3A DAO

@3aaaDAO

Followers

4K

Following

3K

Media

239

Statuses

1K

DeFi infrastructure builders bridging TradFi with blockchain through tokenized real-world assets. Creating permissionless markets for quality RWAs

on-chain

Joined January 2022

3A will distribute Optima Strategy Tokens for Redbelly users: - directly on-chain - permissionless - decentralized

Redbelly x Optima We’re teaming up with @Optima_Fi, the first EU-regulated tokenized asset manager, to bring pro-grade investment strategies to Europe — not just the top 1%. ✅ Low-friction KYC via Redbelly ✅ Strategies via app (Sept 2025) ✅ RWA strategies in 2026 ✅ Stake

3

2

13

🚀 MACRO LIQUIDITY SUPERCYCLE ACCELERATING Massive money creation happening NOW: • $1.9T US deficit creating private sector liquidity • China: $4.3T government spending surge • $14.8B Bitcoin ETF inflows from institutions • 850K+ BTC in corporate treasuries When

1

4

4

📊 Optima's Toolings Strategy crushes Bitcoin by 16% this week! Our basket delivered +20.47% vs BTC's +4.44% thanks to strategic diversification and key performers like Mantle (+44.97%). Why settle for BTC alone when professionally managed exposure gives you 4.6x the returns?

0

3

4

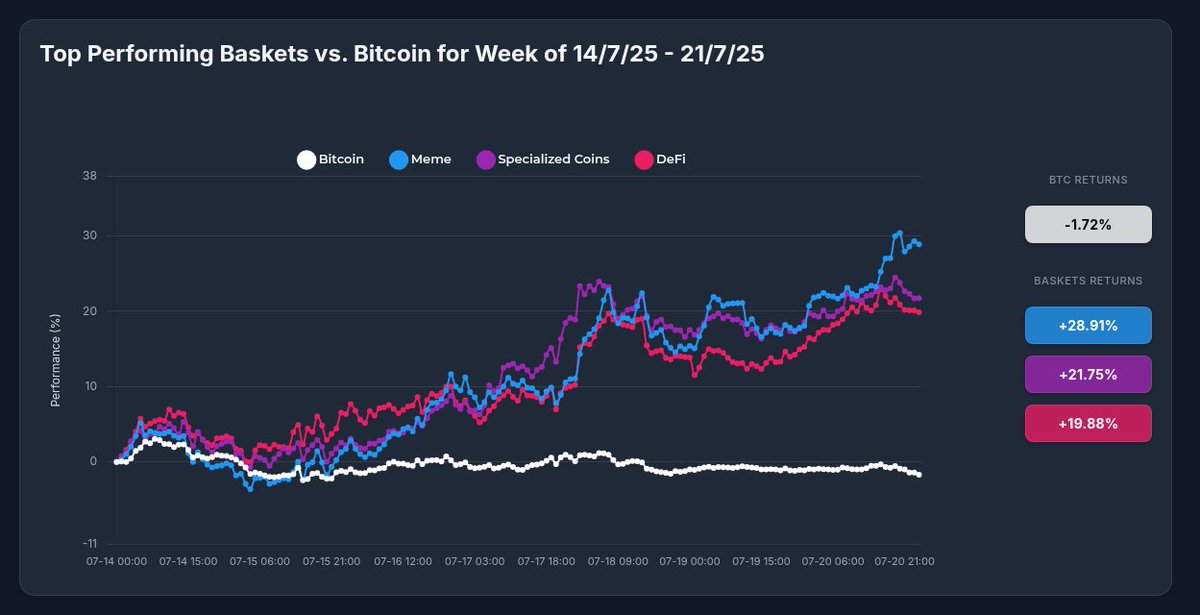

3A DAO will distribute @Optima_Fi basket tokens, incl. the Memecoin, Specialized Coins and DeFi baskets on-chain, available to everyone with a wallet. First on Redbelly #RBNT and Near Intents #NEAR #AURORA

📊 Performance Showdown: July 14-21, 2025 🔵 Optima Meme Basket: +28.91% 🔵 Optima Specialized Coins: +21.75% 🔵 Optima DeFi Basket: +19.88% 🔴 Bitcoin: -1.72% Diversification works! Our strategically curated baskets significantly outperformed BTC while reducing single-asset

2

1

15

Optima Virtual Chain will be used 1) to distribute our Strategy Tokens on-chain, in a decentralized and permission-less way via @3aaaDAO 2) integrate Optima Strategy Tokens into Near Intents for a seamless and secure multi chain experience

🥁 Aurora Blocks Demo Day 5 teams. 5-minute pitches. All launching real blockchains. Not just apps. 📆 July 30, 16:00 UTC Meet the projects. Check what they've been cooking. @Optima_Fi @Coiniseasy @sproutlyrwa @TradableApp @OmegaNetw0rk Register now 👇

3

2

4

While the 1% openly celebrates retail investors as 'exit liquidity,' Optima is flipping the script. Our EU-regulated, tokenized investment strategies give everyday people the same sophisticated tools the pros use. No more being someone else's cash-out plan—with Optima, retail

Search interest in #crypto nearly doubled over the past 9 days, signaling retail is flowing back in Our exit liquidity is returning—momentum is building.

2

1

7

Optima Strategy Tokens (OST) will be distributed by 3A DOA on-chain, available to everyone with a wallet. @RedbellyNetwork $RBNT and Optima Virtual Chain on @NEARProtocol $NEAR operated by @auroraisnear $AURORA will be the first supported chains

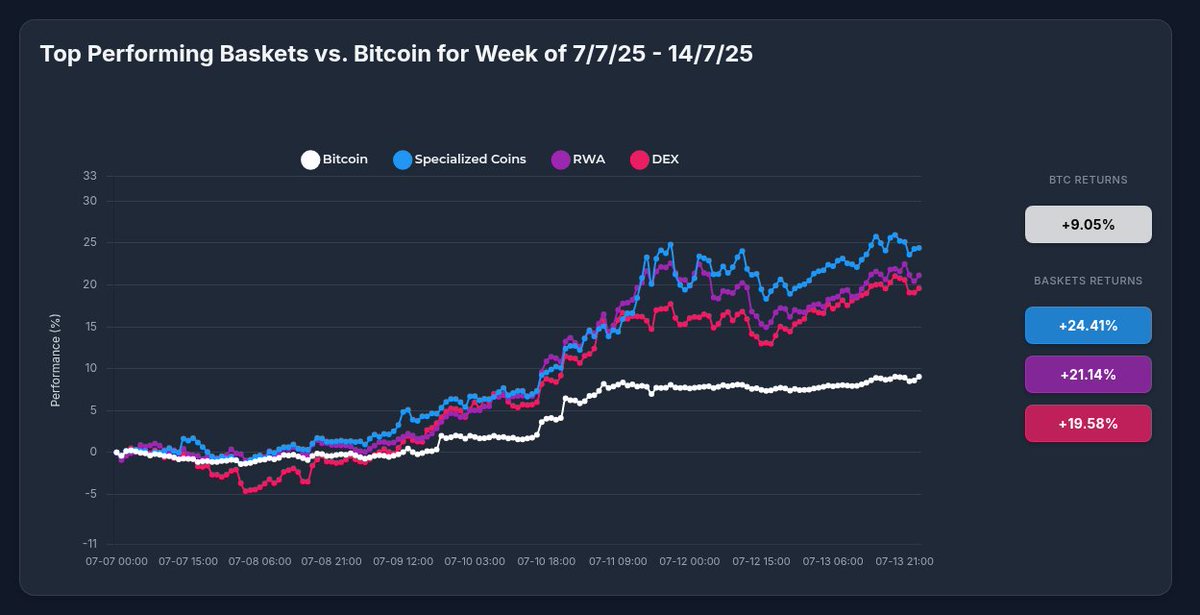

Optima's Specialized Coins strategy delivered a remarkable 24.41% return last week, outperforming BTC's 9.05% by 2.7x! Top performers in our basket: Stellar (XLM) +89% and Pudgy Penguins (PENGU) +87%. The power of diversification in action as our RWA and DEX strategies also beat

5

7

36

How do you turn $1,000 into $6,300 trading crypto? You don't. If you like me, you're the 99% of crypto holders who are just exit liquidity for the top 1%. Trading is hard: all the time and energy need to be spent on research, timing the market, moving funds across wallets,

2

2

4

🚀 BREAKING: 3A DAO partners with @Optima_Fi to bring EU-regulated investment strategies to DeFi! 💰 Their Momentum Strategy delivered 533% gains vs Bitcoin's 129% in 2024 🏛️ First EU-regulated asset manager going decentralized 🌍 Global access through permissionless

3

3

10

Is a 630% gain in 12 months trading crypto too good to be true? This level of performance was previously only achieved by the top 1%: professional trades and hedge funds, influencers and other insiders. For the remaining 99%, it's usually not available: we enter the market too

3

0

5

Only systematic, automated strategies make money in crypto long term. Otherwise, you're just the exit liquidity for the top 1%. We're creating a small group of trusted insiders for early access to Optima strategies. If you'd like to apply and be the first to earn like the top

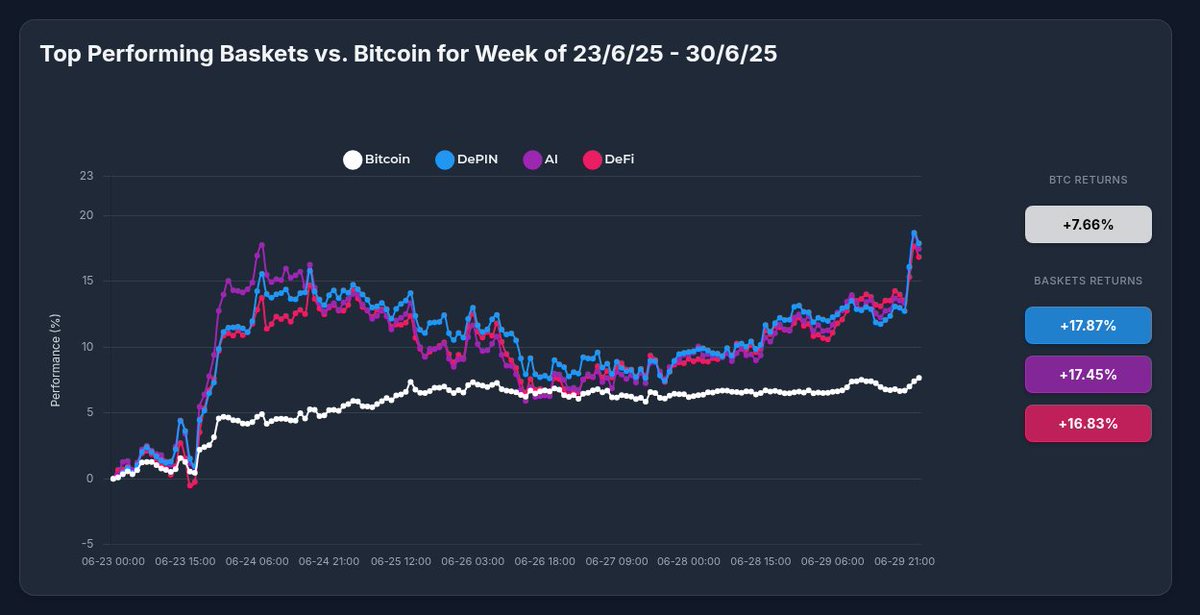

Optima's DePIN Strategy (+17.87%) outperformed Bitcoin (+7.66%) by 2.3x last week! Our basket of top infrastructure tokens like JasmyCoin (+25.61%) and The Graph (+19.98%) delivered exceptional returns with lower volatility than holding individual assets. The future of investing

11

3

17

Since September last year, I've been working on @Optima_Fi in the product lead capacity. Defining requirements, imagining what the product should look like, working with the devs and lawyers to understand what's possible and what's legal. Now that we're very close to launch, I

4

2

6

🔥 MACRO SIGNAL: The Perfect Storm for Crypto Massive global deficits = Direct liquidity injection into private sector: • US: $1.9T projected deficit (13% spending increase) • China: $250B stimulus + 8.5% GDP deficit • Eurozone: 3.1% GDP deficit maintaining flow Meanwhile,

0

1

3

The $180 trillion intellectual property market is getting tokenized, and it's more than just a digital flex. From music royalties to biomedical breakthroughs, IP might be the ultimate RWA play. Check out my deep dive on this untapped frontier! @join_royal @boleromusic_

0

1

6

5 Tokens With MASSIVE Potential Based on Data Analysis 1. $ARDR @ArdorPlatform +64% Korean whale activity driving $610M volume (4.4x market cap!) 92% below ATH = massive upside potential Strong momentum with breakout pattern 2. $AERGO @AERGO_IO +37% Binance Futures launch

1

2

4

The Golden Risk: Why uncollateralized lending in emerging markets might be your portfolio's missing piece. @goldfinch_fi's 'trust through consensus' approach offers 10-12% yields, but recent defaults like Lend East remind us there's no reward without risk. @NexusMutual

1

2

6

Did you know fine art has quietly outperformed #Bitcoin with less drama? Contemporary art averaged 11.5% annual returns from 1995-2023, while blue-chip art pieces maintain 7-10% over decades. @Masterworks, @CollectParticle, @Yieldstreet and @ArtemundiGroup are democratizing this

2

2

5

The $141 trillion traditional bond market is getting disrupted by tokenized Treasury yields, and Wall Street's feeling the heat. @OndoFinance's nearly $1B market cap shows this isn't just a trend—it's a revolution. @BlackRock, @jpmorgan, @GoldmanSachs, and @Citi are scrambling

0

2

5