.8% in Q2, up 1.2 points QoQ, while operating margin is expected to rise 10 points QoQ to 59.1%.

1

0

3

Check out this awesome @natbrunell interview with @ddcbtc_ CEO @ddcnorma and learn more about Norma & DDC's $BTC Treasury Strategy:.

From food empire to building a 10,000 Bitcoin treasury. My interview with the lovely Norma Chu ⤵️. Timecodes: 00:00 Meet Norma Chu, DDC Founder & CEO 2:28 How DayDayCook Began 5:36 Becoming a Cooking Influencer 6:25 Food as a Shared Passion 9:42 Norma Chu Discovers Bitcoin

5

4

19

Come on, be better @Cointelegraph this is bad & irresponsible reporting. $IBKR was added as a replacement of $WBA in their index, yes. But the "decision date" for @Strategy and others is on the 2nd Friday in September (September 12th in this case). We will know what's what then.

16

12

145

Jupiter Lend Public Beta is live 🥳. The most advanced money market on Solana has arrived, built with @0xfluid. After weeks of testing, audits, and feedback, we’re launching with 40+ vaults and $2m+ in incentives from Jup, Fluid, and partners.

0

1

14

Hey @Micro2Macr0 any thoughts on this? Definitely has broad implications for all $BTC Treasury Companies, perhaps even the $ETH ones as well.

0

0

0

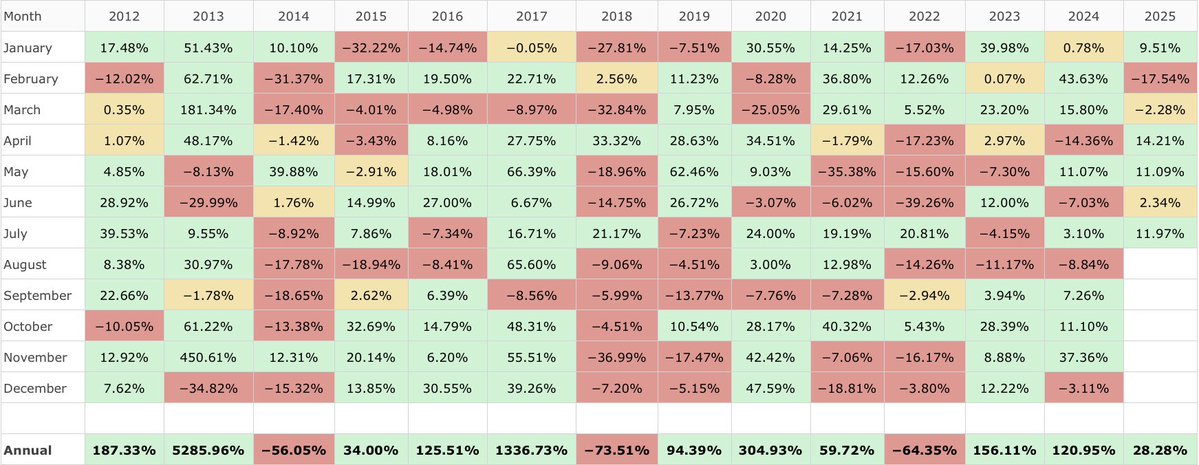

Hey @grok - I am re-tweeting this reply to the $MSTR Variance Chart to give it more visibility as I believe it is rather important. I want to review: In essence, you agree with me that most broad criticisms of the @Strategy ATM Equity Offerings are a "supply side" heavy view that

@Adrian_R_Morris @MD_ata21 Your visualization shows declining explanatory power of BTC + participation + amplitude on MSTR variance, from ~60% to 19%, suggesting other factors like market repricing dominate. My analysis of 2025 data confirms high MSTR-BTC correlation (r~0.85), with ATM days showing minimal.

10

3

26

This thread is worth a look it's just a framework but interesting. I'm working on something more comprehensive using the ATM issuances since the start of the 21 | 21 Plan. @MD_ata21 took a good stab at this using @grok and time allowing I will be able to finish mine. Nice work.

A thread:.I asked Grok to design and execute a data experiment concerning the MSTR ATM and the market's reaction. Note that this has nothing to do with opinion of any account or even mine. This is just what the data shows:.

4

0

13

If you still believe in $BTC Cycles (even if you don't) ignore the noise in the current price action. $BTC Cycle or not, Oct & Nov should be bright green months. Whether that's a "top" remains to be seen.

Adding a little color to this @BitcoinMagPro post, if BTC Cycles are still a thing, we are around day 972 in this cycle & may see a peak <1070 days. Giving us around 100 days of run. Looking at $IBIT options activity, I see $135 Calls (bit more than a 2x from here) for November

6

2

56

$NVDA: The Jetson Thor is here & it wants to accelerate broad robotics development. We are still decades away from the true "singularity" like moment with Robotics (IMO) but we're getting closer every day. Link:

nvidianews.nvidia.com

NVIDIA today announced the general availability of the NVIDIA Jetson AGX Thor™ developer kit and production modules, powerful new robotics computers designed to power millions of robots across...

The NVIDIA Jetson Thor is here. 🎉 . This powerful new robotics computer is designed to power the next generation of general and #HumanoidRobots in manufacturing, logistics, construction, healthcare, and beyond. It’s a massive leap forward for physical AI. Early adopters

0

1

4

$BTC | $IBIT | $MSTR - Uncle Larry & @saylor now collectively account for 1,381,811 $BTC. If we throw in all of the other $BTC ETFs & the $BTC Treasury Companies that number is closing in on 2,000,000 $BTC. This is escalating quickly.

JUST IN: BlackRock and Michael Saylor's Strategy now hold a combined 1,381,811 bitcoin worth $155 BILLION. That's over 6.58% of the total BTC supply 🤯

5

4

86

Sheesh @ddcbtc_ | @ddcnorma have been on a bit of a Bitcoin buying spree. Closing in on 1000 $BTC and with that mark, the @BitwiseInvest $OWNB ETF comes into play - More exposure is always a good thing.

888 for abundance. 🟠 New purchase: +200 BTC.🧮 Total holdings: 888 BTC.🧭 Goal: 10,000 BTC by end-2025. 📄 Read our latest milestone:

2

1

12

$BTC | $MSTR | $STRK | $STRF | $STRD | $STRC: Hello & Good Morning everyone it's Cornday. Happy to report that @Strategy has acquired another 3,081₿ & they now HODL 632,457₿. This purchase was made via $MSTR | $STRK | $STRF | $STRD ATM Equity Offerings. Link:

Strategy has acquired 3,081 BTC for ~$356.9 million at ~$115,829 per bitcoin and has achieved BTC Yield of 25.4% YTD 2025. As of 8/24/2025, we hodl 632,457 $BTC acquired for ~$46.50 billion at ~$73,527 per bitcoin. $MSTR $STRC $STRK $STRF $STRD

12

12

132

$BTC | $MSTR | $STRK | $STRF | $STRD | $STRC: . As mentioned last week, this Data Visualization is my attempt to explain $MSTR price variance. Over the period starting in May, Bitcoin Price Activity & Market Participation as a function of the turnover vs Average $ Volume & $BTC

@TTejpal Take a look at the initial output from this a new measure that I am working on 'MSTR Price Variance' based on @Strategy data going back to 1-21-25:. At the start of May - Bitcoin activity, Market participation as a function of turnover vs ADV (Average Dollar Volume), and BTC

4

1

16